PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842468

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842468

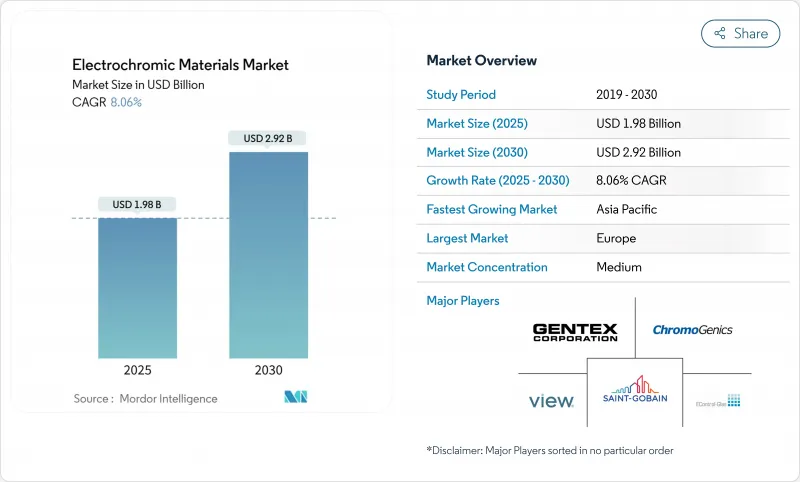

Electrochromic Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The electrochromic materials market stands at USD 1.98 billion in 2025 and is projected to grow to USD 2.92 billion by 2030, advancing at an 8.06% CAGR.

The growth reflects mandatory energy-efficiency codes, falling device costs, and rapid product commercialization across buildings, vehicles, and aircraft. Dynamic glazing lowers building cooling loads by up to 39.5%, positioning the electrochromic materials market as a preferred solution for net-zero construction. Cost breakthroughs have cut smart-window prices to USD 80 per m2 from USD 180-250 per m2, stimulating wider retrofit adoption. Europe leads due to stringent carbon mandates, while Asia-Pacific grows fastest on urbanization and infrastructure programs. Product innovation pivots on tungsten-oxide durability and polymer flexibility, and competitive focus centers on scaling low-cost manufacturing and improving cycling stability.

Global Electrochromic Materials Market Trends and Insights

Energy-efficiency regulations accelerating smart-window adoption

California's 2025 Energy Code requires chromogenic glazing for buildings surpassing specific window-to-wall ratios, creating a compliance template that other U.S. states are evaluating. The 2024 International Energy Conservation Code tightens U-factor limits and air-leakage thresholds, steering architects toward dynamic glazing. Shanghai's 2024 guidelines on light-reflection assessments align Asia-Pacific rules with European norms sthj.sh.gov.cn. The Asian Development Bank underscores building efficiency as vital for decarbonizing rapidly growing cities, supporting sustained demand for the electrochromic materials market. ASHRAE Standard 90.1-2022 clarifies envelope compliance paths that favor electrochromic over static glass.

Automotive demand for auto-dimming mirrors and panoramic sunroofs

Gentex shipped more than 50 million dimmable devices in 2024 and introduced film-based sunroofs at CES 2025, reducing system weight and enabling larger panoramic apertures. Ambilight's second-generation whole-vehicle black smart film delivers 40X dimming with high infrared rejection, addressing electric-vehicle cooling requirements. Hyundai's nano-cooling film cuts cabin temperature by 10 °C without darkening the view, complementing electrochromic glazing in premium EVs. Automotive thermal management mandates and sensor-integration trends are expanding the electrochromic materials market far beyond rearview mirrors.

High unit cost versus conventional coated glass

Traditional electrochromic windows cost USD 180-250 per m2, deterring mass adoption. Electrode-free devices published in 2024 slash cost to USD 80 per m2, signaling a path to parity with low-E glass. Scaling remains limited by niche production volumes, but automotive volumes hint at improving economies.

Other drivers and restraints analyzed in the detailed report include:

- Aerospace window upgrades for weight and glare reduction

- Retro-fit electrochromic facade films for existing buildings

- Cycling-stability and durability challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal oxides accounted for 49.42% of 2024 revenue, anchoring the electrochromic materials market with proven tungsten-oxide stability. The segment's cycling durability surpasses 100,000 cycles at 60 °C, and titanium-intercalated WO3 reaches 85% optical modulation and 95.61% reversibility. Conducting polymers trail yet post a 10.69% CAGR, propelled by PEDOT and polyaniline flexibility that suits rollable displays. MoS2-doped PEDOT achieves 70.28% coloration depth, narrowing performance gaps. Viologens and Prussian Blue serve niche color-switching needs despite environmental scrutiny.

Metal-oxide makers pivot toward thinner coatings compatible with polymer films, while polymer innovators explore hybrid metal-organic stacks to improve UV tolerance. Supply chains remain concentrated in Asia for indium-tin-oxide targets and in Europe for high-purity tungsten trioxide, underscoring material security priorities for the electrochromic materials market

Smart windows retained a 46.04% stake in 2024 and will stay the backbone of the electrochromic materials market as cost drops expand project pipelines. Building-integrated photovoltaics increasingly pair with electrochromic layers to balance daylight and solar power. Displays, though smaller, log an 11.02% CAGR thanks to printed, bi-stable films suited to logistics tags, retail shelving, and curved automotive clusters.

Mirrors remain a stable revenue stream, especially in North American light vehicles. Films gain share in retrofits, while coatings enable custom shapes that flat glass cannot address. Device diversity protects suppliers from single-segment cyclicality and smooths production planning.

The Electrochromic Materials Market Report Segments the Industry by Product Type (Viologens, Conducting Polymers, and More), Device Type (Smart Windows, Mirrors, and More), Form Factor (Glass Substrates, Polymer Films, and More), End-User Industry (Automotive, Electrical and Electronics, and More) and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained 33.15% of 2024 revenue, propelled by binding 2030 carbon targets and subsidies for green-renovation projects. Sweden's energy agency converted a USD 4.5 million loan to ChromoGenics, signaling policy trust in domestic electrochromic capacity. Germany leads installations under KfW efficiency incentives, while the United Kingdom extends smart-window grants in public buildings. Southern Europe adds high-insolation demand for glare control in heritage retrofits.

Asia-Pacific is the fastest-growing region at an 11.07% CAGR, underpinned by China's aggressive urbanization and light-pollution rules that favor adaptive facades. Shanghai's 2024 reflection code underscores regulatory tightening. Japan leverages automotive supply chains for sunroof modules, while South Korea's display majors co-develop flexible electrochromic dashboards. Government net-zero roadmaps and high electricity tariffs accelerate payback calculations, cementing the electrochromic materials market trajectory.

North America adopts through leading California codes and aerospace demand. Boeing and Airbus lines integrate Gentex dimmable windows, driving steady material off-take. Federal tax credits for commercial-building energy retrofits add momentum. South America and Middle East & Africa remain nascent; however, Gulf airports and hospitality projects trial dynamic facades to manage desert solar gain, signaling medium-term opportunities.

List of Companies Covered in this Report:

- Changzhou YAPU new material Co., Ltd.

- ChromoGenics

- Crown Electrokinetics Corp.

- EControl-Glas GmbH & Co. KG

- GENTEX CORPORATION

- KIBING GROUP

- Kinestral Technologies (Halio)

- Ningbo Miruo Electronic Technology Co., Ltd.

- Polytronix, Inc.

- Ricoh

- Saint-Gobain

- View Inc.

- Zhuhai Kaivo Optoelectronic Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency regulations accelerating smart-window adoption

- 4.2.2 Automotive demand for auto-dimming mirrors and panoramic sunroofs

- 4.2.3 Aerospace window upgrades for weight and glare reduction

- 4.2.4 Retro-fit electrochromic facade films for existing buildings

- 4.2.5 Increase in defense spending by the government

- 4.3 Market Restraints

- 4.3.1 High unit cost versus conventional coated glass

- 4.3.2 Cycling-stability & durability challenges

- 4.3.3 Pending ecotoxicity norms on viologen waste streams

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Viologens

- 5.1.2 Conducting Polymers

- 5.1.3 Metal Oxides

- 5.1.4 Prussian Blue

- 5.1.5 Other Product Types

- 5.2 By Device Type

- 5.2.1 Smart Windows

- 5.2.2 Mirrors

- 5.2.3 Displays

- 5.2.4 Films & Coatings

- 5.2.5 Other Devices

- 5.3 By Form Factor

- 5.3.1 Glass Substrates

- 5.3.2 Polymer Films

- 5.3.3 Inks & Paints

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Electrical and Electronics

- 5.4.3 Building and Construction

- 5.4.4 Aerospace and Defense

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Changzhou YAPU new material Co., Ltd.

- 6.4.2 ChromoGenics

- 6.4.3 Crown Electrokinetics Corp.

- 6.4.4 EControl-Glas GmbH & Co. KG

- 6.4.5 GENTEX CORPORATION

- 6.4.6 KIBING GROUP

- 6.4.7 Kinestral Technologies (Halio)

- 6.4.8 Ningbo Miruo Electronic Technology Co., Ltd.

- 6.4.9 Polytronix, Inc.

- 6.4.10 Ricoh

- 6.4.11 Saint-Gobain

- 6.4.12 View Inc.

- 6.4.13 Zhuhai Kaivo Optoelectronic Technology Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment