PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842423

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842423

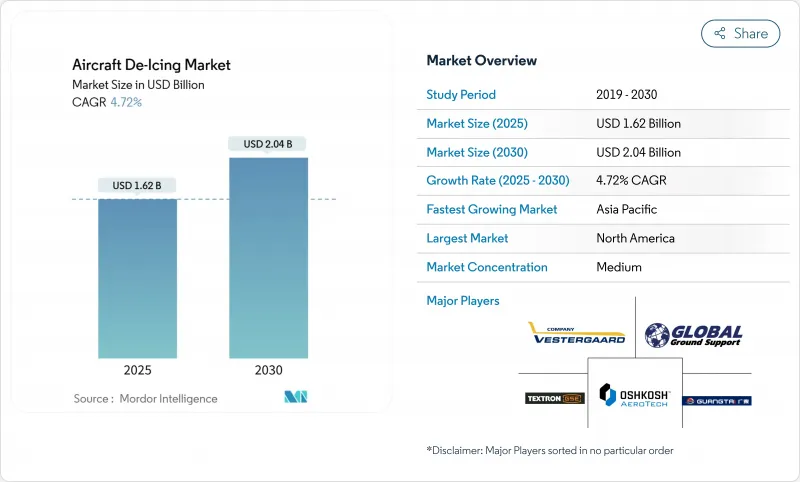

Aircraft De-Icing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft de-icing market size is estimated at USD 1.62 billion in 2025, and is expected to reach USD 2.04 billion by 2030, reflecting a CAGR of 4.72% during the forecast period.

The aircraft de-icing market benefits from larger winter flight schedules at secondary airports, stricter North America and Europe safety rules, and airport investments that favor permanent infrastructure and fluid-recovery systems. Stable demand from commercial airlines, rising e-commerce cargo traffic, and the spread of next-generation narrow-body fleets sustain baseline growth. At the same time, product mix is shifting toward electric equipment, fixed-boom gantry installations, and higher-performance Type IV fluids that extend holdover times. Opportunities are also opening around digital monitoring, predictive maintenance, and glycol-recycling technologies that cut costs and emissions while improving on-time performance. Competitive dynamics remain shaped by OEM electrification roadmaps, airport sustainability targets, and the economics of glycol supply and recovery programs.

Global Aircraft De-Icing Market Trends and Insights

Surge in Winter Flight Schedules Across Secondary Airports in Northern Latitudes

Secondary airports in cold regions add winter routes that keep aircraft flying year-round. Regional carriers such as SkyWest carried 42 million passengers in the US in 2024. This illustrates how stronger winter utilization lifts demand for mobile de-icing units that can be stationed where permanent gantries are not yet viable. Smaller fields that once closed for part of the season now see traffic spikes, encouraging procurement of multi-purpose trucks and modular fluid tanks that fit constrained apron layouts. Equipment makers are responding with compact chassis, faster boom articulation, and digital spray-rate controls. Safety regulators are likewise paying closer attention to secondary airports, pushing operators to match the procedural rigor of major hubs. These factors raise unit volumes and after-market service opportunities across the aircraft de-icing market.

Heightened Safety-Compliance Penalties for Ice-Related Incidents in the EU and US

The Federal Aviation Administration's updated ground-deicing guidance for winter 2024-2025 tightened holdover tables and application procedures, prompting airlines and service companies to modernize fleets and train crews to avoid fines. Parallel moves by the European Union Aviation Safety Agency reinforce the same message, classifying icing severity and mandating documented mitigation steps. Compliance pressure is accelerating the adoption of sensor-based verification, barcode traceability of fluid batches, and real-time weather-linked decision tools. The aircraft de-icing market, therefore, sees rising demand for software licenses, handheld readers, and on-board cameras that validate spray patterns, expanding revenue streams beyond hardware.

Volatility in Ethylene and Propylene Glycol Feedstock Prices

Ethylene and propylene glycol prices follow upstream petrochemical swings, squeezing margins for fluid blenders and service providers. Cost spikes encourage airports to recycle spent fluid and airlines to vary concentration based on ambient conditions. St. Louis Lambert International's 2024/2025 plan highlights blend-to-temperature dosing that reduces consumption in milder conditions. Some carriers hedge costs by contracting multi-year supply volumes, but smaller operators are more exposed, delaying equipment upgrades and limiting market growth in the short term.

Other drivers and restraints analyzed in the detailed report include:

- Fleet Growth of Next-Generation Narrow-Body Jets With Larger Wing Surface Areas

- Expansion of Remote De-Icing Pads to Reduce Gate-Hold Times

- Stringent Waste-Glycol Run-Off Regulations Elevating Operating Expenses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Commercial airlines held 46.29% of the aircraft de-icing market share in 2024, supported by global route networks that must maintain on-time departures during winter peaks. These carriers favor high-throughput truck fleets and automated mixing plants to tighten turnaround times. Though smaller today, Cargo airlines are expanding the aircraft de-icing market size fastest at a 6.57% CAGR through 2030 as e-commerce drives year-round demand for temperature-insensitive logistics. They often operate at night and in secondary hubs, prompting investments in self-contained de-icing rigs that can travel between airports. Military aviation, while niche, specifies ruggedized equipment for Arctic bases and rapid-deployment kits that perform in extreme cold. General aviation and business jets rely on flexible service models, including heated hangars and portable applicators, representing incremental but steady volume for suppliers.

Commercial carriers also influence fluid standards; their push for longer holdover times speeds the shift toward Type IV formulations. Cargo operators reinforce this trend because extended taxi and loading intervals increase the risk of fluid shear or re-freeze. Military users create spill-over benefits for civil operations by funding R&D in portable electro-thermal blankets and compact power systems that later migrate to regional airport applications. The cross-pollination of requirements keeps the aircraft de-icing market dynamic despite moderate headline growth.

De-icing trucks retained 54.49% of the aircraft de-icing market in 2024, thanks to their versatility and lower initial cost relative to permanent gantries. Modern designs integrate single-engine drivetrains, energy-efficient heaters, and touch-screen diagnostics, cutting fuel burn and maintenance downtime. However, airports with congested winter schedules are pivoting to fixed-boom or gantry systems that process multiple wide-body aircraft simultaneously. This sub-segment will advance at a 6.71% CAGR to 2030, raising its contribution to the aircraft de-icing market size and easing workforce constraints during peak storms. Tow-behind sprayers remain relevant for small airfields, while in-hangar solutions cater to MRO operations and corporate fleets.

Electrification overlays all categories. Vestergaard, Oshkosh, and Textron GSE now publish roadmaps targeting majority electric or hybrid deliveries before 2035, responding to airport carbon-reduction pledges. The shift redefines lifetime cost-of-ownership calculations, with energy price volatility and sustainability incentives tilting purchasing decisions toward battery-electric or hybrid hydraulic platforms. Suppliers that master high-voltage integration and cold-weather battery management will lock in long-term service revenue as customers phase out diesel units.

The Aircraft De-Icing Market Report is Segmented by End-User (Commercial Airlines, and More), Equipment Type (De-Icing Trucks (Mobile), and More), Fluid Type (Type I (Glycol-Water), and More), Method (Fluid-Based, Infrared/Electro-Impulse, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 62.75% of 2024 revenue, underpinning the aircraft de-icing market with its dense hub network, severe winters, and rigorous FAA oversight. Recent investments, such as Syracuse Hancock International Airport's USD 19.4 million glycol-recycling plant, demonstrate regional commitment to sustainable operations and cost control. The facility is designed to reclaim fluid with glycol concentrations as low as 0.25%, generating up to 550,000 gallons of Type I solution annually. EPA effluent rules further drive adoption of collection systems and pad-based treatments, ensuring that North American demand remains anchored in regulatory compliance and technology refresh cycles.

Europe is the second-largest territory, shaped by EASA's icing risk classification and the European Green Deal. Clean Aviation initiatives back next-generation wing-ice protection that can cut energy draw by 30% or more, creating fertile ground for suppliers of embedded electro-thermal elements and advanced coatings. Airports across Scandinavia and the Alps invest in remote pads and glycol capture to meet safety and environmental requirements, sustaining equipment orders even in a comparatively mature market.

Asia-Pacific is the clear high-growth frontier, posting a forecast 6.84% CAGR on the strength of expanding airport infrastructure in China, South Korea, and Japan. Many of these facilities are scaling from minimal winter activity to full-season operations, generating first-time purchases of trucks, storage tanks, and fluid bulk plants. Mountainous terrain in parts of China and Korea requires altitude-tolerant systems, while northern Chinese hubs face prolonged sub-zero periods that strain equipment heating capacity. Suppliers that offer modular, quickly deployable fleets and local service partnerships are winning early contracts, positioning the region as a rising share contributor to the aircraft de-icing market size.

- Oshkosh Corporation

- Vestergaard Company

- Global Ground Support LLC

- TUG TECHNOLOGIES CORPORATION (Textron Inc.)

- Ground Support Specialists

- Tronair Inc.

- Safran SA

- Weihai Guangtai Airport Equipment Co., Ltd.

- Mallaghan Group

- Hubei Donghan Airport Equipment Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in winter flight schedules across secondary airports in Northern Latitudes

- 4.2.2 Heightened safety-compliance penalties for ice-related incidents in EU and US

- 4.2.3 Fleet growth of next-gen narrow-body jets with larger wing surface area

- 4.2.4 Expansion of remote de-icing pads to reduce gate-hold times in Canada and Nordics

- 4.2.5 Electrification initiatives and sustainable ground support equipment adoption

- 4.2.6 Military Arctic operations modernization in NATO and Russian far-north bases

- 4.3 Market Restraints

- 4.3.1 Volatility in Ethylene and Propylene Glycol feedstock prices

- 4.3.2 Stringent waste-glycol run-off regulations elevating OPEX at US Class-B airports

- 4.3.3 Airline cost-cutting leading to outsourcing price compression in Asia

- 4.3.4 Infrastructure limitations for electric de-icing equipment deployment

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End User

- 5.1.1 Commercial Airlines

- 5.1.2 Cargo Airlines

- 5.1.3 Military Aviation

- 5.1.4 General Aviation and Business Jets

- 5.2 By Equipment Type

- 5.2.1 De-icing Trucks (Mobile)

- 5.2.2 Fixed-Boom/Gantry Systems

- 5.2.3 Tow-Behind Sprayers

- 5.2.4 In-Hangar De-icing Systems

- 5.3 By Fluid Type

- 5.3.1 Type I (Glycol-Water)

- 5.3.2 Type II

- 5.3.3 Type III

- 5.3.4 Type IV

- 5.4 By Method

- 5.4.1 De-icing with Fluids

- 5.4.2 Infra-red/Electro-Impulse

- 5.4.3 Forced-Air/Hot-Air

- 5.4.4 Hybrid Systems

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Russia

- 5.5.2.3 France

- 5.5.2.4 Germany

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 Australia

- 5.5.3.5 India

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Israel

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oshkosh Corporation

- 6.4.2 Vestergaard Company

- 6.4.3 Global Ground Support LLC

- 6.4.4 TUG TECHNOLOGIES CORPORATION (Textron Inc.)

- 6.4.5 Ground Support Specialists

- 6.4.6 Tronair Inc.

- 6.4.7 Safran SA

- 6.4.8 Weihai Guangtai Airport Equipment Co., Ltd.

- 6.4.9 Mallaghan Group

- 6.4.10 Hubei Donghan Airport Equipment Technology Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment