PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842455

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842455

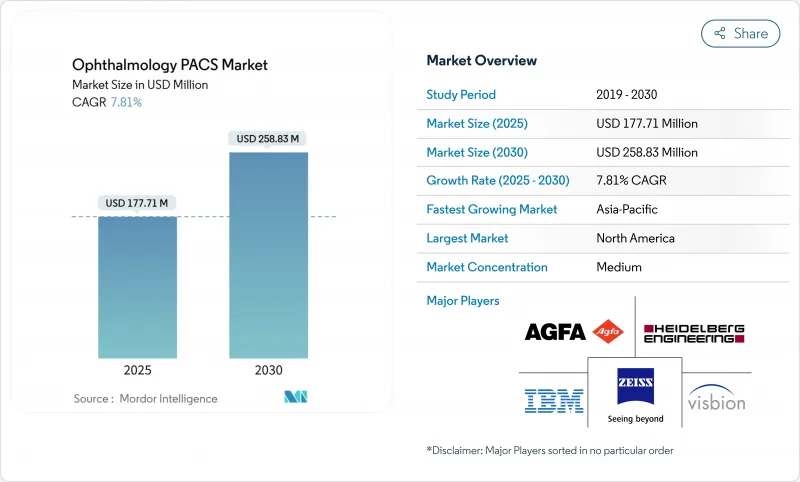

Ophthalmology PACS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ophthalmology PACS Market size is estimated at USD 177.71 million in 2025, and is expected to reach USD 258.83 million by 2030, at a CAGR of 7.81% during the forecast period (2025-2030).

The growing digitization of imaging, the rapid uptake of artificial intelligence tools, and the large pool of elderly and diabetic patients are the primary forces that are expanding the ophthalmology PACS market. Integrated platforms that consolidate acquisition, storage, and analytics functions are replacing siloed, film-based workflows. At the same time, hospital groups and multisite eye-care networks pursue technology that supports value-based reimbursement and tighter clinical governance. Cloud deployment remains the fastest-growing delivery model because subscription pricing lowers capital outlays and simplifies access to AI modules, yet on-premise systems still dominate where data-sovereignty rules and legacy investments prevail. Vendors able to balance security, bandwidth efficiency, and intraoperative OCT integration continue to unlock new efficiencies for clinicians and payers.

Global Ophthalmology PACS Market Trends and Insights

Rising Prevalence of Chronic Eye Diseases

Global cases of diabetic retinopathy are projected to climb 17.9% by 2030, generating unprecedented imaging volumes that require robust storage and analytics. Modern OCT angiography and fundus systems produce gigabyte-level studies, pushing buyers toward PACS platforms that can rapidly visualize and analyze multilayer datasets. Hospitals link early deployment of such systems with improved outcomes in glaucoma, where earlier intervention prevents irreversible vision loss. Consequently, the ophthalmology PACS market is increasingly viewed as a preventive-care enabler rather than a cost center.

Aging and Diabetic Population Expansion

Adults older than 65 need eye examinations three to four times more often than younger cohorts, and the 4.3 billion-strong Asia Pacific population is aging quickly. Chronic diabetes adds a second demand driver, with the United States spending USD 7.2 billion annually on diabetic eye disease management. PACS solutions that support remote screening allow overextended clinicians to triage and follow higher-risk patients, reinforcing payer incentives that promote preventive imaging.

High Implementation and Maintenance Costs

Comprehensive PACS rollouts can pass USD 300,000 after cables, training, and data migration, while annual support adds 15-20% of up-front spend. Complex OCT angiography archives strain budgets for independent clinics, which sometimes defer upgrades, slowing demand in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Tele-ophthalmology Scale-up and Home Monitoring

- Shift to AI-enabled Cloud PACS Lowering TCO

- Cybersecurity and Data-sovereignty Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated systems captured 60.21% ophthalmology PACS market share in 2024, displacing stand-alone servers as buyers prioritize seamless modality connectivity and lower lifetime service costs. The same cohort is projected to grow at an 8.96% CAGR, indicating that future investments lean even further toward single-vendor stacks.

Healthcare groups favor integrated environments because optical coherence tomography, fundus cameras, and angiography units can upload studies into a single viewer without manual reconciliation. Faster AI deployment also tilts decisions toward integrated architectures, as algorithm providers certify one connection rather than adapting to many proprietary formats. As a result, the ophthalmology PACS market increasingly rewards vendors that bundle hardware, cloud, and analytics into one contract.

The Ophthalmology PACS (Picture Archiving and Communication System) Market Report is Segmented by PACS Type (Integrated PACS and Stand-Alone PACS), Delivery Model (Cloud-Based and On-Premise), End User (Hospitals and Eye-Care Networks, Ambulatory Surgical Centers and Specialty Clinics / Solo Practices), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.45% of global revenue in 2024 as mature IT ecosystems, value-based reimbursement, and strict DICOM mandates under the Department of Veterans Affairs converged to sustain high capital investment cycles. Growth moderates, however, as many large networks already completed primary PACS installations and now prioritize incremental AI upgrades.

Asia Pacific is projected to add the largest incremental revenue at an 8.51% CAGR through 2030 due to large aging populations, higher diabetes incidence, and national e-health programs in China and India. Governments subsidize cloud infrastructure and tele-ophthalmology pilots, creating fertile ground for vendors delivering low-bandwidth solutions.

Europe shows steady adoption, aided by pan-regional interoperability initiatives and cloud approvals that satisfy GDPR. Philips recently expanded enterprise imaging services across the region, demonstrating that compliant-by-design platforms can overcome data-localization hurdles. The Middle East, Africa, and South America collectively represent an emerging opportunity pool; however, sporadic broadband and limited ophthalmologist density delay large-scale PACS rollouts. Vendors often pair philanthropic screening programs with commercial pilots to build reference sites that validate return on investment.

- Agfa-Gevaert

- Carl Zeiss

- Heidelberg Engineering

- IBM (Merge PACS)

- Topcon

- Koninklijke Philips

- GE Healthcare

- Siemens Healthineers

- FUJIFILM

- Canon

- Sectra

- Visage Imaging

- RamSoft

- Infinitt Healthcare

- EyePACS

- Sonomed Escalon

- Medical Standard Co.

- Visbion

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic eye diseases

- 4.2.2 Aging & diabetic population expansion

- 4.2.3 Tele-ophthalmology scale-up & home-monitoring

- 4.2.4 Shift to AI-enabled cloud PACS lowering TCO

- 4.2.5 Surgical guidance integration (intra-op OCT feeds)

- 4.2.6 Value-based reimbursement favouring imaging analytics

- 4.3 Market Restraints

- 4.3.1 High implementation & maintenance costs

- 4.3.2 Cyber-security & data-sovereignty concerns

- 4.3.3 Bandwidth limits for high-resolution ocular images

- 4.3.4 Interoperability gaps with legacy ophthalmic devices

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook (AI, Cloud & Edge)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By PACS Type

- 5.1.1 Integrated PACS

- 5.1.2 Stand-alone PACS

- 5.2 By Delivery Model

- 5.2.1 Cloud-based

- 5.2.2 On-premise

- 5.3 By End User

- 5.3.1 Hospitals and Eye-care Networks

- 5.3.2 Ambulatory Surgical Centres

- 5.3.3 Specialty Clinics / Solo Practices

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Agfa-Gevaert NV

- 6.3.2 Carl Zeiss Meditec AG

- 6.3.3 Heidelberg Engineering GmbH

- 6.3.4 IBM (Merge PACS)

- 6.3.5 Topcon Corporation

- 6.3.6 Philips Healthcare

- 6.3.7 GE Healthcare

- 6.3.8 Siemens Healthineers

- 6.3.9 Fujifilm Healthcare

- 6.3.10 Canon Medical Systems

- 6.3.11 Sectra AB

- 6.3.12 Visage Imaging

- 6.3.13 RamSoft

- 6.3.14 Infinitt Healthcare

- 6.3.15 EyePACS

- 6.3.16 Sonomed Escalon

- 6.3.17 Medical Standard Co.

- 6.3.18 Visbion Limited

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment