PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842438

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842438

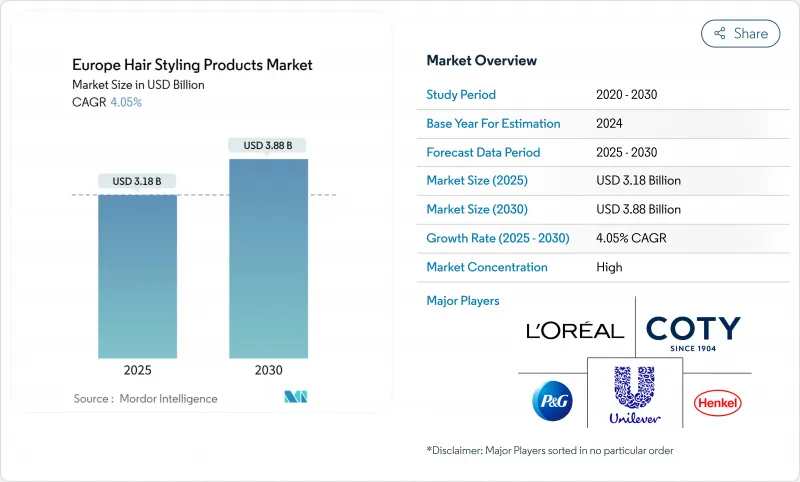

Europe Hair Styling Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The European hair styling products market is projected to grow from USD 3.18 billion in 2025 to USD 3.88 billion by 2030, at a compound annual growth rate (CAGR) of 4.05%.

This growth stems from changing consumer preferences, particularly the increased demand for clean, sustainable, and health-focused beauty products. European consumers are showing a stronger preference for sulfate-free and silicone-free hair styling products, driven by concerns about scalp health, hair damage, and chemical exposure. In response, manufacturers are developing new formulations that align with clean beauty requirements. The market expansion is further supported by growing haircare awareness, influenced by social media and online professional haircare content, which drives the consumption of styling products like gels, sprays, waxes, and creams. The market benefits from urbanization, higher disposable incomes, and increased personal grooming focus, particularly among male consumers and younger age groups. The availability of organic and plant-based products, combined with expanded e-commerce distribution, has improved market access for both established and new brands.

Europe Hair Styling Products Market Trends and Insights

Surge of Sulfate-Free and Silicone-Free Formulations

The European hair styling products market demonstrates a significant transition toward sulfate-free and silicone-free formulations, primarily attributed to heightened consumer awareness and increasing demand for healthier, sustainable alternatives. The market evolution reflects a fundamental shift in consumer preferences toward natural ingredients and environmentally conscious products. Contemporary technological advancements in formulation methodologies facilitate superior styling performance while incorporating essential benefits such as thermal protection, enhanced moisturization, and structural repair properties. For instance, in May 2023, Maria Nila introduced the Coils & Curls haircare line, incorporating specialized nourishing ingredients designed to deliver optimal hydration and refined washing and styling processes. The entire Coils & Curls product range maintains strict exclusion of sulfates, parabens, and silicone compounds.

Influence of Social Media and Celebrity Endorsement

The European hair styling products market has experienced a significant transformation through social media platforms' influence on marketing and consumption patterns. Companies strategically implement celebrity endorsements as a primary marketing approach, wherein prominent personalities promote products to drive consumer purchasing decisions. The effectiveness of these endorsements is contingent upon the strategic alignment between the celebrity's profile and the product attributes, coupled with their capacity to effectively convey brand messaging to the target demographic. Companies are demonstrating increased commitment to marketing investments in the European region. For instance, according to L'Oreal's universal registration document, the company's global advertising and promotional expenditure increased from EUR 13.3 billion in 2023 to EUR 14 billion in 2024.

Health Concerns Over Chemical Ingredients

The increasing consumer awareness about harmful chemical ingredients in European hair styling products presents a significant market restraint. In 2024, the European Chemicals Agency expanded its Candidate List of substances of very high concern, including several ingredients commonly used in traditional hair styling formulations. This development has compelled manufacturers to reevaluate their product formulations and compliance strategies. The European Commission reported 4,137 alerts for dangerous products from European Union Members and EEA countries in 2024, marking the highest number of validated notifications in the "alert" category since the Rapid Alert System for Dangerous Non-food Products began . This increase demonstrates the system's effectiveness in identifying potentially harmful products in the European market, which influences consumer purchasing decisions and manufacturers' product development strategies.

Other drivers and restraints analyzed in the detailed report include:

- Shift Towards Natural and Organic Products

- Technological Innovations in Product Formulations

- Proliferation of Counterfeit Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Creams, gels, and wax products hold a 78.48% share of the European hair styling market in 2024. These products maintain their market leadership through versatility, effectiveness, and consumer preference. Gels and waxes represent the largest segment, a position expected to continue due to their styling capabilities across different hair types. The products deliver hold, shine, and frizz control through ingredients such as silicones and synthetic polymers, which form a protective barrier to enhance manageability and smoothness.

Sprays and mousse products are projected to grow at a CAGR of 4.29% from 2025 to 2030. This growth stems from consumer demand for lightweight, versatile, and easy-to-use styling solutions. These products offer volume, hold, and texture without heaviness, meeting requirements for natural-looking, flexible styles. Heat protectant and UV-shielding sprays have increased in popularity as consumers focus on hair health and multifunctional products. Mousse products appeal to consumers with fine or curly hair seeking professional results at home. Market adoption has increased through fashion trends, social media influence, and advancements in aerosol technology and eco-friendly packaging.

Conventional/synthetic ingredients dominate the European hair styling products market with a 73.58% share in 2024. These products maintain their market leadership due to established consumer habits, widespread availability, and the strong presence of multinational brands. Conventional products remain popular for their proven efficacy, affordability, and broad distribution, especially among consumers prioritizing performance and convenience.

The natural/organic segment is experiencing faster growth with a CAGR of 4.52%. This growth is driven by health-conscious and environmentally aware consumers seeking natural and organic alternatives. Brands are responding by developing plant-based, sulfate-free, and eco-friendly formulations. The shift toward natural products stems from concerns about synthetic chemicals, increasing demand for clean beauty, and regulatory support for safer, non-toxic ingredients. This trend is particularly strong in countries like Germany, where ingredient transparency and sustainability are consumer priorities. While conventional products currently generate the majority of sales, the rapid expansion of the natural segment indicates a transformation in the market's competitive landscape.

The Europe Hair Styling Products Market is Segmented by Product Type (Sprays and Mousse, and More), Ingredient (Natural/Organic, and Conventional/Synthetic), End User (Male and Female), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, and More), and Country (Germany, United Kingdom, Italy, Spain, France, Russia, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal S.A.

- Henkel AG & Co. KGaA

- Procter & Gamble Company

- Unilever PLC

- Coty Inc.

- Kao Corporation

- Revlon Inc.

- Mandom Corp.

- Oriflame Holding AG

- Church & Dwight Co. Inc.

- Shiseido Company, Limited

- Davines Group

- John Paul Mitchell Systems

- Alfaparf Milano S.p.A

- Suavecito Pomade

- Puig Brands, S.A.

- Federici Brands LLC

- Moroccanoil Israel Ltd.

- Maria Nila

- The Estee Lauder Companies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge of Sulfate-free and Silicone-free Formulations

- 4.2.2 Influence of Social Media and Celebrity Endorsement

- 4.2.3 Shift Towards Natural and Organic Products

- 4.2.4 Technological Innovations in Product Formulations

- 4.2.5 Increasing Focus on Personal Grooming

- 4.2.6 Growing Male Grooming Segment

- 4.3 Market Restraints

- 4.3.1 Health Concerns Over Chemical Ingredients

- 4.3.2 Proliferation of Counterfeit Products

- 4.3.3 Salon Service Competition Impacts the Retail Product Market Share

- 4.3.4 Sustainability Concerns Affect Product Packaging and Manufacturing Decision

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Creams, Gels, and Wax

- 5.1.2 Sprays and Mousse

- 5.1.3 Others

- 5.2 By Ingredient

- 5.2.1 Natural/Organic

- 5.2.2 Conventional/Synthetic

- 5.3 By End User

- 5.3.1 Male

- 5.3.2 Female

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Others

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 Spain

- 5.5.5 France

- 5.5.6 Russia

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 Henkel AG & Co. KGaA

- 6.4.3 Procter & Gamble Company

- 6.4.4 Unilever PLC

- 6.4.5 Coty Inc.

- 6.4.6 Kao Corporation

- 6.4.7 Revlon Inc.

- 6.4.8 Mandom Corp.

- 6.4.9 Oriflame Holding AG

- 6.4.10 Church & Dwight Co. Inc.

- 6.4.11 Shiseido Company, Limited

- 6.4.12 Davines Group

- 6.4.13 John Paul Mitchell Systems

- 6.4.14 Alfaparf Milano S.p.A

- 6.4.15 Suavecito Pomade

- 6.4.16 Puig Brands, S.A.

- 6.4.17 Federici Brands LLC

- 6.4.18 Moroccanoil Israel Ltd.

- 6.4.19 Maria Nila

- 6.4.20 The Estee Lauder Companies Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK