PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842447

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842447

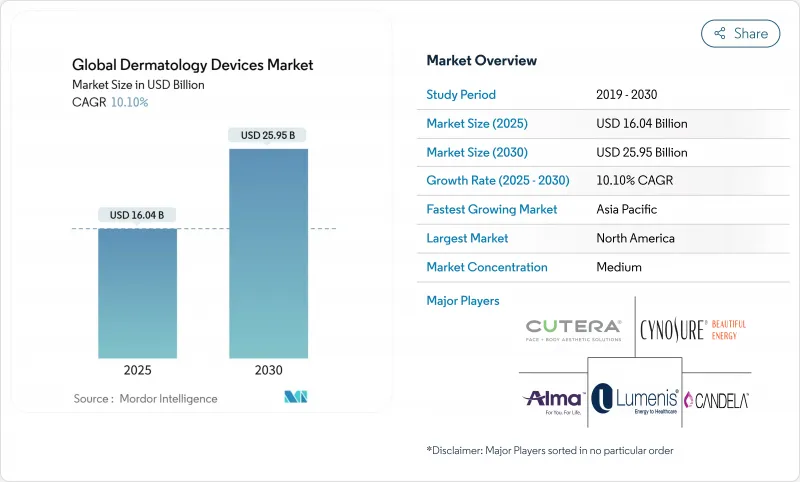

Global Dermatology Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dermatology devices market was valued at USD 16.04 billion in 2025 and is on track to reach USD 25.95 billion by 2030, advancing at a 10.1% CAGR.

The growth trajectory reflects a clear migration from reactive care to predictive diagnostics enabled by artificial intelligence, lasers with real-time thermal monitoring, and tele-dermatology connectivity. Demand remains anchored in established treatments for hair removal and lesion ablation, yet AI-guided imaging now pushes earlier detection of skin cancers into primary-care settings, shortening referral times and expanding patient pools. At the same time, consumer appetite for minimally invasive aesthetics keeps procedure volumes high in clinics, medical spas, and ambulatory surgery centers. Regional patterns diverge: North America benefits from reimbursement clarity, but Asia-Pacific captures the fastest expansion on the back of rising disposable income, government support for domestic manufacturing, and widening specialist networks. Tightened EU regulations and Medicare fee cuts temper momentum, yet they also favor firms with robust quality systems and diversified revenue models.

Global Dermatology Devices Market Trends and Insights

Rising Prevalence of Skin Cancer & Other Disorders

Skin cancer already affects up to one quarter of the United States population, and incidence is accelerating in regions with historically limited specialist coverage IntechOpen. Earlier detection drives dual demand: handheld spectroscopy units guide primary-care triage, while non-surgical treatment devices-such as superficial radiation and photodynamic therapy lamps-allow clinicians to manage lesions that once required excision. Academic evidence that fractional CO2 lasers reduce actinic damage supports preventive protocols, reinforcing device necessity in routine practice PubMed.

Growing Demand for Minimally Invasive Cosmetic Procedures

Global procedure volumes continue to shift toward injectables, resurfacing, and body contouring. Medical spas and chain clinics bypass hospital procurement cycles, accelerating unit turnover and rewarding suppliers with flexible leasing or pay-per-use models. Longer-acting neurotoxins and biostimulatory fillers further intertwine cosmetic and therapeutic indications, effectively enlarging the dermatology devices market.

High Acquisition & Procedure Costs

Medicare cut the 2025 physician conversion factor to USD 32.35, nudging clinics to defer large-ticket equipment purchases. Manufacturers of energy-based devices, including several publicly traded firms, reported revenue contraction and have initiated restructuring to trim debt and overhead. In lower-income countries, limited capital budgets push providers toward refurbished systems or rental models, slowing premium platform penetration.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Lasers & Light-Based Systems

- AI-Enabled Diagnostic Imaging & Tele-Dermatology Adoption

- Stringent Regulatory Approval Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Treatment systems represented 55.45% of revenue in 2024, anchored by hair-removal lasers, vascular lesion systems, and radiofrequency body-contouring. Within that base, recurring consumables and service contracts keep growth steady at a projected 10.85% through 2030. Yet diagnostic platforms are now the fastest improvers, led by AI-integrated spectroscopy and high-definition dermoscopy. A dual-wavelength fractional system launched in 2025 merges imaging feedback with resurfacing output, illustrating how hybrid designs erode the once-rigid boundary between diagnosis and therapy. Entry-level cryotherapy units still serve primary-care and veterinary niches, whereas photodynamic lamps gain oncology codes that secure reimbursement for actinic keratosis.

The Dermatology Devices Market Report Segments the Industry Into by Devices Type (Diagnostics Devices [Imaging Devices, Dermatoscopes, and More. ] and Treatment Devices [Light Therapy Devices, Lasers, and More. ]), by Application (Skin Cancer Diagnosis, Vascular Lesions, Acne, Psoriasis, and Tattoo Removal, and More. ), and by Geography( North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.56% of 2024 revenue. The market benefits from clear FDA pathways, high per-capita procedure rates, and private-insurance coverage of elective treatments. Breakthrough designations for AI diagnostics and acne lasers demonstrate regulatory willingness to speed true innovation. Still, reimbursement cuts and staffing gaps may temper growth, leading clinics to favor platforms with diversified indications and robust service support.

Europe ranks second but faces MDR-linked certification bottlenecks that advantage companies with scale and formal clinical-data repositories. Demand remains strong for pigment and vascular systems, especially in Germany, France, and the United Kingdom, where aesthetic procedure counts continue to climb despite economic headwinds. Because providers are pruning device inventories to limit compliance burden, vendors offering consolidated multi-application workstations gain traction.

Asia-Pacific is the growth engine, forecast at an 11.98% CAGR through 2030. China targets an 8% device CAGR to USD 55.67 billion by 2029, bolstered by policies that localize production and expedite national-reimbursement code approvals. Korea and Japan lead technology adoption in pigmentation and atopic-dermatitis laser therapy, while India shows quick uptake of affordable AI dermatoscopes in tele-health programs. Urban medical tourism in Thailand and Malaysia adds demand for resurfacing and tattoo removal.

Latin America and the Middle East deliver mid-single-digit gains centered on private clinics in Mexico, Brazil, Saudi Arabia, and the UAE. Currency swings and import duties affect capital-equipment cycles, driving interest in leasing. Africa lags, constrained by funding and limited specialist density; mobile tele-dermatology hubs using AI triage hold promise for incremental access expansion.

- Canfield Scientific

- FotoFinder Systems

- Candela Medical

- Cutera

- Alma Lasers (Sisram Medical)

- Cynosure LLC

- Lumenis

- Sciton

- Fotona d.o.o.

- Bausch + Lomb (Solta Medical)

- LEO Photonics

- Lasertec Medical Service

- Energist Ltd.

- Lutronic

- Venus Concept Inc.

- Zimmer MedizinSysteme

- Merz Pharma (Ulthera)

- Sharplight Technologies

- Alma Dermatology Systems

- Surmodics Inc.

- Ellipse A/S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of skin cancer & other disorders

- 4.2.2 Growing demand for minimally-invasive cosmetic procedures

- 4.2.3 Technological advances in lasers & light-based systems

- 4.2.4 AI-enabled diagnostic imaging & tele-dermatology adoption

- 4.2.5 Broader insurance coverage in emerging economies

- 4.3 Market Restraints

- 4.3.1 High acquisition & procedure costs

- 4.3.2 Stringent regulatory approval pathways

- 4.3.3 Scarcity of trained dermatology specialists in LMICs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Diagnostic Devices

- 5.1.1.1 Dermatoscopes

- 5.1.1.2 Confocal Microscopes

- 5.1.1.3 Imaging Systems (Optical, Ultrasound)

- 5.1.2 Treatment Devices

- 5.1.2.1 Lasers (CO2, Er:YAG, Excimer, Dye)

- 5.1.2.2 Light / Phototherapy Systems

- 5.1.2.3 Electrosurgical Units

- 5.1.2.4 Cryotherapy Devices

- 5.1.2.5 Micro-dermabrasion Devices

- 5.1.2.6 Liposuction & Body-Contouring Systems

- 5.1.1 Diagnostic Devices

- 5.2 By Application

- 5.2.1 Skin Cancer Diagnosis

- 5.2.2 Hair Removal

- 5.2.3 Skin Rejuvenation & Resurfacing

- 5.2.4 Acne, Psoriasis & Vitiligo Treatment

- 5.2.5 Pigmented & Tattoo Lesion Removal

- 5.2.6 Vascular Lesions

- 5.2.7 Body Contouring / Fat Reduction

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Dermatology Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Other End-users

- 5.4 By Region

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Canfield Scientific

- 6.3.2 FotoFinder Systems

- 6.3.3 Candela Corporation

- 6.3.4 Cutera Inc.

- 6.3.5 Alma Lasers (Sisram Medical)

- 6.3.6 Cynosure LLC

- 6.3.7 Lumenis Ltd.

- 6.3.8 Sciton Inc.

- 6.3.9 Fotona d.o.o.

- 6.3.10 Bausch + Lomb (Solta Medical)

- 6.3.11 LEO Photonics

- 6.3.12 Lasertec Medical Service

- 6.3.13 Energist Ltd.

- 6.3.14 Lutronic Corporation

- 6.3.15 Venus Concept Inc.

- 6.3.16 Zimmer MedizinSysteme

- 6.3.17 Merz Pharma (Ulthera)

- 6.3.18 Sharplight Technologies

- 6.3.19 Alma Dermatology Systems

- 6.3.20 Surmodics Inc.

- 6.3.21 Ellipse A/S

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment