PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842469

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842469

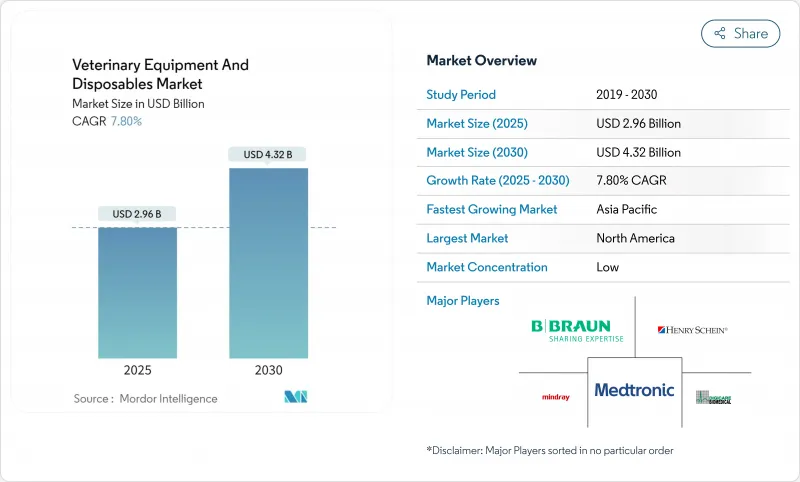

Veterinary Equipment And Disposables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The veterinary medical equipment market is valued at USD 2.96 billion in 2025 and is forecast to reach USD 4.32 billion by 2030, advancing at a 7.8% CAGR during 2025-2030.

Growth is fuelled by sustained pet humanization that lifts spending on advanced diagnostics, regulatory disease-surveillance mandates within livestock sectors, and a steady pipeline of technology upgrades that shorten equipment replacement cycles. Momentum is reinforced by the spread of pet insurance, which improves client willingness to authorize higher-value procedures, and by rapid uptake of portable, AI-enabled devices that suit both clinic-based and mobile care models. Livestock operators add further demand through compulsory H5N1 testing regimes that require rugged point-of-care analyzers . Competitive rivalry is intensifying as platform players bundle instruments, consumables, cloud software, and AI analytics to create sticky ecosystems, while emerging manufacturers court cost-sensitive buyers with modular, service-light designs. Asia-Pacific's build-out of private pet hospitals, alongside consolidation of fragmented chains, positions the region as the most dynamic geography for equipment vendors.

Global Veterinary Equipment And Disposables Market Trends and Insights

Rapid Growth in Pet Insurance Penetration

Pet insurance policies are reshaping the veterinary medical equipment market by encouraging earlier adoption of high-end imaging and in-house laboratory systems. Insured clients approve advanced diagnostics 2.3 times more often than uninsured owners, which lifts practice revenue and accelerates equipment payback periods. In the United States, policy coverage now exceeds 5.5 million pets, and insurers increasingly require detailed imaging or pathology reports for claim validation, driving clinics to upgrade to digital radiography and CT platforms. Europe mirrors this trajectory as Nordic countries exceed 30% penetration, prompting widespread modernization of anesthesia monitors and dental suites. Asian providers are launching bundled micro-insurance products that cover outpatient diagnostics, further broadening demand. The cascading effect of higher reimbursement limits supports premium instrument placements across corporate chains and independent practices.

Rising Livestock Disease Surveillance Mandates

The USDA Federal Order of April 2024 compels dairy herds to test for H5N1 before interstate transport, immediately boosting orders for on-farm PCR units, handheld blood analyzers, and secure data-logging software. European and Chinese authorities are deploying comparable frameworks that require traceable, rapid diagnostics within poultry, swine, and cattle operations, catalyzing procurement of ruggedized ultrasound and thermal-imaging equipment. Producers adopt these tools to minimize quarantine downtime and maintain export eligibility, which translates into recurring consumables revenue for manufacturers. The mandates also accelerate laboratory capacity expansion, stimulating sales of centrifuges, biosafety cabinets, and sample-prep robotics. Short-cycle replacement of field-deployed sensors sustains aftermarket growth throughout the forecast window.

High Capital Cost for Advanced Imaging Suites

Digital radiography units start near USD 21,000 and full DR suites average USD 29,995, yet lifetime costs double once warranties, service contracts, and software upgrades are included. Small clinics postpone purchases or turn to refurbished systems, which slows primary market turnover. In emerging economies, limited access to low-interest financing further deters adoption of CT and MRI platforms. Large corporate chains leverage volume discounts and centralized reading services to dilute per-exam costs, thereby widening the technology gap between consolidated networks and solo practitioners. Government tax incentives, such as US Section 179, provide partial relief but do not fully offset the capital intensity that constrains equipment penetration.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Minimally-Invasive Surgical Tools

- Growth of Tele-Veterinary Diagnostics Platforms

- Shortage of Skilled Veterinary Radiologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equipment represented 64.5% of the veterinary medical equipment market in 2024, underscoring the capital-intensive nature of modern practice operations Mordor Intelligence. Diagnostic imaging units are the fastest-growing subcategory as AI-integrated ultrasound and digital radiography cut scan times and boost triage accuracy. Surgical lasers and regenerative therapy devices broaden therapeutic options and carry premium margins. Anesthesia workstations and multiparameter monitors record steady uptake due to stricter procedural safety protocols. The veterinary medical equipment market size for disposables is smaller, yet single-use drapes, catheters, and endoscopy consumables post an 8.12% CAGR thanks to infection-control standards and predictable cost models.

Disposables accounted for 35.5% share in 2024, but their recurring-revenue profile appeals to suppliers seeking stable cash flows. Syringes and needles dominate volume; wound dressings and cytology slides grow with the focus on preventive dermatology. Single-use endoscopy accessories earn attention where contamination risk is high, though recent studies found reusable forceps non-inferior after repeated sterilization onlinelibrary.wiley.com. Cost-benefit debates will shape penetration levels, especially in resource-constrained clinics. Material advances in breathable laminates lower the environmental footprint of disposables and may attract sustainability-minded buyers.

The Veterinary Equipment and Disposables Market Report is Segmented by Product Type (Equipment [Therapeutic Equipment, Diagnostic Imaging and More] and Disposables [Syringes & Needles, Infusion & Transfusion Sets and More]), Animal (Companion Animals and Livestock Animals), End User (Veterinary Hospitals and Private Clinics), and Geography (North America, Europe and More). The Report Offers the Value (USD) for the Above Segments.

Geography Analysis

North America held 41.43% of 2024 revenue, anchored by high pet ownership, favorable insurance penetration, and federal livestock testing directives that stimulate equipment upgrades aphis.usda.gov. US clinics adopt AI-powered hematology and cytology platforms rapidly, while Canada emphasizes cattle traceability and companion dental care. Mexico's growing middle class drives puppy and kitten wellness programs, increasing small-equipment turnover. Although mature, the region still represents a replacement market for battery-light digital radiography and cloud PACS that streamline workflows.

Asia-Pacific is the fastest-growing region at a 9.56% CAGR through 2030. Japan adopts minimally-invasive surgical towers to serve an aging pet population. South Korea leads in digital neuro-diagnostics for small dogs prone to IVDD. India's livestock modernization pushes uptake of portable ultrasound and mastitis-test readers, while Australia upgrades biosecure poultry inspection systems to protect export status.

Europe ranks second in share owing to robust welfare regulations and broad companion coverage. Germany mandates radiation safety certification for X-ray operators, driving upgrades to low-dose detectors. The UK Competition and Markets Authority investigation into veterinary pricing could spur transparency-driven procurement of cost-efficient analyzers. France and the Netherlands pilot eco-friendly anaesthesia scavenging systems, aligning with EU Green Deal ambitions. Southern markets such as Spain prioritize multi-species versatility in imaging suites to serve mixed companion-livestock practices.

- IDEXX

- Covetrus

- Heska

- Midmark

- B. Braun Vet Care

- Jorgen Kruuse A/S

- Shenzhen Mindray Animal Medical

- Neogen

- Zoetis (VetScan)

- Eickemeyer Veterinary Equipment

- Agfa-Gevaert

- Antibe Therapeutics (Citagenix)

- Veterinary Instrumentation

- Smiths Group

- Cardinal Health

- Burtons Medical Equipment

- Orion Concept Inc.

- Dispomed

- Esaote

- IMV Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth in pet insurance penetration

- 4.2.2 Rising livestock disease surveillance mandates

- 4.2.3 Expansion of minimally-invasive surgical tools

- 4.2.4 Growth of tele-veterinary diagnostics platforms

- 4.2.5 Mainstream adoption of single-use endoscopy

- 4.2.6 Genetic screening driving preventive equipment demand

- 4.3 Market Restraints

- 4.3.1 High capital cost for advanced imaging suites

- 4.3.2 Shortage of skilled veterinary radiologists

- 4.3.3 Re-use culture in price-sensitive markets

- 4.3.4 Regulatory ambiguity for novel disposables

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Equipment

- 5.1.1.1 Therapeutic Equipment

- 5.1.1.2 Diagnostic Imaging

- 5.1.1.3 Anesthesia Machines

- 5.1.1.4 Patient Monitoring

- 5.1.1.5 Dental Equipment

- 5.1.2 Disposables

- 5.1.2.1 Syringes & Needles

- 5.1.2.2 Infusion & Transfusion Sets

- 5.1.2.3 Catheters

- 5.1.2.4 Wound Dressings & Bandages

- 5.1.2.5 Surgical Drapes & Gowns

- 5.1.1 Equipment

- 5.2 By Animal Type

- 5.2.1 Companion Animals

- 5.2.1.1 Dogs

- 5.2.1.2 Cats

- 5.2.1.3 Horses

- 5.2.1.4 Others

- 5.2.2 Livestock Animals

- 5.2.2.1 Cattle

- 5.2.2.2 Swine

- 5.2.2.3 Poultry

- 5.2.2.4 Others

- 5.2.1 Companion Animals

- 5.3 By End User

- 5.3.1 Veterinary Clinics

- 5.3.2 Veterinary Hospitals

- 5.3.3 Academic & Research Institutes

- 5.3.4 Mobile/ Ambulatory Services

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 IDEXX Laboratories

- 6.3.2 Covetrus

- 6.3.3 Heska Corporation

- 6.3.4 Midmark Corporation

- 6.3.5 B. Braun Vet Care

- 6.3.6 Jorgen Kruuse A/S

- 6.3.7 Shenzhen Mindray Animal Medical

- 6.3.8 Neogen Corporation

- 6.3.9 Zoetis (VetScan)

- 6.3.10 Eickemeyer Veterinary Equipment

- 6.3.11 Agfa-Gevaert N.V.

- 6.3.12 Antibe Therapeutics (Citagenix)

- 6.3.13 Veterinary Instrumentation

- 6.3.14 Smiths Medical (ICU Medical)

- 6.3.15 Cardinal Health

- 6.3.16 Burtons Medical Equipment

- 6.3.17 Orion Concept Inc.

- 6.3.18 Dispomed Ltd.

- 6.3.19 Esaote SpA

- 6.3.20 IMV Technologies

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment