PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842461

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842461

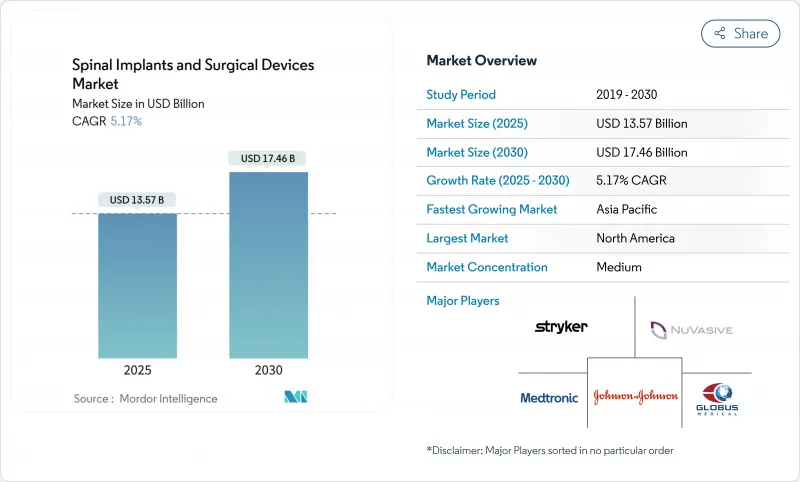

Spinal Implants And Surgical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The spinal implants and surgical devices market reached USD 13.57 billion in 2025 and is projected to reach USD 17.46 billion by 2030, reflecting a 5.17% CAGR.

Demand expands as aging populations, sedentary lifestyles, and rising traumatic injuries converge with rapid technology adoption in AI-guided robotics, navigation, and 3D-printed biomaterials. Spinal fusion systems still anchor revenue, yet motion-preserving technologies and minimally invasive techniques gain momentum because they reduce adjacent-segment disease, shorten hospital stays, and support outpatient care models. Geographical momentum shifts toward Asia-Pacific as procedure volumes soar in China and Japan, while North America continues to set the pace on reimbursement reforms and breakthrough device clearances. Competitive dynamics pivot around integrated surgical ecosystems that blend implants, imaging, robotics, and digital health, even as capital costs and regulatory paths temper the speed of diffusion.

Global Spinal Implants And Surgical Devices Market Trends and Insights

High Burden of Spinal Disorders and Aging Population

Global life expectancy gains create a sustained rise in degenerative spine conditions, compression fractures, and trauma-related injuries. Epidemiological studies project an 80% increase in spine surgery volume by 2060, with vertebral compression fractures already showing 48.9% vertebral-height deterioration despite percutaneous treatments. Annual U.S. spinal cord injury incidence stands at 17,000 cases, and first-year costs for high tetraplegia surpass USD 1 million, reinforcing the imperative for preventive and reconstructive solutions. These clinical and economic factors lift procedure counts, broaden indications, and keep reimbursement authorities focused on cost-effective innovations.

Rapid Uptake of Minimally Invasive Procedures for Spine

Endoscopic and tubular techniques combine exoscope visualization, fluoroscopy, and navigation to lower blood loss, reduce postoperative pain, and facilitate same-day discharge. A transforaminal approach for lumbar discectomy, for example, shows lower complication rates than open microdiscectomy. Outpatient lumbar fusion delivers safety comparable to inpatient settings with fewer medical complications, enabling payer endorsement of bundled payments. These clinical outcomes accelerate the shift toward dedicated spine ambulatory centers and push vendors to refine navigation software for constrained anatomical corridors.

High Implant & Navigation Capital Costs

Acquiring a top-tier robotic or navigation suite surpasses USD 1 million, and 77% of surveyed surgeons cite price as the primary barrier. Procedure-level economics also bite: lumbar disc replacement ranges USD 20,000-70,000, and spinal cord stimulation can hit USD 50,000 before add-ons. Annual service contracts, staff training, and OR redesign raise total cost of ownership, delaying procurement decisions in ambulatory centers and emerging nations.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancement in Spinal Implants and Surgical Devices

- Growing Demand for Outpatient and Ambulatory Spine Surgeries

- Stringent Multi-Jurisdiction Regulatory Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spinal fusion and fixation technologies commanded 54.34% of spinal implants and surgical devices market revenue in 2024. The spinal implants and surgical devices market size for motion-preservation systems is forecast to advance at an 8.86% CAGR, reflecting surgeon interest in preserving segmental biomechanics. Evidence shows artificial cervical discs reduce adjacent-segment degeneration versus fusion, while dynamic stabilization mitigates postoperative stiffness. The field also witnesses hybrid constructs that blend disc arthroplasty at one level and fusion at another, matching patient pathology. Smaller footprints, modular plating, and porous coatings underscore design improvements in contemporary cages. Meanwhile, automation through computer-planned screw trajectories raises fusion accuracy, reinforcing its present dominance.

Patient preferences fuel the transition as long-term quality-of-life studies favor motion preservation for select indications. Mobi-C, with more than 225,000 implants, demonstrates non-inferiority for two-level disease compared with standard ACDF ZimVie Cervical. In the lumbar arena, Prodisc L shows sub-1% reoperation after 25 years, validating durability. These data prompt insurers to revisit coverage exclusions, potentially speeding adoption in the spinal implants and surgical devices market.

Thoracic and lumbar fusion devices provided 40.66% of spinal implants and surgical devices market share in 2024, yet non-fusion counterparts grow at an 8.69% CAGR. Interbody cages headline revenue thanks to additive manufacturing that tailors porosity and endplate fit. The spinal implants and surgical devices market size for interbody cages is projected to rise as PEEK-titanium hybrids address radiolucency while maintaining surface roughness for bone adhesion. Bone graft substitutes combining rhBMP-2 and demineralized matrix inflate fusion probability.

Additive manufacturing unlocks biomimetic lattices; Stryker's Tritanium TL cage uses AMagine to mirror cancellous bone architecture Stryker. Medtronic's Adaptix system integrates Titan nanoLOCK nanotopography to achieve higher pull-out strength. Spine stimulators complement these hardware gains by boosting osteogenesis, posting fusion rates of 86.8% versus 73.7% for controls in meta-analysis.

The Spinal Implants & Surgical Devices Market Report is Segmented by Technology (Spinal Fusion and Fixation, Vertebral Compression Fracture Treatment, and More), Product (Cervical Fusion Devices and More), by Type of Surgery (Open Surgery, and Minimally-Invasive Surgery), Biomaterial (Titanium & Titanium-Alloy, and More), End User (Hospitals, Ascs and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the spinal implants and surgical devices market with 44.33% revenue share in 2024. Robust reimbursement frameworks, early adoption of navigation, and a high concentration of fellowship-trained surgeons sustain leadership. Medicare's incremental inclusion of outpatient spine procedures and FDA breakthrough device designations shorten the technology-to-patient timeline. Academic-industry partnerships, typified by Medtronic's imaging pact with Siemens Healthineers, integrate platforms and set service benchmarks.

Asia-Pacific posts the highest 8.35% CAGR as demographics and incomes change procedure mix. China logged a 12.32% annual rise in surgeries, with winter and spring peaks reflecting elective scheduling habits. Japan's nationwide JSIS-DB registry, now at 5,400 cases, enables outcome-based reimbursement and informs device design. Yet disparities persist: rural Indonesia and Philippines lack navigation infrastructure, requiring vendor outreach and training grants.

Europe remains steady, balancing fiscal prudence with evidence-based adoption. CE agencies demand long follow-up, thus elongating go-to-market timetables. Still, Germany and France accelerate outpatient volumes as payers endorse DRG realignments. Latin America and Middle East & Africa contribute single-digit revenue today but represent white-space growth: fluoroscopy is used in 96.5% of African cases, offering a springboard for low-cost navigation solutions accompanied by NGO-backed surgeon training.

- Medtronic

- Johnson & Johnson

- Stryker

- NuVasive

- Globus Medical

- ZimVie

- Orthofix

- RTI Surgical

- ATEC Spine

- Spineart

- B. Braun (Aesculap)

- Aurora Spine

- Centinel Spine

- SeaSpine (Orthofix)

- Xtant Medical

- K2M Group (Stryker)

- Spinal Elements

- SI-BONE

- Osseus

- Paradigm Spine

- Premia Spine

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden Of Spinal Disorders And Aging Population

- 4.2.2 Rapid Uptake Of Minimally Invasive Procedures For Spine

- 4.2.3 Technological Advancement In Spinal Implants And Surgical Devices

- 4.2.4 Growing Demand For Outpatient And Ambulatory Spine Surgeries

- 4.2.5 AI-Guided Robotic Screw Placement Improving Outcomes

- 4.2.6 Growing Focus And Demand For Customizable 3d Implants

- 4.3 Market Restraints

- 4.3.1 High Implant & Navigation Capital Costs

- 4.3.2 Stringent Multi-Jurisdiction Regulatory Approvals

- 4.3.3 Shortage Of Skilled Spine Surgeons

- 4.3.4 Risk Of Surgical Complications And Implant Failure

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Technology

- 5.1.1 Spinal Fusion & Fixation

- 5.1.2 Vertebral Compression Fracture Treatment

- 5.1.3 Motion Preservation / Non-fusion

- 5.1.4 Spinal Decompression

- 5.2 By Product

- 5.2.1 Thoracic & Lumbar Fusion Devices

- 5.2.2 Cervical Fusion Devices

- 5.2.3 Interbody Fusion Cages

- 5.2.4 Spine Biologics

- 5.2.5 Non-fusion Devices

- 5.2.6 Vertebral Compression Fracture Treatment Devices

- 5.2.7 Spine Bone Stimulators

- 5.3 By Type of Surgery

- 5.3.1 Open Surgery

- 5.3.2 Minimally-invasive Surgery

- 5.4 By Biomaterial

- 5.4.1 Titanium & Titanium-Alloy

- 5.4.2 PEEK & Carbon-PEEK

- 5.4.3 Bio-resorbable Polymers

- 5.4.4 Porous 3-D Printed Metals

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Specialty Orthopedic Clinics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Johnson & Johnson

- 6.3.3 Stryker Corporation

- 6.3.4 NuVasive Inc.

- 6.3.5 Globus Medical Inc.

- 6.3.6 ZimVie Inc

- 6.3.7 Orthofix Holdings Inc.

- 6.3.8 RTI Surgical Inc.

- 6.3.9 Alphatec Spine Inc.

- 6.3.10 Spineart SA

- 6.3.11 B. Braun (Aesculap)

- 6.3.12 Aurora Spine

- 6.3.13 Centinel Spine

- 6.3.14 SeaSpine (Orthofix)

- 6.3.15 Xtant Medical

- 6.3.16 K2M Group (Stryker)

- 6.3.17 Spinal Elements

- 6.3.18 SI-BONE

- 6.3.19 Osseus

- 6.3.20 Paradigm Spine

- 6.3.21 Premia Spine

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment