PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842483

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842483

Automotive Automatic Tire Inflation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

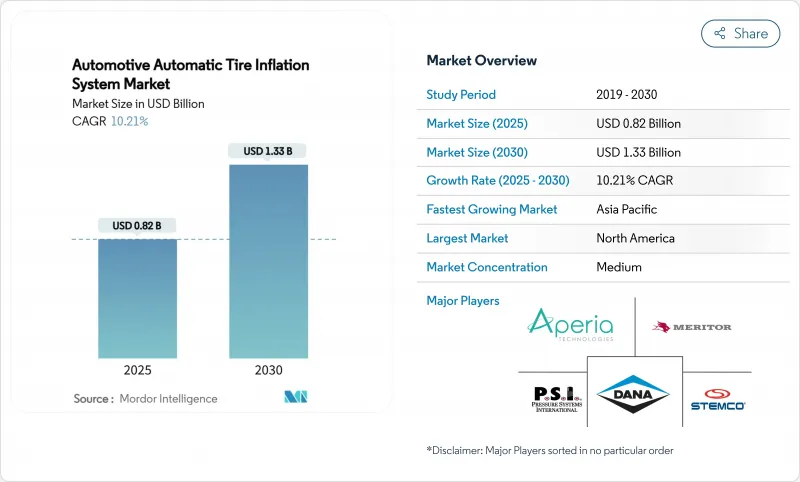

The automotive automatic tire inflation system market size registers a valuation of USD 0.82 billion in 2025 and is forecast to reach USD 1.33 billion by 2030, advancing at a 10.21% CAGR.

Growth reflects coordinated safety regulations, fleet cost-reduction imperatives, and tighter integration with connected-vehicle architectures. North American fleets must comply with 49 CFR 393.75 cold-inflation rules, while the European Union's General Safety Regulation II requires tire-pressure monitoring across all new vehicles, indirectly cementing demand for fully automatic inflation capabilities. Commercial fleets realize up to 1.4% fuel savings when tires remain at correct pressure, sharpening return on investment for automatic systems . In parallel, agricultural and construction equipment makers embed central pressure control to meet soil-conservation mandates and precision-farming needs, as seen in Fendt's VarioGrip that varies pressure from 8.7 to 36.3 PSI while in motion. Investment momentum is buoyed by venture funding, illustrated by Aperia Technologies' USD 45 million raise that targets hub-mounted self-powered inflators.

Global Automotive Automatic Tire Inflation System Market Trends and Insights

Rising Fleet Focus on Fuel and Tire-Wear Cost Reduction

Tire expenditures represent 15-20% of heavy-truck operating budgets, and under-inflation generates up to 95% of roadside tire failures. Pressure Systems International quantifies 1.4% mean fuel gains and 10% tire-life extension when automatic inflation is installed . Data-rich platforms deliver live pressure, temperature, and load information, letting dispatchers optimize speed profiles and maintenance windows. Long-haul carriers accrue the greatest absolute benefit because incremental savings compound across annual mileages that exceed 120,000 miles per tractor. Consequently, procurement teams embed total cost-of-ownership models that prioritize automatic inflation during tractor and trailer replacement cycles.

Stringent Global Tire-Safety Regulations

Worldwide statutes are elevating tire-maintenance discipline. The EU General Safety Regulation II, effective July 2024, mandates tire-pressure monitoring on every newly homologated vehicle category except M1, creating a universal baseline that encourages automatic inflation upgrades. Complementary Euro 7 rules set tire-abrasion caps with 2032 compliance deadlines . In the United States, Federal Motor Carrier Safety Administration inspectors enforce cold-inflation minimums during roadside checks, prompting large fleets to deploy automated systems to avoid citations. Similar provisions are cascading into South America and Southeast Asia as export-oriented OEMs harmonize with EU standards. As a result, fleet managers perceive automotive automatic tire inflation system market adoption as a compliance necessity that also unlocks operational savings.

High Upfront Cost and Integration Complexity

System packages range from USD 1,500 to USD 5,000 per vehicle. Retrofit projects add labor hours and potential downtime that many small carriers cannot absorb. Commercial tire dealers note budget-constrained operators delaying upgrades until capex cycles align, even though break-even analysis often shows payback inside 18 months. Training technicians, calibrating sensors, and harmonizing software with legacy electronic control units further slow adoption in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Commercial-Vehicle Parc and Freight Activity

- OEM Integration with Advanced TPMS and Connected Platforms

- Reliability and Maintenance Issues in Harsh Duty Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium and heavy commercial vehicles accounted for 66.82% of the automotive automatic tire inflation system market revenue in 2024, underscoring the sector's outsized influence on the automotive automatic tire inflation system market. Elevated annual mileage, multi-axle configurations, and fuel-spend sensitivity combine to produce compelling investment cases for automatic inflation. Remote diagnostics and over-the-air pressure calibration let dispatchers minimize roadside service calls and preserve delivery schedules. Adoption is now filtering into regional haul and final-mile trucks as OEMs standardize inflation ports and data protocols across model lines.

Off-highway equipment exhibits the sharpest trajectory at an 11.84% CAGR through 2030. Precision agriculture mandates gentle soil loading to protect yield, while construction and military vehicles require fast adjustments between asphalt, gravel, and mud. Fendt's in-cab VarioGrip toggles pressure inside seconds, boosting tractive efficiency and cutting compaction, and similar offerings from John Deere and CNH Industrial signal an industry shift toward embedded pressure control. Light commercial vans and passenger cars participate more modestly, yet EU safety rules and consumer preference for advanced driver-assistance features are nudging OEMs to incorporate scaled-down automatic inflation modules.

On-road tires secured 72.41% of the automotive automatic tire inflation system market revenue in 2024, anchored by cross-continental trucking, where under-inflation steals fuel economy on every highway mile. Automated systems continuously regulate cold-inflation levels regardless of ambient swings that might lead to chronic under-pressure in conventional weekly-check routines. Fleet telematics dashboards integrate pressure KPIs alongside hours-of-service readouts, and managers benchmark depots on compliance percentages that correlate directly with diesel spend.

Off-road tires are climbing at a 12.29% CAGR, reflecting investment in smart machinery for quarrying, forestry, and agriculture. Michelin's central system posts up to 4% productivity lifts and 10% fuel savings by tailoring pressure to soil type. Studies show that correct pressure can trim soil compaction depth by one-third, preserving arable land and reducing tillage energy. Similarly, wheel-loader operators report lower tire-related downtime after installing closed-loop inflation that alerts them before sidewall pinch damage occurs. These benefits cement future demand even as upfront pricing remains a barrier for smaller contractors.

The Automotive Automatic Tire Inflation System Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application (On-The-Road Tires and Off-The-Road Tires), Sales Channel (OEM and Aftermarket), Product Type (Central Tire Inflation Systems (CTIS), Continuous/Wheel-End Inflators, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 39.81% revenue of the automotive automatic tire inflation system market in 2024, buoyed by well-defined regulatory frameworks and mature telematics penetration. Federal enforcement of tire-pressure rules prompts carriers to adopt automatic solutions as insurance against roadside fines. Large for-hire fleets cite 1-3% diesel savings and 15-20% tire-life gains, outcomes that reinforce board-level sustainability pledges. The region also hosts expansive pilots for driverless freight corridors, and autonomous developers require redundant tire-health systems that remove the driver from the maintenance loop.

Asia-Pacific posts the quickest ascent at 12.19% CAGR through 2030. Explosive e-commerce shipping volumes, extensive highway build-outs, and the push for electrified powertrains sharpen the economic rationale for automatic inflation. India's logistics overhaul seeks to trim the 12-14% GDP drain tied to freight costs, and correcting tire pressure is a visible lever. Chinese OEMs such as FAW and Sinotruk integrate inflation valves on new energy trucks to extend battery range, positioning the automotive automatic tire inflation system market as a standard efficiency measure.

Europe remains consistent, guided by Union-wide safety and environmental directives. Regulation II obliges TPMS on every new vehicle, and Euro 7 introduces abrasion limits that depend heavily on optimum pressure. Operators in Germany and France combine inflation data with carbon reporting to satisfy customer Scope 3 disclosure requests. The Middle East and Africa trail in overall penetration, yet oil-exporting economies funnel infrastructure funds into vocational fleet upgrades, which lifts baseline demand even if service-center density lags.

- Aperia Technologies, Inc.

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Meritor, Inc.

- STEMCO Products Inc.

- CODA Development

- Denso Corporation

- Pressure Systems International, Inc.

- Dana Incorporated

- Michelin Group

- Hendrickson International

- ti.systems GmbH

- FTL Technology

- Parker Hannifin Corporation

- Haltec Corporation

- Trelleborg AB

- SKF Group

- Haldex AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising fleet focus on fuel and tire-wear cost reduction

- 4.2.2 Stringent global tire-safety regulations

- 4.2.3 Expanding commercial?vehicle parc and freight activity

- 4.2.4 OEM integration with advanced TPMS and connected platforms

- 4.2.5 Autonomous-trucking demand for predictive tire health

- 4.2.6 Agricultural shift to on-the-go soil-conserving pressure control

- 4.3 Market Restraints

- 4.3.1 High upfront cost and integration complexity

- 4.3.2 Reliability and maintenance issues in harsh duty cycles

- 4.3.3 Limited global aftermarket service ecosystem

- 4.3.4 Cyber-security vulnerabilities in connected ATIS

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.1.4 Off-Highway Vehicles (Agricultural, Construction, Military)

- 5.2 By Application

- 5.2.1 On-the-Road Tires

- 5.2.2 Off-the-Road Tires

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Product Type

- 5.4.1 Central Tire Inflation Systems (CTIS)

- 5.4.2 Continuous/Wheel-End Inflators

- 5.4.3 Self-Powered Hub Inflators

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Aperia Technologies, Inc.

- 6.4.2 Bridgestone Corporation

- 6.4.3 Continental AG

- 6.4.4 Goodyear Tire & Rubber Company

- 6.4.5 Meritor, Inc.

- 6.4.6 STEMCO Products Inc.

- 6.4.7 CODA Development

- 6.4.8 Denso Corporation

- 6.4.9 Pressure Systems International, Inc.

- 6.4.10 Dana Incorporated

- 6.4.11 Michelin Group

- 6.4.12 Hendrickson International

- 6.4.13 ti.systems GmbH

- 6.4.14 FTL Technology

- 6.4.15 Parker Hannifin Corporation

- 6.4.16 Haltec Corporation

- 6.4.17 Trelleborg AB

- 6.4.18 SKF Group

- 6.4.19 Haldex AB

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment