PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842473

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842473

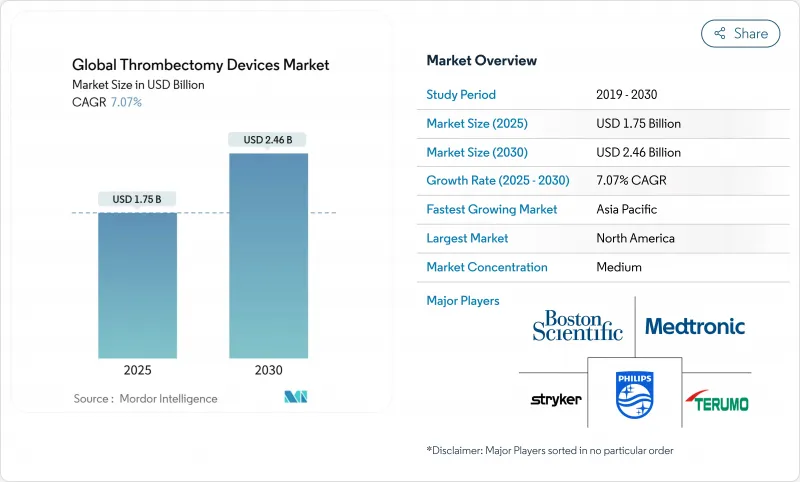

Global Thrombectomy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The thrombectomy devices market is valued at USD 1.75billion in 2025 and is forecast to grow at a 7.07% CAGR to reach USD 2.46 billion by 2030.

Clinical evidence demonstrating superior functional recovery, an aging population that is living longer with vascular risk factors, and steady reimbursement expansion are accelerating adoption across stroke centers and peripheral-vascular programs. Mechanical systems continue to command the largest installed base, yet rapid innovation in aspiration catheters and computer-assisted vacuum pumps is redefining procedural efficiency. Manufacturers are pursuing portfolio breadth through acquisitions and next-generation launches, while hospitals are investing in hub-and-spoke stroke networks to relieve capacity shortages. Meanwhile, regulatory harmonization in growth geographies is shortening time-to-market and nurturing local demand, positioning the thrombectomy devices market for sustained double-digit unit growth.

Global Thrombectomy Devices Market Trends and Insights

Aging Population and Rising Stroke Incidence

Growing life expectancy is swelling the global pool of stroke patients and, by extension, candidates for mechanical clot removal. Worldwide stroke events are projected to climb from 11.81 million in 2021 to 21.43 million by 2050, an 81% surge that will underpin steady procedure growth even if age-adjusted rates fall modestly . China already records 2.77 million ischemic strokes per year, and U.S. modeling shows potential thrombectomy-eligible volumes quadrupling as guideline criteria widen. These trends turn thrombectomy devices from a discretionary technology into essential hospital infrastructure, guaranteeing recurrent replacement demand.

Technological Advancements in Device Design

Innovation is narrowing the gap between difficult anatomy and dependable recanalization. Stanford's milli-spinner prototype achieved 90% success on hard clots versus 50% for conventional capture, using vortex-induced compression that avoids fragmentation . Penumbra's Lightning Flash 2.0 shortens active device time to 13 minutes through dual clot-detection algorithms that modulate suction in real time. Such improvements attack the 10-30% of cases that still end in incomplete reperfusion and are driving hospitals to upgrade ahead of schedule.

High Device Costs and Budget Constraints

Episode-of-care costs reach USD 10,682 for mechanical thrombectomy and up to USD 19,669 for rheolytic systems, with the single-use device the largest line item. Although long-term savings outweigh capital outlays, the initial USD 5,040 price tag for a FlowTriever kit can exceed fixed reimbursement in public systems. Hospitals therefore ration use to highest-acuity patients, slowing penetration in cost-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Clinical Evidence and Guidelines

- Improved Healthcare Infrastructure

- Shortage of Trained Specialists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mechanical platforms captured 46.20% of thrombectomy devices market share in 2024 as physicians rely on well-validated stent-retriever workflows. The thrombectomy devices market size for mechanical systems is expected to expand at 7.1% CAGR through 2030, supported by engineering refinements such as braided nitinol designs that improve clot engagement. First-pass success rates routinely exceed 80%, yet performance drops on calcified or elongated clots, highlighting limits that pure mechanical force cannot breach.

Aspiration catheters are closing that gap and are forecast to grow the fastest at 8.01% CAGR, propelled by computer-guided suction and larger inner lumens that preserve flow while evacuating debris. Hybrid techniques such as mini-SOLUMBRA marry direct aspiration with stent assistance to treat medium-vessel occlusions that account for up to 40% of ischemic strokes. Future segmentation will likely align devices to clot phenotype, moving the conversation from "mechanical versus aspiration" toward precision-guided therapy bundles.

The Thrombectomy Devices Market Report Segments the Industry Into by Technology (Mechanical Stent Retriever, Aspiration Catheter, Rheolytic and More), by Type (Automated and Manual), by Disease Area (Neurovascular, Peripheral Vascular, Coronary and More), and Geography (North America, Europe, Asia-Pacific, South America and More). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America held 38.50% of 2024 revenue as mature stroke systems, reliable reimbursement, and high specialist density sustain procedure volumes. U.S. modeling suggests that endovascular-eligible patient counts could quadruple if recent trial criteria are applied universally, creating a multi-year volume tailwind for the thrombectomy devices market. Device vendors increasingly bundle capital leases with per-procedure disposables, easing hospital cash-flow barriers. Corporate activity-exemplified by Stryker's USD 4.9 billion acquisition of Inari Medical-underscores the region's leadership in portfolio expansion.

Asia-Pacific is the fastest-growing territory at an 8.34% CAGR; China's 2.77 million annual ischemic strokes illustrate unmet need, while Japan's PMDA clearance of ClotTriever signals regulatory receptiveness to advanced devices. Mobile CT units and AI-driven tele-stroke pathways are being piloted to bypass distance barriers across Indonesia, India, and rural provinces of China. Early multicenter data show 87.5% survival to discharge after large-bore suction thrombectomy in resource-constrained hospitals, reinforcing the business case for regional expansion.

Europe combines sophisticated neuro-interventional know-how with capacity bottlenecks: France manages only one procedure for every three potential candidates, and Germany reports 6.7% thrombectomy transfer rates from primary centers. Cost-utility analyses covering 32 nations confirm broad economic justification, but scaling hinges on training and cross-border referral pathways. Latin America and Middle East & Africa offer incremental upside as ANVISA's new fast-track and Gulf Cooperation Council tender reforms compress device registration timelines, enabling faster uptake of best-in-class systems.

- Medtronic

- Stryker

- Penumbra

- Boston Scientific

- Teleflex

- Johnson & Johnson (Cerenovus)

- Abbott Laboratories

- Terumo

- Inari Medical

- AngioDynamics

- Merit Medical Systems

- Control Medical Technology

- Inquis Medical

- Acandis

- MicroVention

- Cardinal Health

- Becton Dickinson (BD)

- Koninklijke Philips

- Cook Group

- Rapid Medical

- VESALIO

- Kaneka

- Asahi Intecc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing incidence of ischemic stroke & systemic embolism

- 4.2.2 Rising demand for minimally-invasive procedures

- 4.2.3 Favorable reimbursement in developed markets

- 4.2.4 Technological advances in stent-retriever design

- 4.2.5 AI-guided intraprocedural imaging adoption

- 4.2.6 Hospital group purchasing boosts capital equipment uptake

- 4.3 Market Restraints

- 4.3.1 High device & procedural costs

- 4.3.2 Shortage of skilled neuro-interventionalists

- 4.3.3 Risk of Complications and Side Effects

- 4.3.4 Limited Access in Rural Areas

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Mechanical Stent Retriever

- 5.1.2 Aspiration Catheter

- 5.1.3 Rheolytic

- 5.1.4 Ultrasonic / Rotational

- 5.2 By Type

- 5.2.1 Automated

- 5.2.2 Manual

- 5.3 By Disease Area

- 5.3.1 Neurovascular

- 5.3.2 Peripheral Vascular

- 5.3.3 Coronary

- 5.3.4 Pulmonary Embolism

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic

- 6.3.2 Stryker

- 6.3.3 Penumbra

- 6.3.4 Boston Scientific

- 6.3.5 Teleflex

- 6.3.6 Johnson & Johnson (Cerenovus)

- 6.3.7 Abbott Laboratories

- 6.3.8 Terumo

- 6.3.9 Inari Medical

- 6.3.10 AngioDynamics

- 6.3.11 Merit Medical Systems

- 6.3.12 Control Medical Technology

- 6.3.13 Inquis Medical

- 6.3.14 Acandis

- 6.3.15 MicroVention

- 6.3.16 Cardinal Health (Cordis)

- 6.3.17 Becton Dickinson (BD)

- 6.3.18 Philips

- 6.3.19 Cook Medical

- 6.3.20 Rapid Medical

- 6.3.21 Vesalio

- 6.3.22 Kaneka

- 6.3.23 Asahi Intecc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment