PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842430

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842430

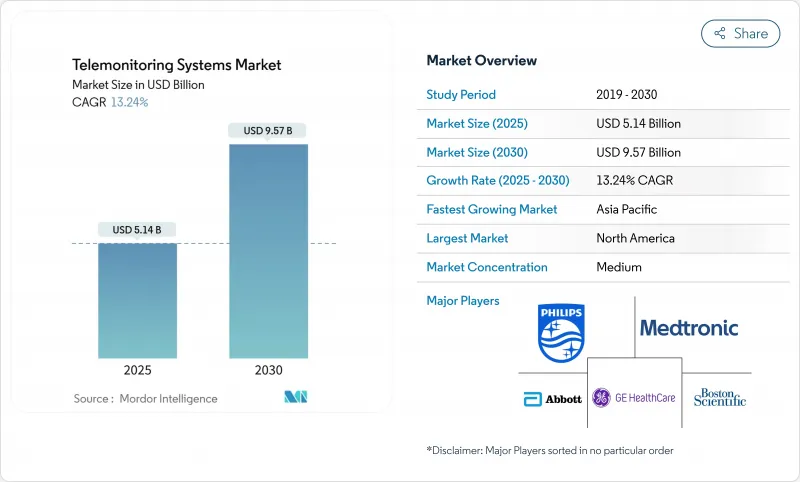

Telemonitoring Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The telemonitoring systems market stands at USD 5.14 billion in 2025 and is forecast to reach USD 9.57 billion by 2030, reflecting a robust 13.24% CAGR.

This growth reflects the rapid transition from episodic care to home-based, predictive models that use artificial intelligence (AI) to convert continuous data feeds into real-time clinical guidance. Recent reimbursement changes-most notably the Centers for Medicare & Medicaid Services (CMS) expansion of Remote Patient Monitoring (RPM) and the debut of Advanced Primary Care Management billing codes-have made these systems financially sustainable for providers. AI-equipped cardiac platforms now detect atrial fibrillation weeks earlier than legacy monitors, while consumer-grade continuous glucose monitors (CGMs) are moving beyond diabetes care to wider metabolic-health applications. North America leads adoption thanks to aggressive Hospital-at-Home rollouts, whereas Asia-Pacific emerges as the fastest-growing region on the back of 5G infrastructure and supportive digital-health policies.

Global Telemonitoring Systems Market Trends and Insights

Growing Chronic Disease Burden & Ageing Population

An unprecedented rise in multimorbidity and an aging demographic underpin demand for continuous monitoring far beyond traditional clinical walls. Japan illustrates the challenge: 29% of its citizens are already over 65, spurring nationwide digital-health initiatives that position telemonitoring as a workforce-saving solution. The Japanese Society of Ningen Dock's endorsement of multi-parameter MCG screening underlines clinician confidence in proactive, tech-enabled chronic-disease management. In rural China, education and income shape willingness to adopt telemedicine, suggesting implementation programs must address socioeconomic hurdles to unlock full population health benefits. Chronic-care telemonitoring, costing roughly USD 10 per patient-day versus USD 500 for a hospital bed, gives providers a compelling economic incentive to scale programs.

Expansion of Reimbursement Codes for RPM & Telehealth

CMS's 2025 Physician Fee Schedule allows providers to layer Advanced Primary Care Management payments on top of existing RPM codes, boosting revenue per enrolled patient. Permanent coverage for audio-only visits and simplified Federally Qualified Health Center billing expands access in low-resource settings. Yet only a dozen US states reimburse Hospital-at-Home under Medicaid, and EU payment policies vary sharply, with Germany and Belgium far ahead of peers in digital-device integration.Clinicians welcome the American Medical Association's newly added RPM codes, but still face complex documentation rules that can slow scaling.

Rural ICT & Broadband Gaps

Roughly 3 million Americans living in broadband "deserts" cannot transmit high-resolution sensor data, limiting telemonitoring reach where chronic-disease rates are often highest. Greene County Health System in Alabama, for instance, operates with speeds a tenth of what electronic health records require, forcing nurses to revert to manual vitals checks. Digital inequities also span device ownership and literacy; only 46% of rural households subscribe to fixed broadband versus 67% of urban peers.

Other drivers and restraints analyzed in the detailed report include:

- Tech Advances in Wearables & 5G Connectivity

- Pressure to Cut Readmissions & Hospital Costs

- Cyber-Security / Privacy Breaches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cardiac platforms held 31.43% of telemonitoring systems market share in 2024, thanks to well-established reimbursement and FDA-cleared devices such as Abbott's Assert-IQ, which offers six-year battery life and AI-enhanced arrhythmia detection. Glucose-monitoring devices are projected to expand at 17.55% CAGR, propelled by consumer wellness trends and OTC CGM approvals. This segment's rise widens the telemonitoring systems market by attracting non-diabetic users keen on metabolic fitness.

Preventive care models are spurring multi-parameter monitors that aggregate ECG, SpO2, and blood pressure in one wearable, echoing the market's pivot from single-metric tools to holistic platforms. COPD and hypertension devices fill niche needs but face slower growth until broader clinical guidelines endorse remote management.

Hardware captured 82.12% revenue in 2024, but software is advancing at a 15.34% CAGR, reflecting the industry's recognition that data unification and algorithmic insights drive value. Philips' viQtor integration exemplifies software-centric ecosystems that streamline clinician dashboards. Telemonitoring systems market size for cloud-first analytics modules is expected to grow steadily as AI models mature and payors reimburse decision-support outputs.

Services-from implementation to training-form the glue that binds devices and platforms, ensuring long-term user adoption. GE HealthCare's CareIntellect uses generative AI to condense cancer patient records, cutting data-retrieval time and underscoring how software reduces cognitive load.

The Telemonitoring Systems Market Report is Segmented by Product Type (COPD Telemonitoring System, Glucose Level Telemonitoring System, and More), Component (Devices, Software Platforms and More), Connectivity Technology (Bluetooth / Low-Energy and More), Application (Cardiovascular Diseases and More), End-User Setting (Hospitals & Specialty Clinics and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 39.87% of telemonitoring systems market share in 2024 on the back of reimbursement leadership and mature provider networks. CMS data show 31,000 patients treated via Hospital-at-Home since 2020 with lower mortality and spending, reinforcing payor confidence in remote care. Mass General Brigham's 70-bed capacity demonstrates how large systems leverage telemonitoring to free inpatient beds for higher acuity cases. Enterprise deals between Philips and leading health systems are translating into nationwide rollouts of AI-enabled dashboards.

Asia-Pacific is the fastest-growing territory with a 14.76% CAGR to 2030, supported by proactive digital-health policies. Japan's 7.29% market expansion underscores how demographic pressure catalyzes technology uptake, whereas China's 5G private networks create infrastructure readiness for always-on monitoring. Bibliometric analysis reveals China jumped from 10th to 6th in telemedicine publications post-pandemic, reflecting amplified innovation spending.

Europe posts steady growth anchored by the WHO Regional Digital Health Action Plan, with Norway's AI-assisted teleradiology programs setting benchmarks for cross-border data-sharing. Yet reimbursement fragmentation slows deployment speed. The forthcoming European Health Data Space and HTA regulation aim to harmonize evaluation criteria, which could reduce launch timelines.

Elsewhere, Middle East, Africa, and South America remain nascent but promising. Pilot programs in the United Arab Emirates and Brazil demonstrate viability once regulatory guardrails and broadband build-outs advance.

- Koninklijke Philips

- Medtronic

- GE HealthCare Technologies Inc.

- Abbott Laboratories

- Resideo (Honeywell HomMed)

- Boston Scientific

- OMRON

- Nihon Kohden

- Dexcom

- Teladoc Health

- Masimo

- Aerotel Medical Systems

- InfoBionic Inc.

- iRhythm Technologies

- AliveCor

- VitalConnect Inc.

- Care Innovation LLC (Intel-GE JV)

- AMD Global Telemedicine

- SHL Telemedicine Ltd.

- Resmed

- Qardio Inc.

- Withings

- VivaLNK

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Chronic Disease Burden & Ageing Population

- 4.2.2 Expansion Of Reimbursement Codes For RPM & Telehealth

- 4.2.3 Tech Advances In Wearables & 5G Connectivity

- 4.2.4 Pressure To Cut Readmissions & Hospital Costs

- 4.2.5 Capacity-Driven "Hospital-At-Home" Roll-Outs

- 4.2.6 AI-Powered Predictive Analytics Turns RPM Data Into Billable Insight

- 4.3 Market Restraints

- 4.3.1 Rural ICT & Broadband Gaps

- 4.3.2 Cyber-Security / Privacy Breaches

- 4.3.3 Clinician Workflow Overload From Raw RPM Data

- 4.3.4 Patchy Non-US Reimbursement & Evidence Thresholds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 COPD Telemonitoring Systems

- 5.1.2 Glucose Level Telemonitoring Systems

- 5.1.3 Cardiac Telemonitoring Systems

- 5.1.4 Blood-Pressure Telemonitoring Systems

- 5.1.5 Multi-parameter/Other Systems

- 5.2 By Component

- 5.2.1 Devices

- 5.2.2 Software Platforms

- 5.2.3 Services

- 5.3 By Connectivity Technology

- 5.3.1 Bluetooth / Low-Energy

- 5.3.2 Cellular / NB-IoT

- 5.3.3 Wi-Fi / WLAN

- 5.3.4 Wired

- 5.4 By Application / Condition

- 5.4.1 Cardiovascular Diseases

- 5.4.2 Diabetes

- 5.4.3 Respiratory Diseases (e.g., COPD, Asthma)

- 5.4.4 Other Chronic & Acute Conditions

- 5.5 By End-User Setting

- 5.5.1 Hospitals & Specialty Clinics

- 5.5.2 Home-care Settings

- 5.5.3 Long-term Care Facilities

- 5.5.4 Ambulatory Surgical & Out-patient Centers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 Medtronic plc

- 6.3.3 GE HealthCare Technologies Inc.

- 6.3.4 Abbott Laboratories

- 6.3.5 Resideo (Honeywell HomMed)

- 6.3.6 Boston Scientific Corp.

- 6.3.7 Omron Corporation

- 6.3.8 Nihon Kohden Corporation

- 6.3.9 Dexcom Inc.

- 6.3.10 Teladoc Health Inc.

- 6.3.11 Masimo Corporation

- 6.3.12 Aerotel Medical Systems Ltd.

- 6.3.13 InfoBionic Inc.

- 6.3.14 iRhythm Technologies Inc.

- 6.3.15 AliveCor Inc.

- 6.3.16 VitalConnect Inc.

- 6.3.17 Care Innovation LLC (Intel-GE JV)

- 6.3.18 AMD Global Telemedicine Inc.

- 6.3.19 SHL Telemedicine Ltd.

- 6.3.20 ResMed Inc.

- 6.3.21 Qardio Inc.

- 6.3.22 Withings

- 6.3.23 VivaLNK

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment