PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842439

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842439

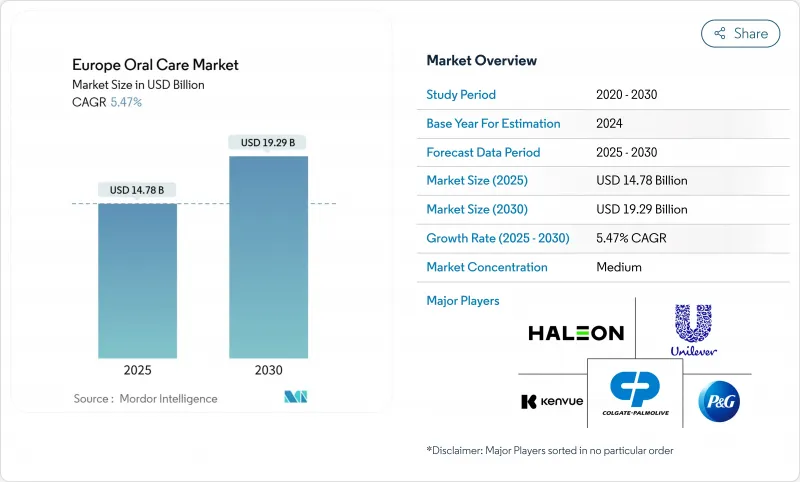

Europe Oral Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The European oral care market is projected to demonstrate robust growth potential, increasing from USD 14.78 billion in 2025 to USD 19.29 billion by 2030, at a compound annual growth rate (CAGR) of 5.47%.

The market expansion is primarily driven by heightened awareness of preventive dental healthcare measures, continuous advancements in oral hygiene product formulations, and the rising prevalence of dental disorders across the region. A significant transformation in the market landscape is evident through the fundamental shift in consumer perception, where oral health has transitioned from being perceived as a cosmetic consideration to an integral component of overall health outcomes. The implementation of the World Health Organization's comprehensive oral health strategy has further strengthened this transformation by systematically integrating oral healthcare protocols within primary healthcare frameworks across European nations.

Europe Oral Care Market Trends and Insights

Rising Demand for Natural and Organic Toothpaste

The European oral care market is experiencing increased demand for natural and organic toothpaste due to changing consumer preferences toward health-conscious and environmentally friendly products. Consumers are moving away from synthetic ingredients like parabens, triclosan, artificial sweeteners, and sulfates, choosing instead toothpaste with plant-based, chemical-free, and sustainably sourced ingredients. The focus on personal health and sustainable living among European consumers has increased the demand for oral care products that meet these criteria. The European Commission actively reinforces this trend through comprehensive initiatives like the Green Deal and Farm to Fork Strategy, which establish clear guidelines for sustainable consumption across various sectors, including personal care products. These regulatory frameworks have not only strengthened product standards but have also enhanced consumer understanding of eco-friendly and organic oral care options, leading to increased adoption of natural toothpaste products throughout the European market.

Increase Consumer Focus on Oral Hygiene

European consumers are actively prioritizing oral hygiene, which drives growth in the oral care market. They recognize that good oral health directly affects cardiovascular health, diabetes management, and respiratory well-being. This understanding has transformed oral care from a simple daily routine into a crucial health practice. Older adults, who experience more dental problems, actively seek advanced oral care products and follow thorough hygiene routines. According to the OECD, the population aged 65 and older will grow from 21% in 2023 to 30% by 2050 . This aging population actively shapes the oral care market by demanding specific products. They need specialized items like dry mouth toothpaste, anti-gum disease mouthwashes, and denture care solutions. Their requirements for targeted oral health products drive companies to develop new solutions and expand the specialized oral care market.

Prevalence of Traditional Way of Tooth Cleaning

European consumers largely stick to traditional oral care methods, which restricts the growth of advanced oral care products in the region. Many people continue to use manual toothbrushes and basic toothpaste due to cost concerns, lack of awareness about newer products, and limited access to dental education. This behavior is especially common among the elderly and rural populations. Most consumers treat oral care as a simple daily task and believe brushing twice a day with manual tools meets their needs, even when dentists recommend modern alternatives. Lower-income regions in Central and Eastern Europe show minimal adoption of electric toothbrushes, interdental cleaning tools, and therapeutic products. This low adoption directly impacts sales of innovative oral hygiene products. For example, the Italian personal care association (CI) reports that toothpaste sales in Italy dropped from EUR 541.7 million in 2014 to EUR 528 million in 2023.

Other drivers and restraints analyzed in the detailed report include:

- Integration of Smart Technologies in Electric Toothbrush

- Favorable Government Initiatives on Oral Hygiene

- Counterfeit Products Affecting Brand Reputation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Toothpaste leads the European oral care market, capturing 46.35% market share in 2024. Consumers rely on toothpaste as a fundamental part of their daily oral care routine. Manufacturers actively develop specialized formulations that target specific dental concerns. These products address enamel protection, promote gum health, reduce tooth sensitivity, prevent cavities, and enhance tooth whitening. The widespread daily use of toothpaste, combined with its consumer acceptance and affordable pricing, reinforces its position as the market leader.

Mouthwash/rinses will grow at 5.97% CAGR between 2025 and 2030. Consumers increasingly recognize mouthwash as a vital component of complete oral care. They value its effectiveness in cleaning between teeth, controlling plaque, and maintaining fresh breath. More consumers now incorporate mouth rinses into their daily routine alongside brushing and flossing. The rising preference for alcohol-free options and therapeutic formulations drives this segment's growth.

Conventional/synthetic ingredients hold an 89.34% share of the European oral care market in 2024, supported by established manufacturing processes, cost efficiencies, and consumer familiarity. The natural/organic segment is expected to grow at 6.35% CAGR from 2025-2030, exceeding the overall market growth rate as consumers increasingly prefer clean-label products. The European Food Safety Authority's 2024 review of food-grade ingredients in oral care products has confirmed the safety and efficacy of natural compounds like xylitol and plant-derived enzymes, supporting natural formulation claims. The European Commission's Sustainable Products Initiative, within the European Green Deal framework, is implementing regulations for environmentally friendly formulations and packaging, driving the shift toward natural ingredients.

The European Medicines Agency has approved multiple naturally derived active ingredients for therapeutic oral care products, enabling natural formulations with validated health claims. The WHO's 2024 report on environmental determinants of health emphasizes reducing chemical exposure through personal care products, including oral care, and providing policy support for natural alternatives. The sales value of organic health and beauty products, including oral care, in the United Kingdom amounted to GBP 136 million in 2023, according to the Soil Association . The demand for natural and organic oral care products has grown, driven by scientific research validation and regulatory compliance. Consumers are prioritizing oral care products that combine effectiveness with safety and environmental sustainability.

The Europe Oral Care Market is Segmented by Product Type (Toothpaste, Mouthwash/Rinses, and More), Ingredient (Natural/Organic, and Conventional/Synthetic), End-User (Kids/Children, and Adult), Distribution Channel (Supermarkets/Hypermarket, Drug Stores/Pharmacies, and More), and Country (Germany, United Kingdom, Italy, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Colgate-Palmolive Company

- Procter & Gamble Co.

- Unilever PLC

- Haleon PLC

- Kenvue, Inc.

- Koninklijke Philips N.V. (Philips Oral Healthcare)

- Sunstar Suisse S.A.

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Pierre Fabre S.A.

- Hawley & Hazel (BVI) Co., Ltd.

- Denttabs GmbH

- The Humble Co.

- Curaden AG

- TePe Munhygienprodukter AB

- Jordan AS (Orkla)

- GC Corporation (Europe)

- Venture Life Group

- Polished London

- Ludovico Martelli SpA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Natural and Organic Toothpaste

- 4.2.2 Increase Consumer Focus on Oral Hygiene

- 4.2.3 Integration of Smart Technologies in Electric Toothbrush

- 4.2.4 Favorable Government Initiatives on Oral Hygiene

- 4.2.5 Aging Population and Dental Health Needs

- 4.2.6 Rising Disposable Income and Healthcare Spending

- 4.3 Market Restraints

- 4.3.1 Prevelance of Traditional Way of Tooth Cleaning

- 4.3.2 Counterfeit Products Affecting Brand Reputation

- 4.3.3 Raw Material Price Fluctuations

- 4.3.4 Regulatory Compliance Requirements

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Toothpaste

- 5.1.2 Mouthwash/Rinses

- 5.1.3 Toothbrush

- 5.1.4 Other Product Types

- 5.2 By Ingredient

- 5.2.1 Natural/Organic

- 5.2.2 Conventional/Synthetic

- 5.3 By End User

- 5.3.1 Kids/Children

- 5.3.2 Adult

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarket

- 5.4.2 Drug Stores/Pharmacies

- 5.4.3 Online Retail Stores

- 5.4.4 Others Distribution Channel

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 Spain

- 5.5.5 France

- 5.5.6 Russia

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Colgate-Palmolive Company

- 6.4.2 Procter & Gamble Co.

- 6.4.3 Unilever PLC

- 6.4.4 Haleon PLC

- 6.4.5 Kenvue, Inc.

- 6.4.6 Koninklijke Philips N.V. (Philips Oral Healthcare)

- 6.4.7 Sunstar Suisse S.A.

- 6.4.8 Church & Dwight Co., Inc.

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Pierre Fabre S.A.

- 6.4.11 Hawley & Hazel (BVI) Co., Ltd.

- 6.4.12 Denttabs GmbH

- 6.4.13 The Humble Co.

- 6.4.14 Curaden AG

- 6.4.15 TePe Munhygienprodukter AB

- 6.4.16 Jordan AS (Orkla)

- 6.4.17 GC Corporation (Europe)

- 6.4.18 Venture Life Group

- 6.4.19 Polished London

- 6.4.20 Ludovico Martelli SpA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK