PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842484

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842484

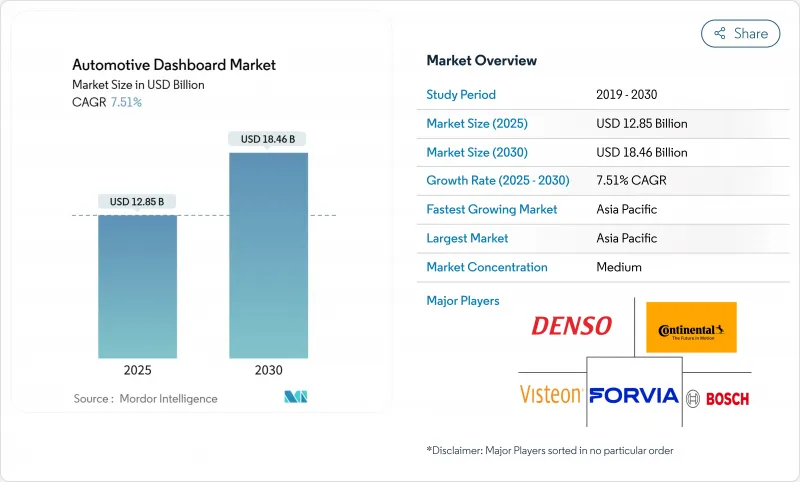

Automotive Dashboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive dashboard market size stands at USD 12.85 billion in 2025 and is forecast to reach USD 18.46 billion by 2030, reflecting a 7.51% CAGR.

Strong momentum comes from the shift toward fully digital cockpits, tighter global safety requirements for display readability, and rising electric-vehicle volumes that favor software-defined interiors. Original-equipment manufacturers (OEMs) are replacing analog clusters with configurable screens built on domain-controller architectures that cut electronic control unit counts and wiring complexity. Asia-Pacific continues to anchor production scale thanks to Chinese display-panel capacity and an expansive local EV supply chain. Meanwhile, hybrid dual-mode dashboards that blend physical controls with touch displays are gaining traction as OEMs prepare for European mandates that require tactile access to critical functions.

Global Automotive Dashboard Market Trends and Insights

EV Production Boom & Integrated Cockpits

Battery-electric architectures remove mechanical constraints, giving designers freedom to merge clusters, infotainment, and head-up displays into seamless surfaces. Yanfeng's EVI concept replaces the traditional instrument panel with seat-integrated Smart Cabin modules that showcase the possibilities of a flat EV floor. ECARX shipped 2 million digital cockpit units in 2024, mostly to Chinese EV makers, underscoring the scale effect of electrification.

Digital-Instrument-Cluster Adoption

Automakers are rapidly phasing out mechanical gauges in favor of software-configurable instrument clusters that streamline parts counts and enable continuous feature upgrades. BMW's Panoramic iDrive, slated for all new models from late 2025, eliminates physical dials and supports deep personalization through the BMW Operating System X. Broader acceptance extends into high-volume models as display prices fall, while regulators evaluate distraction risks and may require tactile redundancies for core functions.

Semiconductor Supply Constraints

Automotive dashboards rely heavily on mature-node microcontrollers that vie with industrial and IoT applications for foundry slots. Hurricane damage to high-purity quartz mining in North Carolina spotlighted the fragility of upstream materials and pushed lead times into the 40-week range in early 2024. Manufacturers mitigated risk through multi-sourcing and redesigns that tolerate alternative chipsets, yet the episode illustrated how thin inventory buffers can delay new-model launches.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Connected Infotainment & HMI

- Safety Regulations for Display Readability

- High Cost of OLED/Mini-LED Panels

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LCD/TFT clusters dominated 2024 with a 64.95% revenue share of the automotive dashboard market. Demand grows for hybrid dual-mode layouts that integrate rotary knobs or pushbuttons around a primary display, expanding at a 9.14% CAGR as OEMs hedge against upcoming European tactile-control rules.

Hybrid solutions balance cost targets with safety compliance. Suppliers such as Continental now integrate anti-reflection coatings and anti-fog treatments to keep LCDs competitive. Premium nameplates push into full-width curved OLEDs, yet volume models favor hybrids that allow phased upgrades without re-certification.

Passenger cars accounted for 76.31% of 2024 revenue, reflecting high production volumes and faster adoption of connected features. This segment is projected to advance at an 8.45% CAGR as owners value personalized interfaces and over-the-air upgrade paths.

Commercial fleets adopt digital dashboards more slowly, although light-duty delivery vans gain from telematics dashboards that automate route and maintenance data. Heavy trucks remain conservative, but electronic logging and safety mandates gradually raise digital cluster penetration.

The Automotive Dashboard Market Report is Segmented by Type (LCD/TFT Digital Dashboard and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM and Aftermarket), Component (Display Panel, Control Electronics and SoC, and More), Display Size (Less Than 7-Inch and More), Technology (LCD, OLED / Mini-LED, and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 49.55% of global revenue in 2024 and is expected to grow with a 9.54% CAGR to 2030. Chinese OEMs increasingly source dashboards and domain controllers in-house, improving cost leverage. Japan supplies high-reliability infotainment platforms, and South Korean firms secure export contracts that diversify regional production bases.

North America shows steady replacement demand as the light-vehicle parc ages. The United States light-duty aftermarket expanded 5.7% in 2024 to USD 413.7 billion, signaling headroom for retrofit dash upgrades. Connected-service subscription uptake, such as Ford Pro's telematics plans, underscores recurring-revenue potential.

Europe shapes global design trends through stringent safety assessments. Euro NCAP's 2026 requirement for physical access to key functions influences cockpit architectures worldwide. Software-defined vehicle strategies promise additional profit streams for regional OEMs, but success hinges on harmonizing cybersecurity and interface standards to offset cost pressure from electrification.

- Continental AG

- Robert Bosch GmbH

- Visteon Corporation

- DENSO Corporation

- Forvia SE (Faurecia SE)

- Hyundai Mobis Co. Ltd

- Panasonic Automotive Systems

- Nippon Seiki Co. Ltd

- Yazaki Corporation

- Magna International Inc.

- Valeo SA

- Marelli Holdings Co. Ltd

- Harman International Industries

- Aptiv PLC

- ECARX Holdings

- Huayu Automotive Systems Co. Ltd

- LG Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV production boom & integrated cockpits

- 4.2.2 Digital-instrument-cluster adoption

- 4.2.3 Demand for connected infotainment & HMI

- 4.2.4 Safety regulations for display readability

- 4.2.5 Low-cost domain-controller architectures

- 4.2.6 OTA-monetized software-defined dashboards

- 4.3 Market Restraints

- 4.3.1 Semiconductor supply constraints

- 4.3.2 High cost of OLED/mini-LED panels

- 4.3.3 Pending rules on display size/touch distraction

- 4.3.4 Cyber-security certification delays

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.7.6 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Type

- 5.1.1 LCD/TFT Digital Dashboard

- 5.1.2 Hybrid/Dual-mode Dashboard

- 5.1.3 Conventional Analog Dashboard

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.3 By Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Component

- 5.4.1 Display Panel

- 5.4.2 Control Electronics and SoC

- 5.4.3 Software/HMI Layer

- 5.4.4 Structural Trim and HVAC Interfaces

- 5.5 By Display Size

- 5.5.1 Less than 7-inch

- 5.5.2 7 to 11 inch

- 5.5.3 Above 11-inch

- 5.6 By Technology

- 5.6.1 LCD

- 5.6.2 OLED / Mini-LED

- 5.6.3 HUD-Integrated Cluster

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Egypt

- 5.7.5.4 Turkey

- 5.7.5.5 South Africa

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Visteon Corporation

- 6.4.4 DENSO Corporation

- 6.4.5 Forvia SE (Faurecia SE)

- 6.4.6 Hyundai Mobis Co. Ltd

- 6.4.7 Panasonic Automotive Systems

- 6.4.8 Nippon Seiki Co. Ltd

- 6.4.9 Yazaki Corporation

- 6.4.10 Magna International Inc.

- 6.4.11 Valeo SA

- 6.4.12 Marelli Holdings Co. Ltd

- 6.4.13 Harman International Industries

- 6.4.14 Aptiv PLC

- 6.4.15 ECARX Holdings

- 6.4.16 Huayu Automotive Systems Co. Ltd

- 6.4.17 LG Electronics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment