PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842477

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842477

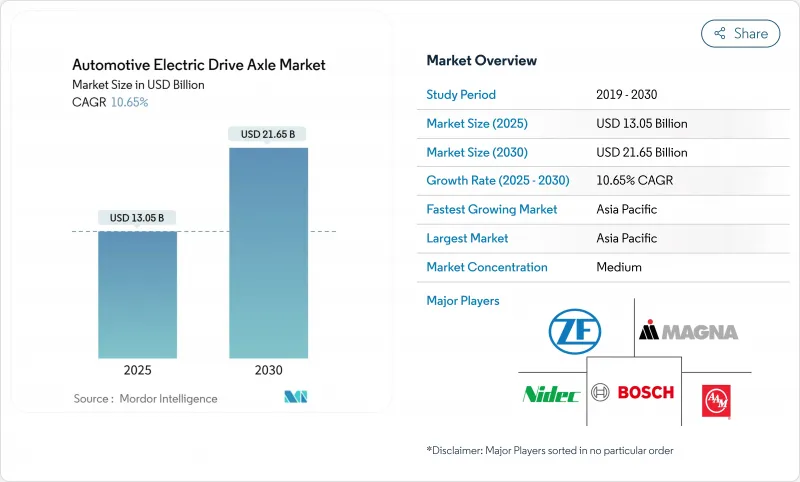

Automotive Electric Drive Axle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive electric drive axle market size is valued at USD 13.05 billion in 2025 and is forecast to reach USD 21.65 billion by 2030, advancing at a 10.65% CAGR.

The accelerating move to zero-emission mobility, mandated fleet CO2 targets, and faster battery cost declines are anchoring steady volume visibility for e-axle suppliers. Model launches built on 800 V systems, the rise of integrated 4-in-1 solutions, and expanded production footprints in Asia-Pacific are compressing cost curves and widening addressable demand. Competitive positioning now hinges on thermal-management know-how, rare-earth magnet alternatives, and the ability to package software-defined torque-vectoring features. Conversion kits for in-service vehicles, higher-margin dual-motor layouts for SUVs and pickups, and public subsidies for domestic drivetrain content are opening additional revenue pools across the automotive electric drive axle market.

Global Automotive Electric Drive Axle Market Trends and Insights

OEM Electrification Road-maps Accelerate E-axle Demand

Firm multi-year production targets from global automakers are giving Tier-1 suppliers unusually clear visibility into order volumes, encouraging larger capital outlays for dedicated e-axle lines and localized component sourcing. BMW's sixth-generation eDrive for the Neue Klasse raises drivetrain efficiency by 20% while supporting both rear- and all-wheel layouts across sedans, SUVs, and compact crossovers. ZF has already booked EUR 31 billion in high-voltage e-mobility orders, demonstrating how locked-in road maps convert directly into binding, bankable contracts for suppliers.

Government Zero-emission Mandates and Purchase Incentives

Binding sales quotas and steep non-compliance penalties are turning e-axle adoption from a discretionary choice into a regulatory requirement. The UK ZEV mandate starts with 22% electric sales in 2024 and climbs to 100% by 2035, backed by GBP 15,000 fines per non-compliant vehicle that materially exceed drivetrain cost premiums. California's Advanced Clean Cars II rule compels 100% zero-emission light-duty sales by 2035 and full medium- and heavy-duty fleet conversion by 2036, cementing demand irrespective of short-term fuel-price swings .

Rare-earth Magnet Price Volatility

Sharp swings in neodymium and dysprosium pricing are eroding margin predictability and pushing manufacturers toward alternative magnet chemistries or excitation technologies. Nissan targets a 30% motor-cost cut by substituting samarium-iron magnets, reducing exposure to supply chains concentrated in one geography. GE Aerospace's 23 kW dual-phase magnetic motor eliminates dysprosium yet improves power density, proving that performance compromises are no longer inevitable when moving away from rare-earth materials .

Other drivers and restraints analyzed in the detailed report include:

- Battery-pack Cost Falls Below USD 80/kWh, Widening E-axle Affordability

- Surge in Battery-electric SUV and Pickup Launches

- Up-front Cost Gap vs. Conventional Drivelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery-electric axles delivered 74.05% of 2024 volumes, underscoring their centrality in the automotive electric drive axle market. Mass-production scale, rapid charger rollouts, and policy preference for zero-tailpipe emissions anchor this lead. Hybrid e-axles address transitional duty cycles, while fuel-cell axles, though nascent, are pacing at an 11.24% CAGR on the back of heavy-duty truck pilots and bus trials. The automotive electric drive axle market size for fuel-cell platforms is projected to rise alongside hydrogen infrastructure, aided by projects such as Symbio's 400 kW StackPack for Class 8 trucks. California's support for bus deployments validates long-haul promise.

Growing OEM interest in fuel-cell range extenders and national hydrogen strategies suggests a gradual broadening of powertrain diversity. Suppliers that can tailor modular housings to either battery-electric or fuel-cell stacks will hedge volume risk as fleet operators experiment with both technologies.

A 42.85% share still resides with 3-in-1 units that merge motor, gear, and inverter, offering cost-effective packaging within current cooling envelopes. Yet customer RFQs now favor 4-in-1 layouts that also integrate thermal loops, lifting that segment at an 11.50% CAGR. The automotive electric drive axle market size attached to 4-in-1 designs is forecast to compound as wide-bandgap semiconductors reduce heat rejection and enable smaller cooling circuits. Schaeffler's solution combines all elements into a 70 kg module that fits compact C-segment vehicles.

Thermal complexity still caps adoption in high-performance EVs where sustained power loads demand separate chillers. Suppliers are investing in phase-change materials and split-loop architectures to extend peak-power windows without raising mass.

The Automotive Electric Drive Axle Market Report is Segmented by Propulsion Type (Battery-Electric Axle, Hybrid Axle, and More), Integration Level (2-In-1 (Motor, and Gear), 3-In-1 (Motor, Gear, and Inverter), and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Sales Channel (OEM-Fitted and Aftermarket Retrofit Kits), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 45.11% of 2024 revenue and is expanding at a 12.33% CAGR, making it the gravitational center of the automotive electric drive axle market. China produced more than 70% of global EVs in 2024, giving local e-axle makers unmatched scale advantages. State subsidies, domestic mining of battery materials, and aggressive quota targets sustain high plant-utilization rates. HSBC forecasts the region will represent over 60% of new EV sales by 2030. Japanese Tier-1s are pivoting quickly: Nidec is optimizing smaller e-motors tailored to low-cost micro EVs, while midsize suppliers are pooling R&D to close technology gaps.

North America is building momentum around electric pickups and policy-driven local content rules. The Inflation Reduction Act ties consumer rebates to regionally sourced drivetrains, steering fresh investment into axle assembly lines. BorgWarner reported a 47% year-on-year rise in e-product sales for Q1 2025, reflecting strong ramp-ups at US OEM plants. American Axle's e-Beam targets this truck wave with 150 kW output for body-on-frame platforms.

Europe maintains a lead in premium EV engineering underpinned by stringent fleet CO2 rules. The 22% electric sales mandate in 2024, moving to 100% by 2035, ensures steady axle demand despite a softer macro backdrop. ZF is partnering with IVECO BUS for integrated driveline solutions while courting Foxconn for digital chassis systems. Thermal-management innovation and 800 V adoption shape tenders as brands strive for extended range on high-speed German motorways. Meanwhile, emerging ASEAN markets eye a 16-39% EV CAGR through 2035, though financing and charging infrastructure must mature before large-scale axle assembly shifts south.

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Magna International Inc.

- Nidec Corporation

- American Axle & Manufacturing

- Dana Inc.

- GKN Automotive

- Schaeffler AG

- BorgWarner Inc.

- Aisin Corporation

- Cummins Inc.

- Valeo SA

- Hitachi Astemo

- BYD Co. Ltd.

- Hyundai Mobis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OEM electrification road-maps accelerate e-axle demand

- 4.2.2 Government zero-emission mandates and purchase incentives

- 4.2.3 Battery-pack cost falls below USD 80/kWh, widening e-axle affordability

- 4.2.4 Surge in battery-electric SUV and pickup launches

- 4.2.5 Shift to 800 V architectures requiring next-gen axle designs

- 4.2.6 Monetization of software-defined torque-vectoring via e-axle data services

- 4.3 Market Restraints

- 4.3.1 Rare-earth magnet price volatility

- 4.3.2 Up-front cost gap vs. conventional drivelines

- 4.3.3 OEM insourcing squeezing Tier-1 addressable market

- 4.3.4 Thermal-management limits at 4-in-1 integration level

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Propulsion Type

- 5.1.1 Battery-Electric Axle

- 5.1.2 Hybrid Axle

- 5.1.3 Fuel-Cell Electric Axle

- 5.2 By Integration Level

- 5.2.1 2-in-1 (Motor, and Gear)

- 5.2.2 3-in-1 (Motor, Gear, and Inverter)

- 5.2.3 4-in-1 (Motor, Gear, Inverter, and Thermal)

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Off-Highway and Specialty (Construction and Agriculture)

- 5.4 By Sales Channel

- 5.4.1 OEM-Fitted

- 5.4.2 Aftermarket Retrofit Kits

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 ZF Friedrichshafen AG

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Magna International Inc.

- 6.4.4 Nidec Corporation

- 6.4.5 American Axle & Manufacturing

- 6.4.6 Dana Inc.

- 6.4.7 GKN Automotive

- 6.4.8 Schaeffler AG

- 6.4.9 BorgWarner Inc.

- 6.4.10 Aisin Corporation

- 6.4.11 Cummins Inc.

- 6.4.12 Valeo SA

- 6.4.13 Hitachi Astemo

- 6.4.14 BYD Co. Ltd.

- 6.4.15 Hyundai Mobis

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment