PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842467

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842467

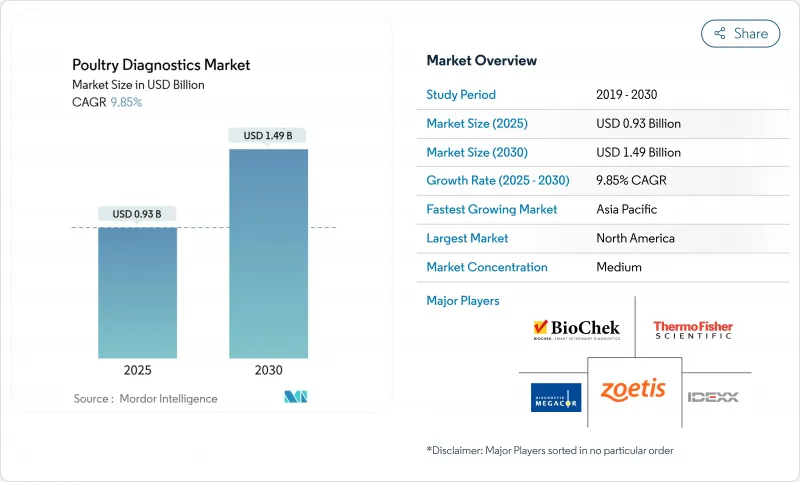

Poultry Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The poultry diagnostics market is valued at USD 0.93 billion in 2025 and is forecast to reach USD 1.49 billion by 2030, advancing at a 9.85% CAGR.

The growth reflects widespread adoption of sophisticated flock-health programs, the shift toward molecular confirmation of emerging pathogens, and tighter surveillance requirements that link export access to documented testing. Government vaccination and monitoring schemes following recent highly pathogenic avian influenza episodes reinforce steady demand for routine screening, while artificial-intelligence tools that analyze hatchery data in real time are moving diagnostics from a reactive function to a preventive pillar. Integrated producers are standardizing testing protocols across multi-site operations to protect high-value genetics, and reference laboratories are scaling automation to mitigate persistent shortages of trained technologists. In parallel, point-of-care devices are gaining traction on farms that cannot wait for off-site results, giving the poultry diagnostics market additional momentum in low-infrastructure regions.

Global Poultry Diagnostics Market Trends and Insights

Heightened Government & NGO Surveillance Programs

Regulatory bodies treat veterinarians and diagnostic labs as the first barrier against zoonotic spill-over, which has elevated routine testing volumes across commercial flocks. The United States Department of Agriculture enforces the National Poultry Improvement Plan, linking program compliance to interstate movement privileges, while its avian-influenza monitoring protocols can suspend flock accreditation for non-conformance . Similar frameworks in the European Union mandate accredited testing before export certification. These policies turn diagnostics from a discretionary cost into an operational necessity. International funding from the World Organisation for Animal Health supports laboratory upgrades in Southeast Asia, further expanding the testing footprint. Together, these initiatives exert structural upward pressure on the poultry diagnostics market.

Escalating Avian-Influenza & Zoonotic Outbreaks

Highly pathogenic avian influenza continues to circulate in wild migratory birds, triggering recurrent culls in commercial operations and creating surges in sample submissions. The Centers for Disease Control and Prevention documented viral fragments in three veterinarians after routine farm visits, illustrating cross-species risk and reinforcing the need for high-sensitivity molecular assays . Vaccine field trials run by the USDA demonstrated near-complete protection but highlighted the parallel need for diagnostics that can differentiate infected from vaccinated animals, sustaining long-term testing demand. Real-time PCR panels capable of sub-typing H5, H7 and H9 strains within 60 minutes are now standard in reference labs, and automated workflows ensure capacity during outbreak spikes. These dynamics intensify reliance on rapid, accurate diagnostics across every production tier.

High Cost Of Molecular Tests & Consumables

Consumables for multiplex PCR panels remain priced beyond reach for many smallholders, particularly in regions where farm-gate margins run thin. Shipping buffers and cold-chain requirements add logistical mark-ups that can raise landed costs by 25% in remote locations. Public laboratories subsidize fees, but budget cycles and competing human-health priorities limit scope. Manufacturers are responding with lyophilized reagents stable at ambient temperatures and cartridge systems that integrate extraction, amplification and detection. While innovations promise gradual cost relief, near-term affordability continues to restrain full penetration of the poultry diagnostics market.

Other drivers and restraints analyzed in the detailed report include:

- Surging Demand For Poultry Protein In Emerging Economies

- Rapid Adoption Of ELISA, PCR And Other Molecular Assays

- Limited Skilled Lab Workforce In Low-Income Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

ELISA generated 46.12% of global revenue in 2024, reflecting its role as the backbone of surveillance and vaccination monitoring. These assays combine low cost with reliable throughput, which keeps them entrenched even as new modalities emerge. The poultry diagnostics market size for ELISA-based offerings stood at USD 0.43 billion in 2025 and is forecast to edge past USD 0.62 billion by 2030. PCR platforms, while starting from a lower baseline, are projected to record 10.45% CAGR, driven by regulatory mandates for molecular confirmation during H5 or H7 outbreaks. Manufacturers bundle validated reagents with automated thermocyclers, reducing hands-on time and contamination risk. Next-generation sequencing panels sit at the cutting edge, capable of characterizing entire viromes in a single workflow, yet remain confined to reference laboratories until costs fall further.

The lateral-flow segment addresses on-farm triage needs with cartridges that deliver qualitative answers within 15 minutes. Demand rises where immediate culling decisions can avert severe financial losses, especially in integrated operations that house millions of birds. Hemagglutination-inhibition tests, still required by several export authorities, continue to secure a niche share. Vendors now develop digital-image capture solutions that interpret titer patterns objectively, improving consistency. Together, these dynamics ensure that the poultry diagnostics market offers a wide technology continuum, allowing users to balance price, speed and sensitivity.

Infectious agents commanded 38.15% revenue share in 2024 and remain the economic focal point for producers wary of trade bans and mass depopulation orders. Sample submissions spike each winter when migratory birds intersect commercial flocks in the northern hemisphere, underscoring the seasonal volatility embedded in the poultry diagnostics market. The sector responds with multiplex PCR panels detecting avian influenza, Newcastle disease and infectious bronchitis in a single run, improving cost efficiency. Researchers also refine DIVA (Differentiation of Infected from Vaccinated Animals) assays to support widespread immunization strategies without compromising surveillance.

Parasitic diseases, led by coccidiosis, exhibit the fastest 10.82% CAGR, expanding the poultry diagnostics market size for this niche from USD 0.14 billion in 2025 to an expected USD 0.23 billion by 2030. Automated oocyst-counting instruments reduce subjectivity and staff fatigue, boosting test reliability. Concurrent interest in metabolic and nutritional disorders signals a broader trend toward precision husbandry, where wearable sensors track body temperature and activity to pre-empt welfare issues. Although these categories remain smaller today, their growth rate suggests a gradual diversification of diagnostic demand away from an exclusive pathogen focus.

The Market is Segmented by Test Type (ELISA, PCR, Molecular Diagnostic Test, and More), Disease Type (Infectious Diseases, Parasitic Diseases, and More), by Service(Bacteriology, Virology, and More), End User (Veterinary Reference Laboratories, and More) and by Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest revenue block with 42.19% share in 2024, an outcome of stringent food-safety legislation, advanced cold-chain infrastructure and widespread insurance schemes that reimburse disease-control expenses. The region invests heavily in biocontainment upgrades and supports a network of more than 60 accredited veterinary diagnostic labs that handle avian submissions, underpinning the mature demand profile. Even so, the United States faces a projected gap of qualified diagnosticians by 2030, which has prompted subsidies for automation upgrades, shaping the medium-term outlook for the poultry diagnostics market.

Asia-Pacific is the fastest-growing territory at 11.86% CAGR to 2030, underpinned by population growth, urbanization and policy drives to boost domestic protein self-sufficiency. China, India and Indonesia collectively plan multi-billion-dollar investments in slaughter and cold-storage capacity, and each mandates routine disease monitoring for export certification. Public-private partnerships fund regional laboratory networks that offer reduced-fee PCR screening, embedding diagnostics in standard production economics. As a result, the poultry diagnostics market size in Asia-Pacific is expected to surpass USD 0.42 billion by 2030, up from USD 0.24 billion in 2025.

Europe preserves steady demand through harmonized veterinary legislation and mutual-recognition protocols handled by the Veterinary Batch Release Network, ensuring cross-border movement of poultry without redundant testing. Latin America and the Middle East & Africa register double-digit growth on small absolute bases, supported by multinational integrators establishing vertically aligned complexes that include on-site laboratories. While infrastructure deficits remain in parts of Sub-Saharan Africa, multilateral donors channel grants for mobile labs that can travel between farms, setting foundations for future expansion of the poultry diagnostics market.

- IDEXX

- Zoetis

- Thermo Fisher Scientific

- GD Animal Health

- Biochek

- Bionote

- Boehringer Ingelheim

- Megacor Diagnostik

- QIAGEN

- Bio-Rad Laboratories

- Neogen

- Randox Laboratories

- Abaxis (Zoetis)

- Virbac

- Fassisi

- Anigen (South Korea)

- IDEXX Asia Pacific Pte Ltd.

- Avian Diagnostics Ltd.

- Ring Biotechnology Co. Ltd.

- BioNote USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Deliverables

- 1.2 Study Assumptions & Market Definition

- 1.3 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened Government & Ngo Surveillance Programs

- 4.2.2 Escalating Avian-Influenza & Zoonotic Outbreaks

- 4.2.3 Surging Demand For Poultry Protein In Emerging Economies

- 4.2.4 Rapid Adoption Of Elisa, Pcr And Other Molecular Assays In Veterinary Reference Laboratories

- 4.2.5 Expansion Of Large Integrated Poultry Operations

- 4.2.6 Ai-Driven Predictive Analytics For Hatchery Health

- 4.3 Market Restraints

- 4.3.1 High Cost Of Molecular Tests & Consumables

- 4.3.2 Limited Skilled Lab Workforce In Low-Income Regions

- 4.3.3 Compliance Burden From Evolving Bio-Security Protocols

- 4.3.4 Reagent Supply Disruptions During Trade Bans

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Test Type

- 5.1.1 ELISA

- 5.1.2 PCR

- 5.1.3 Lateral-Flow Immunoassays

- 5.1.4 Hemagglutination-Inhibition & AGID

- 5.1.5 Next-Generation Sequencing Panels

- 5.1.6 Other Diagnostic Tests

- 5.2 By Disease Type

- 5.2.1 Metabolic & Nutritional Disorders

- 5.2.2 Infectious Diseases

- 5.2.3 Parasitic Diseases (Coccidiosis, Helminths)

- 5.2.4 Other Disease Types

- 5.3 By Service Type

- 5.3.1 Bacteriology

- 5.3.2 Virology

- 5.3.3 Parasitology

- 5.3.4 Serology & Immunology

- 5.3.5 Necropsy & Histopathology

- 5.4 By End User

- 5.4.1 Poultry Farms & Integrators

- 5.4.2 Veterinary Reference Laboratories

- 5.4.3 Point-of-Care / On-Farm Testing Units

- 5.4.4 Academic & Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 IDEXX Laboratories Inc.

- 6.3.2 Zoetis Inc.

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 GD Animal Health

- 6.3.5 BioChek BV

- 6.3.6 Bionote Inc.

- 6.3.7 Boehringer Ingelheim GmbH

- 6.3.8 Megacor Diagnostik GmbH

- 6.3.9 QIAGEN NV

- 6.3.10 Bio-Rad Laboratories Inc.

- 6.3.11 Neogen Corporation

- 6.3.12 Randox Laboratories Ltd.

- 6.3.13 Abaxis (Zoetis)

- 6.3.14 Virbac SA

- 6.3.15 Fassisi GmbH

- 6.3.16 Anigen (South Korea)

- 6.3.17 IDEXX Asia Pacific Pte Ltd.

- 6.3.18 Avian Diagnostics Ltd.

- 6.3.19 Ring Biotechnology Co. Ltd.

- 6.3.20 BioNote USA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment