PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842431

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842431

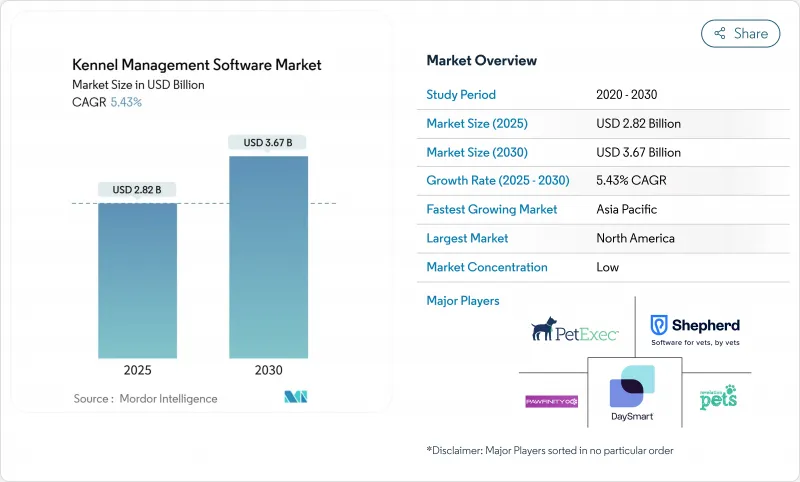

Kennel Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The kennel management software market size is valued at USD 2.82 billion in 2025 and is projected to climb to USD 3.67 billion by 2030, advancing at a 5.43% CAGR.

Sustained digitization of pet-care operations, strengthened by cloud-first architectures and artificial-intelligence modules, keeps the growth trajectory intact. Regulatory mandates that force deeper animal-welfare record keeping continue to accelerate purchase cycles, particularly among micro-kennels looking to professionalize services. Vendors that embed payment gateways and insurance APIs in their platforms capture measurable wallet share as facilities seek all-in-one systems. Headwinds still persist from data-security anxieties and the high switching costs of spreadsheets, but subscription pricing that aligns cost with usage is lowering resistance across all enterprise sizes.

Global Kennel Management Software Market Trends and Insights

Rising Global Pet Ownership & Spending

Urban pet humanization pushes facilities to digitize every touchpoint so that owners receive hotel-grade experiences. Asia-Pacific pet-care spending is on track to reach USD 34.8 billion in 2029, sustaining demand for platforms that document premium services. In Japan, lifetime dog-ownership costs climbed to JPY 2.446 million (USD 16,000) in 2023, affirming willingness to pay for value-added care tracking. Younger digital-native owners select kennels that offer mobile bookings and live pet updates, which in turn expands the kennel management software market.

Rapid Shift to SaaS-Based Deployment

Subscription models remove the capital hurdle that once blocked software investment for small operators. The European companion-animal segment, moving from USD 3.96 billion in 2022 to USD 5.37 billion by 2027, provides fertile ground for cloud rollouts.Continuous upgrades, bundled compliance, and device-agnostic access have normalized SaaS as the default procurement path, intensifying competitive differentiation on user experience rather than price.

Low Digital Literacy Among Micro-Kennel Operators

Many micro-facilities run on family labor and informal scheduling, limiting appetite for enterprise software. Sixty-six percent of pet owners in Japan delay veterinary visits due to perceived cost, while 41% cite time constraints, hinting at operators' sensitivity to workflow complexity. Training clinics on basic system navigation remain costly, restraining penetration even as the segment shows 6.80% CAGR potential.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Integrated Payment & CRM Suites

- Need for Real-Time Capacity & Run-Utilisation Analytics (AI-Driven)

- Data-Security & PII-Compliance Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud platforms accounted for 68.0% of the kennel management software market in 2024 and are forecast to expand at a 6.40% CAGR. The shift reflects lower upfront spending, seamless integrations, and automatic regulatory updates. Multi-location chains benefit from centralized dashboards that standardize SOPs across sites. Meanwhile, on-premise solutions linger within large hospitals, demanding local data custody but face shrinking refresh budgets. Vendors that demonstrate ISO-27001 and SOC-2 compliance accelerate conversions among late adopters. As a result, cloud continues to expand wallet share and strengthens the overall kennel management software market position.

On-premise systems still serve niche scenarios such as rural areas with inconsistent bandwidth. However, the total cost of ownership rises as aging hardware requires replacement. Security patches become cumbersome without managed services, creating vulnerabilities that regulators scrutinize. Over time, life-cycle economics favor migration, reinforcing the long-term dominance of cloud in the kennel management software market.

Boarding and daycare facilities generated 46.0% revenue in 2024, validating their role as the core demand engine. These operators value rapid check-in workflows and mobile updates that reassure owners. Veterinary boarding, although only 12.0% share in 2024, is projected to rise at 7.20% CAGR as medical oversight merges with hospitality. Integrated electronic health records, medication alerts, and post-operative monitoring capabilities influence purchase decisions, positioning software as clinical infrastructure, not merely scheduling support.

Grooming salons and pet retail chains are leveraging CRM modules to upsell spa packages and merchandise. Home-based sitters demand mobile-first tools with quick-tap invoicing. Their growth reveals that even solo operators recognize software's branding and compliance benefits. The kennel management software market continues to diversify in response to these varying workflows.

Global Kennel Software Market is Segmented by Deployment (Cloud, On-Premise), End-User Type (Boarding and Daycare Facilities, Grooming Salons, and More), Enterprise Size (Micro (<10 Runs), Small (10-49 Runs), and More), Subscription Model (SaaS (Monthly/Annual), Perpetual License + Maintenance), Sales Channel (Direct, Value-Added Reseller/Marketplace), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 40.0% share in 2024, sustained by high pet ownership and well-funded veterinary ecosystems. The United States hosts dense boarding chains that require HIPAA-like record rigor, propelling premium feature uptake. Canada's pet-food export surge hints at wider sector maturity, indirectly increasing demand for facility software. Regional state privacy regulations keep data-security modules top of mind for buyers, enhancing vendor stickiness. Cross-border mergers produce consolidated chains that standardize on a single platform to leverage economies of scale, further deepening the kennel management software market.

Europe follows as the second-largest region, benefiting from established veterinary care frameworks and robust broadband penetration. Companion-animal health spending is climbing toward USD 5.37 billion by 2027, underpinning steady software conversion. GDPR compels detailed consent tracking, spurring demand for audit trails and encrypted backups. Germany, France, and the United Kingdom spearhead adoption, while Nordic countries emphasize sustainability reporting on the same platforms. Cross-functional modules that couple inventory with prescription labeling deliver compliance efficiencies, making software indispensable rather than discretionary.

Asia-Pacific is the growth engine with 7.30% CAGR through 2030. Japan's pet population exceeded 15.9 million in 2024, sustaining facility investments in digital infrastructure. China's Tier-1 cities introduce licensing that mandates electronic welfare logs, accelerating SaaS penetration. South Korea and Singapore, known for the quick adoption of fintech, show enthusiasm for payment-embedded kennel platforms. Localized interfaces and integration with regional e-wallets become decisive factors as Western vendors localize offerings. With disposable incomes rising and urban dwellers prioritizing pet wellness, Asia-Pacific has the potential to overtake North America in the kennel management software market revenue by the early 2030s.

- PetExec Inc.

- DaySmart Software (incl. Gingr)

- Shepherd Software

- PedFast Technologies (Kennel Connection)

- Software Revolutions Ltd (Revelation Pets)

- Pawfinity

- ProPet Software

- K9 Bytes Inc.

- PawLoyalty

- Dog BizPro

- KennelBooker

- KennelPlus

- Grensoft

- Gespet

- K9 Sky

- Kennel Link

- AcuroVet

- Digitail

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global pet ownership and spending

- 4.2.2 Rapid shift to SaaS-based deployment

- 4.2.3 Demand for integrated payment and CRM suites

- 4.2.4 Need for real-time capacity and run-utilisation analytics (AI-driven)

- 4.2.5 Embedded pet-insurance APIs unlocking new revenue streams

- 4.2.6 Hybrid workplace trends boosting daycare traffic

- 4.3 Market Restraints

- 4.3.1 Low digital literacy among micro-kennel operators

- 4.3.2 Data-security and PII-compliance concerns

- 4.3.3 High switching costs from legacy spreadsheets

- 4.3.4 Fragmented regional rules on animal-welfare data capture

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (IoT wearables, AI video)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By End-User Type

- 5.2.1 Boarding and Daycare Facilities

- 5.2.2 Grooming Salons

- 5.2.3 Pet Retail and Multi-Service Chains

- 5.2.4 Veterinary / Medical Boarding

- 5.2.5 Home-based Sitters

- 5.3 By Enterprise Size

- 5.3.1 Micro (<10 runs)

- 5.3.2 Small (10-49 runs)

- 5.3.3 Medium (50-199 runs)

- 5.3.4 Large (200+ runs / multi-site)

- 5.4 By Subscription Model

- 5.4.1 SaaS (Monthly / Annual)

- 5.4.2 Perpetual Licence + Maintenance

- 5.5 By Sales Channel

- 5.5.1 Direct (Vendor-Hosted)

- 5.5.2 Value-Added Reseller / Marketplace

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Benelux

- 5.6.3.8 Russia

- 5.6.3.9 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN 5

- 5.6.4.6 Australia and NZ

- 5.6.4.7 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Initiatives and Mergers and Acquisitions

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PetExec Inc.

- 6.4.2 DaySmart Software (incl. Gingr)

- 6.4.3 Shepherd Software

- 6.4.4 PedFast Technologies (Kennel Connection)

- 6.4.5 Software Revolutions Ltd (Revelation Pets)

- 6.4.6 Pawfinity

- 6.4.7 ProPet Software

- 6.4.8 K9 Bytes Inc.

- 6.4.9 PawLoyalty

- 6.4.10 Dog BizPro

- 6.4.11 KennelBooker

- 6.4.12 KennelPlus

- 6.4.13 Grensoft

- 6.4.14 Gespet

- 6.4.15 K9 Sky

- 6.4.16 Kennel Link

- 6.4.17 AcuroVet

- 6.4.18 Digitail

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment