PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842448

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842448

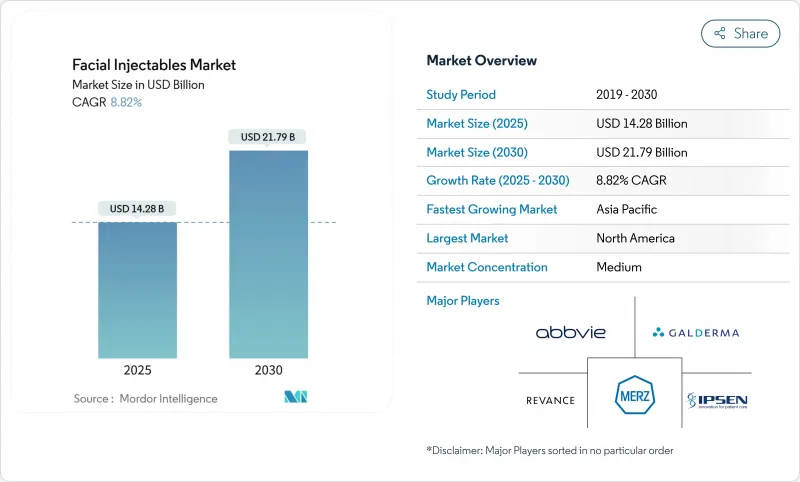

Facial Injectables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The facial injectables market is valued at USD 14.28 billion in 2025 and is forecast to reach USD 21.79 billion by 2030, advancing at an 8.82% CAGR.

Growth remains steady as consumer demand for minimally invasive aesthetics rises and product science evolves to deliver longer-lasting, more comfortable results. Preventative neuromodulator use among younger adults, the emergence of regenerative injectables such as polynucleotides, and the integration of subscription programs that lift per-patient spend are expanding the addressable base. North America continues to generate the largest revenue pool, yet Asia-Pacific is outpacing all regions on the back of medical tourism and a growing middle class. Competitive intensity is climbing as established leaders acquire pipeline assets and smaller entrants pursue differentiated pricing and marketing aimed at Gen Z and male patients-the two fastest growing cohorts in the facial injectables market.

Global Facial Injectables Market Trends and Insights

Social-media-driven Baby Botox trend

Market momentum is buoyed by smaller-dose neuromodulator injections that appeal to Gen Z consumers seeking subtle, preventative results. Influencer posts on TikTok and Instagram have removed stigma around early intervention, and procedural volume among patients aged 20-29 rose 71% between 2019 and 2022. Brands now tailor messaging and loyalty apps to younger budgets, extending the lifetime value of this segment inside the facial injectables market.

Cross-border aesthetic tourism boosting procedure volumes

An estimated 10 million patients travel annually for cosmetic care, with 60% opting for injectables. Cost advantages, surgeon reputation, and streamlined visa policies make South Korea, Mexico, and Dubai high-traffic hubs. Clinics in these destinations refine multilingual after-care programs and bundle injectables with adjunct treatments, channeling a steady inflow of demand into the facial injectables market.

Proliferation of counterfeit fillers undermining brand trust

FDA alerts in 2024 on falsified Botox lots and subsequent CDC advisories have heightened consumer concern. An estimated 10% of supply in certain markets is unregulated, which spurs stricter serialization and clinician education programs that raise compliance costs for brands active in the facial injectables market.

Other drivers and restraints analyzed in the detailed report include:

- Long-acting lidocaine HA fillers improving patient throughput

- New indications approved for botulinum toxin products

- Tightening injector-licensing rules limiting provider capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Botulinum toxin contributed 56.10% of 2024 revenue, anchoring the facial injectables market with high repeat rates and multiple cosmetic and therapeutic indications. Uptake remains strong across glabellar lines, crow's-feet and emerging off-label uses, supported by physician familiarity and broad clinical data. Manufacturers defend share through next-generation serotypes and on-label expansions that extend dosing intervals or speed onset.

Hyaluronic acid fillers are advancing at a 10.23% CAGR, the fastest among products. Tri-hyal cross-linking and lidocaine inclusion lengthen durability to 12-18 months and elevate patient comfort. Collagen, calcium hydroxylapatite and poly-L-lactic acid maintain niche roles for targeted volume restoration, while fat transfer and PMMA serve patients seeking permanent outcomes, contributing depth to the facial injectables industry landscape.

Women accounted for 80.76% of 2024 procedures, underscoring longer historical adoption and higher social acceptance. Preventative treatment messaging and influencer marketing sustain steady clinic footfall.

Male procedure volume is rising 10.04% annually. Demand centers on subtle forehead relaxation and jawline refinement that preserve masculine features, often marketed as "personal grooming" rather than cosmetic change. Clinics are offering male-focused hours and marketing to capture this unmet slice of the facial injectables market.

The Facial Injectables Market Report is Segmented by Product Type (Botulinum Toxin, Hyaluronic Acid, and More), Gender (Male and Female), Application (Facial Line Correction, Lip Augmentation, and More), End-User (Hospitals & Ambulatory Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held a 38.75% revenue share in 2024, underpinned by 8,800+ medical spas and broad insurance coverage for certain therapeutic uses. The region's 8.45% growth pace is moderated by economic headwinds and regulatory scrutiny of counterfeit products, yet product innovation and new indications keep procedure pipelines healthy.

Asia-Pacific is projected to reach double-digit 10.89% growth through 2030. Rising disposable income, pop culture focus on beauty and mature medical tourism ecosystems in South Korea and Thailand attract both regional and international clients. Local firms like LG Chem scale competitively priced fillers that grow the facial injectables market size without compromising quality.

Europe delivers an 8.81% CAGR, benefiting from sophisticated patient awareness and cohesive pan-EU training networks. Proposed UK licensing rules are likely to lift clinical standards and reinforce patient trust, sustaining expansion in the facial injectables market. The Middle East and Africa record 8.67% CAGR, propelled by Dubai's positioning as a luxury cosmetic hub and growing urban affluent populations in Saudi Arabia and South Africa. South America advances 9.23% as Brazil's culture of aesthetics and expanding insurance reimbursement for corrective procedures broaden access to injectables.

- Abbvie

- Anika Therapeutics

- BioPlus

- Bloomage Biotechnology Corp. Ltd.

- EG Bio Co. Ltd.

- Evolus Inc.

- Galderma

- Huons Global Co. Ltd.

- IBSA Institut Biochimique SA

- Ipsen

- LG Chem

- Medytox

- Merz Pharma

- PharmaResearch Products Co. Ltd.

- Revance Therapeutics

- Samyang Biopharm USA Inc.

- Sinclair France SAS

- Sinclair Pharma Ltd.

- Teoxane Laboratories SA

- Tiger Aesthetics Medical, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Social-media-fueled "Baby Botox" trend among Gen Z consumers

- 4.2.2 Cross-border aesthetic tourism boosting procedure volumes

- 4.2.3 Long-acting lidocaine-enhanced HA fillers improving patient throughput

- 4.2.4 New indications approved for botulinum toxin products

- 4.2.5 Subscription-based MedSpa programs driving repeat spend

- 4.2.6 Rise of regenerative polynucleotide injectables expanding product mix

- 4.3 Market Restraints

- 4.3.1 Proliferation of counterfeit fillers undermining brand trust

- 4.3.2 Tightening injector-licensing rules limiting provider capacity

- 4.3.3 Economic headwinds reducing discretionary cosmetic spend

- 4.3.4 HA raw-material supply constraints disrupting production

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Botulinum Toxin

- 5.1.2 Hyaluronic Acid

- 5.1.3 Collagen

- 5.1.4 Calcium Hydroxylapatite

- 5.1.5 Poly-L-lactic Acid

- 5.1.6 Polymethyl-methacrylate (PMMA)

- 5.1.7 Fat Injection

- 5.1.8 Other Fillers

- 5.2 By Gender

- 5.2.1 Female

- 5.2.2 Male

- 5.3 By Application

- 5.3.1 Facial Line Correction

- 5.3.2 Lip Augmentation

- 5.3.3 Face-Lift

- 5.3.4 Acne Scar Treatment

- 5.3.5 Lipoatrophy Treatment

- 5.3.6 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals & Ambulatory Surgical Centers

- 5.4.2 Clinics & Aesthetic Centers

- 5.4.3 MedSpas & Others

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AbbVie Inc. (Allergan Aesthetics)

- 6.4.2 Anika Therapeutics Inc.

- 6.4.3 BioPlus Co. Ltd.

- 6.4.4 Bloomage Biotechnology Corp. Ltd.

- 6.4.5 EG Bio Co. Ltd.

- 6.4.6 Evolus Inc.

- 6.4.7 Galderma SA

- 6.4.8 Huons Global Co. Ltd.

- 6.4.9 IBSA Institut Biochimique SA

- 6.4.10 Ipsen SA

- 6.4.11 LG Chem Ltd.

- 6.4.12 Medytox Inc.

- 6.4.13 Merz Pharma GmbH & Co. KGaA

- 6.4.14 PharmaResearch Products Co. Ltd.

- 6.4.15 Revance Therapeutics Inc.

- 6.4.16 Samyang Biopharm USA Inc.

- 6.4.17 Sinclair France SAS

- 6.4.18 Sinclair Pharma Ltd.

- 6.4.19 Teoxane Laboratories SA

- 6.4.20 Tiger Aesthetics Medical, LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment