PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842443

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842443

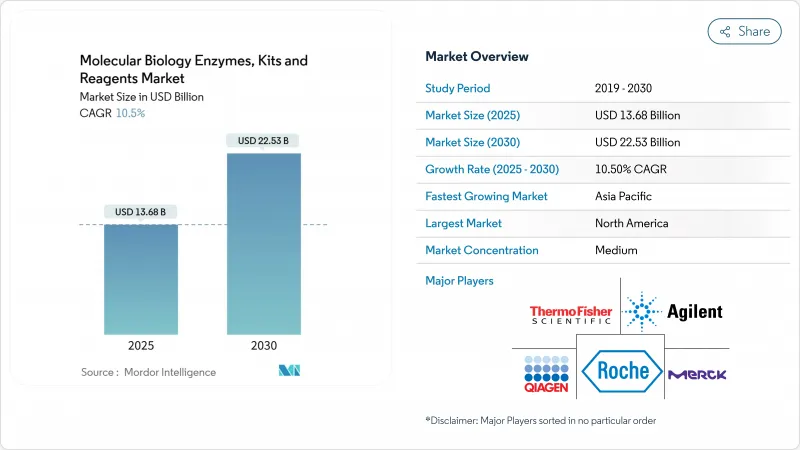

Molecular Biology Enzymes, Kits And Reagents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The molecular biology enzymes, kits & reagents market is valued at USD 13.68 billion in 2025 and is forecast to reach USD 22.53 billion by 2030, reflecting a 10.5% CAGR.

Strong momentum comes from next-generation sequencing platform upgrades, growing clinical adoption of single-cell multi-omics assays, and the shift toward field-deployable, lyophilized diagnostics. Ultra-high-fidelity enzyme innovations are raising analytical precision, enabling detection of rare mutations and supporting CRISPR-based therapeutic pipelines. At the same time, sustained federal R&D spending in North America and Europe, coupled with intensified life-science investment in Asia-Pacific, is enlarging the customer base for high-value consumables. Competitive rivalry is intensifying as large suppliers pursue strategic acquisitions to integrate sample preparation, amplification, detection, and data-analysis capabilities, while smaller specialists stake out opportunities in sustainable consumables and machine-learning-guided enzyme engineering.

Global Molecular Biology Enzymes, Kits And Reagents Market Trends and Insights

Rising Incidence of Infectious Diseases & Genetic Disorders

COVID-19 highlighted the value of rapid nucleic-acid testing, accelerating demand for portable molecular platforms such as a lyophilized LAMP-based Dragonfly system that achieved 96.1% sensitivity for mpox detection. Health systems now view early molecular surveillance as essential for outbreak containment and cost control. Expanded newborn genetic-disorder screening and population-level carrier testing require enzymes with extremely low error rates to spot rare variants. CRISPR-based detection chemistries and microfluidic cartridges are entering frontline laboratories, enlarging the addressable market for high-value reagents.

Expanding Life-Science R&D Budgets

A 2025 survey showed overall academic research budgets rising 4%, even as some capital-equipment lines stayed flat, signaling a tilt toward high-turnover consumables. Contract research organizations increasingly win bulk-supply agreements, encouraging vendors to offer customized master mixes and sustainably packaged kits.

High Cost & Limited Reimbursement For Genetic Testing

Medicare's MolDX program uses stringent clinical-utility thresholds, leaving many novel assays uncovered or reimbursed below cost. Private insurers now demand real-world evidence, adding time and expense to test launches. Smaller labs struggle to fund multi-site trials, constraining innovation until payers harmonize evidence standards.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Advances in NGS, qPCR & dPCR Platforms

- Growing Adoption of Precision-Medicine Diagnostics

- Complex IP & Licensing Landscape for Enzyme Patents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Kits & reagents contributed 65.52% of 2024 revenue, underlining their consumable nature in routine workflows. The enzymes portion, though smaller, is climbing at 12.25% CAGR as researchers demand ultra-high-fidelity polymerases for single-cell sequencing. DNA polymerases remain the dominant enzyme class, bolstered by a screening platform that can assay 10 million variants daily. Within the molecular biology enzymes, kits & reagents market size, Takara Bio's mutant T7 RNA polymerase cuts double-stranded RNA by 90%, addressing mRNA-therapeutics quality needs.

Recurrence-driven revenue from PCR master mixes and NGS library kits cements reagent leadership. Yet enzymes capture premium pricing because single-amino-acid tweaks can halve error rates and improve CRISPR specificity. Machine-learning-aided evolution lets vendors tailor catalytic optima to new sequencing chemistries, ensuring double-digit growth for the enzymes slice of the molecular biology enzymes, kits & reagents market.

PCR held 45.53% market share in 2024, reflecting ubiquity in diagnostics and QA. However, NGS is expanding at 16.53% CAGR on the back of falling per-genome costs and rapid oncology adoption. A new amplification method, AMPLON, shortens run time 50% without sacrificing accuracy, widening PCR's reach into rapid screening.

CRISPR workflows are the fastest-growing niche inside the molecular biology enzymes, kits & reagents market, fueled by engineered Cas12a variants that deliver allele-specific edits. Epigenetics assays and protein-analysis kits also gain traction as multi-omic studies proliferate, creating cross-selling potential for integrated reagent bundles.

The Molecular Biology Enzymes, Kits & Reagents Market Report is Segmented by Product (Enzymes, Kits and Reagents), Application (Polymerase Chain Reaction, Next-Generation Sequencing, and More), End Users (Hospitals and Diagnostic Centers, Academic and Research Institutes, and More), Form (Liquid, and Lyophilized), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.82% of 2024 revenue, anchored by NIH and NSF funding lines that sustain reagent consumption across academic and clinical labs. Strong reimbursement for molecular tests, despite MolDX hurdles, keeps hospital throughput high, and U.S. start-ups continue to spin out novel enzymes, maintaining regional leadership.

Europe posted steady mid-single-digit growth. Regulatory alignment under IVDR is driving demand for validated kit components, benefiting suppliers able to document performance to CE-IVD standards. Investment in antimicrobial-resistance surveillance has led to rollout of high-density qPCR systems capable of thousands of reactions per run, spurring reagent pull-through.

Asia-Pacific registers the fastest trajectory at 11.32% CAGR. China recorded a 35.84% jump in drug and device filings in 2023, with IVD reagents comprising nearly one-quarter of submissions. Japan is revising laboratory-developed-test frameworks, giving clarity to local innovators. South Korea's tiered approval pathway expedites low-risk molecular assays, widening market access. APAC public-health agencies also invest in field-deployable diagnostics for rural clinics, accelerating uptake of lyophilized formats within the molecular biology enzymes, kits & reagents market size.

The Middle East & Africa are smaller today but pursue national genomics programs that mandate kit localization, signaling long-run upside. Latin America sees procurement spikes tied to disease-surveillance campaigns, though currency volatility moderates spending cycles.

- Agilent Technologies

- Thermo Fisher Scientific

- Roche

- Illumina

- Merck

- QIAGEN

- Takara Bio

- New England Biolabs

- Promega

- Lucigen (LGC Biosearch)

- Bio-Rad Laboratories

- PerkinElmer

- Oxford Nanopore Technologies

- Pacific Biosciences

- BGI

- Bio-Techne

- Enzymatics (Cell Signaling Tech)

- Genscript

- ArcherDx (Invitae)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence Of Infectious Diseases & Genetic Disorders

- 4.2.2 Expanding Life-Science R&D Budgets

- 4.2.3 Rapid Advances In NGS, Qpcr & Dpcr Platforms

- 4.2.4 Growing Adoption Of Precision-Medicine Diagnostics

- 4.2.5 Ultra-High-Fidelity Enzymes Enabling Single-Cell Multi-Omics

- 4.2.6 Field-Deployable Lyophilized Kits Reduce Cold-Chain Costs

- 4.3 Market Restraints

- 4.3.1 High Cost & Limited Reimbursement For Genetic Testing

- 4.3.2 Complex IP & Licensing Landscape For Enzyme Patents

- 4.3.3 Fragile Supply Chain For Specialty Recombinant Reagents

- 4.3.4 Sustainability Pressure On Single-Use Kit Plastics

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Enzymes

- 5.1.1.1 DNA Polymerases

- 5.1.1.2 Reverse Transcriptases

- 5.1.1.3 Ligases & Kinases

- 5.1.1.4 Nucleases & Restriction Enzymes

- 5.1.1.5 Modifying Enzymes

- 5.1.1.6 Other Specialty Enzymes

- 5.1.2 Kits & Reagents

- 5.1.2.1 PCR Master-Mix & qPCR Kits

- 5.1.2.2 NGS/Library-Prep Kits

- 5.1.2.3 DNA/RNA Extraction & Purification Kits

- 5.1.2.4 Lyophilized Field-Use Kits

- 5.1.2.5 Buffers, dNTPs & Additives

- 5.1.1 Enzymes

- 5.2 By Application

- 5.2.1 Polymerase Chain Reaction

- 5.2.2 Next-Generation Sequencing

- 5.2.3 Epigenetics

- 5.2.4 Cloning & Synthetic Biology

- 5.2.5 Gene-Editing / CRISPR Workflows

- 5.2.6 Protein Analysis & Proteomics

- 5.3 By End-User

- 5.3.1 Hospitals & Diagnostic Centers

- 5.3.2 Academic & Research Institutes

- 5.3.3 Pharmaceutical & Biotechnology Companies

- 5.3.4 Contract Research & Manufacturing Organizations

- 5.3.5 Forensic & Security Laboratories

- 5.3.6 Food, Environmental & Agricultural Testing Labs

- 5.4 By Form

- 5.4.1 Liquid (Cold-Chain)

- 5.4.2 Lyophilized (Ambient)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Agilent Technologies

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 F. Hoffmann-La Roche

- 6.3.4 Illumina

- 6.3.5 Merck KGaA (Sigma-Aldrich)

- 6.3.6 Qiagen

- 6.3.7 Takara Bio

- 6.3.8 New England Biolabs

- 6.3.9 Promega

- 6.3.10 Lucigen (LGC Biosearch)

- 6.3.11 Bio-Rad Laboratories

- 6.3.12 PerkinElmer

- 6.3.13 Oxford Nanopore Technologies

- 6.3.14 Pacific Biosciences

- 6.3.15 BGI Group

- 6.3.16 Bio-Techne

- 6.3.17 Enzymatics (Cell Signaling Tech)

- 6.3.18 Genscript

- 6.3.19 ArcherDx (Invitae)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment