PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842450

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842450

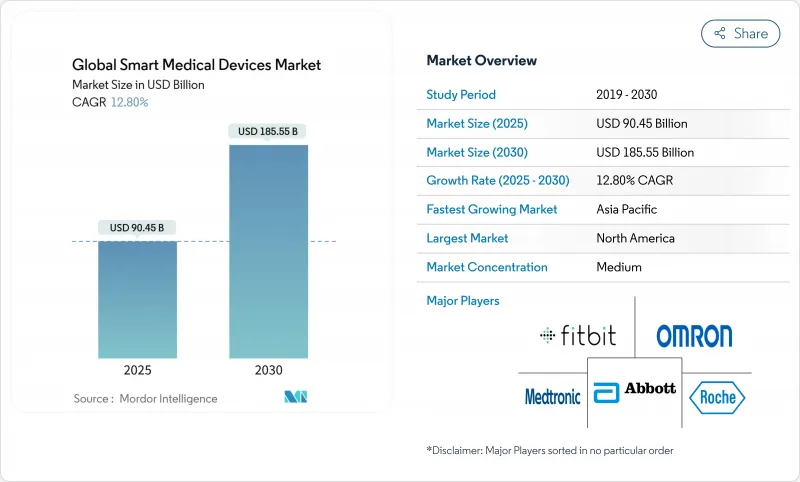

Global Smart Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart medical devices market size stands at USD 90.54 billion in 2025 and is forecast to reach USD 185.55 billion by 2030, advancing at a 12.8% CAGR.

Continuous progress in artificial intelligence, edge-enabled 5G connectivity and miniaturized sensors is allowing clinicians to pair near-real-time diagnostics with long-range data sharing. Regulatory clarity has improved as the FDA's 2025 draft guidance sets performance baselines for software-as-a-medical-device, which in turn is lowering investment risk and encouraging broader product pipelines. Accelerating demand for at-home chronic-disease management, combined with large technology firms collaborating with established device makers, is reshaping distribution models and shortening upgrade cycles. Hospitals are using connectivity to reduce readmissions, while value-based payment policies reward providers that deploy continuous monitoring to demonstrate measurable outcome gains. Semiconductor constraints and cybersecurity obligations still add cost pressure, yet component innovation and subscription pricing are helping to offset capital hurdles for smaller facilities.

Global Smart Medical Devices Market Trends and Insights

Smartphone-enabled and Wireless Adoption Surge

Wearable ownership reached 44.5% of U.S. adults in 2024, reflecting the appeal of mobile-paired health devices that fit daily routines . Device makers now preload HIPAA-compliant encryption and deliver data directly to cloud dashboards that clinicians can audit in near real time. Apple's FDA-cleared arrhythmia tracking and emergency cardiac-alert features illustrate how consumer electronics firms translate mainstream design into clinical benefit. This mainstreaming of connected sensors is shifting care from episodic encounters to an always-on model, reinforcing patient engagement and lowering non-urgent clinic visits. Insurers have begun reimbursing smartwatch-driven atrial-fibrillation programs that demonstrate lower hospitalization rates, proving the economic value of wireless monitoring.

Rapid Technological Breakthroughs in Sensors & AI

The U.S. FDA had cleared 801 AI-enabled devices by mid-2024, tripling approvals recorded two years prior. Technologies such as Medtronic's BrainSense Adaptive deep brain stimulation dynamically alter stimulation parameters by reading patient-specific neural signals, improving Parkinson's symptom control while conserving battery life. Meanwhile, 5G-linked ECG patches deliver latency below 110 ms, fast enough to trigger automated emergency dispatches during myocardial events. Research centers are also piloting battery-free ultrasound implants for chronic pain that combine AI inference with edge energy harvesting, eliminating routine replacement surgeries. These advances collectively increase diagnostic accuracy, shorten intervention times and expand deployment to primary-care environments that once lacked specialty equipment.

High Device Acquisition and Maintenance Cost

Continuous glucose monitors and implantable cardiac devices still present high upfront prices that challenge budget-constrained hospitals. Semiconductor shortages have pushed component lead times to as long as 52 weeks, inflating bill-of-materials costs and slowing product refresh cycles . Because medical components represent only 11% of global industrial semiconductor demand, device makers possess limited negotiating leverage when foundries prioritize consumer electronics. Subscription models now bundle hardware, software and consumables into monthly fees that convert capital expense into operating expense, easing entry for mid-sized providers. Yet transitional Medicare coverage rules still link reimbursement to the completion of post-market evidence studies, delaying revenue capture for breakthrough devices.

Other drivers and restraints analyzed in the detailed report include:

- Growing Chronic-Disease Burden

- 5G and Edge-AI for Real-time Remote Diagnostics

- Patient-Data Privacy and Cybersecurity Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diagnostic and monitoring devices accounted for 63.54% of the smart medical devices market share in 2024, a lead built on the proven clinical utility of continuous glucose and cardiac rhythm monitors. AI-enhanced dermatology scanners such as DermaSensor report 96% sensitivity for common skin cancers, speeding specialist referrals and steering treatment earlier in the disease course. Implantable loop recorders that stream arrhythmia data directly to cardiologists now feature smart-alert hierarchies that lower false positives by learning patient-specific signal patterns. Blood-pressure cuffs and pulse oximeters maintain traction in both acute and home settings as telehealth reimbursement normalizes episodic vitals capture.

Therapeutic devices, while representing a smaller revenue base, incorporate adaptive dosing and closed-loop feedback that improve outcomes in insulin therapy, neuromodulation and rehabilitative orthopedics. Simplera CGM's seamless integration with the MiniMed 780G insulin pump shows how firms combine diagnostic insight and automated therapy in one ecosystem. Spinal cord stimulators with onboard AI categorize pain signatures in real time, allowing clinicians to tailor signal frequencies without repeated clinic visits. Smart hearing aids analyze environmental acoustics and adjust gain instantaneously, a feature that elevates speech intelligibility for complex soundscapes and aligns with demographic ageing trends.

Hospitals and clinics represented 46.21% of the smart medical devices market size in 2024, capitalizing on existing telemetry infrastructure and specialized care teams hhs.gov. Smart-hospital blueprints in China integrate IoT sensors, automated drug dispensing and AI triage algorithms within unified command centers that cut administrative task time by 30%. U.S. Accountable Care Organizations deploy remote monitoring kits upon discharge to reduce 30-day readmissions, an initiative shown to save USD 390 million across 2024 program participants.

Home-care settings post the fastest 13.93% CAGR as ageing populations and reimbursement parity for telehealth expand remote-first care pathways. Adjustable beds with embedded respiratory monitors feed data into cloud dashboards where nurses can adjust CPAP settings without a home visit. Direct-to-patient shipment of mobile ECG patches bypasses traditional durable medical-equipment distributors and accelerates therapy initiation. Ambulatory centers and emergency medical services also integrate portable ultrasound and blood-gas analyzers that synchronize to electronic records before the patient reaches the hospital bay, reducing door-to-intervention times.

The Report Covers Global Smart Medical Devices Market Size & Trends and It is Segmented by Product Type (Diagnostic and Monitoring and Therapeutic Devices), End User (Hospitals/Clinics, Home-Care Setting, and More), by Connectivity (Bluetooth, Wi-Fi, and More), by Distribution Channel (Offline and Online), and Geography. The Market Provides the Value (in USD Million) for the Above Segments.

Geography Analysis

North America held 43.53% of the smart medical devices market in 2024, supported by advanced reimbursement structures and an AI strategic plan that guides public-sector procurement and algorithmic fairness audits hhs.gov. Digital-health investment totaled USD 3 billion in Q1 2025, channeled into startup accelerators partnering directly with university medical centers. Canada's Pan-Canadian AI Health Strategy promotes standards-based data exchange across provinces, while Mexico's medical-device export corridors supply cost-effective assembly resources and maintain duty-free status under USMCA.

Asia-Pacific registers the steepest 15.34% CAGR between 2025 and 2030. China's Trinity smart-hospital program ties state funding to quantified improvements in patient throughput by mandating integrated digital registries and 5G bedside terminals. India's Ayushman Bharat Digital Mission issues unique health IDs, enabling longitudinal records that simplify device-generated data ingestion into national platforms. Japan's Medical DX initiative standardizes electronic medical records across 4,000 hospitals and launches nationwide online qualification checks, aligning device interoperability protocols to international FHIR specifications. Singapore's Synapxe links public institutions with community clinics, piloting fall-detection wearables for seniors that triggered 2,300 timely interventions during 2024 trials.

Europe remains a steady adopter thanks to the Medical Device Regulation's post-market surveillance rules and GDPR's strict consent frameworks that boost patient trust. National telehealth agencies integrate outcome dashboards that rank remote-monitoring programs and allocate incentives accordingly. Middle East & Africa and South America trail in installed base but show double-digit growth as infrastructure projects extend broadband coverage and private insurance options proliferate. Development banks are channeling concessional finance into regional OEM assembly plants, aiming to localize supply and cut foreign-exchange exposure.

- Abbott Laboratories

- Apple

- Medtronic

- Dexcom

- Roche

- Samsung Electronics

- Fitbit (Google)

- OMRON

- Philips N.V.

- Garmin

- Huawei Technologies

- Xiaomi Corp.

- Resmed

- Masimo

- iRhythm Technologies

- AliveCor

- Senseonics

- Withings

- NeuroMetrix

- Bio-Beat

- Vital Connect

- Otsuka

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smartphone-Enabled & Wireless Adoption Surge

- 4.2.2 Rapid Technological Breakthroughs In Sensors & Ai

- 4.2.3 Rising Fitness & Wellness Awareness

- 4.2.4 Growing Chronic-Disease Burden (Diabetes, Cvd)

- 4.2.5 5G + Edge-Ai Enabling Real-Time Remote Diagnostics

- 4.2.6 Value-Based Reimbursement Rewarding Continuous Monitoring

- 4.3 Market Restraints

- 4.3.1 High Device Acquisition & Maintenance Cost

- 4.3.2 Patient-Data Privacy & Cybersecurity Risk

- 4.3.3 Reimbursement Lag For Ai-Driven Diagnostic Algorithms

- 4.3.4 Sensor-Grade Semiconductor Supply Chain Bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 Blood Glucose Monitors

- 5.1.1.2 Continuous Glucose Monitors

- 5.1.1.3 Heart-Rate Monitors

- 5.1.1.4 Pulse Oximeters

- 5.1.1.5 Blood-Pressure Monitors

- 5.1.1.6 Breath Analyzers

- 5.1.1.7 Other Diagnostic & Monitoring

- 5.1.2 Therapeutic Devices

- 5.1.2.1 Portable O2 Concentrators & Ventilators

- 5.1.2.2 Insulin Pumps (Traditional, Patch, Smart)

- 5.1.2.3 Hearing Aids (Smart & AI-enabled)

- 5.1.2.4 Smart Orthopedic & Other Therapeutic

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By End User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Home-Care Settings

- 5.2.3 Ambulatory & Emergency Services

- 5.2.4 Others (Sports Medicine, Military, etc.)

- 5.3 By Connectivity

- 5.3.1 Bluetooth

- 5.3.2 Wi-Fi

- 5.3.3 Cellular/5G

- 5.3.4 LPWAN (NB-IoT, LoRa)

- 5.4 By Distribution Channel

- 5.4.1 Offline (Hospital Pharmacies, Retail)

- 5.4.2 Online (e-Commerce, DTC)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Abbott Laboratories

- 6.3.2 Apple Inc.

- 6.3.3 Medtronic PLC

- 6.3.4 Dexcom Inc.

- 6.3.5 F. Hoffmann-La Roche Ltd

- 6.3.6 Samsung Electronics

- 6.3.7 Fitbit (Google)

- 6.3.8 Omron Corporation

- 6.3.9 Philips N.V.

- 6.3.10 Garmin Ltd

- 6.3.11 Huawei Technologies

- 6.3.12 Xiaomi Corp.

- 6.3.13 ResMed

- 6.3.14 Masimo Corporation

- 6.3.15 iRhythm Technologies

- 6.3.16 AliveCor Inc.

- 6.3.17 Senseonics

- 6.3.18 Withings

- 6.3.19 NeuroMetrix Inc.

- 6.3.20 Bio-Beat

- 6.3.21 VitalConnect

- 6.3.22 Otsuka Holdings Co. Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment