PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842425

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842425

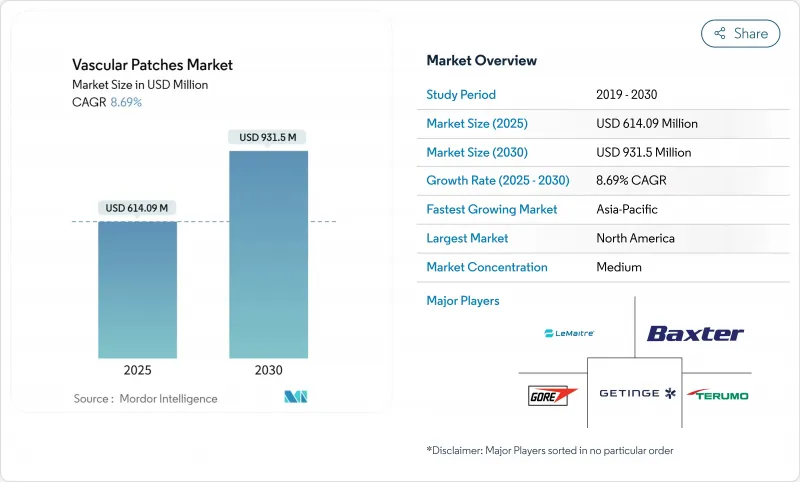

Vascular Patches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Vascular Patches Market size is estimated at USD 614.09 million in 2025, and is expected to reach USD 931.5 million by 2030, at a CAGR of 8.69% during the forecast period (2025-2030).

Expansion reflects an aging population that demands more complex vascular repair, regulatory fast-tracking of resorbable and tissue-engineered patches, and wider acceptance of outpatient vascular surgery. Growth is reinforced by hospitals upgrading toward value-based care models that reward clinical outcomes, while surgeons increasingly rely on patch angioplasty to improve long-term patency. Synthetic materials gain ground thanks to scalable manufacturing and lower unit costs, yet biologic products continue to dominate high-risk and contaminated procedures. Regionally, North America leads on revenue, but Asia-Pacific provides the steepest growth curve as cardiovascular disease prevalence rises and surgical capacity expands.

Global Vascular Patches Market Trends and Insights

Rapidly Growing Geriatric Population and Prevalence of Vascular Diseases

Older adults now represent the single largest cohort undergoing vascular repair, and their numbers continue to climb. Age-related atherosclerosis, carotid stenosis, and peripheral artery disease often require patch angioplasty because primary closure poses higher restenosis risk. Multimorbidity typical in seniors drives surgeons toward materials that integrate smoothly and lower infection odds, a gap biologic patches fill well. Clinical evidence suggests that biologic patches demonstrate superior performance in elderly patients due to reduced inflammatory responses and better integration with aging vascular tissue.

Surge in Carotid Endarterectomy and Other Vascular Procedures

Carotid endarterectomy procedures are experiencing renewed growth as stroke prevention strategies evolve and diagnostic capabilities improve, with patch closure becoming the preferred technique over primary closure due to superior long-term patency rates. Meta-analysis shows patch angioplasty lowers restenosis by 30% versus primary closure, cementing the patch as standard of care regardless of material. Multi-center studies confirm that different patch materials-bovine pericardial, polyester, and venous-yield comparable long-term results, suggesting that procedural technique rather than material choice drives clinical success.

Immune Response and Infection Risk with Xenogeneic Material

Bovine pericardium remains the mainstay of biologic patches yet can trigger alpha-gal reactions in roughly 3% of patients, compelling surgeons to stock alternative materials. Although anti-calcification processing mitigates immune events, infection risk still outpaces autologous options, especially when postoperative care resources are scarce. Clinical studies indicate that bovine pericardial patches demonstrate excellent biocompatibility in most patients, but the subset experiencing adverse reactions requires alternative treatment approaches that complicate surgical planning and inventory management.

Other drivers and restraints analyzed in the detailed report include:

- Increased Adoption of Biologic Patches

- Adoption of 3-D Printed Patient-Specific Vascular Patches

- Product Failures and High-Profile Recalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Biologic patches retained 57.21% of 2024 revenue, underscoring surgeon confidence in their superior tissue integration. That segment anchors the vascular patches market because elderly and high-risk patients often present contaminated fields where reduced infection matters most. The synthetic category, however, is advancing at 9.32% CAGR, outpacing the overall vascular patches market as heparin-bonded ePTFE and new copolymers close the biocompatibility gap. Hospitals under fiscal pressure see synthetics as a cost-effective standard for routine arteriotomy closure, especially in outpatient settings.

Competitive focus has therefore shifted from blanket material replacement to application-specific choice: biologic patches dominate complex reconstructions, whereas synthetics expand in predictable, lower-risk repairs. The vascular patches market size for synthetic materials is projected to climb steadily alongside ASC procedure growth, while the biologic share remains durable in value-based care.

The Vascular Patches Market Report is Segmented by Material (Biologic Vascular Patches and Synthetic Vascular Patches), Application (Carotid Endarterectomy, Aortic Aneurysms, Profundaplasty and Femoral Patch Angioplasty, and Other Applications), End User (Hospitals, Ambulatory Surgical Centers and More), and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds the largest regional share at 36.34%, driven by high procedure volume and early adoption of breakthrough devices. Medicare's reimbursement structure, which increasingly favors ambulatory procedures, drives diffusion of patches that balance cost efficiencies with superior outcomes. FDA fast-track designations, such as the December 2024 approval of Humacyte's ATEV, keep the region at the forefront of biologic innovation.

Asia-Pacific is the vascular patches market's fastest-growing geography, expanding at a 10.13% CAGR. Aging populations and westernized lifestyles raise cardiovascular disease incidence, while government-led infrastructure development improves surgical capacity. Local price sensitivity favors high-volume synthetic products, yet widening middle-class insurance coverage unlocks demand for premium biologics in major urban centers. Regulatory harmonization through initiatives such as ASEAN Medical Device Directive is shortening product approval times, offering manufacturers a clearer path to market leadership.

Europe, Middle East & Africa, and South America together contribute material revenue though with varied growth trajectories. EU MDR increases compliance costs and could slow the introduction of novel patches, but mature surgical expertise supports stable demand. South America's growth hinges on economic stability and public-private partnerships that expand access to vascular surgery. In MEA, limited reimbursement and supply-chain hurdles curb adoption; nonetheless, select Gulf states invest heavily in tertiary cardiovascular centers, creating pockets of high-end demand. Across these regions, supply-chain resilience and cost-effective synthetic innovations determine competitive edge.

- LeMaitre Vascular

- Baxter

- W. L. Gore & Associates

- Getinge

- B. Braun

- Terumo

- Artivion

- Edward Lifesciences

- Collagen Solutions

- Vascumed

- Celox Medical

- Labcor Laboratorios

- CryoLife

- Maquet (Getinge)

- CorMatrix Cardiovascular

- Admedus

- Becton Dickinson (C. R. Bard)

- Medtronic

- Lifecore Biomedical

- Perouse Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly Growing Geriatric Population and Prevalence of Vascular Diseases

- 4.2.2 Surge in Carotid Endarterectomy and Other Vascular Procedures

- 4.2.3 Increased Adoption of Biologic Patches

- 4.2.4 Adoption of 3-D Printed Patient-Specific Vascular Patches

- 4.2.5 Regulatory Fast-Tracking of Resorbable ECM Patches for Pediatric Use

- 4.2.6 Outpatient-Based Reimbursement Models for Peripheral Vascular Repair

- 4.3 Market Restraints

- 4.3.1 Immune Response and Infection Risk with Xenogeneic Material

- 4.3.2 Product Failures and High-Profile Recalls

- 4.3.3 High Device Cost Vs. Limited Reimbursement in Emerging Markets

- 4.3.4 Disruptions in the Bovine-Pericardium Supply Chain (Zoonotic Outbreaks)

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Biologic Vascular Patches

- 5.1.2 Synthetic Vascular Patches

- 5.2 By Application

- 5.2.1 Carotid Endarterectomy

- 5.2.2 Aortic Aneurysm Repair

- 5.2.3 Profundaplasty and Femoral Patch Angioplasty

- 5.2.4 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 LeMaitre Vascular

- 6.3.2 Baxter International

- 6.3.3 W. L. Gore & Associates

- 6.3.4 Getinge AB

- 6.3.5 B. Braun SE

- 6.3.6 Terumo Corporation

- 6.3.7 Artivion

- 6.3.8 Edwards Lifesciences

- 6.3.9 Collagen Solutions

- 6.3.10 Vascumed (Pty) Ltd

- 6.3.11 Celox Medical

- 6.3.12 Labcor Laboratorios

- 6.3.13 CryoLife

- 6.3.14 Maquet (Getinge)

- 6.3.15 CorMatrix Cardiovascular

- 6.3.16 Admedus

- 6.3.17 Becton Dickinson (C. R. Bard)

- 6.3.18 Medtronic plc

- 6.3.19 Lifecore Biomedical

- 6.3.20 Perouse Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment