PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842426

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842426

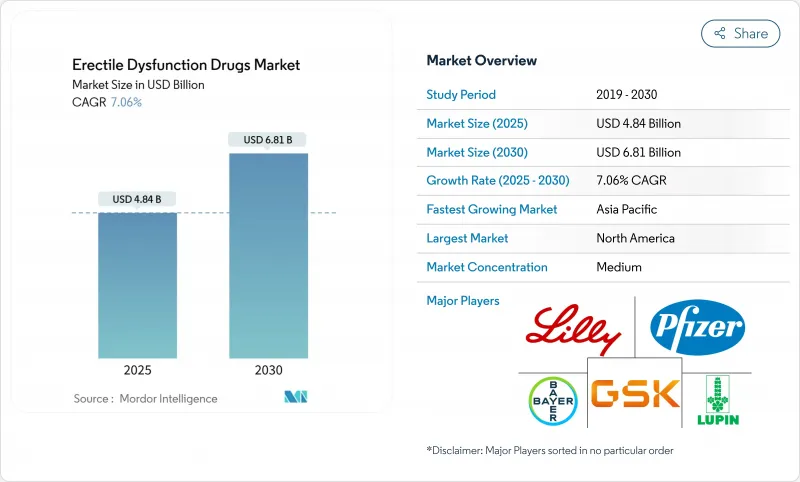

Erectile Dysfunction Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The erectile dysfunction drugs market reached USD 4.84 billion in 2025 and is projected to advance to USD 6.81 billion by 2030, posting a 7.06% CAGR.

Growth reflects an accelerating migration from traditional retail dispensing toward integrated telemedicine ecosystems that combine virtual consultation, electronic prescribing, and home delivery. Over-the-counter (OTC) regulatory pathways, especially in the United States and parts of Europe, are broadening patient access while lowering entry barriers for consumer-health companies. Aging populations, rising obesity and diabetes prevalence, and wider recognition of erectile dysfunction as an early cardiometabolic warning sign reinforce steady baseline demand. Competitive dynamics intensify as branded patents expire and generic competition compresses prices, prompting originators to develop alternative formulations, pursue combination products, and deepen partnerships with digital health platforms.

Global Erectile Dysfunction Drugs Market Trends and Insights

Growing Telemedicine & E-Pharmacy Penetration

Digital platforms remove geographic and psychological barriers, allowing discreet consultations and mail-order fulfillment in a single workflow. Hims & Hers expanded to 2.4 million subscribers and more than doubled revenue in Q1 2025 by integrating asynchronous medical evaluations with low-cost generic sildenafil hims.com. Similar models from Lemonaid Health price sildenafil at USD 2 per pill, undercutting brick-and-mortar pharmacies and encouraging price-sensitive users to enter the erectile dysfunction drugs market. GoodRx launched a subscription service for erectile dysfunction therapies in June 2025, reinforcing consumer appetite for predictable monthly costs. Platform data analytics guide personalized adherence nudges that improve refill persistence, lifting lifetime value per patient. As governments relax telehealth reimbursement restrictions, particularly in Asia-Pacific, digital incumbents enjoy a first-mover trust advantage that is hard for late-stage entrants to replicate.

Nasal & Topical Fast-Onset Formulations Nearing Approval

Formulations that shorten onset time from nearly an hour to under 15 minutes solve a key dissatisfaction point cited in follow-up surveys of oral PDE5 non-responders. LTR Pharma's SPONTAN nasal spray peaks plasma levels in 12 minutes with half the oral dosage, positioning the drug for premium pricing when approved. The FDA's 2024 De Novo clearance for Eroxon gel created the first OTC topical category, with 60% of users reporting erection within 10 minutes. Futura Medical is pursuing enhanced versions that target both male and female sexual dysfunction, broadening addressable revenue pools. Topical agents also serve patients contraindicated for systemic therapy, extending market reach without cannibalizing established oral brands. Manufacturers expect accelerated global rollouts once real-world safety data accumulate.

Persisting Social Stigma & Under-Diagnosis

Cultural taboos limit physician-patient dialogue, especially in rural regions where urologist density tracks well below search-term interest levels. Anonymous telehealth chats mitigate embarrassment yet cannot fully replace in-person screening where psychological or relational factors complicate assessment. Younger men often self-diagnose via online forums, delaying professional evaluation until comorbidities surface. Education campaigns timed around OTC launches aim to reframe erectile dysfunction as an early cardiometabolic signal rather than a purely sexual issue. Nevertheless, stigma is expected to weigh on adoption rates for at least the next decade.

Other drivers and restraints analyzed in the detailed report include:

- Aging-Related Comorbidities Boost PDE5 Demand

- Increasing Lifestyle-Induced Stress & Obesity Prevalence

- High Out-of-Pocket Cost for Branded Therapies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Viagra franchise maintained a leading 45.35% slice of the erectile dysfunction drugs market in 2024, reflecting decades-long brand equity and prescriber familiarity. However, Teva's AB-rated sildenafil tablets priced at a deep discount eroded trademark loyalty throughout 2025. Stendra's rapid onset profile and limited food interaction helped the brand register a 10.25% CAGR, the highest among on-patent agents. Cialis benefited from its dual-indication label covering benign prostatic hyperplasia, sustaining cash flows despite generic tadalafil entries in several markets. Levitra lost shelf space as payers prioritized lower-cost therapeutic equivalents. Topical Eroxon created a non-pill alternative that appeals to patients wary of systemic side effects, marking a structural inflection in the erectile dysfunction drugs market. Regional brands such as Zydena remained confined to South Korea and select Asian countries, limiting global influence. Overall, generics are projected to capture incremental volume, but innovative delivery formats will protect premium niches. Branded incumbents respond with life-cycle extensions like oro-dispersible films to defend share.

Second-generation brands also exploit pharmacokinetic tweaks to differentiate, offering ultra-rapid uptake or longer half-lives. Fixed-dose combination products such as ENTADFI illustrate how shared pathophysiology between prostate enlargement and erectile dysfunction supports multi-symptom positioning. These dynamics align with broader OTC liberalization efforts, pointing to a fragmented yet opportunity-rich competitive canvas for the erectile dysfunction drugs market.

PDE5 inhibitors generated 85.53% of 2024 revenue, cementing their status as first-line pharmacotherapy. Nevertheless, a pipeline of nitric-oxide donors, Rho-kinase inhibitors, and centrally acting agents is moving through Phase II and III trials. Novel mechanisms collectively post an 11.85% CAGR, suggesting room for differentiated efficacy and tolerability profiles. Prostaglandin analogues preserved a niche role for patients with nitrate contraindications but face compliance challenges due to local administration discomfort. Clinical interest in protein kinase C inhibition rose after MDPI-published data showed restored nitric-oxide signaling in diabetic cavernosal tissue. Combination regimens mixing low-dose PDE5 with peripheral vasodilators seek to reduce systemic exposure while maintaining potency, a strategy expected to entice risk-averse prescribers.

Patents surrounding pyrazolopyrimidinone derivatives exemplify the ongoing innovation race as originators attempt to lock in next-generation exclusivity drugpatentwatch.com. Should centrally acting molecules overcome safety hurdles, they could redefine therapeutic sequencing in the erectile dysfunction drugs industry by addressing psychogenic etiology more directly. For now, PDE5s dominate treatment algorithms, but pharmacologic diversification is gathering momentum.

The Erectile Dysfunction Durgs Market is Segmented by Product (Viagra (Sildenafil), Cialis (Tadalafil), Levitra / Staxyn (Vardenafil), and More), Drug Class (PDE5 Inhibitors, Prostaglandin Analogues, and More), Mode of Administration (Oral Tablets / Capsules, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.82% of global revenue in 2024, sustained by high discretionary income, advanced telehealth coverage, and early OTC regulatory pilots. The FDA's landmark green light for Eroxon established a template other regulators now study, reinforcing the region's leadership in self-care models. Still, generic saturation and payer cost controls temper absolute growth, bending the North American CAGR closer to the 7% global mean. Europe shares similar maturity, yet remains a focal point for digital health expansion; the Hims & Hers-ZAVA deal instantly unlocked multi-country reach without protracted license registrations.

Asia-Pacific posted the highest CAGR at 10.52%, driven by demographic aging in China, Japan, and South Korea, coupled with regulatory modernization. China's 2025 guideline overhaul accelerates new-drug reviews, slashing approval timelines to under 200 days and attracting cross-border license applications. Japan's pharmaceutical revitalization initiatives include fee waivers for digital trial submissions, encouraging global sponsors to site late-phase studies locally. Regional distributors such as Zuellig Pharma bought Cialis rights in ASEAN markets to consolidate supply chains and localize marketing.

South America and the Middle East & Africa trail in absolute size but show accelerating online-pharmacy adoption as smartphone penetration climbs. Payment-gateway innovation in Brazil and Saudi Arabia lowers cross-border import frictions, allowing global brands to seed awareness ahead of formal regulatory approvals. However, fragmented reimbursement frameworks and lingering cultural stigma remain structural hurdles. Long-term prospects hinge on public-health recognition that sexual health intersects broader non-communicable disease management, a narrative gaining traction among regional policymakers.

- Pfizer

- Eli Lilly and Company

- Bayer

- Teva Pharmaceutical Industries

- Viatris

- Cipla

- Lupin

- Aurobindo Pharma

- Dr. Reddy's Laboratories

- Sun Pharmaceuticals Industries

- Futura Medical plc

- Petros Pharmaceuticals

- Apricus Biosciences

- Vivus

- S.K. Chemicals

- LTR Pharma Pty Ltd

- Endo International

- Sanofi

- Glenmark Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Related Comorbidities Boost PDE5 Demand

- 4.2.2 Increasing Lifestyle-Induced Stress & Obesity Prevalence

- 4.2.3 Growing Tele-Medicine & E-Pharmacy Penetration

- 4.2.4 Wider Off-Label Use In BPH & LUTS Management

- 4.2.5 Nasal & Topical Fast-Onset Formulations Nearing Approval

- 4.3 Market Restraints

- 4.3.1 Persisting Social Stigma & Under-Diagnosis

- 4.3.2 High Out-Of-Pocket Cost For Branded Therapies

- 4.3.3 Online Counterfeit Supply Hurting Safety & Trust

- 4.3.4 Sub-Optimal Long-Term Adherence In Cardio-Metabolic Patients

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes (devices, surgery, regenerative)

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Viagra (Sildenafil)

- 5.1.2 Cialis (Tadalafil)

- 5.1.3 Levitra / Staxyn (Vardenafil)

- 5.1.4 Stendra / Spedra (Avanafil)

- 5.1.5 Zydena (Udenafil)

- 5.1.6 Vitaros / Alprostadil

- 5.1.7 Others

- 5.2 By Drug Class

- 5.2.1 PDE5 Inhibitors

- 5.2.2 Prostaglandin Analogues

- 5.2.3 Centrally-acting Agents

- 5.2.4 NO Donors / Novel MOA

- 5.3 By Mode of Administration

- 5.3.1 Oral Tablets / Capsules

- 5.3.2 Oro-dispersible Films & Sublingual

- 5.3.3 Topical & Transdermal

- 5.3.4 Nasal Sprays

- 5.3.5 Injectable / Intra-urethral

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies & DTC Platforms

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Pfizer Inc.

- 6.3.2 Eli Lilly and Company

- 6.3.3 Bayer AG

- 6.3.4 Teva Pharmaceutical Industries Ltd

- 6.3.5 Viatris Inc

- 6.3.6 Cipla Ltd

- 6.3.7 Lupin Limited

- 6.3.8 Aurobindo Pharma

- 6.3.9 Dr. Reddy's Laboratories

- 6.3.10 Sun Pharmaceutical Industries Ltd

- 6.3.11 Futura Medical plc

- 6.3.12 Petros Pharmaceuticals

- 6.3.13 Apricus Biosciences Inc.

- 6.3.14 VIVUS Inc.

- 6.3.15 S.K. Chemicals Co. Ltd

- 6.3.16 LTR Pharma Pty Ltd

- 6.3.17 Endo International plc

- 6.3.18 Sanofi SA

- 6.3.19 Glenmark Pharmaceuticals Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment