PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842470

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842470

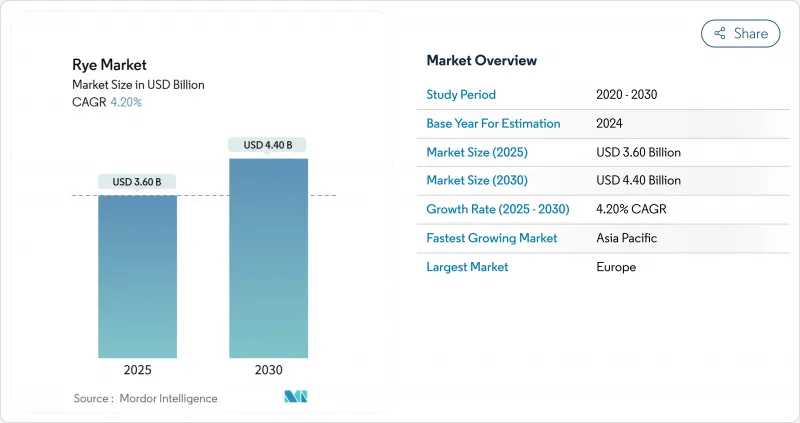

Rye - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global rye market, valued at USD 3.6 billion in 2025, is projected to reach USD 4.4 billion by 2030, growing at a CAGR of 4.2%.

The market's growth is influenced by climate variability, increasing consumer preference for functional grains, and consistent demand from distilleries. Farmers favor rye cultivation due to its resilience, particularly its ability to withstand winter conditions and soil moisture deficits compared to other small grains. The integration of rye in regenerative agriculture and cover-crop programs provides additional revenue through carbon credits, averaging 0.19 t CO2e per acre. Major distillers, including Buffalo Trace and Whiskey House of Kentucky, are expanding operations, indicating sustained demand for premium rye grain. While Europe dominates production and processing activities, the Asia-Pacific region demonstrates the highest growth rate, driven by health-conscious middle-class consumers seeking high-fiber dietary options.

Global Rye Market Trends and Insights

Expansion in Organic Area

The organic rye cultivation area continues to expand despite declining organic corn and soybean prices. Certified organic rye farmers receive 30-40% higher prices, which compensate for the 15-20% lower yields and increased certification costs. European farms with established certification processes benefit from consistent demand for clean-label products. Processing companies invest in separate milling equipment to prevent contamination and maintain organic integrity. The retail sector's emphasis on supply chain transparency drives increased organic rye production.

Government-Backed Export Incentives

The USDA's GSM-102 credit guarantee program covers up to 98% of principal and a portion of interest for grain buyers in developing countries, reducing counterparty risk. The program has issued approximately USD 86.5 billion in guarantees since 1981, with 2024-2025 allocations including rye among other bulk grains. The program enables traders to diversify their markets amid geopolitical disruptions to traditional trade routes. Additionally, it provides smaller exporters with access to working capital that was previously unavailable from banks, helping increase overall rye sales volumes.

Recurring Disease Outbreaks

Fusarium head blight and ergot contamination affected 90% of Polish winter rye samples in the 2024 season. Wet conditions during flowering periods increase infection risk, requiring farmers to implement extensive fungicide programs and maintain separate storage facilities. Due to the severe health risks ergot alkaloids pose to livestock, buyers enforce strict zero-tolerance policies, which reduce the available supply. Processors must invest in rapid testing equipment and dedicated milling lines, increasing operational costs. While disease resistance breeding continues as a research priority, widespread implementation of resistant varieties requires multiple years.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand from Bakery and Breakfast-Cereal Manufacturers

- Expansion of Rye-Based Craft Spirits

- Yield Losses from Erratic Spring Frosts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Rye Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Study Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Europe held a 41% value share in 2024, anchored by Germany's 3.2 million metric tons harvest and a network of mills and distilleries. Drought conditions reduced yields in Spain and Poland, but milling groups implemented moisture sensors and silo aeration to maintain quality. Russian output declined below 2 million metric tons, increasing cross-border trade from Scandinavia. European agricultural policies supporting crop rotation and cover cropping help maintain rye acreage, while traditional consumer preference for rye bread sustains demand.

Asia-Pacific demonstrates the fastest 5.2% CAGR through 2030, driven by expanding functional bakery capacity in China and India, and Japan's increased dietary fiber requirements. Companies such as The Healthy Grain and Itochu expand rye-based food distribution networks. Urban consumers increasingly adopt high-protein diets incorporating various grains. Limited domestic production necessitates imports from Europe and North America. Port infrastructure improvements in Shanghai and Mumbai enhance grain handling efficiency, ensuring a consistent supply.

North America's 2024 production reached 14.7 million bushels, the highest since 1987, driven by cover-crop incentives and whiskey industry demand. Canada's prairie provinces benefit from cool nights and long day lengths for optimal test weights, despite frost risks. U.S. government export credit guarantees expand market access in Africa and South America. Distillery expansion in Kentucky and Indiana supports premium-grade demand, while Kansas feedlots utilize lower-grade supplies. Carbon reduction initiatives and regenerative agriculture practices strengthen the regional market position.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion in Organic Area

- 4.2.2 Government-Backed Export Incentives

- 4.2.3 Rising Demand from Bakery and Breakfast-Cereal Manufacturers

- 4.2.4 Expansion of Rye-Based Craft Spirits

- 4.2.5 Monetization of Winter-Rye Cover Crops Through Carbon Credits

- 4.2.6 Adoption of Hybrid Rye in Animal Feed

- 4.3 Market Restraints

- 4.3.1 Recurring Disease Outbreaks

- 4.3.2 Yield Losses from Erratic Spring Frosts

- 4.3.3 Acreage Competition from Higher-Margin Crops

- 4.3.4 Stricter Mycotoxin Regulations Impact Rye Processing Industry

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 Poland

- 5.1.2.3 Russia

- 5.1.2.4 France

- 5.1.2.5 United Kingdom

- 5.1.2.6 Denmark

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 India

- 5.1.3.3 Japan

- 5.1.3.4 Australia

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.5 Middle East

- 5.1.5.1 Turkey

- 5.1.5.2 Israel

- 5.1.5.3 Iraq

- 5.1.6 Africa

- 5.1.6.1 South Africa

- 5.1.6.2 Egypt

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Stakeholders

7 Market Opportunities and Future Outlook