PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842476

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842476

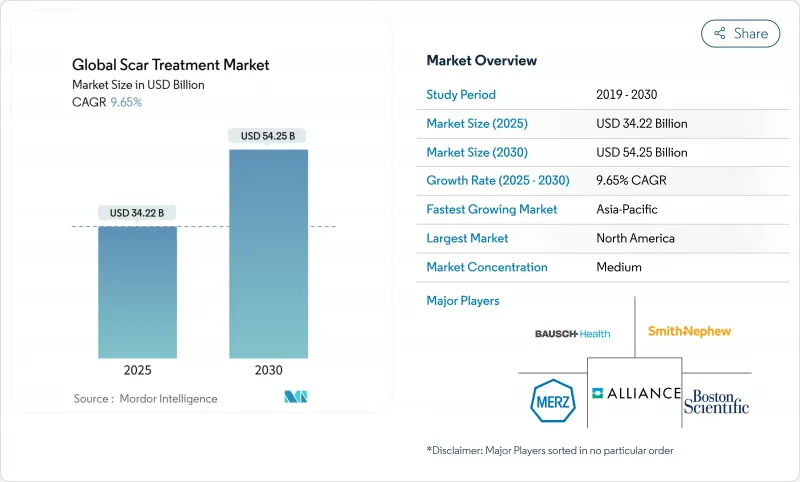

Global Scar Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The scar treatment market stood at USD 34.22 billion in 2025 and is projected to grow to USD 54.25 billion by 2030, advancing at a 9.65% CAGR.

Intensifying R&D in fractional lasers, RF-microneedling, and lysyl-oxidase inhibitor biologics is accelerating the shift from legacy silicone sheets to precision, clinic-grade solutions. Clinical validation of laser-assisted drug delivery platforms is shortening recovery times, while AI-enabled thermal monitoring is lowering the risk of post-inflammatory hyperpigmentation, a key adoption barrier in darker skin types. At the same time, expanding tele-dermatology networks in China and India are funneling new patient volumes into professional care settings. Counterfeit OTC products remain a drag on long-term brand equity, but device makers are countering with tamper-proof packaging and real-time verification apps. Strategic consolidation-such as the 2024 merger of Cynosure and Lutronic-signals an industry pivot toward vertically integrated portfolios and global service footprints.

Global Scar Treatment Market Trends and Insights

Increased Incidence of Road Accidents & Burn Injuries

Global burn fatalities surpassed 195,000 in 2024, with a disproportionate burden on low- and middle-income economies where prevention programs remain fragmented . Pediatric and geriatric cohorts exhibit heightened vulnerability, spurring demand for dedicated treatment algorithms and pediatric-safe dressings. The WHO Global Burn Registry, rolled out in late 2024, is standardizing trauma data and catalyzing evidence-based intervention reimbursements. Fast-rising motorcycle ownership in Indonesia and Vietnam is escalating soft-tissue injuries, creating predictable throughput for emergency wound care and subsequent scar remodeling services. These demographic and epidemiological trends collectively reinforce procedure volumes in both government and private facilities.

Growing Demand for Aesthetic Appearance & Scar-less Surgeries

Consumer willingness to invest in early scar management is expanding as social media normalizes elective dermatologic procedures. Medical spa locations in the United States approached 10,000 by late 2024, almost doubling capacity since 2018, and are forecast to rise to 12,000 by 2027. Minimally invasive techniques like micro-coring and fractional non-ablative lasers promise visible improvements with limited downtime, aligning with patient lifestyle preferences. Surgeons increasingly bundle intra-operative scar prevention protocols-such as stromal vascular fraction injections-into cosmetic procedures, cementing a preventative rather than corrective care mind-set. Those attitudinal shifts sustain premium pricing power for device makers offering user-friendly interfaces and shorter learning curves.

High Costs of Laser Procedures & Limited Insurance Coverage

Payers continue to classify most laser interventions as elective, reimbursing only cases that impede function, such as periorbital contractures that restrict eyelid mobility. Single-session fees span USD 200-3,400, and full correction often requires three to six treatments, placing advanced care beyond the reach of many middle-income households. Financing models-ranging from clinic-run installment plans to buy-now-pay-later fintech partnerships-are emerging stop-gaps. Nonetheless, cost exposure remains a headwind that curtails broader penetration of the scar treatment market, especially where public health insurance neither reimburses nor subsidizes aesthetic procedures.

Other drivers and restraints analyzed in the detailed report include:

- Rising Prevalence of Acne and Atrophic Scars

- Rapid Adoption of Advanced Laser & Energy-Based Devices

- Pipeline Breakthroughs in Anti-Fibrotic Biologics

- AI-Enabled Tele-Dermatology Expansion

- Adverse Events & Inconsistent Clinical Evidence for Some Topicals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Atrophic scars commanded the largest revenue pool in 2024 with 42.15%, reflecting the pervasive burden of acne sequelae on global urban populations. The scar treatment market size for atrophic lesions reached USD 12.1 billion and is projected to grow 8.3% annually as fractional lasers, micro-coring devices, and collagen-stimulating injectables converge in multi-session protocols. Hypertrophic scars, although accounting for a smaller baseline, are projected to rise at 12.2% CAGR through 2030 due to biologic breakthroughs that target aberrant fibroblast signaling.

Clinical data on FOXO4-DRI peptides demonstrated 42% volume reduction in keloid nodules by week 24, signaling a paradigm shift for patients historically unresponsive to steroids . Contracture scars remain a specialized niche, typically requiring surgical release followed by adjunctive energy-based therapy; however, micro-needling with topical siRNA is showing promise in early studies. Stretch marks, long relegated to cosmetic corners, now benefit from fractional picosecond lasers that deliver visible results in three sessions, broadening the revenue canvas for the scar treatment market.

Intense professional interest in recalcitrant keloids is attracting cross-disciplinary collaborations among plastic surgeons, molecular biologists, and data scientists. Predictive genomics platforms are mapping gene clusters associated with fibrotic overdrive, paving the way for prophylactic screening. As payers weigh the socio-economic costs of recurrent keloid excisions, biologic reimbursements could expand, injecting fresh momentum into the scar treatment industry. Simultaneously, the atrophic segment faces commoditization pressure as numerous OTC vitamin C serums crowd retail aisles; device makers respond with value-added services like AI-driven progress tracking apps to sustain differentiation.

Topical formulations retained a 65.25% scar treatment market share in 2024 owing to convenience, price accessibility, and entrenched consumer habits. Yet revenue mix is tilting: injectables and implantables are scaling at 10.75% CAGR, poised to seize incremental share as practitioners combine regenerative fillers with autologous fat grafting for volumetric restoration.

Laser and energy-based devices benefited from dual-wavelength innovations such as the 1550/1927 nm Fraxel FTX launched in April 2025, which reduces erythema and downtime while extending penetration depths. Silicone sheets, once the gold standard for post-operative scars, now face competition from botanical-infused hydrogels featuring licorice extract for tyrosinase inhibition.

Profit pools are gravitating to clinics that bundle topicals with device-based sessions, delivering a full-cycle solution that locks in patient retention. OTC brands combat revenue leakage by debuting smartphone-linked refill subscriptions, ensuring steady engagement. In 2026, dermal bioprinting cartridges are expected to enter pilot programs, potentially blurring categorical lines between injectables and devices, and further signaling the dynamic evolution within the scar treatment market.

The Report Covers Scar Removal Treatment Market Insights and It is Segmented by Scar Type (Atrophic Scars, Hypertrophic, and Keloid Scars, Contracture Scars, Others), Product Type (Topical Product, Laser Product, Injectable Product, Others), End-User (Hospitals/Clinics, Retail Drug Stores, E-Commerce Stores), and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa, and South America).

Geography Analysis

North America secured 41.25% of the scar treatment market in 2024, leveraging high discretionary spending and fast-track regulatory pathways that moved three new laser systems and two biologics from submission to clearance within 14 months. Despite saturation in coastal metro areas, secondary cities are fueling new clinic openings, aided by state-level tele-medicine parity laws that widen referral funnels.

Asia-Pacific is the principal growth engine, set to expand at 11.15% CAGR to 2030. China's dermatology sector grew revenues to RMB 673 million (USD 94.2 million) in 2024 on the back of IPO-funded clinic rollouts. India's National Health Digital Mission is onboarding tele-dermatology modules that elevate rural access, while South Korean device exporters leverage K-FDA harmonization to penetrate ASEAN markets rapidly. Persistent counterfeit product circulation remains a hurdle, prompting regional regulators to pilot QR-code verification for licensed OTC gels.

Europe maintains steady single-digit growth as stringent CE-mark standards underpin consumer trust. Galderma obtained European Commission approval in late 2024 for nemolizumab, expanding biologic options for pruritic scars and reinforcing Europe's position as a springboard for global launches. Middle East & Africa and South America collectively represent under 15% of current revenues but are registering double-digit clinic expansions in affluent urban corridors. Brazil's ANVISA now recognizes FDA predicates, trimming device localization timelines by up to 12 months and improving ROI for exporters.

- Smiths Group

- Merz Pharma

- Bausch Health

- Cynosure LLC (Hologic)

- Lumenis

- Alliance Pharma plc

- Sonoma Pharmaceuticals Inc.

- Molnlycke Health Care

- Suneva Medical

- Sientra

- Avita Medical Inc.

- Cutera

- Candela Medical

- Organogenesis

- Solta Medical (Bausch)

- Perrigo Company

- Galderma

- Novartis

- RXi Pharmaceuticals

- Pac-Derm (BIOCORNEUM)

- ScarAway (Perrigo)

- Scar Heal Inc.

- Anika Therapeutics

- PolyNovo Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased incidence of road accidents & burn injuries

- 4.2.2 Growing demand for aesthetic appearance & scar-less surgeries

- 4.2.3 Rising prevalence of acne and atrophic scars

- 4.2.4 Rapid adoption of advanced laser & energy-based devices

- 4.2.5 Clinical pipeline breakthroughs in lysyl-oxidase inhibitors & anti-fibrotic biologics

- 4.2.6 AI-enabled tele-dermatology driving early intervention in emerging markets

- 4.3 Market Restraints

- 4.3.1 High costs of laser procedures & limited insurance coverage

- 4.3.2 Adverse events & inconsistent clinical evidence for some topical agents

- 4.3.3 Proliferation of counterfeit / sub-standard OTC scar products in Asia & Africa

- 4.3.4 Dermatologist scepticism toward gene-editing approaches

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

5 Market Size & Growth Forecasts

- 5.1 By Scar Type

- 5.1.1 Atrophic & Acne Scars

- 5.1.2 Hypertrophic Scars

- 5.1.3 Keloid Scars

- 5.1.4 Contracture Scars (Burn & Post-surgical)

- 5.1.5 Stretch Marks

- 5.1.6 Others

- 5.2 By Product Type

- 5.2.1 Topical Formulations

- 5.2.1.1 Silicone Sheets & Sprays

- 5.2.1.2 Creams & Ointments

- 5.2.1.3 Gels & Serums

- 5.2.1.4 Botanical & Herbal Topicals

- 5.2.2 Laser & Energy-based Devices

- 5.2.2.1 CO2 Fractional Lasers

- 5.2.2.2 Pulsed-dye Lasers

- 5.2.2.3 Er:YAG & Nd:YAG Lasers

- 5.2.2.4 RF & Ultrasound Devices

- 5.2.3 Injectable & Implantables

- 5.2.3.1 Dermal Fillers

- 5.2.3.2 Corticosteroid Injections

- 5.2.3.3 Autologous Fat Grafting

- 5.2.4 Surgical & Other Procedures

- 5.2.4.1 Excision & Skin Grafting

- 5.2.4.2 Micro-needling & PRP

- 5.2.4.3 Cryotherapy & Radiation

- 5.2.1 Topical Formulations

- 5.3 By Treatment Modality

- 5.3.1 Over-the-Counter (OTC)

- 5.3.2 Prescription (Rx)

- 5.3.3 In-clinic Procedures

- 5.4 By End User

- 5.4.1 Hospitals & Specialty Clinics

- 5.4.2 Dermatology & Aesthetic Centers

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Smith & Nephew plc

- 6.3.2 Merz Pharma GmbH & Co. KGaA

- 6.3.3 Bausch Health Companies Inc.

- 6.3.4 Cynosure LLC (Hologic)

- 6.3.5 Lumenis Be Ltd.

- 6.3.6 Alliance Pharma plc

- 6.3.7 Sonoma Pharmaceuticals Inc.

- 6.3.8 Molnlycke Health Care AB

- 6.3.9 Suneva Medical Inc.

- 6.3.10 Sientra Inc.

- 6.3.11 Avita Medical Inc.

- 6.3.12 Cutera Inc.

- 6.3.13 Candela Medical

- 6.3.14 Organogenesis Holdings Inc.

- 6.3.15 Solta Medical (Bausch)

- 6.3.16 Perrigo Company plc

- 6.3.17 Galderma SA

- 6.3.18 Novartis AG

- 6.3.19 RXi Pharmaceuticals

- 6.3.20 Pac-Derm (BIOCORNEUM)

- 6.3.21 ScarAway (Perrigo)

- 6.3.22 Scar Heal Inc.

- 6.3.23 Anika Therapeutics Inc.

- 6.3.24 PolyNovo Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment