PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842452

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842452

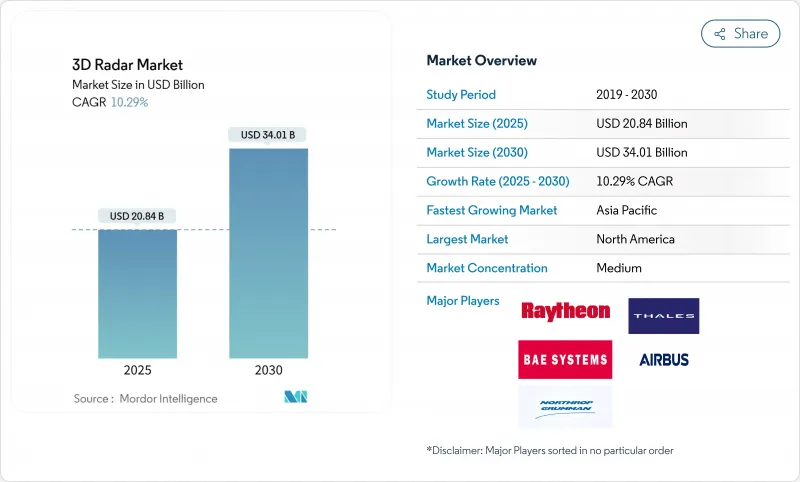

3D Radar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global 3D radar market is valued at USD 20.84 billion in 2025 and is forecast to reach USD 34.01 billion by 2030, reflecting a 10.29% CAGR.

Expansion stems from rising defense modernization, wider automotive adoption of radar-based driver-assistance technologies, and strong investment in space-based surveillance. GaN-powered AESA architectures are extending detection ranges by nearly 25% in contested electromagnetic environments, while artificial intelligence is shortening target-classification cycles from minutes to seconds. Emerging requirements for low-Earth-orbit (LEO) satellite tracking, counter-unmanned-aircraft systems (C-UAS), and climate-resilience weather monitoring are widening the addressable opportunity set. Against this backdrop, manufacturers are prioritizing open-system architectures and software-defined upgrades to maximize lifecycle value and capture recurring revenue streams in the 3D radar market.

Global 3D Radar Market Trends and Insights

Rapid deployment of 3D multi-mission radars in NATO counter-UAS programs

Across Europe, procurement authorities are funding multi-mission radars that can fuse air-surveillance, ground-surveillance, and coastal-surveillance roles within a single array. Italy's EUR 73 million Skynex contract exemplifies this shift, pairing Rheinmetall cannons with a 50 km-range 3D radar that tracks rotary-wing drones at low altitude. These systems leverage machine learning for drone discrimination, enabling near-real-time threat assessment and reducing operator workload. Their modular architecture supports plug-and-fight integration into existing C-UAS command networks, accelerating fielding schedules. As NATO standardizes threat libraries and software updates, volume orders are driving cost curves lower, reinforcing demand in the 3D radar market.

Surge in LEO satellite constellations demanding space-based 3D tracking radars

Commercial operators are launching hundreds of small satellites for broadband, Earth-observation, and in-orbit servicing. To manage the resulting traffic, governments are procuring precision 3D tracking radars capable of cataloguing objects below 1 cm at altitudes of 500-1,200 km. Lockheed Martin's strategy for proliferated architectures illustrates how space surveillance now demands Ku/Ka band arrays linked to AI-driven ground segments. North America's end-users are prioritizing shared civil-military space domain awareness platforms, bolstering the long-term outlook for the 3D radar market.

Increased demand for meteorological 3D Doppler radars for climate resilience

Cyclone-prone island states and African nations are replacing legacy 2D weather radars with dual-polarization 3D systems that can resolve storm structure in real time. Projects funded via multilateral climate-adaptation programs are bundling training and maintenance packages, ensuring sustainable operations. Adoption is strongest where agriculture contributes more than 20% of GDP, reinforcing the developmental impact of the 3D radar market.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM shift toward 4D imaging radar for Level 3+ ADAS

- Adoption of GaN-based AESA 3D radars for integrated air & missile defense modernization

- Civil airport upgrades to digital 3D surveillance radars under airspace capacity expansion

- Capital-intensive transition from legacy 2D to phased-array 3D radars in emerging nations

- Scarcity of RF spectrum in C & X bands limiting urban installations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground-based installations captured 46.2% of 3D radar market share in 2024, reflecting their pivotal role in border surveillance, early-warning, and C-UAS missions. Power-optimized GaN T/R modules enable transportable arrays that deploy within four hours and connect to tactical networks via software-defined radios. Ground-based radars are benefiting from AI algorithms that classify drones under 2 kg, improving decision-making for layered defense architectures.

The airborne segment is forecast to expand at 12.4% CAGR as fifth-generation fighters integrate indigenous AESA radars with over 900 modules, extending look-down detection against low-observable targets. Modular line-replaceable units cut maintenance turnaround by 30%, positioning airborne solutions as a premium slice of the 3D radar market. Naval platforms add growth momentum through lightweight solid-state rotating arrays designed for offshore patrol vessels guarding exclusive economic zones.

Long-range systems commanded 41% of the 3D radar market size in 2024, protecting air-defense identification zones and strategic assets. Recent deployments achieve 600 km instrumented range while tracking 1,500 objects, enabled by digital waveform agility and edge processing. AI-assisted clutter maps improve low-RCS detection over mountainous terrain, vital for hypersonic-missile warning.

Short-range radars, expanding at a 14.6% CAGR, are integrated into vehicle-mounted C-UAS kits and perimeter-security towers. Coprime-sampling techniques reduce channel counts, shrinking antenna footprints for rooftop installation. Medium-range arrays address mobile-force protection, balancing 3 km minimum range with 120 km maximum reach, thereby filling doctrinal gaps in layered defense and broadening opportunities across the 3D radar market.

3D Radar Market Segmented by Platform (Airborne, Ground and More), Range Type (Long Range, Medium Range and More), Frequency Band (L Band, S Band and More), Component (Hardware, Software and More), Application (Defense & Security, Air Traffic Control and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38.7% of 3D radar market share in 2024, underpinned by USD 28.4 billion earmarked for missile-defeat systems and an additional USD 9.9 billion Pacific Deterrence Initiative allocation. Recent contracts for AN/TPY-4 expeditionary radars illustrate the push toward transportable long-range coverage. Regional suppliers emphasize open-system interfaces and AI-driven sensor fusion, strengthening inter-service interoperability.

Asia-Pacific is climbing at a 12.7% CAGR as indigenous programs close capability gaps. India's self-sufficiency in long-range AESA radars bolsters border surveillance, while Japan's plan to double defense outlays to 2% of GDP accelerates integrated air-and-missile defense spending. Local manufacturing initiatives such as the PULSE joint venture reflect the region's appetite for sovereign production within the 3D radar market.

Europe maintains momentum through NATO counter-UAS requirements and rising defense budgets, with 23 member states on track to hit the 2% target. Italy's Skynex, Poland's 4.7% GDP ambition, and EDF funding for cognitive-radar research highlight the continent's investment trajectory. Spectrum-management reforms will shape urban deployments, influencing long-term 3D radar market growth.

The Middle East and Africa are upgrading layered air defenses amid drone incursions, often via offset agreements that spur local assembly. South American states prioritize weather-radar modernization for disaster resilience, working with multilateral financiers to secure phased-array technology. Collectively these regions contribute incremental demand, reinforcing the global expansion of the 3D radar market.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

- BAE Systems plc

- Airbus Defence and Space

- Lockheed Martin Corporation

- Hensoldt AG

- Saab AB

- Israel Aerospace Industries Ltd. (ELTA Systems)

- Leonardo S.p.A.

- Rheinmetall AG

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Indra Sistemas S.A.

- Terma A/S

- Aselsan A.S.

- Cobham plc (Eaton)

- SRC, Inc.

- Echodyne Corp.

- Spartan Radar, Inc.

- Kelvin Hughes Ltd. (Hensoldt UK)

- Telephonics Corporation (TTM Technologies)

- Bharat Electronics Limited

- China Electronics Technology Group Corporation (CETC)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Rapid Deployment of 3D Multi-Mission Radars in NATO Counter-UAS Programs (Europe)

- 4.1.2 Surge in LEO Satellite Constellations Demanding Space-Based 3D Tracking Radars (North America)

- 4.1.3 Automotive OEM Shift Toward 4D Imaging Radar for Level-3+ ADAS (Asia)

- 4.1.4 Adoption of GaN-Based AESA 3D Radars for Integrated Air and Missile Defense Modernization (Middle East)

- 4.1.5 Increased Demand for Meteorological 3D Doppler Radars for Climate Resilience (Pacific Islands)

- 4.1.6 Civil Airport Upgrades to Digital 3D Surveillance Radars under Airspace Capacity Expansion (US and EU)

- 4.2 Market Restraints

- 4.2.1 Capital-Intensive Transition from Legacy 2D to Phased-Array 3D Radars in Emerging Nations

- 4.2.2 Scarcity of RF Spectrum in C and X Bands Limiting Urban Installations

- 4.2.3 ITAR and National Export Controls Hindering International Collaboration

- 4.2.4 Thermal and Power Management Challenges in High-Density GaN Modules

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory or Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Ground

- 5.1.1 Naval

- 5.2 By Range Type

- 5.2.1 Long Range

- 5.2.2 Medium Range

- 5.2.3 Short Range

- 5.3 By Frequency Band

- 5.3.1 L Band

- 5.3.2 S Band

- 5.3.3 C Band

- 5.3.4 X Band

- 5.3.5 Ku / Ka Band

- 5.4 By Application

- 5.4.1 Defense and Security

- 5.4.2 Air Traffic Control

- 5.4.3 Weather Monitoring

- 5.4.4 Automotive and Industrial

- 5.4.5 Space Surveillance

- 5.5 By Component

- 5.5.1 Hardware

- 5.5.2 Software

- 5.5.3 Service

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.3.1 Northrop Grumman Corporation

- 6.3.2 Raytheon Technologies Corporation

- 6.3.3 Thales Group

- 6.3.4 BAE Systems plc

- 6.3.5 Airbus Defence and Space

- 6.3.6 Lockheed Martin Corporation

- 6.3.7 Hensoldt AG

- 6.3.8 Saab AB

- 6.3.9 Israel Aerospace Industries Ltd. (ELTA Systems)

- 6.3.10 Leonardo S.p.A.

- 6.3.11 Rheinmetall AG

- 6.3.12 Honeywell International Inc.

- 6.3.13 Mitsubishi Electric Corporation

- 6.3.14 Indra Sistemas S.A.

- 6.3.15 Terma A/S

- 6.3.16 Aselsan A.S.

- 6.3.17 Cobham plc (Eaton)

- 6.3.18 SRC, Inc.

- 6.3.19 Echodyne Corp.

- 6.3.20 Spartan Radar, Inc.

- 6.3.21 Kelvin Hughes Ltd. (Hensoldt UK)

- 6.3.22 Telephonics Corporation (TTM Technologies)

- 6.3.23 Bharat Electronics Limited

- 6.3.24 China Electronics Technology Group Corporation (CETC)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis