PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842479

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842479

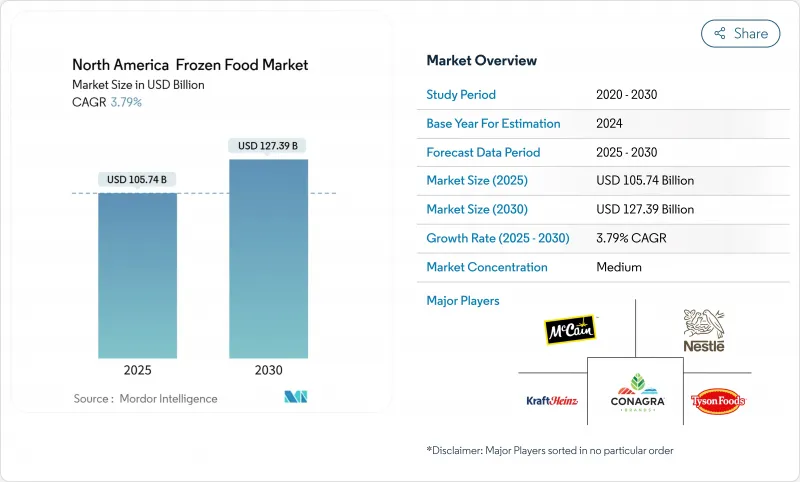

North America Frozen Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America frozen food market size reached USD 105.74 billion in 2025 and is forecast to advance at a 3.79% CAGR, lifting the value to USD 127.39 billion by 2030.

North America's appetite for frozen food is surging, propelled by a confluence of regional factors. One of the primary factors is the region's fast-paced lifestyle, coupled with an uptick in women's workforce participation, amplifying the demand for convenient meal solutions. As a result, consumers are gravitating towards ready-to-eat and ready-to-cook frozen meals that seamlessly fit into their hectic routines. Bolstering this trend is the region's robust cold chain infrastructure and the omnipresence of modern retail outlets, like supermarkets and hypermarkets, ensuring a broad spectrum of frozen products is readily available. Heightened health awareness among North Americans is steering them towards the rising trend of clean-label and organic frozen foods, further shaping market dynamics.On another front, technological strides in food preservation and packaging are not only enhancing the quality and shelf life of frozen items but also amplifying their allure.

North America Frozen Food Market Trends and Insights

Rising demand for convenience meal solutions among U.S. Millennials and Gen Z

Millennials and Generation Z consumers, who are in their prime years for household formation, show a strong preference for frozen food products that combine convenience with variety. Their busy lifestyles and need for quick meals drive this trend. According to the United States Census Bureau, millennials are the largest generation group in the United States as of 2024, comprising approximately 74.19 million people .Consumption patterns have evolved from traditional appetizers to main meals in bite-sized and miniature formats, particularly among urban residents and young professionals. This change reflects modern lifestyle demands, where conventional meal structures have given way to flexible eating schedules. Food manufacturers have responded by incorporating premium ingredients and chef-developed recipes, establishing frozen foods as primary meal options. The increasing household adoption of frozen foods indicates growth potential in entree and snack categories, supported by improvements in packaging, portion control, and nutritional content. Manufacturers now prioritize sustainable packaging solutions and clean-label products to address consumer demands for environmental responsibility and transparency. The market has also expanded into plant-based and organic frozen food options to accommodate health-conscious consumers and various dietary preferences.

Innovation in plant-based frozen entrees boosting health-positioned offerings

The United States market shows significant advancement in plant-based frozen entrees, particularly in health-focused offerings. This development addresses consumer demand for convenient, nutritious meal options that accommodate various dietary preferences. Companies use advanced culinary techniques and quality ingredients to create nutritious plant-based frozen meals. In July 2024, Unlimeat, a Korean plant-based food brand, launched five products across 149 Giant and Martin's stores. The company's products meet the increasing demand for plant-based foods by offering alternatives to traditional meats. This expansion introduces Korean-style plant-based options to the US market, broadening consumer choice in sustainable food products. The product lineup includes plant-based meat and convenient meals like frozen kimbap products. Consumer awareness of food-related environmental impacts drives the demand for plant-based frozen options. This transformation in frozen meal offerings indicates a shift toward health-focused and sustainable food products in the United States. Moreover, the emergence of GLP-1 weight management has created demand for portion-controlled, calorie-specific products. Conagra responded by introducing GLP-1 friendly labels on Healthy Choice frozen meals in January 2025. These changes have improved the perception of frozen foods among health-conscious consumers who previously avoided the category.

Perceived nutritional inferiority vs fresh produce among affluent consumers

Frozen fruits and vegetables provide comparable nutritional value to fresh produce, with studies demonstrating equivalent levels of vitamins, minerals, and antioxidants. However, many high-income households remain hesitant to purchase frozen foods, often perceiving them as inferior alternatives to fresh options. This hesitation is particularly evident among millennials, who have concerns about additives, processing methods, and potential quality loss during storage. The International Food Information Council Food and Health Survey 2024 reveals that 62% of consumers prioritize health benefits over price in their food purchasing decisions highlighting the importance of addressing quality perceptions . Companies are addressing these perceptions through transparent communication about flash-freezing processes, ingredient sourcing, and preservation methods. The adoption of clear labeling practices, detailed nutritional information, and third-party certifications by manufacturers is helping reduce consumer skepticism and build trust in frozen food products.

Other drivers and restraints analyzed in the detailed report include:

- Targeted marketing and advertisements elevating frozen food sales

- Technological advancements in freezing and packaging

- Rising competition from fresh meal kits and delivery services

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Frozen Ready Meals dominated the market with a 34.12% share in 2024, reflecting their alignment with modern lifestyles. The segment continues to grow through improvements in sauce quality, pasta texture, and air-fryer compatibility. Frozen Snacks, including pizza bites and dumplings, are expected to achieve the highest growth rate at 6.21% CAGR (2025-2030), driven by the increasing trend of snacks replacing traditional meals. While meat and poultry maintain a significant market presence, the Seafood segment shows higher growth rates as consumers seek convenient, lean protein options.

The fruit and vegetable segment maintains steady market presence despite quality perception challenges, addressing these through farm-traceability QR codes and advanced flash-steaming processes to maintain nutritional value. Market innovation continues to target specific health requirements. For instance, in May 2024, Nestle launched Vital Pursuit, a frozen food line designed for GLP-1 weight loss medication users and weight-conscious consumers in the US. These products feature high protein content, substantial fiber, essential nutrients, and portions specifically designed for reduced appetite profiles.

The North America Frozen Food Market Report Segments the Industry Into Product Type (Frozen Fruit and Vegetable, Frozen Meat and Seafood, Frozen Ready Meals, and More), Category (Ready-To-Eat and Ready-To-Cook), Distribution Channel (Retail and Foodservice (HoReCa)), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Conagra Brands Inc.

- Tyson Foods Inc.

- Nestle S.A

- McCain Foods Limited

- Ajinomoto Co. Inc.

- General Mills Inc.

- Kraft Heinz Company

- Kellanova

- Smithfield Foods Inc.

- Maple Leaf Foods Inc.

- Hormel Foods Incorporation

- JBS USA Holdings Inc.

- BandG Foods Inc.

- Wawona Frozen Foods Inc.

- High Liner Foods Incorporated

- Beyond Meat Inc.

- The Hain Celestial Group Inc.

- Amy's Kitchen Inc.

- Rich Products Corporation (SeaPak Shrimp and Seafood Co.)

- Gorton's Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for convenience meal solutions among Millennials and Gen Z

- 4.2.2 Innovation in plant-based frozen entrees

- 4.2.3 Targeted marketing and advertisements elevating frozen food sales

- 4.2.4 Technological advancements in freezing and packaging

- 4.2.5 Growing ethnic and global cuisine options

- 4.2.6 Increasing frozen aisles in retail channels

- 4.3 Market Restraints

- 4.3.1 Perceived nutritional inferiority vs fresh produce among affluent consumers

- 4.3.2 Rising competition from fresh meal kits and delivery services

- 4.3.3 Perceptions around ultra-processed frozen product

- 4.3.4 Energy costs for freezing and storage

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Frozen Fruit and Vegetables

- 5.1.2 Frozen Meat and Poultry

- 5.1.3 Frozen Seafood

- 5.1.4 Frozen Ready Meals

- 5.1.5 Frozen Bakery and Desserts

- 5.1.6 Frozen Snacks

- 5.1.7 Others

- 5.2 By Category

- 5.2.1 Ready-to-eat

- 5.2.2 Ready-to-cook

- 5.3 By Distribution Channel

- 5.3.1 Foodservice (HoReCa)

- 5.3.2 Retail

- 5.3.2.1 Supermarkets and Hypermarkets

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Online Stores

- 5.3.2.4 Other Retail Formats

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Conagra Brands Inc.

- 6.4.2 Tyson Foods Inc.

- 6.4.3 Nestle S.A

- 6.4.4 McCain Foods Limited

- 6.4.5 Ajinomoto Co. Inc.

- 6.4.6 General Mills Inc.

- 6.4.7 Kraft Heinz Company

- 6.4.8 Kellanova

- 6.4.9 Smithfield Foods Inc.

- 6.4.10 Maple Leaf Foods Inc.

- 6.4.11 Hormel Foods Incorporation

- 6.4.12 JBS USA Holdings Inc.

- 6.4.13 BandG Foods Inc.

- 6.4.14 Wawona Frozen Foods Inc.

- 6.4.15 High Liner Foods Incorporated

- 6.4.16 Beyond Meat Inc.

- 6.4.17 The Hain Celestial Group Inc.

- 6.4.18 Amy's Kitchen Inc.

- 6.4.19 Rich Products Corporation (SeaPak Shrimp and Seafood Co.)

- 6.4.20 Gorton's Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK