PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842446

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842446

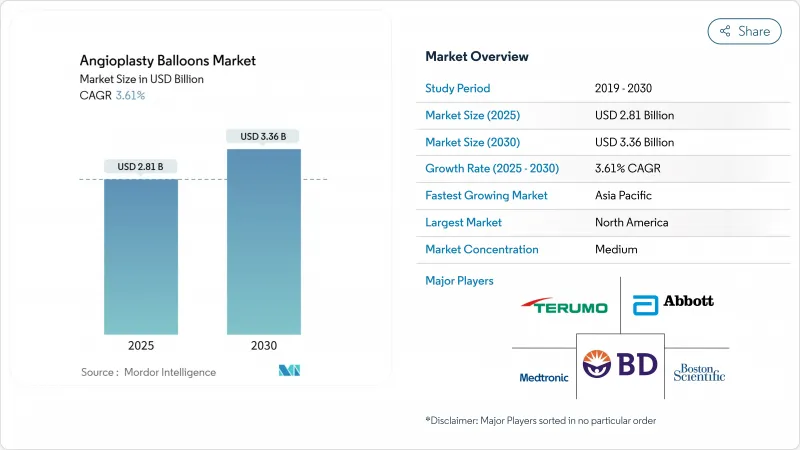

Angioplasty Balloons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The angioplasty balloons market stands at USD 2.81 billion in 2025 and is projected to reach USD 3.36 billion by 2030, translating into a 3.61% CAGR.

This outlook confirms that the angioplasty balloons market continues to mature in a cardiovascular care environment where device sophistication must counterbalance modest procedure growth in developed regions. Demand remains firmly rooted in a large and aging cardiovascular patient pool-127.9 million Americans aged 20 and older live with heart disease today, and coronary artery disease prevalence remains close to 4.6%-4.9%. Growing clinician preference for minimally invasive percutaneous coronary intervention (PCI) sustains core procedure volumes, while recent approvals for drug-coated balloons (DCBs) validate a "leave-nothing-behind" treatment strategy that reduces reliance on permanent metallic implants. Normal balloons still dominate routine PCI, yet specialized scoring and drug technologies are gaining share as lesion complexity rises and pay-for-performance models reward durable outcomes.

Key competitive and regional shifts underpin medium-term upside. North America retains the largest regional position with 39.68% of the angioplasty balloons market in 2024 thanks to advanced infrastructure and reimbursement that now covers PCI in ambulatory surgical centers (ASCs). Asia-Pacific is the fastest-growing territory, expanding at 4.53% CAGR, supported by rapid procedure adoption amid demographic aging and investments in cath-lab capacity. At the care-delivery level, angioplasty balloons market growth tilts toward outpatient centers; ASC-based PCI volumes climbed from 0.01 to 0.87 per 10,000 Medicare beneficiaries between 2018 and 2022, pointing to 4.67% CAGR for this setting. On the product front, normal balloons held 41.54% share in 2024, but scoring balloons are pacing 4.32% CAGR as clinicians seek plaque-modification efficiency. Meanwhile, Boston Scientific's 2024 FDA clearance for the AGENT coronary DCB, which cut target-lesion revascularization risk by 50% versus plain balloons, signals a decisive regulatory green light for drug-coated platforms.

Global Angioplasty Balloons Market Trends and Insights

Rising Cardiovascular Disease Prevalence

The number of adults living with clinical cardiovascular disease is projected to top 45 million in the United States alone by 2050. Hypertension, diabetes, and obesity rates all continue to climb, reinforcing a long-run need for catheter-based revascularization. Although coronary mortality dropped markedly between 2000 and 2020, it has plateaued in recent years, keeping demand for balloon angioplasty stable. Hospitalizations linked to heart disease cost USD 108 billion in 2021, and forecasts point to USD 131.3 billion by 2030, highlighting the economic imperative for cost-effective minimally invasive solutions.

Shift toward Minimally-invasive PCI & Technology Advances

Clinical practice now favors percutaneous catheter approaches that shorten recovery and curb facility costs. Standardized endpoints for coronary DCB trials released in 2025 have legitimized drug-coated balloons, which posted 17.9% target-lesion failure at 1 year versus 28.6% with plain balloons. Intravascular lithotripsy is gaining momentum, using acoustic pressure waves inside the balloon to fracture calcium and improve luminal gain. These technologies collectively strengthen the angioplasty balloons market outlook by enhancing outcomes without leaving permanent metal behind.

High Procedure & Device Cost versus Stenting Bundles

Healthcare payers remain cautious when balloon-only strategies appear more expensive than bundled stent packages that include follow-up imaging and medication plans. Despite Medicare approval, ASCs still perform only 1.8% of outpatient PCIs in the United States, signaling persistent economic hesitation. Premium pricing on drug-coated balloons tightens purchasing decisions, especially where supply-chain inflation has lifted input costs to 20% of device revenues.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Geriatric PAD Pool in Emerging Economies

- Breakthroughs in Bio-resorbable & Ultra-high-pressure Polymers

- Regulatory Scrutiny on Paclitaxel DCB Safety Signals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Scoring balloons held the fastest growth trajectory at 4.32% CAGR through 2030, a pace that reflects their role in plaque-modification strategies for calcified or fibrotic lesions. The angioplasty balloons market size for scoring systems is rising as studies such as Naviscore's first-in-man series reported 94% procedural success in moderate-to-severe calcification. Normal balloons still dominate everyday PCI with 41.54% 2024 share because they remain indispensable for routine pre- and post-dilation steps.

Drug-coated balloons gained decisive momentum after Boston Scientific's AGENT approval, which showed a 50% reduction in repeat revascularization compared with conventional angioplasty. Cutting balloons preserve a niche for in-stent restenosis and small-vessel work, with meta-analysis indicating a 33% reduction in target-lesion revascularization risk. Ultra-high-pressure variants, now exceeding 40 atm, extend percutaneous treatment to hard fibro-calcific plaques, expanding the angioplasty balloons market both procedurally and technologically.

The Angioplasty Balloons Market Report Segments the Industry Into by Product Type (Normal Balloons, Cutting Balloons, Scoring Balloons, and Drug-Eluting Balloons), by Application (Coronary Angioplasty, Peripheral Angioplasty), by End User (Hospitals, Ambulatory Surgical Centers, Others), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 39.68% angioplasty balloons market share in 2024, supported by broad insurance coverage, established cath-lab networks, and early adoption of premium devices. The region's regulatory environment favors innovation, evidenced by the 2024 clearance of the AGENT coronary DCB. CMS policy changes permitting ASC-based PCI have begun to reshape volume distribution, yet hospitals keep the bulk of complex procedures. Persistent supply-chain turbulence has forced local manufacturers to absorb double-digit logistics and raw-material inflation, heightening focus on digital inventory control. Consolidation remained active, highlighted by Teleflex's EUR 760 million acquisition of BIOTRONIK's vascular unit, which enriched its drug-coated balloon and stent offerings.

Asia-Pacific registers the swiftest expansion at 4.53% CAGR. Population aging, urbanization, and infrastructure build-out are unlocking cath-lab demand. Government moves to harmonize device approvals and encourage domestic manufacturing continue to reduce time-to-market for new balloons. Regional clinical guidelines now recommend DCBs for small-vessel disease and in-stent restenosis, aligning therapy choices with global standards. Growth, however, is tempered by price sensitivity, which pushes buyers toward cost-effective platforms and accelerates local production of basic balloons even as demand for high-end scoring and drug-coated variants climbs.

Europe delivers steady but measured gains as economic pressures constrain premium device uptake in some public-health systems. The Medical Device Regulation (MDR) framework, while rigorous, provides clarity that helped Terumo secure CE marks for several vascular-closure solutions in 2024, sustaining procedural ecosystems. Cordis's SELUTION SLR sirolimus-eluting balloon posted 81.5% three-year patency in Japan and 91.1% freedom from target-lesion revascularization in European trials, reinforcing drug-coated platforms. Clinical collaboration through groups such as the Drug-Coated Balloon Academic Research Consortium promotes evidence-based adoption across the continent, maintaining Europe's role as a bellwether market for next-generation balloons.

- Abbott Laboratories

- AngioDynamics

- Beckton Dickinson

- BIOTRONIK

- Boston Scientific

- B. Braun

- Cook Group

- Terumo Corp.

- INFINITY Angioplasty Balloon

- Johnson & Johnson

- Koninklijke Philips

- Medtronic

- Merit Medical Systems

- Integer Holdings Corp.

- Shockwave Medical Inc.

- Teleflex

- Cardionovum

- Biosensors International

- LEPU Medical Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Cardiovascular Disease Prevalence

- 4.2.2 Shift toward Minimally-invasive PCI & Tech Advances

- 4.2.3 Expanding Geriatric PAD Pool in Emerging Economies

- 4.2.4 Normal-pressure Balloons Remain Hospital Workhorse

- 4.2.5 Breakthroughs in Bio-resorbable & Ultra-high-pressure Polymers

- 4.2.6 Migration of Angioplasty to Outpatient Cath-lab Settings

- 4.3 Market Restraints

- 4.3.1 High Procedure & Device Cost vs. Stenting Bundles

- 4.3.2 Periprocedural Complications

- 4.3.3 Supply-chain Tightness for High-grade Nylon & PET Films

- 4.3.4 Regulatory Scrutiny on Paclitaxel DCB Safety Signals

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Normal Balloons

- 5.1.2 Cutting Balloons

- 5.1.3 Scoring Balloons

- 5.1.4 Drug-Eluting Balloons

- 5.2 By Application

- 5.2.1 Coronary Angioplasty

- 5.2.2 Peripheral Angioplasty

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 Turkey

- 5.4.4.3 South Africa

- 5.4.4.4 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Abbott Laboratories

- 6.3.2 AngioDynamics

- 6.3.3 Becton, Dickinson & Co.

- 6.3.4 BIOTRONIK

- 6.3.5 Boston Scientific Corp.

- 6.3.6 B. Braun Melsungen AG

- 6.3.7 Cook Medical

- 6.3.8 Terumo Corp.

- 6.3.9 INFINITY Angioplasty Balloon

- 6.3.10 Johnson & Johnson

- 6.3.11 Koninklijke Philips N.V.

- 6.3.12 Medtronic plc

- 6.3.13 Merit Medical Systems

- 6.3.14 Integer Holdings Corp.

- 6.3.15 Shockwave Medical Inc.

- 6.3.16 Teleflex Inc.

- 6.3.17 Cardionovum GmbH

- 6.3.18 Biosensors International

- 6.3.19 LEPU Medical Technology

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment