PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842459

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842459

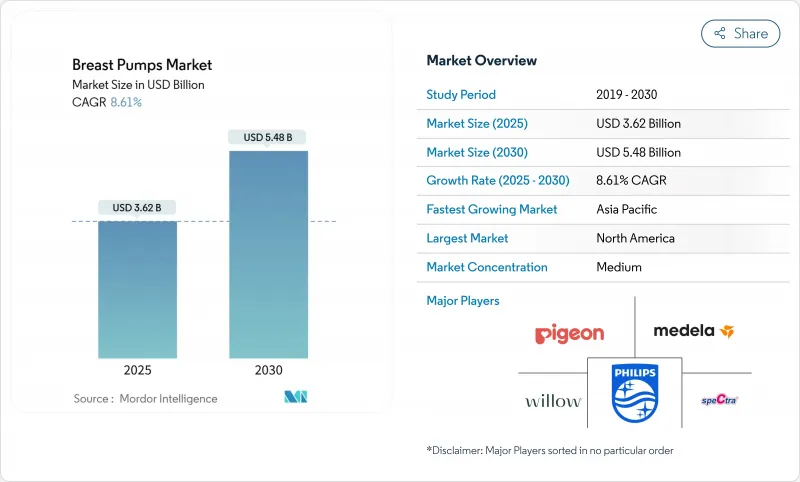

Breast Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The breast pumps market stands at USD 3.62 billion in 2025 and is projected to reach USD 5.48 billion by 2030, advancing at an 8.61% CAGR.

Across every major region, three structural forces-workplace lactation mandates, hands-free wearable innovation, and direct-to-consumer e-commerce-are expanding access to modern pumping solutions. Employers covered by the Pregnant Workers Fairness Act must now provide reasonable lactation accommodations, so corporate demand for closed-system electric models keeps building. Meanwhile, AI-enabled, app-linked pumps transform home routines and encourage premium upgrades. On-line sales channels simplify insurance reimbursement, lower mark-ups, and shorten delivery times, all of which enlarge the overall addressable base. At the same time, governments from Washington to Seoul continue earmarking maternal-health funds, which fosters R&D activity and accelerates regulatory clearances.

Global Breast Pumps Market Trends and Insights

Growing Global Female-Workforce Participation

Rising labor-force participation keeps expanding the breast pumps market because working mothers need efficient pumping tools during office hours. A 2024 cross-sectional study found exclusive-breastfeeding rates of 20.36% in U.S. states with paid family-leave laws versus 18.48% in states without such support. These differences translate directly into demand for portable, hospital-strength devices that help women meet lactation goals while maintaining careers. Consumer-goods leaders such as Nestle have added maternal-nutrition SKUs in India and Southeast Asia, signaling private-sector confidence in sustained growth. As more women enter office, retail, and manufacturing jobs, the need for reliable, closed-system electric pumps rises steadily.

Expansion of Maternity-Leave & Lactation-Room Mandates

Regulators on both sides of the Atlantic boosted demand by stipulating access to lactation spaces and equipment. The Pregnant Workers Fairness Act obliges U.S. employers to supply reasonable accommodations for pumping activities. European directives push similar reforms, and corporate compliance is driving bulk procurement of multi-user hospital-grade pumps. Turn-key pod providers such as Mamava report a broad uptick in workplace installations, underlining how policy creates predictable demand. Longer paid-leave durations also stretch the overall pumping period, reinforcing replacement purchases and accessory sales.

High Upfront Device Cost vs. Manual Expression

Premium wearable units can exceed USD 400, which restricts uptake among price-sensitive shoppers. Insurance typically covers only basic electric models, so advanced app-linked features often still require out-of-pocket spending. While cost-of-ownership studies favor electric pumps on time savings, many families in low- and middle-income economies still view manual expression as more economical despite higher physical strain.

Other drivers and restraints analyzed in the detailed report include:

- Rapid E-Commerce Penetration for Mother-and-Baby Products

- Accelerating Adoption of Hands-Free Wearable Pumps

- Supply-Chain Exposure to Medical-Grade Plastics Price Swings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Closed-system pumps commanded 69.84% of revenue in 2024, and their CAGR out to 2030 is pegged at 10.23%. Contamination-prevention backflow barriers satisfy strict NICU protocols, which amplifies institutional orders. The Medela Symphony PLUS, designed for multi-user hospital programs, epitomizes this safety-first trend. Open-system pumps still appeal to budget-focused families because of lower acquisition prices, yet their share keeps sliding as insurers upgrade reimbursement schedules to include closed architectures.

In consumer environments, parents increasingly select closed-system kits even for occasional use because they want hospital-grade hygiene at home. Greater awareness of infection-control guidelines, broadcast through pediatric-society advisories, reinforces that preference. Manufacturers now emphasize easy-to-sterilize components and spill-proof diaphragms in marketing copy, which further strengthens closed-system adoption.

Electric designs held 61.23% of global revenue during 2024. They promise hospital-strength suction, programmable cycles, and superior milk output. The electric segment's 9.86% CAGR reflects continual motor-efficiency improvements and widening battery-life ranges. Manual pumps retain appeal for travel and silent operation but face gradual displacement as electric price points fall.

Battery-powered units bridge the gap between wall-plug performance and wearable freedom. New entrants are merging brushless DC motors with compact lithium-polymer cells, trimming weight without reducing suction. Smart-sensor feedback loops provide real-time pressure adjustments, and companion apps log output in graphical dashboards. These upgrades position electric formats as the default choice for both first-time and experienced users.

The Breast Pumps Market Report is Segmented by Product (Open System Breast Pump and Closed System Breast Pump), Technology (Manual Breast Pump, Battery Powered Breast Pump, and Electric Breast Pump), Application (Personal/ Home Use and Hospital Grade), Distribution Channel (Offline/ Retail and Online) and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 35.43% of global revenue in 2024, propelled by insurance reimbursement, strict employer accommodations, and high per-capita disposable income. The breast pumps market size in the region is forecast to reach nearly USD 1.9 billion by 2030. Federal funding has also spurred R&D around AI-enabled lactation monitoring, which feeds premium adoption rates.

Europe ranks second thanks to generous maternity-leave statutes and a culture that values breast-feeding. Competitive intensity is rising after Willow acquired Elvie's assets, consolidating wearable intellectual property under a U.S. brand umbrella. Sellers who emphasize data security and CE-mark compliance hold an edge with regulatory bodies.

Asia-Pacific stands out with a 10.12% CAGR and is on track to narrow the gap with mature Western markets. South Korea's KRW 10 trillion healthcare overhaul reserved funds for maternal-care devices, and India's swelling female-workforce base underpins steady urban demand. Multinationals like Nestle invest aggressively in regional product localization, including pumps engineered for smaller body frames and local voltage standards.

Latin America and the Middle East & Africa are earlier in the adoption curve yet exhibit strong e-commerce growth. Local distributors often bundle pumps with prenatal vitamin kits to overcome lower brand recognition. Incentive programs run by health ministries in Brazil and the Gulf Cooperation Council frame breast-feeding as a national health priority, indirectly stimulating pump purchases.

- Medela

- Koninklijke Philips

- Pigeon Corp. (Lansinoh)

- Ameda

- Ardo Medical

- Willow Innovations Inc.

- Elvie (Chiaro Technology)

- Spectra Baby (UDerma Korea)

- Evenflo Feeding Inc.

- Mayborn Group (Tommee Tippee)

- Freemie (Ingamed)

- Cimilre

- Haakaa

- Motif Medical

- Dr Brown's (Handi-Craft)

- Hygeia Health

- Unimom

- BabyBuddha

- Linco Baby Merchandise Works

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Global Female-Workforce Participation

- 4.2.2 Expansion Of Maternity-Leave & Lactation-Room Mandates

- 4.2.3 Rapid E-Commerce Penetration For Mother-&-Baby Products

- 4.2.4 Accelerating Adoption Of Hands-Free Wearable Pumps

- 4.2.5 ESG-Led Shift Toward BPA-Free & Silicone Pumping Kits

- 4.2.6 AI-Enabled Lactation-Tracking Ecosystems

- 4.3 Market Restraints

- 4.3.1 High Upfront Device Cost Vs. Manual Expression

- 4.3.2 Supply-Chain Exposure To Medical-Grade Plastics Price Swings

- 4.3.3 Counterfeit Accessories On Online Marketplaces

- 4.3.4 Data-Privacy Concerns Around Connected Smart Pumps

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Open-System Breast Pump

- 5.1.2 Closed-System Breast Pump

- 5.2 By Technology

- 5.2.1 Manual Breast Pump

- 5.2.2 Battery-Powered Breast Pump

- 5.2.3 Electric Breast Pump

- 5.3 By Application

- 5.3.1 Personal/Home-use

- 5.3.2 Hospital Grade

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail (Pharmacies, Baby-Stores)

- 5.4.2 Online/E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Medela AG

- 6.3.2 Koninklijke Philips NV

- 6.3.3 Pigeon Corp. (Lansinoh)

- 6.3.4 Ameda AG

- 6.3.5 Ardo Medical AG

- 6.3.6 Willow Innovations Inc.

- 6.3.7 Elvie (Chiaro Technology)

- 6.3.8 Spectra Baby (UDerma Korea)

- 6.3.9 Evenflo Feeding Inc.

- 6.3.10 Mayborn Group (Tommee Tippee)

- 6.3.11 Freemie (Ingamed)

- 6.3.12 Cimilre

- 6.3.13 Haakaa

- 6.3.14 Motif Medical

- 6.3.15 Dr Brown's (Handi-Craft)

- 6.3.16 Hygeia Health

- 6.3.17 Unimom

- 6.3.18 BabyBuddha

- 6.3.19 Linco Baby Merchandise Works

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment