PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842422

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842422

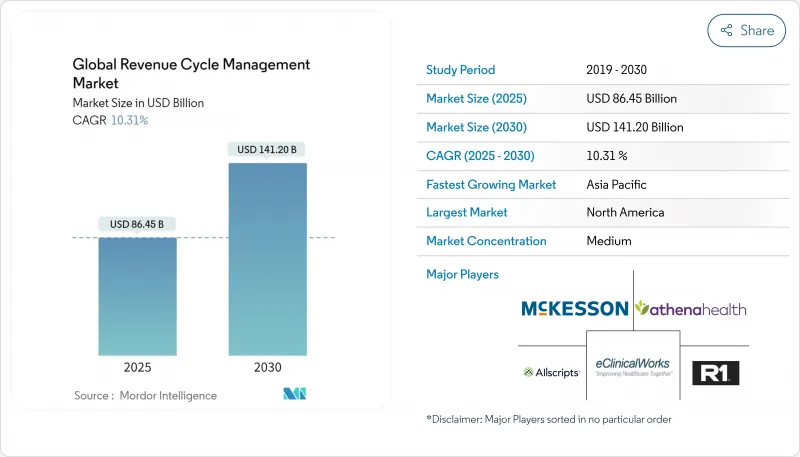

Revenue Cycle Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The revenue cycle management market is valued at USD 86.45 billion in 2025, is set to expand at a 10.31% CAGR, and should reach USD 141.20 billion by 2030.

Expanding administrative overhead, the pivot toward value-based reimbursement, and widening AI adoption are combining to make automated revenue capture a board-level necessity. Providers are prioritizing integrated platforms that merge clinical documentation, denial avoidance, and cash-flow analytics in one workspace, cutting manual touches and shortening days in accounts receivable. North American health systems continue to anchor demand, yet rising private-insurance penetration in Asia-Pacific is unlocking sizable new addressable volumes. Service outsourcing remains prevalent because staffing gaps persist, but cloud software's rapid acceleration signals a gradual hand-off from labor-heavy models to subscription-based architectures that scale with patient volumes. The net effect is heightened competition among technology vendors that can wrap predictive analytics and compliance updates into a single, interoperable stack.

Global Revenue Cycle Management Market Trends and Insights

Global Shift Toward Value-Based & Outcome-Linked Reimbursement

Value-based care, now written into major payer contracts, is recasting Revenue Cycle Management industry priorities by tying payment to clinical quality rather than service volume. Health systems that adopted accountable care frameworks recorded collective savings in excess of USD 700 million, proving that financial upside exists once organizations master quality metrics. As a response, RCM platforms are integrating population-health dashboards that translate clinical outcomes into reimbursement triggers, ensuring that providers track gaps in care before payment risk materializes. That evolution implicitly demands normalized data from disparate sources, giving interoperability a new commercial urgency.

Escalating Administrative Cost Pressure Prompting RCM Automation

Administrative expenses routinely consume 20 - 25 % of United States healthcare spending, so executives view automation as a proven lever to arrest cost inflation. AI-enabled bots now complete routine prior authorization transactions in seconds, a process that previously required manual review and days of staff follow-up, and some hospitals have documented a 50 % reduction in claim preparation time after deployment. These improvements free billing professionals to concentrate on complex exceptions, generating an unplanned productivity dividend that management can redeploy toward patient-facing roles. Importantly, institutions that automate admit-through-cash workflows report heightened staff satisfaction because tedious, error-prone data entry tasks disappear.

Heterogeneous, Ever-Changing Payer Rules and Coding Standards

Denial rates hovering around 10 - 15 % illustrate how quickly payer edits and policy updates can overturn otherwise compliant claims. Medical group leaders confirm that denials climbed further in 2024, so organizations are investing in continuous code updates and predictive scrubbers that flag likely rejections before submission. Forward-looking health systems allocate dedicated teams to mine denial root causes, and iterative feedback loops between coders and clinicians are shortening correction cycles. AI-driven rules engines that self-learn from payer remittances now deliver measurable reductions in attachment requests, cutting administrative overhead.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Digital-Health & Interoperability Mandates Worldwide

- Consumerization of Healthcare Increasing Patient Billing Complexity

- Persistent Shortage of Skilled Coding and RCM Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services hold 78% market share of the Revenue Cycle Management market size in 2024, mirroring providers' preference for turnkey expertise amid staffing shortages. Clients view outsourcing as an immediate route to improved collections because service partners assume responsibility for technology investment and continuous process refinement. Nevertheless, cloud-based software is posting a 14.2% CAGR through 2030, more than the overall market growth, because subscription pricing aligns cost with usage and removes large capital hurdles.

Hospitals that implement cloud RCM suites often discover secondary benefits, such as real-time dashboards that spotlight physician documentation gaps, enabling corrective coaching within a single shift. Over time, these analytics capabilities encourage in-house teams to transition from transactional tasks to strategic revenue integrity roles. The dual-track growth pattern implies that hybrid operating models, combining retained oversight with selective outsourcing-will become common, broadening the Revenue Cycle Management industry opportunity for both software firms and service bureaus.

On-premise deployments retain 58.5% Revenue Cycle Management market share in 2024, reflecting earlier capital purchases and residual security concerns. Yet cloud installations are expanding at a 14.2% CAGR to 2030, propelled by flexible infrastructure, automatic upgrades, and easier integration with payer APIs. Organizations that climb the HFMA technology-adoption curve frequently cite cloud moves as the inflection point when cycle-time metrics start to trend downward. One observed benefit is faster implementation of regulatory code sets, since cloud vendors push updates centrally instead of relying on client IT teams.

As cyber-security frameworks mature, board-level resistance to off-site hosting is receding, and CFOs note that predictable subscription fees simplify multi-year budgeting. This cost transparency acts as a hidden accelerant to overall Revenue Cycle Management market size growth because even mid-tier hospitals can now access features that were once reserved for large academic centers.

The Revenue Cycle Management Market is Segments by Component (Software [Integrated RCM Suite, and More], and Services [Outsourced RCM BPO, and More]), Deployment (Cloud-Based and On-Premise), Function (Claims & Denial Management, and More) End User (Hospitals, Laboratories, and More), Specialty (Radiology, Oncology, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 48% of the current Revenue Cycle Management market size, supported by complex multi-payer frameworks and a long history of EHR adoption. Vendor consolidation is active, evidenced by R1 RCM's USD 8.9 billion transaction, signaling private-equity conviction that scaled process expertise can deliver outsized cash-flow gains. Hospitals in the United States report that 46% already utilize some form of AI in revenue-cycle workflows. Interestingly, Canadian single-payer structures still require RCM tools for provincial reconciliation, revealing that payer complexity is not the only growth driver. The region's reimbursement transparency mandates create rich data sets, enabling vendors to refine machine-learning models faster than elsewhere, reinforcing North American leadership.

Asia-Pacific is forecast to post a 16.4% CAGR through 2030, the fastest regional pace in the Revenue Cycle Management industry, propelled by government-backed digital-health investments and swelling middle-class demand for private insurance. India's national insurance expansion is catalyzing standardized claims infrastructure, and hospitals that digitize billing early capture accelerated settlement times. China's tier-three city hospitals increasingly seek cloud RCM to leapfrog older client-server models, mirroring the smartphone adoption curve seen in other industries. Local partners remain critical for navigating regulatory approval in markets such as Japan, where data localization laws shape hosting architecture. This need for contextual adaptation presents a barrier to entry for global vendors but simultaneously offers high returns to firms that secure first-mover standing.

Europe retains meaningful Revenue Cycle Management market share, although growth is steadier because many countries operate single-payer models that centralize claim standards. Even so, GDPR requirements push hospitals toward cloud environments with strict encryption and audit trails, spurring joint ventures between U.S. and European software firms experienced in privacy engineering. In the United Kingdom, the National Health Service's renewed focus on backlog reduction has elevated interest in AI scheduling and billing triage features that resemble private-sector RCM. Meanwhile, Middle East, Africa, and South America represent emerging territories where private hospital chains drive early demand, setting a foundation for accelerated adoption once regulatory frameworks mature.

- Optum (UnitedHealth Group)

- R1 RCM

- Conifer Health Solutions

- Cognizant (Trizetto)

- athenahealth

- Oracle

- Epic Systems

- Veradigm

- Solventum

- GeBBS Healthcare

- MCKESSON Corporation

- Accenture Health

- Infosys

- Med-Metrix

- Access Healthcare

- Conduent

- eClinicalWorks

- XIFIN

- Quest Diagnostics RCM

- HCLTech Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Shift Toward Value-Based & Outcome-Linked Reimbursement

- 4.2.2 Escalating Administrative Cost Pressure Prompting RCM Automation

- 4.2.3 Accelerated Digital-Health & Interoperability Mandates Worldwide

- 4.2.4 Consumerization of Healthcare Increasing Patient Billing Complexity

- 4.2.5 Proliferation of Cloud-Native Health IT Platforms & SaaS Economics

- 4.3 Market Restraints

- 4.3.1 Heterogeneous, Ever-Changing Payer Rules and Coding Standards

- 4.3.2 Persistent Shortage of Skilled Coding & RCM Talent

- 4.3.3 Data-Privacy & Cyber-security Risks Handling Protected Health Info

- 4.3.4 High Up-Front Investment and Change-Management Barriers

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 Integrated RCM Suite

- 5.1.1.2 Standalone Modules

- 5.1.2 Services

- 5.1.2.1 Outsourced RCM BPO

- 5.1.2.2 Consulting & Training

- 5.1.1 Software

- 5.2 By Deployment

- 5.2.1 Cloud-based

- 5.2.2 On-premise

- 5.3 By Function

- 5.3.1 Claims & Denial Management

- 5.3.2 Medical Coding & Billing

- 5.3.3 Electronic Health Record (Integrated RCM)

- 5.3.4 Clinical Documentation Improvement (CDI)

- 5.3.5 Insurance Eligibility Verification

- 5.3.6 Other Functions (Patient Scheduling, Pricing Transparency)

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Physician Offices & Clinics

- 5.4.3 Ambulatory Surgery Centers

- 5.4.4 Laboratories

- 5.4.5 Diagnostic Imaging Centers

- 5.4.6 Other End Users

- 5.5 By Specialty

- 5.5.1 Radiology

- 5.5.2 Oncology

- 5.5.3 Cardiology

- 5.5.4 Pathology

- 5.5.5 Multi-specialty & Others

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Optum (UnitedHealth Group)

- 6.3.2 R1 RCM Inc.

- 6.3.3 Conifer Health Solutions

- 6.3.4 Cognizant (Trizetto)

- 6.3.5 athenahealth

- 6.3.6 Oracle Cerner

- 6.3.7 Epic Systems

- 6.3.8 Veradigm LLC

- 6.3.9 Solventum

- 6.3.10 GeBBS Healthcare

- 6.3.11 MCKESSON Corporation

- 6.3.12 Accenture Health

- 6.3.13 Infosys Limited

- 6.3.14 Med-Metrix

- 6.3.15 Access Healthcare

- 6.3.16 Conduent

- 6.3.17 eClinicalWorks

- 6.3.18 XIFIN

- 6.3.19 Quest Diagnostics RCM

- 6.3.20 HCLTech Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment