PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842471

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842471

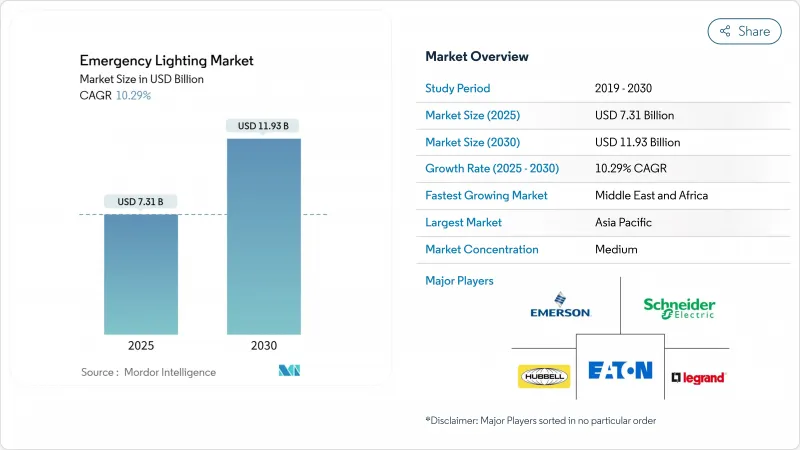

Emergency Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The emergency lighting market size reached USD 7.31 billion in 2025 and is on track to hit USD 11.93 billion by 2030, reflecting a 10.29% CAGR.

The expansion is propelled by stringent life-safety codes, retrofits tied to green-building targets, and smart-lighting technologies that provide automated testing and remote monitoring. LED conversion remains the largest upgrade driver, while wireless connectivity lowers installation costs for existing buildings. Infrastructure investments in tunnels, airports, and data centers further accelerate demand, especially in Asia-Pacific and the Middle East. Competitive dynamics favor brands that pair hardware with cloud-based diagnostics, allowing facility managers to oversee thousands of devices from a single dashboard.

Global Emergency Lighting Market Trends and Insights

Smart LED retrofits across European public infrastructure

European municipalities are replacing fluorescent fixtures with networked LED luminaires that cut energy consumption by up to 50% while simplifying compliance reporting. The EU Green Deal pushes public buildings to reach carbon neutrality by 2030, and connected fixtures automatically send test logs to facility dashboards, trimming maintenance labor. Acuity Brands' STAR Gateway illustrates how automated audits meet EN 50172 requirements, making smart LEDs the default choice for rail stations, schools, and government offices.

Stricter U.S. IBC/NFPA 101 mandates for high-rises

The 2024 code cycle raises minimum egress illuminance to 1.07 lux for 90 minutes and cuts activation time to 10 seconds. Many legacy nickel-cadmium units cannot pass updated UL 924 tests that now require a "normal-power present" signal, compelling owners to replace equipment ahead of recertification deadlines. Federal facilities add another layer of pressure by specifying LED systems with integrated controls to meet GSA energy targets.

Lithium-ion fire-safety concerns in healthcare facilities

Hospitals are delaying lithium-ion rollouts after thermal-runaway incidents that led to ward evacuations. NFPA is drafting NFPA 800 to govern on-site storage, but until finalized, many health networks stay with sealed lead-acid or nickel-metal hydride packs despite shorter life. Proposed U.S. legislation to codify national battery safety standards adds further uncertainty.

Other drivers and restraints analyzed in the detailed report include:

- Urban rail-tunnel build-outs in China and India

- Data-center boom adopting centralized battery systems

- Supply-chain crunch for IC drivers and optics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LED devices controlled 57.9% of emergency lighting market share in 2024, and the segment is set to advance at a 9.8% CAGR through 2030. Fluorescent tubes linger in older buildings, yet rising energy tariffs and lamp bans speed replacement schedules. Niche high-intensity discharge units remain in petrochemical zones where 10 kV surge immunity takes precedence over efficacy.

Smart diodes now embed sensors, memory, and selectable color temperatures, exemplified by the Green Creative Universal CCT Select tube, which helps specifiers tailor glare levels without swapping hardware. This convergence of intelligence with illumination keeps LED systems as the anchor of the emergency lighting market, even as wireless protocols reshape product line roadmaps.

Self-contained packs represented 65.8% of emergency lighting market size in 2024, thanks to straightforward installation and unitized maintenance. Large venues, however, prefer central banks to cut room-by-room battery checks. Data centers exemplify the shift, with centralized racks ensuring all fixtures receive conditioned power and firmware updates from a single hub.

Eaton's inverter platforms, soon incorporating Exertherm thermal analytics, highlight how predictive monitoring reduces unscheduled downtime. Lithium-ion strings deliver long cycle life, yet hospitals and airports still specify VRLA in critical zones until regulatory clarity improves. The split between autonomy and central command will define procurement choices over the forecast horizon.

The Emergency Lighting Market Report is Segmented by Light Source (LED, Fluorescent, and More), Power System (Self-Contained/Battery-Backup, Central Battery (UPS), and More), Installation Type (Surface-Mounted, Recessed, and More), Product (Emergency Exit Signs, and More), Communication (Wired, and More), End-User (Residential, Industrial, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific, with a 34.2% stake in the emergency lighting market, benefits from megaprojects such as Mumbai Metro Line 3 and Beijing Sub-Center Tunnel. Regional governments use concessional loans from institutions like ADB to electrify outlying provinces, ensuring every new substation or rail spur specifies compliant luminaires. Semiconductor shortages make scheduling tricky, but local PCB houses in Shenzhen and Penang shorten lead times for domestic vendors.

The Middle East and Africa will register a 10.9% CAGR through 2030 as Qatar extends LNG export hubs and Saudi Vision 2030 accelerates tourism corridors. Offshore rigs in the Gulf demand copper-free aluminum bodies that survive salt-spray and 60 °C highs. Chalmit-branded Protecta X fixtures in North Sea fields validate 120,000-hour lifespans, encouraging NOCs to budget for premium solutions.

North America and Europe offer steady replacement cycles. U.S. code revisions now force high-rise landlords to upgrade within recertification windows, bolstering retrofit volumes. Europe's Renovation Wave funnels grants toward public-sector LED swaps, with Germany underwriting smart controls that shave carbon footprints ahead of 2030 targets. Mature buyers favor vendors that bundle analytics dashboards with hardware, elevating software maintenance contracts as a vital slice of the emergency lighting market.

- Acuity Brands Inc.

- Arrow Emergency Lighting Ltd.

- Beghelli SpA

- Cooper Lighting Solutions (Signify)

- Daisalux SAU

- Digital Lumens

- Diehl Stiftung and Co. KG

- Eaton Corp. plc

- Emerson Electric Co.

- Fulham Co. Inc.

- Hubbell Lighting Inc.

- Legrand SA

- Lutron Electronics Co.

- Myers Emergency Power Systems

- OSRAM GmbH

- Schneider Electric SE

- Signify NV (Philips Lighting)

- Taurac BV

- Thorlux Lighting

- Toshiba Corporation

- Tridonic GmbH

- Zumtobel Group AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing retrofit demand for smart-connected LED emergency luminaires across Europe-s public infrastructure

- 4.2.2 Stricter occupant-safety mandates in United States high-rise codes (IBC/NFPA 101)

- 4.2.3 Rapid urban rail-tunnel build-outs in China and India

- 4.2.4 Data-center boom driving centralized battery-backup lighting in North America

- 4.2.5 ESG-led green-building certifications fueling LED exit-sign upgrades

- 4.2.6 Surge in offshore platform investments in Middle East

- 4.3 Market Restraints

- 4.3.1 Lithium-ion battery fire-safety concerns limiting adoption in healthcare facilities

- 4.3.2 Supply-chain crunch for IC drivers and optics since 2023

- 4.3.3 Fragmented local standards complicating product localization in ASEAN

- 4.3.4 High installation and testing cost for addressable wireless systems

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Light Source

- 5.1.1 LED

- 5.1.2 Fluorescent Lamps

- 5.1.3 High-Intensity Discharge (HID)

- 5.1.4 Induction and Others

- 5.2 By Power System

- 5.2.1 Self-Contained/Battery-Backup

- 5.2.2 Central Battery (UPS)

- 5.2.3 Hybrid/Distributed

- 5.3 By Installation Type

- 5.3.1 Surface-Mounted

- 5.3.2 Recessed

- 5.3.3 Suspended

- 5.3.4 Portable

- 5.4 By Product

- 5.4.1 Emergency Exit Signs

- 5.4.2 Stand-alone Emergency Luminaires

- 5.4.3 Combo Units

- 5.4.4 Emergency Ballasts and Drivers

- 5.5 By Communication

- 5.5.1 Wired

- 5.5.2 Wireless/IoT-Enabled

- 5.6 By End-user

- 5.6.1 Commercial - Offices

- 5.6.2 Commercial - Hospitality and Retail

- 5.6.3 Industrial -Manufacturing and Warehouses

- 5.6.4 Oil and Gas/Mining

- 5.6.5 Residential

- 5.6.6 Public Infrastructure (Airports, Tunnels, Rail)

- 5.6.7 Healthcare Facilities

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Nordics

- 5.7.2.5 Rest of Europe

- 5.7.3 South America

- 5.7.3.1 Brazil

- 5.7.3.2 Rest of South America

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South-East Asia

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Gulf Cooperation Council Countries

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Acuity Brands Inc.

- 6.4.2 Arrow Emergency Lighting Ltd.

- 6.4.3 Beghelli SpA

- 6.4.4 Cooper Lighting Solutions (Signify)

- 6.4.5 Daisalux SAU

- 6.4.6 Digital Lumens

- 6.4.7 Diehl Stiftung and Co. KG

- 6.4.8 Eaton Corp. plc

- 6.4.9 Emerson Electric Co.

- 6.4.10 Fulham Co. Inc.

- 6.4.11 Hubbell Lighting Inc.

- 6.4.12 Legrand SA

- 6.4.13 Lutron Electronics Co.

- 6.4.14 Myers Emergency Power Systems

- 6.4.15 OSRAM GmbH

- 6.4.16 Schneider Electric SE

- 6.4.17 Signify NV (Philips Lighting)

- 6.4.18 Taurac BV

- 6.4.19 Thorlux Lighting

- 6.4.20 Toshiba Corporation

- 6.4.21 Tridonic GmbH

- 6.4.22 Zumtobel Group AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment