PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842463

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842463

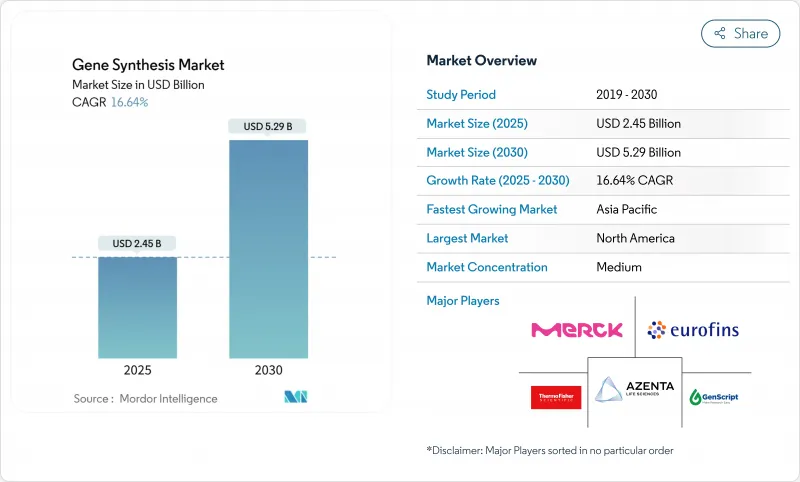

Gene Synthesis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The gene synthesis market size stands at USD 2.45 billion in 2025 and is forecast to reach USD 5.29 billion by 2030, advancing at a 16.64% CAGR.

This rapid expansion reflects sustained breakthroughs in enzymatic oligonucleotide production, larger research budgets for precision genomics, and surging demand from biopharmaceutical companies seeking faster design-build-test cycles . Growing regulatory clarity also supports the gene synthesis market, with the Biden administration's Executive Order on AI and biotechnology outlining new federal screening rules that create common operating standards for providers. Manufacturing capacity is playing catch-up because oligonucleotide demand is rising 30% each year even as synthesis productivity improves more slowly than sequencing throughput. In parallel, 10 gene therapies gained FDA approval in 2024-twice the prior year's figure-showing how regulatory momentum accelerates commercial orders for long, high-fidelity constructs.

Global Gene Synthesis Market Trends and Insights

Surging Genomics & NGS-Driven R&D Pipelines

More than 900 active clinical trials in North America now incorporate synthetic DNA constructs, underscoring how next-generation sequencing pushes laboratories toward higher-throughput build capabilities. CEPI has committed USD 4.7 million to automate DNA Script's template production so vaccine developers can move from design to bench in days rather than weeks . Academic progress supports the driver: University of Hawaii researchers achieved 96% editing success when using high-fidelity templates, demonstrating direct links between synthesis quality and therapeutic efficacy . NHGRI's USD 2.2 million grant for multiplex oligo synthesis further embeds synthetic DNA as critical research infrastructure. Together, these elements enlarge sample backlogs and create premium opportunities for providers able to guarantee error-free sequences on demand.

Expanding Biopharma Demand for Synthetic Genes

Biopharmaceutical pipelines now depend on custom genes for cell therapies, mRNA vaccines, and antibody-drug conjugates. The FDA cleared five gene therapies in 2024, including the first CRISPR-edited treatment, and each approval validates commercial need for precise, viral-vector-ready inserts. GSK invested USD 35 million in Elegen to secure linear DNA that fits its mRNA vaccine portfolio. Clinically, Casgevy prevented severe vaso-occlusive crises in 93.5% of treated sickle-cell patients, proving that accurate template design translates into therapeutic success. Investor sentiment mirrors demand; Constructive Bio attracted USD 58 million in Series A funding as synthetic genomics promises to ease global peptide shortages. These developments shorten development timelines and intensify competition for trustworthy synthesis partners.

Scarcity of Skilled Synthetic-Biology Workforce

Synthetic biology blends molecular biology, engineering, and computation, yet most academic curricula still emphasize traditional wet-lab skills. NHGRI earmarked USD 5.25 million to boost workforce diversity, signalling institutional recognition of the shortage. European biotechnology contributes EUR 31 billion to GDP but already suffers talent bottlenecks that curtail start-up scaling. Japan's venture funding remains low relative to the United States, partly because of limited entrepreneurial depth. Continuous retraining is essential because enzymatic platforms require new skill sets compared with phosphorus-based chemistry. Without enough qualified staff, production lines risk under-utilization, slowing revenue accrual for the gene synthesis market.

Other drivers and restraints analyzed in the detailed report include:

- Government Genomics-Funding Initiatives

- Rapid Drop in DNA-Synthesis Cost & Turnaround

- High Capital Cost for Large-Scale Synthesis Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chemical oligonucleotide synthesis retained 55.45% gene synthesis market share in 2024 thanks to decades of process optimization and reliable supply chains. Solid-phase phosphoramidite reactions remain standard for short strands, and microchip-based approaches improve batch throughput. Yet the gene synthesis market is pivoting as assembly technologies post a 17.21% CAGR through 2030, propelled by the need for longer constructs in CRISPR and viral vectors.

Enzymatic platforms such as DNA Script's SYNTAX produce up to 96 oligos within hours, offering laboratories instant access without toxic solvents. Molecular Assemblies' fully enzymatic flow technology further reduces error rates while extending read length, positioning it to steal share from incumbent methods. Hybrid strategies that combine chemical speed for short primers with enzymatic assembly for long genes are emerging, ensuring the gene synthesis market continues to diversify rather than converge on a single technique.

Antibody DNA synthesis contributed 48.28% of the gene synthesis market size in 2024 because of rising antibody-drug conjugate pipelines and CAR-T cell interest. Viral gene synthesis is set for a 17.34% CAGR as mRNA platforms and viral vectors dominate vaccine and gene-therapy arenas.

CEPI funding of automated template production confirmed strategic urgency to shorten vaccine R&D cycles. Johnson & Johnson's collaboration with GenScript on approved CAR-T therapies exemplifies how proprietary antibody sequences generate recurring orders. Service providers capable of bundling sequence design, enzymatic synthesis, and AI-based optimization stand to capture premium contracts, expanding overall revenue for the gene synthesis market.

The Gene Synthesis Market is Segmented by Synthesis Method (Chemical Oligonucleotide Synthesis and Gene Assembly[PCR-Mediated and Ligation-Mediated), Service Type (Antibody DNA Synthesis and More), Application (Gene and Cell Therapy Developments and More), End User (Biopharmaceutical Companies and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.31% of the gene synthesis market size in 2024 because of strong venture capital flows, mature biopharmaceutical clusters, and supportive regulation. The NHGRI's USD 1.5 million annual commitment to platform technologies fosters public-private partnerships, while the FDA's coordinated gene-therapy review pathway removes regulatory uncertainty. Private firms mirror policy confidence; Thermo Fisher is spending USD 2 billion on domestic capacity expansions through 2028.

Asia-Pacific is projected to log a 17.61% CAGR through 2030 and is the fastest-growing region in the gene synthesis market. China classifies biotechnology as a strategic pillar and channels generous subsidies into synthetic genetics ventures. India's BioE3 policy prioritizes precision biotherapeutics and positions local biofoundries to serve global clients. Japan plans to double private drug-discovery investment by 2028, with induced pluripotent stem-cell projects demanding long synthetic sequences. South Korea's cell-therapy initiatives further reinforce regional momentum.

Europe remains a steady growth contributor as coordinated policy frameworks such as the EU Bioeconomy Strategy back industrial biotechnology. SYNBEE grants help startups combine AI and DNA design, while the continent's pharmaceutical giants deliver consistent order volumes. Middle East and Africa along with South America are early in adoption cycles, yet rising healthcare spending and agricultural biotech needs are widening the addressable base for the gene synthesis market.

- ATUM

- Bio Basic

- Beijing SBS Genetech Co.

- Eurofins

- Azenta Life Sciences (Genewiz)

- GenScript Biotech

- Merck KGaA (Sigma GeneArts)

- OriGene Technologies

- Thermo Fisher Scientific (GeneArt)

- Integrated DNA Technologies

- Twist Bioscience

- DNA Script

- Ansa Biotechnologies

- Evonetix

- Telesis Bio

- Synbio Technologies

- Bioneer

- ProteoGenix

- Bio-Synthesis

- ATLATL Innovations

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging genomics & NGS-driven R&D pipelines

- 4.2.2 Expanding biopharma demand for synthetic genes

- 4.2.3 Government genomics-funding initiatives

- 4.2.4 Rapid drop in DNA-synthesis cost & turnaround

- 4.2.5 Emerging enzymatic DNA-synthesis platforms

- 4.2.6 Venture-capital rush into bio-foundries & cloud labs

- 4.3 Market Restraints

- 4.3.1 Scarcity of skilled synthetic-biology workforce

- 4.3.2 High capital cost for large-scale synthesis capacity

- 4.3.3 IP-ownership uncertainty for de-novo constructs

- 4.3.4 Biosecurity & dual-use regulatory scrutiny

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Synthesis Method

- 5.1.1 Chemical Oligonucleotide Synthesis

- 5.1.1.1 Solid-Phase Phosphoramidite

- 5.1.1.2 Microchip-based Oligonucleotide Synthesis

- 5.1.2 Gene Assembly

- 5.1.2.1 PCR-mediated

- 5.1.2.2 Ligation-mediated

- 5.1.1 Chemical Oligonucleotide Synthesis

- 5.2 By Service Type

- 5.2.1 Antibody DNA Synthesis

- 5.2.2 Viral Gene Synthesis

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Gene and Cell Therapy Developments

- 5.3.2 Vaccine Development

- 5.3.3 Disease Diagnosis

- 5.3.4 Others

- 5.4 By End User

- 5.4.1 Biopharmaceutical Companies

- 5.4.2 Academic & Government Institutes

- 5.4.3 CROs and CDMOs

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 ATUM (DNA2.0 Inc.)

- 6.3.2 Bio Basic Inc.

- 6.3.3 Beijing SBS Genetech Co.

- 6.3.4 Eurofins Genomics

- 6.3.5 Azenta Life Sciences (Genewiz)

- 6.3.6 GenScript Biotech

- 6.3.7 Merck KGaA (Sigma GeneArts)

- 6.3.8 OriGene Technologies

- 6.3.9 Thermo Fisher Scientific (GeneArt)

- 6.3.10 Integrated DNA Technologies

- 6.3.11 Twist Bioscience

- 6.3.12 DNA Script

- 6.3.13 Ansa Biotechnologies

- 6.3.14 Evonetix

- 6.3.15 Telesis Bio

- 6.3.16 Synbio Technologies

- 6.3.17 Bioneer

- 6.3.18 ProteoGenix

- 6.3.19 Bio-Synthesis Inc.

- 6.3.20 ATLATL Innovations

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment