PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842456

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842456

Doxorubicin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

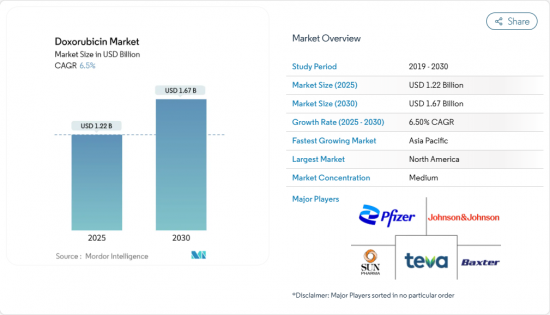

The global doxorubicin market is valued at USD 1.22 billion in 2025 and is projected to reach USD 1.67 billion by 2030, registering a 6.50% CAGR over the forecast period.

Robust clinical evidence keeps the agent at the center of many oncology protocols, and continuous advances in liposomal delivery expand its therapeutic window. Sustained cancer prevalence, wider generic availability, and targeted formulation innovations are reinforcing demand even as high-cost biologics compete for market share. At the same time, cardiotoxicity concerns, stricter hazardous-drug handling rules, and workflow shifts toward specialty pharmacy models temper longer-term uptake.

Global Doxorubicin Market Trends and Insights

Escalating Global Cancer Burden Elevating Chemotherapy Volumes

Rising worldwide cancer incidence is driving persistent use of broad-spectrum cytotoxics such as doxorubicin. Even as precision biologics proliferate, clinicians continue to rely on anthracycline-taxane combinations for breast tumors with high recurrence scores, showing superior survival versus taxane monotherapy in recent Phase 3 data presented at the San Antonio Breast Cancer Symposium. Versatility across solid and hematologic indications expands procedure volumes, reinforcing the doxorubicin market despite premium biologic entrants.

Growing Availability of Affordable Generic & Liposomal Doxorubicin

Intensifying generic competition is widening patient access and pressuring prices. New entrants such as Lupin introduced doxorubicin hydrochloride liposome injection in the United States in August 2024, enlarging the liposomal category and catalyzing broader adoption in budget-constrained health systems. This influx of lower-priced alternatives supports treatment equity in Asia-Pacific and Latin America, further stimulating doxorubicin market growth.

Cumulative Cardiotoxicity Risk Necessitating Strict Dose Caps & Monitoring

Anthracycline-induced cardiomyopathy limits lifetime exposure, with cumulative dose caps of 450-550 mg/m2 enshrined in guidelines. Although dexrazoxane offers partial protection, no other FDA-approved cardioprotective agent exists, forcing prescribers to juggle efficacy and long-term cardiac safety. This restraint slows repeat-cycle utilization within the doxorubicin market, spurring innovation in safer delivery platforms.

Other drivers and restraints analyzed in the detailed report include:

- Technological Progress in Liposomal & Nanocarrier Delivery

- Government-Led Cancer Care Expansion Programs in Emerging Markets

- Shift Toward Targeted Therapies and Immuno-Oncologics Displacing Anthracyclines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional injection maintained a 52% revenue contribution to the doxorubicin market in 2024, anchored in decades of clinical familiarity and competitive generic pricing. Pegylated liposomal doxorubicin, while only a fraction of earlier volume, is expanding at a 7.5% CAGR and is pivotal to enlarging the doxorubicin market size owing to reduced cardiac toxicity and prolonged circulation time. Regulatory approvals for advanced carriers such as Myocet and Celdoxome in Europe underscore a growing consensus that lipid-based vectors can safely extend cumulative dose ceilings. Research on pH-triggered nanocarriers and thermosensitive liposomes reveals promising preclinical data, suggesting that co-development of device-based hyperthermia triggers could structurally differentiate future entrants and compound competitive intensity in this formulation segment.

Continued supply stability of lyophilized powder formulations protects treatment access in regions lacking sophisticated cold chains, particularly parts of Africa and rural South America. Volume demand here, though modest, provides durable revenue streams for manufacturers with cost-focused portfolios inside the broader doxorubicin market.

The Doxorubicin Market Report is Segmented by Drug Formulation (Conventional Doxorubicin Injection (Solution), Lyophilized Powder for Reconstitution, and More), Application (Bladder Cancer, Ovarian Cancer, and More), Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online / E-Commerce Pharmacy), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the anchor geography with 48% of global revenue in 2024. Inpatient reimbursement structures, broad insurance coverage, and early adoption of cardioprotective delivery systems safeguard volume. Value-based contracts tying payments to progression-free survival may modify pricing headroom, yet the switch to liposomal variants is likely to sustain stable dollar growth for the regional doxorubicin market.

Asia-Pacific is set to be the principal acceleration engine, advancing at 8.3% CAGR to 2030. Rising diagnostic penetration, burgeoning private insurance pools in China and India, and government incentives for local manufacturing underpin robust demand. Sun Pharmaceutical Industries' oncology build-out via acquisitions such as the USD 355 million Checkpoint Therapeutics deal shows local players' intent to climb the innovation ladder. Indigenous production, combined with regulatory fast-tracking, is expected to shrink time-to-market for new formulations and entrench regional suppliers inside the doxorubicin market.

Europe benefits from a sophisticated reimbursement apparatus but faces budget constraints that favor generics. EMA approvals for multiple liposomal options diversify clinician choice yet subject pricing to national tender pressures. South America holds latent potential, particularly Brazil, where oncology hospital expansion and biosimilar uptake broaden patient throughput. Improvement in domestic fill-finish capabilities could lower import dependencies and stimulate localized segments of the doxorubicin market.

- Johnson & Johnson

- Sun Pharmaceuticals Industries

- Pfizer

- Baxter

- Teva Pharmaceutical Industries

- Cadila Pharmaceuticals Ltd

- Cipla

- Dr. Reddy's Laboratories

- Hikma Pharmaceuticals

- Viatris (Mylan)

- Accord Healthcare

- Intas Pharmaceutical

- Fresenius

- Celon Laboratories

- Zhejiang Hisun Pharmaceutical Co.

- Nantong Jinghua Pharmaceutical Co.

- Lupin

- TTY Biopharm Co. Ltd

- Sandoz Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global Cancer Burden Elevating Chemotherapy Volumes

- 4.2.2 Growing Availability of Affordable Generic & Liposomal Doxorubicin

- 4.2.3 Technological Progress in Liposomal & Nanocarrier Delivery Enhancing Therapeutic Index

- 4.2.4 Government-Led Cancer Care Expansion Programs in Emerging Markets

- 4.2.5 Rising Adoption of Combination Regimens Featuring Doxorubicin for Hematologic Malignancies

- 4.3 Market Restraints

- 4.3.1 Cumulative Cardiotoxicity Risk Necessitating Strict Dose Caps & Monitoring

- 4.3.2 Shift Toward Targeted Therapies and Immuno-oncologics Displacing Anthracyclines

- 4.3.3 Stringent Hazardous-Drug Handling Standards Raising Distribution Costs

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Formulation

- 5.1.1 Conventional Doxorubicin Injection (Solution)

- 5.1.2 Lyophilized Powder for Reconstitution

- 5.1.3 Pegylated Liposomal Doxorubicin (PLD)

- 5.1.4 Non-Pegylated Liposomal Doxorubicin

- 5.2 By Application (Cancer Type)

- 5.2.1 Breast Cancer

- 5.2.2 Ovarian Cancer

- 5.2.3 Leukemia

- 5.2.4 Lymphoma

- 5.2.5 Bladder Cancer

- 5.2.6 Kaposi Sarcoma

- 5.2.7 Multiple Myeloma

- 5.2.8 Gastric Cancer

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacy

- 5.3.2 Retail Pharmacy

- 5.3.3 Online / E-commerce Pharmacy

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Johnson & Johnson (Janssen)

- 6.3.2 Sun Pharmaceutical Industries Ltd

- 6.3.3 Pfizer Inc.

- 6.3.4 Baxter International Inc.

- 6.3.5 Teva Pharmaceutical Industries Ltd

- 6.3.6 Cadila Pharmaceuticals Ltd

- 6.3.7 Cipla Ltd

- 6.3.8 Dr. Reddy's Laboratories Ltd

- 6.3.9 Hikma Pharmaceuticals PLC

- 6.3.10 Viatris (Mylan)

- 6.3.11 Accord Healthcare

- 6.3.12 Intas Pharmaceuticals Ltd

- 6.3.13 Fresenius Kabi AG

- 6.3.14 Celon Laboratories Pvt Ltd

- 6.3.15 Zhejiang Hisun Pharmaceutical Co.

- 6.3.16 Nantong Jinghua Pharmaceutical Co.

- 6.3.17 Lupin Limited

- 6.3.18 TTY Biopharm Co. Ltd

- 6.3.19 Sandoz AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment