PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842465

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842465

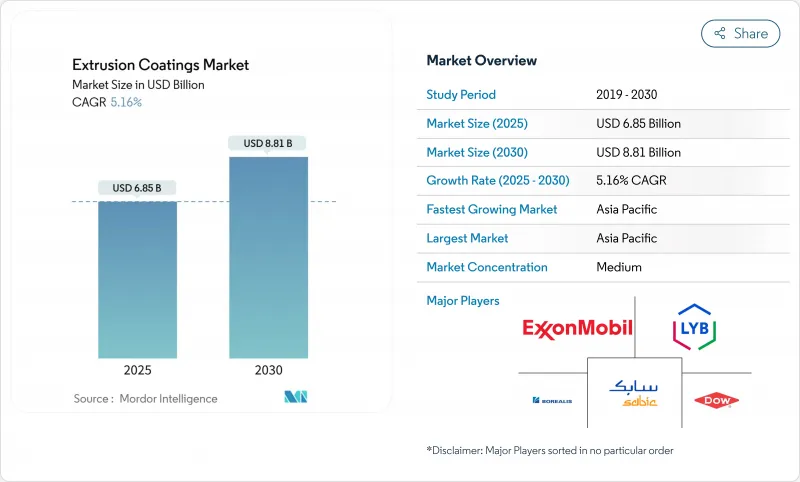

Extrusion Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The extrusion coatings market stands at USD 6.85 billion in 2025 and is projected to reach USD 8.81 billion by 2030, registering a 5.16% CAGR over the forecast period.

Rapid uptake of barrier-enhanced polymers in liquid food formats, e-commerce mailers, and sterile pharmaceutical packs anchors the current demand base. Regulatory tailwinds-from the European Union's Packaging and Packaging Waste Regulation to national recycled-content mandates-are accelerating shifts toward mono-material structures, while steady urbanization in Asia-Pacific expands end-market volumes. Volatility in polyolefin feedstock pricing and the sector's carbon footprint remain headwinds, yet sustained investments in bio-based resins and advanced mechanical recycling temper these risks. Market leaders are countering cost pressure through vertical integration, long-term supply contracts, and pilot lines that validate recyclable coating architectures at commercial scale.

Global Extrusion Coatings Market Trends and Insights

Growing Demand for Liquid & Flexible Food Packaging

Liquid food cartons and lightweight pouches capture 48.95% of the extrusion coatings market in 2024, a share reinforced by limited cold-chain infrastructure in emerging economies and brand owner preference for shelf-stable formats. New biomass-derived LDPE and EVA grades launched in 2024 match incumbent barrier performance yet cut fossil feedstock by 20%. Packaging converters are leveraging these resins to downgauge laminate thickness and reduce logistics weight without sacrificing heat-seal integrity. Combined with plant-based dairy alternatives gaining shelf space, the outlook affirms steady volume gains across Asia and Latin America.

Surge in E-commerce Protective Packaging Volumes

Fulfilment centers require coating layers that withstand automated forming, high-speed sealing and last-mile handling. Metallocene-catalyzed PE delivers the clarity, slip, and puncture resistance needed for this workflow, prompting brand owners to specify films with 30-50% recycled content that still meet ASTM shipping drop tests. Although the sector lacks definitive global volume data, converter order books reveal double-digit growth since 2023, confirming e-commerce as a resilient demand pillar for extrusion coatings market participants.

High Polyolefin Feedstock Price Volatility

Average PE contract prices in China swung by more than USD 120/ton between Q1 and Q4 2024, compressing converter margins and triggering procurement shifts toward spot purchases. Integrated producers buffer volatility through internal ethylene supply, yet small and midsized coaters face working-capital stress, occasionally delaying new line investments. While futures contracts and strategic stockpiling offer partial relief, raw-material uncertainty remains a near-term drag on the extrusion coatings market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Sterile Medical & Pharma Packaging

- Recyclable Mono-material Structures Adoption

- Increasing Carbon-Footprint Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene captured 42.65% of the extrusion coatings market share in 2024 and continues to anchor high-volume liquid and flexible packaging. Advancements in metallocene catalysis lift toughness and optics, while chemical-recycling initiatives promise circular feedstock at scale; one commercial line already delivers 30,000 t/y and targets 500,000 t/y by 2026. Ethyl vinyl acetate, expanding at 5.78% CAGR, secures medical and specialty food niches due to superior adhesion and low-temperature flexibility. Blending EVA with LDPE also enables mono-material laminate architectures that fit mechanical recycling streams. Polypropylene, PET, and specialty acrylates fill durability, high-barrier, or high-heat slots but remain secondary volume contributors. Continuous resin innovation underscores why the extrusion coatings market maintains a diversified polymer slate even as circular-economy mandates tighten.

A second wave of growth is evident in engineered blends that lower seal initiation temperature, cut energy use, and meet glycol-based sterilization cycles for biologics. These functional enhancements raise switching costs for converters, cementing polyethylene's role as the workhorse resin within the broader extrusion coatings industry. By contrast, EVA's rising volume encourages backward-integration moves among Asia-Pacific suppliers keen to ensure consistent VA content and food-contact compliance.

Paperboard and cardboard accounted for 52.58% of the extrusion coatings market size in 2024, reflecting their entrenched role in aseptic cartons and take-out foodservice. Specialty biopolymer additives launched in 2025 allow downgauging up to 50% while maintaining grease resistance, helping brand owners align with fibre-recycling goals. Polymer films, growing at 6.50% CAGR, benefit from high line speeds, downgauged thickness, and expanding applications in collation shrink and mailer films. Cast PP variants now match BO-PP clarity and bag-making efficiency yet cost up to 15% less, accelerating their penetration into dry food and personal-care wraps. Metal foils remain indispensable for moisture-critical pharma packs despite recyclability challenges. Specialty fabrics and non-wovens fill chemical-resistant industrial slots, but their adoption is tempered by cost and process complexity.

Technological cross-pollination is notable: solvent-less primer chemistries originally developed for film lines are being re-formulated for paperboard, giving converters a common toolkit across substrate platforms. This convergence emphasizes the strategic value substrate agility provides in an era where the extrusion coatings market must balance barrier performance, recyclability, and cost discipline simultaneously.

The Extrusion Coatings Market Report Segments the Industry by Material (Polyethylene, Ethyl Vinyl Acetate (EVA), and More), Substrate (Paperboard and Cardboard, Polymer Films, and More), Application (Liquid Packaging, Flexible Packaging, and More), End-User Industry (Food and Beverage, Healthcare and Pharma, and More) and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 57.19% of the extrusion coatings market size in 2024 and is poised to compound at 6.25% CAGR through 2030 on the back of large-scale resin expansion and rising disposable incomes. China's sustained polymer self-sufficiency strategy and India's USD 87 billion petrochemical build-out furnish abundant raw materials, while rapid urbanization intensifies packaged-food and e-commerce penetration. SABIC's joint venture ethylene unit in Fujian, breaking ground in 2024, reinforces localized resin supply circa 2027.

North America leverages advanced recycling pilots and stringent FDA packaging norms to sustain technology leadership. Dow's divestment of non-core adhesive assets in late 2024 frees capital for circular-polymer scale-ups aimed at future demand. Europe maintains policy influence via recycling and carbon targets that compel rapid reformulation but also unleash premium pricing for compliant barrier solutions. Capacity additions in Mexico-such as AkzoNobel's USD 3.6 million extrusion-coatings line-signal North American realignment to serve regional converters.

South America, the Middle East, and Africa expand from a lower base yet post robust gains. Saudi Arabia's USD 1.5 trillion infrastructure pipeline lifts demand for corrosion-resistant wraps, while the GCC paints and coatings sector is projected to reach USD 4.5 billion by 2027. These regions offer strategic greenfield opportunities for mid-tier players aiming to diversify beyond saturated Western markets.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- Borealis AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- Davis-Standard

- Dow

- DuPont

- Eastman Chemical Company

- Exxon Mobil Corporation

- LyondellBasell Industries Holdings B.V.

- Optimum Plastics

- PPG Industries, Inc.

- Qenos Pty Ltd

- SABIC

- SCG Chemicals Public Company Limited

- The Lubrizol Corporation

- The Sherwin-Williams Company

- Transcendia

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for liquid & flexible food packaging

- 4.2.2 Surge in e-commerce protective packaging volumes

- 4.2.3 Expansion of sterile medical & pharma packaging

- 4.2.4 Recyclable mono-material structures adoption

- 4.2.5 Increasing usage in construction applications

- 4.3 Market Restraints

- 4.3.1 High polyolefin feedstock price volatility

- 4.3.2 Increasing carbon-footprint regulations

- 4.3.3 Shift toward water-based barrier alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (USD)

- 5.1 By Material

- 5.1.1 Polyethylene

- 5.1.1.1 Low Density Polyethylene (LDPE)

- 5.1.1.2 High Density Polyethylene (HDPE)

- 5.1.1.3 Other Polyethylenes (LLDPE & m-LLDPE, etc.)

- 5.1.2 Ethyl Vinyl Acetate (EVA)

- 5.1.3 Ethyl Butyl Acrylate (EBA)

- 5.1.4 Polypropylene

- 5.1.5 Polyethylene Terephthalate

- 5.1.6 Other Materials

- 5.1.1 Polyethylene

- 5.2 By Substrate

- 5.2.1 Paperboard and Cardboard

- 5.2.2 Polymer Films

- 5.2.3 Metal Foils

- 5.2.4 Other Substrates (Woven Fabrics and Non-wovens, etc.)

- 5.3 By Application

- 5.3.1 Liquid Packaging

- 5.3.2 Flexible Packaging

- 5.3.3 Medical Packaging

- 5.3.4 Personal-Care and Cosmetics Packaging

- 5.3.5 Photographic Film

- 5.3.6 Industrial Packaging/Wrapping

- 5.3.7 Other Applications (Corrosion Protection, etc.)

- 5.4 By End-User Industry

- 5.4.1 Food and Beverage

- 5.4.2 Healthcare and Pharma

- 5.4.3 Personal-Care and Cosmetics

- 5.4.4 Industrial and Chemical

- 5.4.5 Other End-User Industries (Publishing, Photographic)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 Borealis AG

- 6.4.4 Celanese Corporation

- 6.4.5 Chevron Phillips Chemical Company LLC

- 6.4.6 Davis-Standard

- 6.4.7 Dow

- 6.4.8 DuPont

- 6.4.9 Eastman Chemical Company

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Optimum Plastics

- 6.4.13 PPG Industries, Inc.

- 6.4.14 Qenos Pty Ltd

- 6.4.15 SABIC

- 6.4.16 SCG Chemicals Public Company Limited

- 6.4.17 The Lubrizol Corporation

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 Transcendia

- 6.4.20 Westlake Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Development of Bio-based Polymers as Raw Material