PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842457

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842457

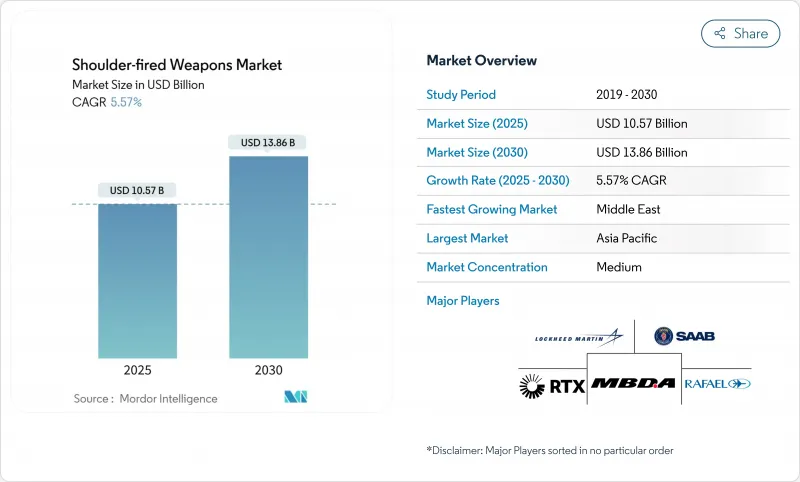

Shoulder-fired Weapons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The shoulder-fired weapons market is valued at USD 10.57 billion in 2025 and is projected to reach USD 13.86 billion by 2030, reflecting a 5.57% CAGR.

Several interlocking trends sustain this expansion in market size. First, infantry units now face heavy armor, drones, and fortified positions inside densely populated areas; portable precision launchers let them respond without waiting for artillery or airpower. Second, the Russia-Ukraine war shifted procurement from peacetime pacing to surge production, reopening dormant missile lines and prompting suppliers to triple or quadruple monthly output. Third, Asia-Pacific programs emphasize indigenous design and joint ventures, lifting volumes for seeker electronics and advanced fire-control units. Fourth, homeland-security agencies and border guards increasingly adopt man-portable air-defense systems to counter cheap drones, widening the end-user base. Finally, lighter carbon-fiber launch tubes and soft-launch propulsion stages cut combat loads, encouraging special-operations forces to carry multi-role launchers on long-range patrols.

Global Shoulder-fired Weapons Market Trends and Insights

Intensifying Asymmetric Warfare Driving Demand for Portable Anti-Armor

Irregular forces, urban militias, and small expeditionary platoons increasingly face main battle tanks inside narrow streets and rugged valleys. Since 2024, global acquisitions of next-generation anti-tank missiles rose 37%, spearheaded by Saab's fourfold boost to NLAW output and Lockheed Martin's 2.5-times increase in Javelin shipments. Programmable tandem warheads, reduced minimum-range fuzes, and soft-launch motors allow dismounted squads to defeat reactive armor without exposing themselves to backblast. The shoulder-fired weapons market, therefore, benefits from every frontline that relies on infantry over heavy formations.

Accelerated Defense Modernization Programs Driven by Territorial Disputes Worldwide

Rising sovereignty concerns move parliaments to allocate larger capital budgets for quick-reaction firepower. Asia-Pacific defense outlays climbed to USD 411 billion in 2023, with Japan procuring 300 Carl-Gustaf launchers for 2025 delivery and India perfecting its man-portable ATGM. Similar trajectories appear in Northern Europe, where Finland and Sweden revamp Arctic brigades, and in the Gulf, where lightweight launchers complement layered missile shields. Long-term industrial plans bundle seeker production with domestic final assembly, pulling electronics firms into the shoulder-fired weapons market while anchoring supply chains close to end-users.

Stringent ITAR and MTCR Export Controls Limiting Market Access

The US Munitions List and the Missile Technology Control Regime restrict the transfer of shoulder-launched missiles and seeker electronics. Exporters must secure end-user certificates, delay lead times, and raise compliance costs. Buyers not aligned with NATO often shift toward suppliers in China or opt for simpler recoilless rifles, shaving 0.7 percentage points from baseline growth in the shoulder-fired weapons market.

Other drivers and restraints analyzed in the detailed report include:

- Geopolitical Conflicts Triggering Rapid Replenishment of Depleted Shoulder-Launched Inventories

- Rising Need for Cost-Effective MANPADS in Global Counter-UAV Missions

- Rising Anti-Armor Drone Swarms Reducing Demand for Short-Range ATGMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Guided solutions generated USD 7.19 billion in revenue during 2025, representing 69.45% of the shoulder-fired weapons market. Integration of compact imaging seekers and inertial navigation chips, once exclusive to larger missiles, allows infantry to defeat moving armor from outside return-fire range. The shoulder-fired weapons market size for unguided systems will grow at a 7.89% CAGR trajectory. South Korea's Raybolt block upgrade blends a fiber-optic data-link with a motor capable of 5 km standoffs, showing how indigenous R&D narrows technology gaps. Unguided rockets still appeal where cost trumps accuracy. Yet, their share shrinks yearly because new soft-launch designs and programmable fuzes make guided rounds safer in tight urban alleys and better against reactive armor.

Rising adoption of soldier-worn thermal sights has further tilted procurement toward guided profiles. Cloud-based training aides now shorten operator qualification to days, not months, enabling conscripts to fire advanced missiles effectively during their first deployment cycles. The switchover accelerates as production volumes rise and unit prices fall. Overall, competitive differentiation moves from propulsion hardware to software-defined seekers, supplying fertile ground for smaller electro-optics firms to enter the shoulder-fired weapons market.

Anti-tank guided missile launchers represented 35.51% of the shoulder-fired weapons market share. Their sustained appeal stems from proven lethality against armored columns, as in Ukraine. The category receives continuous block upgrades: Javelin's lightweight CLU and warhead refresh land in US formations by 2025, breakingdefense.com. Though smaller in 2025, MANPADS will post the highest segment CAGR of 8.72%, buoyed by drone threats and the need for cost-effective dome defenses around forward bases. Estonia's large Piorun framework deal underlines European appetite for modern shoulder-fired air-defense tools.

Recoilless rifles enjoy renewed interest because new rounds give them anti-structure punch without breaching treaties. The US Army's USD 16 million Carl-Gustaf M4 order validates this trend. RPGs and SLAW categories maintain relevance in budget-constrained forces but lose relative growth to smarter systems. The shoulder-fired weapons market, therefore, tilts toward multi-mission payloads, modular launch tubes, and electronic fuze programming within a single family of launchers.

The Shoulder-Fired Weapons Market Report is Segmented by Technology (Guided and Unguided), Weapon Type (Recoilless Rifles, and More), Range (Short, Medium, and Long), Projectile (Launcher/Tube, Projectile/Missile, and Fire-Control and Sighting Systems), End-User (Army, Navy, Air Force, Special Operations Forces, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated USD 2.70 billion, equal to 32.47% of 2025 global revenue, and remains the largest regional slice of the shoulder-fired weapons market. Territorial disputes in the South China Sea and the Himalayan frontier push governments to equip infantry with credible anti-armor deterrents. Japan's 2025 Carl-Gustaf order modernizes an inventory fielded over four decades ago. The Philippines seeks Javelins while integrating BrahMos shore-based missiles to discourage gray-zone incursions. India's MPATGM test flights, featuring day/night imaging and top-attack profiles, signal a maturing domestic supply chain. These events suggest a durable requirement for portable precision weapons and sustain a pipeline of regional co-production deals.

North America maintains a strong but evolving demand. After large transfers to Ukraine, the United States must restore Javelin, Stinger, and tube-launched systems to mandated readiness levels, underpinning multi-year contracts with Lockheed Martin, RTX, and Northrop Grumman. A new Javelin lightweight launcher enters service in 2025, improving cold-weather reliability for Arctic units. Canada plans to augment its Carl-Gustaf holdings to align with NATO munition interchangeability goals. Consequently, the shoulder-fired weapons market in North America benefits from both replenishment and modernization.

Europe's market complexion shifted the most after February 2024. NATO states emptied inventories early in the conflict, then issued urgent operational requirements. Saab reacted by scaling NLAW output; Rheinmetall partnered with MBDA to develop laser counter-drone pods, hinting at a layered defense ecosystem. The UK's replacement program for Javelin seeks a next-generation round to bypass tank active-protection systems. Poland procured additional Javelins and pursues its home-grown Pirat ATGM to hedge supply risk. Europe, therefore, acts as both a volume buyer and a technology incubator.

The Middle East and Africa shoulder-fired weapons market will rise at a 9.61% CAGR to 2030. Israel's USD 5.2 billion umbrella contract for Iron Dome, David's Sling, and Iron Beam underscores regional willingness to invest in layered air defense. Turkey's Roketsan demonstrated the Karaok missile's 50 m "dive" kill profile, proving domestic innovation capacity and supporting export pitches to Gulf clients. African demand is varied: while established suppliers face export-control delays, Chinese firms establish showrooms in West Africa, bundling armored vehicles with QN-202 launchers. These dynamics suggest sustained growth on the southern arc.

Latin America represents a smaller opportunity but shows episodic spikes, driven by border tensions and anti-crime operations. Chile evaluated Spike SR rounds for mountain infantry, while Brazil's army complements its Astros II MLRS with Alacran disposable anti-structure launchers. Budget headwinds temper large acquisitions, yet fleet rationalization plans could convert stockpiled legacy RPGs to newer recoilless rifles.

- Saab AB

- Lockheed Martin Corporation

- RTX Corporation

- MBDA

- BAE Systems plc

- General Dynamics Corporation

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- Roketsan A.S.

- Bharat Dynamics Ltd.

- AirTronic USA LLC

- Northrop Grumman Corporation

- Kongsberg Gruppen ASA

- China North Industries Group Corp. Ltd. (NORINCO)

- Israel Aerospace Industries Ltd.

- Nexter KNDS Group

- Denel SOC Ltd.

- Nammo AS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Intensifying asymmetric warfare demand for portable anti-armor solutions

- 4.2.2 Accelerated defense modernization amid territorial disputes

- 4.2.3 Geopolitical conflicts prompting rapid inventory replenishment

- 4.2.4 Rising need for cost-effective MANPADS for counter-UAV missions

- 4.2.5 Global expansion of special forces requiring lightweight multi-role launchers

- 4.2.6 Industrial localization policies leading to indigenous launcher production

- 4.3 Market Restraints

- 4.3.1 Stringent ITAR and MTCR export controls limiting market access

- 4.3.2 Rising anti-armor drone swarms reducing demand for short-range ATGMs

- 4.3.3 High back-blast and collateral risk curbing urban RPG deployment

- 4.3.4 Budget shifts to precision-guided munitions reducing unguided launcher buys

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Guided

- 5.1.2 Unguided

- 5.2 By Weapon Type

- 5.2.1 Man-Portable Air Defense Systems (MANPADS)

- 5.2.2 Rocket-Propelled Grenade Launchers (RPGs)

- 5.2.3 Anti-Tank Guided Missile (ATGM) Launchers

- 5.2.4 Recoilless Rifles

- 5.2.5 Shoulder-Launched Assault Weapons (SLAW)

- 5.3 By Range

- 5.3.1 Short ( Less than 500 m)

- 5.3.2 Medium (500 - 2 km)

- 5.3.3 Long (Greater than 2 km)

- 5.4 By Projectile

- 5.4.1 Launcher/Tube

- 5.4.2 Projectile/Missile

- 5.4.3 Fire-Control and Sighting Systems

- 5.5 By End-User

- 5.5.1 Army

- 5.5.2 Navy

- 5.5.3 Air Force

- 5.5.4 Special Operations Forces

- 5.5.5 Homeland Security and Law Enforcement

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 Russia

- 5.6.3.4 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Saab AB

- 6.4.2 Lockheed Martin Corporation

- 6.4.3 RTX Corporation

- 6.4.4 MBDA

- 6.4.5 BAE Systems plc

- 6.4.6 General Dynamics Corporation

- 6.4.7 Rafael Advanced Defense Systems Ltd.

- 6.4.8 Rheinmetall AG

- 6.4.9 Roketsan A.S.

- 6.4.10 Bharat Dynamics Ltd.

- 6.4.11 AirTronic USA LLC

- 6.4.12 Northrop Grumman Corporation

- 6.4.13 Kongsberg Gruppen ASA

- 6.4.14 China North Industries Group Corp. Ltd. (NORINCO)

- 6.4.15 Israel Aerospace Industries Ltd.

- 6.4.16 Nexter KNDS Group

- 6.4.17 Denel SOC Ltd.

- 6.4.18 Nammo AS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment