PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842488

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842488

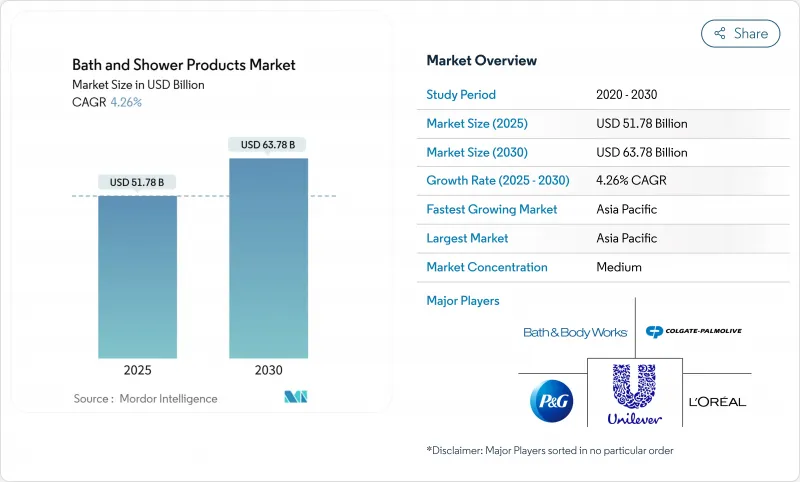

Bath And Shower Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bath and shower products market is estimated to be USD 51.78 billion in 2025 and is projected to reach USD 63.78 billion by 2030, representing a compound annual growth rate (CAGR) of 4.26%.

The market encompasses a diverse range of products, including body wash, shower gels, bar soaps, bath additives, and liquid soaps. This growth trajectory reflects a fundamental shift in consumer behavior toward premium personal care experiences, where traditional soap bars are increasingly displaced by sophisticated liquid formulations that promise enhanced skincare benefits. The market expansion is driven by increasing consumer awareness about personal hygiene and self-care routines, supported by rising disposable incomes in emerging economies and growing urbanization. Manufacturers have responded to market demands through significant product innovations, particularly in natural and organic formulations, addressing consumer preferences for sustainable and eco-friendly options. The industry has also witnessed enhanced product accessibility and market penetration through e-commerce platforms. Companies maintain their competitive position through product differentiation strategies, including innovative packaging, specialized formulations, and therapeutic benefits.

Global Bath And Shower Products Market Trends and Insights

Growing Demand for pH-Balanced, Sulfate-Free Products

The shift toward sulfate-free formulations represents a fundamental reformulation challenge that extends beyond marketing claims to core product chemistry. The increasing consumer awareness about skin health and pH balance has driven significant changes in the bath and shower products market, with consumers seeking products that maintain the skin's natural pH level of 5.5. According to the National Institute of Health, Sodium Lauryl Sulfate (SLS) can potentially irritate the eyes and skin, leading manufacturers to develop alternative formulations. For instance, in January 2024, Bath & Body Works demonstrated this industry transformation by reformulating its body care products without parabens and sulfates while maintaining their established scents. This trend is particularly relevant for consumers with sensitive skin conditions and those following clean beauty regimens, supported by dermatologists and skincare professionals who recommend pH-balanced and sulfate-free products for maintaining healthy skin. The growing preference for gentle formulations has created new opportunities in the premium and mid-range segments of the bath and shower products market.

Influence of Social Media and Celebrity Endorsement

Social media has transformed personal care purchasing decisions, evolving from basic product awareness to comprehensive ingredient education and routine optimization. The platforms have become essential marketing channels for bath and shower products, with Instagram, Facebook, and TikTok enabling direct consumer engagement and product discovery through visually appealing content and user-generated reviews. The shift toward digital beauty shopping behavior indicates that social media influence extends beyond discovery to purchase behavior modification, creating opportunities for brands to build direct-to-consumer relationships while gathering first-party data for personalization. According to a University of Portsmouth (2024) survey, 60% of consumers trust influencer recommendations, with nearly half of all purchasing decisions influenced by these endorsements . This trend is exemplified by launches such as Selena Gomez's Rare Beauty body care collection in June 2024. Major brands continue to collaborate with celebrities to create signature product lines and marketing campaigns, leveraging their substantial social media following to drive market growth and brand awareness.

Proliferation of Counterfeit Products

Counterfeit personal care products present significant challenges to market growth through multiple channels. These fake products, manufactured with substandard ingredients and poor quality control measures, create dual threats through consumer safety risks and brand equity erosion that undermines premium positioning strategies. The sophistication of counterfeit operations has evolved to include near-perfect packaging replication and distribution through legitimate-appearing online channels, making detection increasingly difficult for consumers. This challenge is particularly acute in emerging markets where price sensitivity creates demand for lower-cost alternatives, even when authenticity is questionable. Furthermore, the acquisition of counterfeit products by uninformed consumers results in negative outcomes, which damages legitimate brand reputations and reduces consumer confidence in the market. The effectiveness of regulatory enforcement against counterfeiting varies across regions, with several markets lacking sufficient consumer and brand protection measures.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Inclination Towards Natural and Organic Products

- Increased Consumer Spending on Self-care Products

- Growing Health Concerns Over Product Safety and Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Body wash/shower gel dominates the bath and shower products market with a 36.80% share in 2024 and is projected to grow at a 4.53% CAGR through 2030. This dominance is attributed to their liquid formulations, which enable superior ingredient delivery systems for complex formulations incorporating moisturizers, vitamins, and active ingredients that are difficult to stabilize in solid formats. The convenience of application and storage has made these products increasingly popular among urban consumers. Additionally, manufacturers are continuously innovating with new fragrances and therapeutic formulations to meet evolving consumer preferences.

Bar soap maintains a substantial market presence through sustainability positioning and cost-effectiveness, particularly appealing to price-sensitive consumers in emerging markets. Manufacturers have expanded the category beyond basic cleansing by incorporating moisturizing properties and targeted benefits, while other product types, such as specialty cleansers and exfoliating products, serve specific consumer needs. The reduced packaging waste associated with bar soaps has resonated well with environmentally conscious consumers. Traditional bar soap manufacturers are also adapting to modern demands by introducing organic and natural ingredient-based formulations.

Conventional/synthetic ingredients dominate the market with a 68.55% share in 2024, while natural/organic alternatives grow at a 4.85% CAGR through 2030, reflecting a gradual shift toward cleaner formulations. Technical challenges in natural formulation, including limited ingredient options, inconsistent supply chains, and performance gaps compared to synthetic alternatives, create barriers that favor established manufacturers with advanced research and development capabilities. The rise of "Clean Beauty" as a marketing category bridges the gap between natural aspirations and performance expectations, allowing brands to emphasize safety and effectiveness without organic certification complexities.

The bio-based surfactants market's projected growth indicates expanding supply chain infrastructure to support natural formulation trends, though cost premiums continue to limit mass market adoption. Additionally, biotechnology-derived ingredients are creating convergence between natural and synthetic categories, offering synthetic-level performance with natural sustainability benefits, further supporting the industry's transition toward cleaner formulations. This evolution in ingredient technology and market dynamics suggests a future where the distinction between natural and synthetic categories becomes increasingly blurred, potentially reshaping the industry's approach to formulation and product development.

The Bath and Shower Products Market is Segmented by Product Type (Bar Soap, Body Wash/Shower Gel and Other Product Types), Ingredient (Conventional/Synthetic and Natural/Organic), End User (Kids/Children and Adult), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds a 29.78% market share in 2024 and is projected to grow at a CAGR of 5.75% through 2030. The region's exceptional growth potential is driven by rising disposable incomes, rapid urbanization, and cultural shifts toward self-care and wellness. A young population, heavily influenced by social media and beauty trends, contributes significantly to market expansion, with women generating the most revenue. The organic segment shows substantial growth potential due to increasing consumer demand for natural products and heightened hygiene awareness.

North America and Europe maintain steady growth through premiumization and innovation, with sophisticated consumer preferences driving market development. The North American market is characterized by strong consumer education regarding ingredients and formulation science, creating opportunities for premium positioning and specialized products. The implementation of the Modernization of Cosmetics Regulation Act (MoCRA) introduces new compliance requirements, affecting facility registration and safety substantiation. European market dynamics are governed by strict regulatory frameworks, including the European Commission's ban on specific siloxanes, while consumer demand for safety and sustainability credentials shapes product development.

South America, and Middle East and Africa present distinct market opportunities with varying consumer preferences and regulatory landscapes. Brazil leads the South American market through its robust manufacturing infrastructure and growing middle class. The Middle East and Africa demonstrate significant growth potential, particularly in GCC countries, where the expanding hospitality sector drives premium product demand. Success in these regions requires localized strategies, with brands adapting their product formulations, marketing approaches, and distribution methods to meet specific market conditions.

- Procter & Gamble Company

- Colgate-Palmolive Company

- Kenvue Inc.

- L'Oreal S.A.

- Bath & Body Works, Inc.

- Beiersdorf AG

- Kao Corporation

- Reckitt Benckiser Group PLC

- The Estee Lauder Companies Inc.

- Godrej Consumer Products Ltd.

- Henkel AG & Co. KGaA

- Coty Inc.

- L'Occitane International SA

- Unilever Plc

- Shiseido Company Limited

- Lion Corporation

- Natura & Co Holdings SA

- Lush Limited

- ITC Limited

- Moroccanoil Israel Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Ph-balanced, Sulfate-free Products

- 4.2.2 Influence of Social Media and Celebrity Endorsement

- 4.2.3 Consumer Inclination Towards Natural and Organic Products

- 4.2.4 Strong Demand for Products Formulated with Clean Label Ingredients

- 4.2.5 Technological Innovations in Product Formulations

- 4.2.6 Increased Consumer Spending on Self-care Products

- 4.3 Market Restraints

- 4.3.1 Proliferation of Counterfeit Products

- 4.3.2 Growing Health Concerns Over Product Safety and Ingredients

- 4.3.3 Rising Raw Material and Manufacturing Costs

- 4.3.4 Intense Market Competition Leading to Price Pressure

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Bar Soap

- 5.1.2 Body Wash/ShowerGel

- 5.1.3 Other Product Types

- 5.2 By Ingredient

- 5.2.1 Conventional/Synthetic

- 5.2.2 Natural/Organic

- 5.3 By End User

- 5.3.1 Kids/Children

- 5.3.2 Adult

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Procter & Gamble Company

- 6.4.2 Colgate-Palmolive Company

- 6.4.3 Kenvue Inc.

- 6.4.4 L'Oreal S.A.

- 6.4.5 Bath & Body Works, Inc.

- 6.4.6 Beiersdorf AG

- 6.4.7 Kao Corporation

- 6.4.8 Reckitt Benckiser Group PLC

- 6.4.9 The Estee Lauder Companies Inc.

- 6.4.10 Godrej Consumer Products Ltd.

- 6.4.11 Henkel AG & Co. KGaA

- 6.4.12 Coty Inc.

- 6.4.13 L'Occitane International SA

- 6.4.14 Unilever Plc

- 6.4.15 Shiseido Company Limited

- 6.4.16 Lion Corporation

- 6.4.17 Natura & Co Holdings SA

- 6.4.18 Lush Limited

- 6.4.19 ITC Limited

- 6.4.20 Moroccanoil Israel Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK