PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842437

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842437

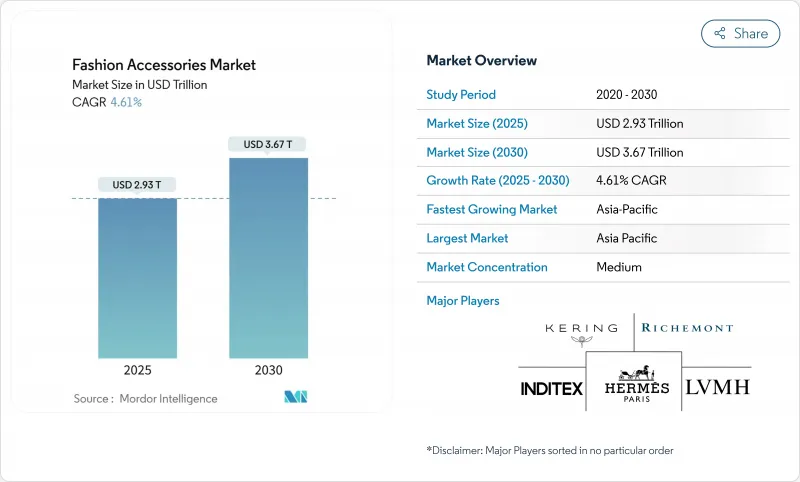

Fashion Accessories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global fashion accessories market reached USD 2.93 trillion in 2025 and is projected to grow to USD 3.67 trillion by 2030, at a CAGR of 4.61%.

The market's growth reflects a maturing luxury landscape where accessories like statement jewelry, footwear, and handbags are increasingly viewed as investment pieces rather than disposable items. This resilience is driven by consumer priorities shifting toward quality craftsmanship and brand heritage. The industry's competitive nature necessitates continuous innovation in product design to adapt to changing consumer preferences. Developing countries, particularly India, contribute significantly to market expansion due to increasing purchasing power, urbanization, and evolving consumer behavior. Additionally, fitness trends, fashion consciousness, celebrity endorsements, and effective online marketing strategies have stimulated demand for both fashion and sports accessories, with e-commerce platforms emerging as the preferred purchasing channel.

Global Fashion Accessories Market Trends and Insights

Technological Advancements in Terms of Design and Raw Material

Smart textiles and wearable technology integration are transforming the global accessories market by enabling premium positioning and creating new revenue streams. The convergence of material science innovations and sustainable alternatives addresses environmental concerns while meeting consumer demands for functionality. This technological integration has evolved fashion accessories from purely aesthetic items to functional lifestyle tools through AI customization and payment-enabled features. For instance, in December 2024, the collaboration between Gucci and Oura resulted in an 18-karat gold smart ring that combines health monitoring capabilities with luxury design, demonstrating how the accessories market is adapting to consumer preferences for both functionality and style. The ring's ability to track vital health metrics, including heart rate, respiratory rate, temperature, and sleep stages, while maintaining premium aesthetics, exemplifies the market's direction toward tech-integrated fashion accessories. Major fashion brands are increasingly investing in research and development to incorporate advanced technologies into their accessory lines, from smart handbags with built-in charging capabilities offered by Smith and Canova, to connected jewelry that enables contactless payments. As the integration of technology and fashion continues to evolve, the fashion accessories market is poised to witness further innovations that seamlessly blend functionality with style, creating enhanced value propositions for consumers.

Rising Demand For Sportswear From Fitness-Conscious Consumers

The convergence of performance and luxury segments is experiencing significant growth, driven by fitness-conscious consumers who increasingly participate in accessible social sports like pickleball and off-course golf. The integration of athletic functionality with premium design elements has created a new category of versatile apparel that meets both performance and style requirements. This market evolution reflects changing consumer preferences, where traditional boundaries between activewear and luxury fashion continue to blur. According to a 2024 WHO report, approximately 31% of people globally are physically inactive, indicating a significant market opportunity as more individuals embrace active lifestyles post-pandemic. This shift in consumer behavior toward wellness-integrated fashion enables manufacturers to develop hybrid products that combine performance functionality with luxury aesthetics, catering to diverse fashion preferences across a broader market. For instance, in January 2025, British brand Tu (Sainsbury's) collaborated with TV personality Oti Mabuse to launch "Reaktiv x Oti Mabuse," a versatile activewear and loungewear line designed for both athletic activities and daily wear.

Proliferation of Counterfeit Products

Counterfeiting poses a significant restraint on the global fashion accessories market, as evidenced by the European Union Intellectual Property Office's (EUIPO) January 2024 report, which revealed annual losses of EUR 16 billion across Europe's clothing, cosmetics, and toy sectors, representing 5.2% of their total revenue. The accessibility of counterfeit products at lower prices appeals to price-sensitive consumers, while the localization of counterfeit production near destination markets and advanced manufacturing techniques make it increasingly difficult to differentiate between authentic and fake products. These factors collectively undermine legitimate luxury brands' market position and diminish their long-term brand value, constraining the market's growth potential. The rise of e-commerce platforms has further complicated the situation, providing counterfeiters with additional channels to distribute fake products globally while making enforcement more challenging. Additionally, the economic impact extends beyond direct revenue losses, affecting employment in legitimate manufacturing facilities and reducing tax revenues for governments. The proliferation of social media platforms has also enabled counterfeiters to target younger consumers more effectively, creating sophisticated marketing campaigns that mimic authentic brands.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and Ethical Production

- Influence of Social Media and Celebrity Endorsements

- Supply Chain Disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The fashion accessories market continues to be dominated by apparel, which holds a 58.44% share in 2024. This leadership position is strengthened by the expansion of luxury ready-to-wear and the growing influence of athleisure trends that transcend traditional category boundaries. Watches have emerged as the most dynamic segment, projected to grow at a 4.96% CAGR through 2030, driven by smartwatch integration and increased demand for luxury timepieces as investment assets. The footwear segment maintains momentum through premium sneaker culture and sustainable material innovations, while jewelry experiences renewed interest through statement pieces and celebrity collaborations.

Market dynamics vary across product categories, with handbags facing challenges due to evolving consumer mobility patterns in the post-pandemic environment. Sunglasses and wallets, representing mature market segments, seek differentiation through technological integration and sustainable materials. Across all categories, product innovation cycles are accelerating as brands utilize digital design tools and advanced material science to maintain competitive advantages in an increasingly saturated market. The integration of digital elements and smart features in traditional luxury products reflects the industry's adaptation to changing consumer preferences and technological advancement.

Mass market accessories maintain a dominant 66.44% market share in 2024, while premium segments grow at a 5.68% CAGR through 2030, highlighting a market bifurcation amid economic uncertainty. As middle-market brands face pressure from both affordable fast fashion and luxury alternatives, premium positioning benefits from consumers' shifting investment mindset that prioritizes durability and brand heritage over disposable fashion trends. This trend is particularly evident in key markets like North America and Europe, where consumers increasingly seek long-term value in their purchases. The mass market segment continues to rely on competitive pricing and widespread distribution networks to maintain its market leadership position.

The premium segment's growth is driven by limited edition releases, celebrity collaborations, and emphasis on artisanal craftsmanship to justify higher price points. In response, mass market players are implementing quality improvements and adopting sustainable materials to defend their market share against premium segment expansion. Digital marketing initiatives and enhanced online retail presence have become crucial strategies for both segments to capture market share. The integration of technology in product development and customer experience has emerged as a key differentiator for brands across both segments.

The Fashion Accessories Market Report Segments the Industry Into Product Type (Footwear, Apparel, Wallets, Handbags, Watches, Sunglasses, and Jewelry), End-User (Men, Women, and Kids/Children), Category (Mass and Premium), Distribution Channel (Offline Stores and Online Stores), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands a dominant 34.55% market share in 2024 and exhibits the highest regional growth rate at 6.58% CAGR through 2030. This growth is primarily driven by Japan's market expansion and increasing adoption of premium accessories by India's emerging middle class. The region's robust textile and apparel foundation, combined with demographic advantages and rising disposable incomes, creates sustainable demand across both mass and premium segments. The market demonstrates resilience through brand diversification across multiple Asian countries, reducing single-market dependency while creating strategic opportunities through adaptation to local preferences and economic conditions.

Europe maintains a significant market presence while adapting to new sustainability regulations, including the EU's Corporate Sustainability Reporting Directive and Extended Producer Responsibility frameworks. The region's commitment to growth is evident in the opening of 83 new luxury fashion retail stores in 2024, with fashion and accessories accounting for 41 locations. European brands are increasingly implementing vertical integration strategies, with companies such as Chanel and Prada acquiring suppliers to enhance manufacturing control and ensure sustainability compliance.

The Middle East, particularly Dubai and Saudi Arabia, continues to attract fashion and luxury investment through tourism growth and high concentration of high-net-worth individuals. Latin American markets show promise due to economic stabilization and improved brand accessibility. Meanwhile, North American markets are adjusting to trade policy changes, including tariff implementations that influence sourcing strategies and cost structures.

- LVMH Moet Hennessy Louis Vuitton

- Inditex SA

- Kering SA

- Richemont SA

- Hermes International SA

- Tapestry Inc.

- Capri Holdings

- Prada SpA

- Giorgio Armani SpA

- Dolce & Gabbana SRL

- Chanel SA

- Ramsbury Invest AB

- Swatch Group

- Fossil Group Inc.

- Luxottica Group SpA

- Pandora A/S

- Tory Burch LLC

- Nike Inc.

- Adidas AG

- VF Corporation

- Under Armour Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological advancements in terms of design and raw material

- 4.2.2 Increasing demand for luxury products

- 4.2.3 Rising demand for sportswear from fitness-conscious consumers

- 4.2.4 Globalisation of fashion trends

- 4.2.5 Sustainability and ethical production

- 4.2.6 Influence of social media and celebrity endorsements

- 4.3 Market Restraints

- 4.3.1 Proliferation of counterfeit products

- 4.3.2 Supply chain disruptions

- 4.3.3 Fluctuating raw material prices

- 4.3.4 Rising trade barriers and tariffs

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Footwear

- 5.1.2 Apparel

- 5.1.3 Wallets

- 5.1.4 Handbags

- 5.1.5 Watches

- 5.1.6 Sunglasses

- 5.1.7 Jewelery

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Kids/Children

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Offline Stores

- 5.4.2 Online Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 LVMH Moet Hennessy Louis Vuitton

- 6.4.2 Inditex SA

- 6.4.3 Kering SA

- 6.4.4 Richemont SA

- 6.4.5 Hermes International SA

- 6.4.6 Tapestry Inc.

- 6.4.7 Capri Holdings

- 6.4.8 Prada SpA

- 6.4.9 Giorgio Armani SpA

- 6.4.10 Dolce & Gabbana SRL

- 6.4.11 Chanel SA

- 6.4.12 Ramsbury Invest AB

- 6.4.13 Swatch Group

- 6.4.14 Fossil Group Inc.

- 6.4.15 Luxottica Group SpA

- 6.4.16 Pandora A/S

- 6.4.17 Tory Burch LLC

- 6.4.18 Nike Inc.

- 6.4.19 Adidas AG

- 6.4.20 VF Corporation

- 6.4.21 Under Armour Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK