PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842454

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842454

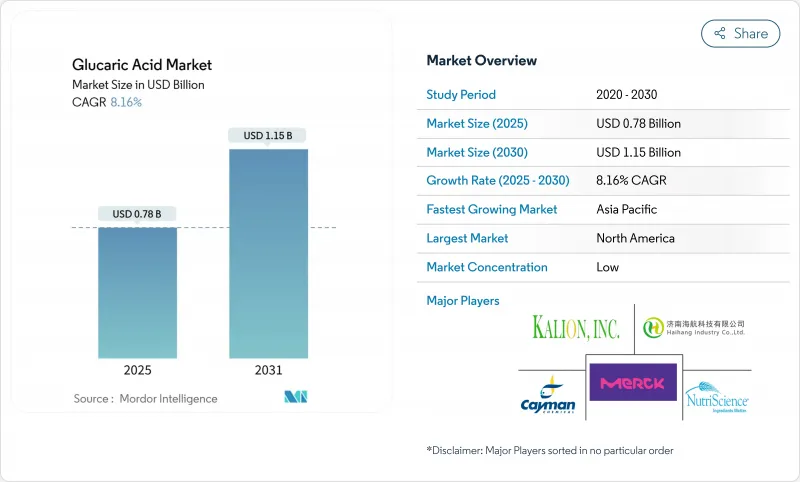

Glucaric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global glucaric acid market, valued at USD 0.78 billion in 2025, is expected to reach USD 1.15 billion by 2030, growing at a CAGR of 8.16% during the forecast period.

Driven by stringent environmental regulations and a global push for sustainable chemical alternatives, the glucaric acid market is gaining significant momentum. Key drivers of this upward trend include advancements in biotechnology and an increasing application in pharmaceuticals and food processing. The growing focus on reducing dependency on petrochemical-based products further supports the market's expansion. Purified forms currently lead the market, showcasing their commercial maturity and widespread application. Yet, derivatives aimed at the health supplement segments are on the rise, with expectations of a faster adoption rate in the near future. The increasing consumer awareness regarding health and wellness is driving this segment's growth. While detergents hold the top spot in applications, there's a notable surge in food-grade uses, driven by a growing demand for clean-label and functional ingredients. This trend aligns with the broader shift toward transparency and sustainability in food production. Mature economies, bolstered by established industrial infrastructures and supportive regulations, still command the largest market share. However, the Asia-Pacific region is making waves as the fastest-growing area, propelled by swift industrialization and robust policy initiatives championing environmental sustainability. The region's expanding middle-class population and rising disposable incomes further contribute to the market's growth. With innovation at the forefront and regional dynamics in play, the market is poised for a transformative evolution.

Global Glucaric Acid Market Trends and Insights

Consumer Preference for Non-Toxic, Allergen Free Additives Across Industries

The increasing demand for non-toxic, allergen-free additives is transforming chemical procurement strategies across industries, with glucaric acid emerging as an alternative to conventional chelating agents. The Environmental Protection Agency (EPA)'s Safer Choice Standard amendments, taking effect in August 2024, mandate improved ingredient transparency and lifecycle analysis for product certification, supporting the adoption of bio-based alternatives . This aligns with the European Union's Directive 2024/825, which requires verification of environmental claims and third-party certification for sustainability labels, eliminating unsubstantiated "eco-friendly" marketing claims. These regulatory changes provide advantages to glucaric acid manufacturers who can demonstrate quantifiable environmental benefits. Industrial purchasers prioritize non-toxic additives to minimize liability risks and meet corporate sustainability goals, expanding their evaluation criteria beyond cost factors. The pharmaceutical industry's use of calcium glucarate in metabolic health products illustrates how safety considerations influence pricing strategies, as supported by clinical studies that confirm its effectiveness in glucose management.

Surging Consumer Focus on Detox and Metabolic Health

The increasing prevalence of metabolic health conditions has generated substantial market demand for glucaric acid derivatives, particularly calcium glucarate. This growth is primarily attributed to consumers' heightened awareness of metabolic health management and their pursuit of scientifically validated natural alternatives to conventional pharmaceutical interventions. Glucaric acid compounds have demonstrated significant potential in modulating GLP-1 response pathways, positioning them as credible alternatives to prescription medications within the expanding weight management market. Healthcare institutions are increasingly integrating these compounds into their treatment protocols as cost-effective interventions for various metabolic disorders. The concurrent demographic shifts toward aging populations and the rising incidence of diabetes create a strong market foundation for glucaric acid-based health solutions, particularly in preventive healthcare and metabolic support applications. For instance, according to World Bank data, in 2023, Japan reported the highest proportion of individuals aged 65 or older at 30% of its population, with Italy following at 24% .

Complex and Energy-Intensive Purification Process

Stringent purification requirements for pharmaceutical and food-grade glucaric acid restrain market growth, particularly affecting smaller biotechnology companies. Traditional purification methods demand multiple crystallization steps and strict impurity control measures. High energy costs in certain regions limit purification processes, benefiting only producers with access to affordable clean energy. Although advanced technologies such as electrodialysis and membrane separation present viable alternatives, these methodologies necessitate considerable capital expenditure and specialized technical expertise. The inherent complexity of maintaining standardized product quality across diverse feedstock materials and fermentation parameters creates a competitive advantage for established manufacturing entities. Furthermore, the regulatory framework established by the Food and Drug Administration (FDA) and European Medicines Agency (EMA) mandates comprehensive documentation and validation protocols, presenting substantial operational barriers for smaller-scale producers. These combined factors significantly influence the market's growth trajectory and operational dynamics within the glucaric acid industry.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Regulatory Push for Phosphate-Free Detergents

- Rising Demand for Bio-Based Chemicals as Sustainable Alternatives

- Price Sensitivity in Mass-Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, pure D-glucaric acid commands a 30.88% share of the market, driven by its critical role in pharmaceuticals, industry, and research, where purity is paramount. This segment's expansion is bolstered by established production techniques and adherence to regulations, especially in water treatment. Here, approvals under the Toxic Substances Control Act (TSCA) confer a competitive edge. The demand for pure D-lucaric acid is further supported by its versatility in applications, ranging from chemical intermediates to environmentally friendly solutions, which align with the growing emphasis on sustainability. Additionally, advancements in production technologies are expected to enhance efficiency and reduce costs, further driving their adoption across various segments. Meanwhile, calcium D-glucarate is on track to expand at a 9.37% CAGR through 2030, fueled by its pharmaceutical uses and clinical research focus on metabolic health. Its calcium salt form boasts superior bioavailability and stability over its free acid counterpart, making it a prime choice for dietary supplements. The increasing consumer awareness regarding health and wellness is also contributing to the rising demand for calcium-D-glucarate in dietary formulations.

Potassium and sodium-D-glucarate variants find their primary application in the industrial segments, notably in detergent formulations where both solubility and pH stability are paramount. These variants are also gaining traction due to their role in enhancing the performance of cleaning agents, particularly in hard water conditions. D-glucaric acid-1,4-lactone carves out a specialized niche in polymer chemistry and synthesis reactions. Its unique chemical properties make it an essential component in high-performance materials and advanced manufacturing processes. The 'other' category encompasses a range of emerging derivatives and tailored formulations for distinct industrial applications. This market segmentation indicates a transition from fundamental chemical uses to premium pharmaceutical and specialty products. Biotechnology firms are at the forefront, crafting derivatives that not only enhance performance but also fetch premium prices. The ongoing innovation in derivative development is expected to open new avenues for market growth, particularly in high-value applications such as drug delivery systems and advanced industrial processes.

The Global Glucaric Acid Market is Segmented by Product Type (Pure D-Glucaric Acid, Calcium-D-Glucarate, Potassium/Sodium-D-Glucarate, D-Glucaric Acid-1, 4-Lactone, and Others), by Application (Food Ingredients, Detergents, Pharmaceuticals, and Others), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a dominant 31.34% market share, bolstered by its robust biotechnology infrastructure, stringent environmental regulations, and a broad embrace of sustainable chemistry. Major companies in the region are pioneering fermentation-based production technologies and obtaining regulatory nods for water treatment. Modifications to the Safer Choice Standard and heightened environmental compliance demands fuel a steady appetite for bio-based alternatives. Meanwhile, the region's well-established pharmaceutical and specialty chemical segments present lucrative market opportunities. Additionally, the presence of advanced research facilities and a strong focus on innovation further strengthens North America's position in the market. The region's ability to adapt to evolving regulatory landscapes and its emphasis on sustainability make it a key player in driving the adoption of bio-based solutions.

Asia-Pacific is on track to achieve the highest growth trajectory, boasting a 9.74% CAGR through 2030. This surge is fueled by significant investments in research and development facilities, a rising embrace of bio-based chemicals, and an escalating demand from the pharmaceutical sector. Government-backed initiatives championing sustainable chemical production, heightened environmental awareness among manufacturers, and a broadened scope of applications from food preservation to personal care further bolster the region's growth. The region also benefits from its large and rapidly growing population, which drives demand for sustainable products across various industries. Furthermore, the increasing presence of global players and collaborations with local manufacturers are accelerating the development and adoption of bio-based technologies in Asia-Pacific.

European markets, navigating under stringent REACH regulations and circular economy initiatives, are witnessing a surge in bio-based chemicals, spurred by a growing consumer inclination towards sustainability. The region's strong regulatory framework ensures consistent quality and safety standards, which further encourage the adoption of bio-based alternatives. Additionally, Europe's focus on reducing carbon emissions and achieving climate goals aligns with the increasing demand for sustainable products. Meanwhile, South America and the Middle East and Africa are in the nascent stages of adoption, driven by their burgeoning agricultural sectors, escalating investments in bio-refineries, and a concerted effort to diminish reliance on petroleum for chemical production. These regions are also exploring opportunities to leverage their abundant natural resources to develop bio-based chemicals, which could position them as emerging players in the global market.

- Merck KGaA

- Kalion Inc.

- Haihang Group

- Cayman Chemical Company

- NutriScience Innovations, LLC

- Rivertop Renewables

- Johnson Matthey plc

- Anmol Chemicals Pvt.Ltd

- Alfa Chemistry

- AK Scientific Inc.

- Jungbunzlauer Suisse AG

- Shanpar Industries Private Limited

- Jiaan Biotech

- Tokyo Chemicals Industry Pvt Ltd

- Geocon Products

- Spectrum Chemical Mfg. Corp.

- Hindustan Bec Tech India Pvt. Ltd.

- Santa Cruz Biotechnology, Inc.

- Surfachem Group Ltd

- Kanto Chemical Co., Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Consumer Preference for Non-Toxic, Allergien Free Additives Across Industries

- 4.2.2 Surging Consumer Focus on Detox and Metabolic Health

- 4.2.3 Increasing Regulatory Push for Phosphate-Free Detergents

- 4.2.4 Rising Demand for Bio-Based Chemical as Sustinable Alternatives

- 4.2.5 Industrial Shift Towards Safer and Non-Corrosive Acid Alternatives

- 4.2.6 Wide Application of Glucaric Acid in Detergent and Cleaning Products

- 4.3 Market Restraints

- 4.3.1 Complex and Energy-Intensive Purification Process

- 4.3.2 Price Sensitivity in Mass-Market

- 4.3.3 Low Solubility in Organic Solvents

- 4.3.4 Patent Constraints in Key Synthesis Technologies

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Pure D-Glucaric Acid

- 5.1.2 Calcium-D-Glucarate

- 5.1.3 Potassium/Sodium-D-Glucarate

- 5.1.4 D-Glucaric Acid-1,4-Lactone

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Food Ingredients

- 5.2.2 Detergents

- 5.2.3 Pharmaceuticals

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Spain

- 5.3.2.6 Netherlands

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Merck KGaA

- 6.4.2 Kalion Inc.

- 6.4.3 Haihang Group

- 6.4.4 Cayman Chemical Company

- 6.4.5 NutriScience Innovations, LLC

- 6.4.6 Rivertop Renewables

- 6.4.7 Johnson Matthey plc

- 6.4.8 Anmol Chemicals Pvt.Ltd

- 6.4.9 Alfa Chemistry

- 6.4.10 AK Scientific Inc.

- 6.4.11 Jungbunzlauer Suisse AG

- 6.4.12 Shanpar Industries Private Limited

- 6.4.13 Jiaan Biotech

- 6.4.14 Tokyo Chemicals Industry Pvt Ltd

- 6.4.15 Geocon Products

- 6.4.16 Spectrum Chemical Mfg. Corp.

- 6.4.17 Hindustan Bec Tech India Pvt. Ltd.

- 6.4.18 Santa Cruz Biotechnology, Inc.

- 6.4.19 Surfachem Group Ltd

- 6.4.20 Kanto Chemical Co., Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK