PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842475

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842475

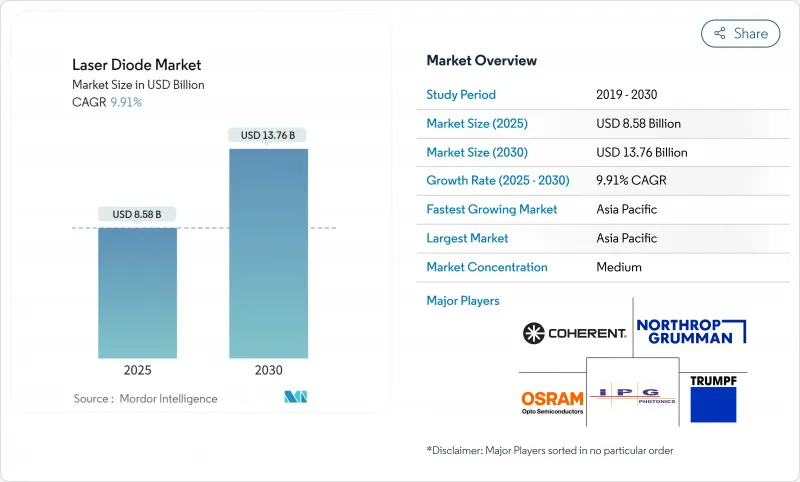

Laser Diode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The laser diode market is valued at USD 8.58 billion in 2025 and is forecast to rise to USD 13.76 billion by 2030, reflecting a 9.91% CAGR.

Sustained demand from fiber-optic communications, automotive LiDAR, and high-precision industrial processing is steering this expansion. Structural tailwinds include the migration from lamp-based light sources toward efficient semiconductor emitters, the rollout of 5G and future 6G networks, and continuous efficiency gains in device architecture. Manufacturers are accelerating vertical integration to secure gallium and indium supplies,while breakthroughs in quantum cascade lasers (QCLs) have pushed room-temperature power-conversion efficiency past 20%.The laser diode market is shifting toward application-specific designs such as 905 nm pulsed sources for automotive LiDAR and VCSEL arrays for 3D sensing in smartphones.

Global Laser Diode Market Trends and Insights

Proliferation of 3D sensing and Face-ID in smartphones

Smartphone producers are embedding multi-junction VCSEL arrays to support facial authentication, gesture control, and spatial mapping. A record 74% power-conversion efficiency in laboratory VCSELs reduces heat and battery demand, allowing thinner handset designs. Foundries in China, South Korea, and Taiwan are scaling 6-inch compound-semiconductor wafers that integrate back-side illumination and driver ICs on the same substrate. Optical component suppliers are racing to add polarization control and on-wafer testing to boost yields and cut costs.

Rapid deployment of FTTH networks leveraging 1550 nm DFB lasers

European carriers are extending fiber to underserved suburbs, selecting narrow-linewidth 1550 nm DFB emitters for long-haul reach. Recent prototypes achieve 50 kHz linewidths and 150 mW output, enabling unregenerated spans that trim remote-office equipment needs.In-house integration of thermoelectric coolers inside butterfly packages provides temperature stability that keeps bit-error rates low in dense-wavelength-division multiplexing systems.

Thermal management challenges limiting CW scaling > 20 W

Spatially non-uniform heat paths raise junction temperatures, capping wall-plug efficiency. Oxidation-confinement stripe structures now deliver 77.8% peak efficiency, but device makers still derate to extend lifetime.Novel diamond heat-spreaders and micro-channel coolers promise further gains, though cost and packaging complexity slow adoption.

Other drivers and restraints analyzed in the detailed report include:

- Automotive LiDAR programs adopting 905 nm pulsed lasers

- Rising use of high-power diode lasers in metal additive manufacturing

- Supply-chain dependency on gallium and indium causing price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Edge-emitting devices accounted for 42% of 2024 revenue, confirming their status as the workhorse across telecom, industrial, and medical arenas. High-brightness variants now reach >70 % efficiency at 28 W continuous power, aided by oxidation-confinement stripes that stabilize current flow. Falling cost per watt broadens uptake into precision welding and polymer curing. VCSELs, posting a 14.4% CAGR outlook, benefit from on-wafer testing that drives down unit cost for smartphone and in-cabin driver-monitoring modules. Multi-junction VCSELs have exceeded 74 % efficiency, aligning mobile OEM goals for battery autonomy.

The laser diode market size for edge-emitting designs is projected to widen further as aerospace and analytics adopt narrow-linewidth variants. Meanwhile, the laser diode market share for VCSELs will climb in consumer, industrial, and vehicular depth-sensing once 200 mm GaAs wafer lines reach volume production.

Infrared sources (700-1600 nm) captured 54% of 2024 revenue, supported by entrenched deployment in 5G backhaul and coherent optical links. Telecom vendors favor 1310 nm and 1550 nm distributed-feedback chips for their low attenuation over silica fiber. The laser diode market size in the blue band will grow fastest at a 12.3% CAGR, propelled by copper and aluminum processing in e-mobility supply chains. Recent platforms demonstrate kilowatt-class 445 nm CW power with medical-grade beam quality. Ultraviolet emitters, though niche, gain revenue in sterilization and micro-lithography.

Demand heterogeneity ensures that the laser diode market continues tailoring epitaxial structures to spectral windows that match application absorption peaks, enabling higher material utilization and yield.

The Laser Diode Market Report is Segmented by Type (Edge-Emitting Laser Diodes, VCSEL, and More), Wavelength (Infrared, Red, Blue, Green, and More), Output Power (Low Power, Mid Power, High Power), Operating Mode (Continuous-Wave, and Pulsed), Packaging Configuration (TO-CAN, C-Mount, and More), End-User Application (Telecommunications and Datacom, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 46% of 2024 revenue due to dense electronics supply chains across China, Japan, and South Korea. Contract fabs push capacity for 6-inch GaAs wafers, supporting high-volume VCSEL and edge-emitter runs. Regional governments fund 5G densification and early 6G pilots, expanding demand for 1550 nm coherent links. Export curbs on gallium and germanium introduced by China in 2023 raised sourcing risk, prompting Japanese and Korean firms to explore recycling and alternative chemistries.

North America leverages its defense and data-center ecosystem. The CHIPS and Science Act allocates USD 50 billion to shore up domestic semiconductor fabs, narrowing supply-chain exposure. LiDAR module makers in California and Michigan co-locate with automotive OEMs, shortening qualification cycles.

Europe remains pivotal for telecom components, especially 1550 nm DFB emitters used in fiber-to-the-home rollouts. German institutes collaborate with tool vendors to industrialize blue multi-kW arrays for additive manufacturing. The European Union's 7% share of global semiconductor output underscores its dependence on Asian wafer processing publications..

The Middle East and Africa laser diode market is projected to grow 11.2% CAGR as Gulf states digitize energy operations and roll out high-capacity optical backbones. Local universities partner with European labs to establish photonics clusters. South America increases submarine-cable landings, stimulating coherent transponder demand, though purchasing power remains a constraint.

- Coherent Corp.

- Lumentum Holdings Inc.

- Nichia Corporation

- TRUMPF SE + Co KG

- OSRAM Opto Semiconductors GmbH

- IPG Photonics Corp.

- Hamamatsu Photonics K.K.

- Sharp Corp.

- Sumitomo Electric Industries Ltd.

- Sony Corp.

- Mitsubishi Electric Corp.

- Ushio Inc.

- II-VI Inc. (now Coherent)

- Jenoptik AG

- Thorlabs Inc.

- Frankfurt Laser Co.

- OSI Laser Diode Inc.

- Lasea SA

- Newport Corp.

- Rohm Semiconductor

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of 3D Sensing and Face-ID in Smartphones propelling VCSEL demand in Asia

- 4.2.2 Rapid Deployment of FTTH Networks leveraging 1550 nm DFB Lasers in Europe

- 4.2.3 Automotive LiDAR programs adopting 905 nm Pulsed Lasers across North America

- 4.2.4 Rising Use of High-Power Diode Lasers in Metal Additive Manufacturing in Germany and Japan

- 4.2.5 Defense Funding Surge for Directed-Energy Weapons utilizing Diode Pumped Modules in United States and Israel

- 4.2.6 Miniaturization of Medical Aesthetic Devices integrating Blue-Green GaN Lasers

- 4.3 Market Restraints

- 4.3.1 Thermal Management Challenges limiting CW scaling >20 W

- 4.3.2 Supply-chain Dependency on Gallium and Indium causing price volatility

- 4.3.3 Safety Regulations on eye exposure restricting consumer-grade power in EU

- 4.3.4 Yield variability in GaN-on-Si wafer fabrication raising costs for Blu-ray lasers

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Edge-Emitting Laser Diodes

- 5.1.2 VCSEL

- 5.1.3 Quantum Cascade Lasers

- 5.1.4 DFB and DBR

- 5.1.5 Fabry-Perot Laser Diodes

- 5.2 By Wavelength

- 5.2.1 Infrared (700-1600 nm)

- 5.2.2 Red (630-700 nm)

- 5.2.3 Blue (400-500 nm)

- 5.2.4 Green (500-570 nm)

- 5.2.5 Ultraviolet (<400 nm)

- 5.3 By Output Power

- 5.3.1 Low Power (<1 W)

- 5.3.2 Mid Power (1-10 W)

- 5.3.3 High Power (>10 W)

- 5.4 By Operating Mode

- 5.4.1 Continuous-Wave (CW)

- 5.4.2 Pulsed

- 5.5 By Packaging Configuration

- 5.5.1 TO-CAN

- 5.5.2 C-Mount

- 5.5.3 HHL and Butterfly

- 5.5.4 Module/Sub-system

- 5.6 By End-User Application

- 5.6.1 Telecommunications and Datacom

- 5.6.2 Industrial Processing and Manufacturing

- 5.6.3 Healthcare and Medical

- 5.6.4 Automotive

- 5.6.5 Consumer Electronics and Display

- 5.6.6 Defense and Security

- 5.6.7 Research and Academia

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Coherent Corp.

- 6.4.2 Lumentum Holdings Inc.

- 6.4.3 Nichia Corporation

- 6.4.4 TRUMPF SE + Co KG

- 6.4.5 OSRAM Opto Semiconductors GmbH

- 6.4.6 IPG Photonics Corp.

- 6.4.7 Hamamatsu Photonics K.K.

- 6.4.8 Sharp Corp.

- 6.4.9 Sumitomo Electric Industries Ltd.

- 6.4.10 Sony Corp.

- 6.4.11 Mitsubishi Electric Corp.

- 6.4.12 Ushio Inc.

- 6.4.13 II-VI Inc. (now Coherent)

- 6.4.14 Jenoptik AG

- 6.4.15 Thorlabs Inc.

- 6.4.16 Frankfurt Laser Co.

- 6.4.17 OSI Laser Diode Inc.

- 6.4.18 Lasea SA

- 6.4.19 Newport Corp.

- 6.4.20 Rohm Semiconductor

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment