PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842489

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842489

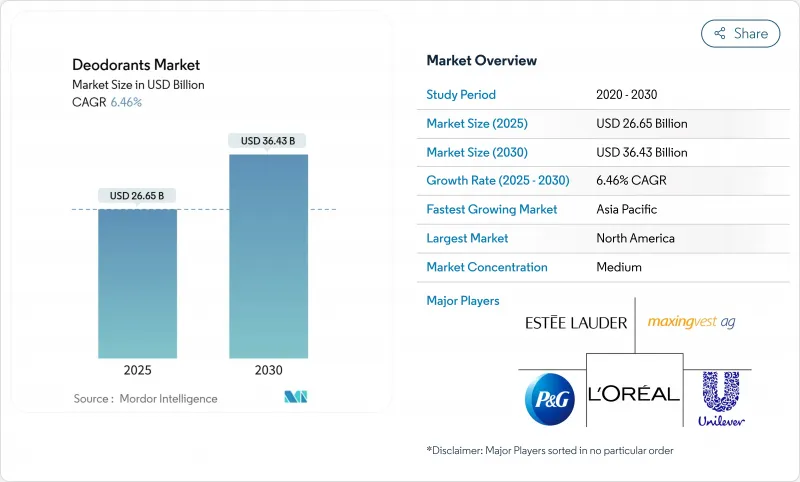

Deodorants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global deodorant market is poised to expand from USD 26.65 billion in 2025 to USD 36.43 billion by 2030, advancing at a CAGR of 6.46%.

The growth reflects increasing consumer demand for multifunctional personal care products that combine hygiene benefits with enhanced user experience. The market is evolving in response to wellness trends and sustainability requirements, expanding competition beyond traditional product effectiveness. Consumer preferences are shifting toward products that offer multiple benefits, including long-lasting protection, skin-friendly formulations, and environmentally conscious packaging. Manufacturers are investing in research and development to create innovative formulations that meet evolving consumer demands and comply with stringent safety standards. Additionally, the growth of natural and clean-label products is also dominating the market growth.

Global Deodorants Market Trends and Insights

Natural and Clean-Label Formulation Shift Stimulating Innovation Globally

The demand for natural and clean-label formulations has changed the deodorant industry's value chain, impacting ingredient selection, packaging, and manufacturing processes. Consumer concerns about aluminum compounds and synthetic preservatives have led companies to reformulate their products using biotech-derived actives and microbiome-friendly ingredients. This shift has prompted manufacturers to invest in research and development of alternative natural ingredients while maintaining product efficacy. The transformation is particularly noticeable in premium segments, where improved formulation techniques have enhanced the effectiveness of natural deodorants. Companies are also focusing on sustainable packaging solutions and eco-friendly manufacturing practices to align with the clean-label trend.

The incorporation of plant-based ingredients and essential oils in deodorants has increased as manufacturers respond to consumer demand for natural alternatives that maintain efficacy. This shift reflects broader industry trends toward sustainable and natural formulations, with manufacturers investing in research and development to create effective plant-based alternatives. For instance, in May 2023, Totem Eco, an all-natural body care brand, unveiled a new line of deodorant sticks, now free from bi-carb and infused with Australian botanical essential oils. The products are formulated by using plant-based and natural ingredients. The growing consumer awareness of ingredient safety and environmental impact has further accelerated the adoption of natural active ingredients in deodorant formulations.

Rising Awareness of Personal Hygiene

Growing consumer awareness of personal hygiene has transformed deodorants from optional items to essential personal care products. This transformation is notable in emerging markets, where expanding middle-class populations are incorporating more extensive personal care practices. The market has evolved to offer enhanced functionality, including whole-body deodorants with odor-adaptive technology for multiple application areas. Consumer preferences are shifting towards products that provide comprehensive protection and align with their wellness goals.

In response to the growing demand for eco-friendly and sustainable products, particularly among younger consumers, market players are actively developing and offering such products. This shift is driven by increasing environmental awareness and a preference for products that align with sustainable practices, prompting companies to innovate and adapt their offerings to meet these expectations. For instance, in June 2023, eco-friendly cosmetics brand Respectueuse launched a deodorant product line with Sonoco's recyclable EnviroStick packaging. The packaging claims to be fully recyclable and made from rigid paper. The integration of hygiene features with skincare benefits has established a new premium category in the mass market, offering products that extend beyond traditional odor control. Manufacturers are responding to these trends by developing innovative formulations that address multiple consumer needs while maintaining sustainable practices.

Proliferation of Counterfeit Products

The increasing value of established deodorant brands has attracted counterfeiters, especially in emerging markets with weak enforcement systems. Counterfeit products damage legitimate brand value and create health risks for consumers through the use of unregulated ingredients and poor manufacturing standards. The presence of harmful chemicals and contaminants in fake deodorants can cause skin irritation, allergic reactions, and other adverse health effects. This issue is prominent in e-commerce channels, where product verification is challenging, and price-conscious consumers may inadvertently purchase fake products. The rise of third-party sellers and cross-border e-commerce platforms has made it increasingly difficult to track and authenticate products throughout the distribution chain.

While major manufacturers implement authentication technologies and consumer awareness programs, the growth of online distribution continues to create supply chain vulnerabilities. The financial impact includes reduced sales, damaged brand reputation, and higher security costs, affecting industry profitability in impacted markets. Companies must invest in anti-counterfeiting measures, including holographic labels, QR codes, and blockchain tracking systems. Additionally, manufacturers are collaborating with local authorities and e-commerce platforms to strengthen enforcement and remove counterfeit listings, though these efforts require significant resources and ongoing monitoring.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media and Celebrity Endorsement

- Product Differentiation in Terms of Fragrance

- Health Concerns Over Chemical Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sprays hold the dominant position in the deodorant market with a 48.59% share in 2024, as consumers value their ease of application and effectiveness. The spray format's popularity stems from its quick-drying properties, wide coverage area, and ability to reach difficult areas. Additionally, the format's compatibility with both water-based and alcohol-based formulations provides manufacturers with flexibility in product development. Roll-on deodorants are experiencing the highest growth rate with an expected CAGR of 6.86% from 2025 to 2030, driven by their convenience and precise application features. The format's controlled dispensing mechanism reduces product waste and appeals to environmentally conscious consumers. NIVEA Men's roll-on product line expansion into Canada in April 2024 demonstrates this format's growing acceptance across consumer segments. The success of roll-ons is further supported by innovations in ball bearing technology and leak-proof packaging.

Cream deodorants occupy a consistent market position, primarily attracting consumers with sensitive skin due to their moisturizing benefits. These products often incorporate natural ingredients and skin-conditioning agents, making them suitable for users with dermatological concerns. The cream format also allows for higher concentrations of active ingredients, providing longer-lasting protection. Alternative formats, including wipes and solid sticks, comprise a small but expanding market segment that addresses specific consumer requirements. Wipes cater to the on-the-go lifestyle and travel market, while solid sticks offer precise application and minimal residue.

Mass products dominated the deodorant market in 2024 with a 68.46% share, leveraging their accessibility and value proposition to maintain broad consumer appeal across diverse demographic segments. However, the premium segment is outpacing the overall market with a projected 7.24% CAGR from 2025-2030, reflecting consumers' increasing willingness to invest in higher-quality formulations and sophisticated fragrances. This premiumization trend is evident in the strategic moves of traditionally mass-market players like L'Oreal and Unilever, who are launching higher-priced offerings to capture this growing segment. Unilever's Dove Whole Body Deodorants, priced at USD 11.99 compared to USD 6.99 for standard offerings, exemplify this upmarket shift.

The narrowing gap between mass and prestige beauty products is reshaping category dynamics, as consumers increasingly prioritize efficacy and results-oriented offerings over traditional price-based segmentation. Brands like Aesop and Salt & Stone are transforming deodorant from a hygiene necessity to a beauty item through sophisticated fragrance development and design aesthetics, creating new premium price points in the category. This evolution suggests that the traditional binary of mass versus premium is giving way to a more nuanced spectrum of offerings that blend attributes from both categories to meet specific consumer needs.

The Deodorant Market Report Segments the Industry Into Product Type (Spray, Creams, and More), Category (Mass and Premium), Ingredient (Conventional/Synthetic and Vegan/Organic), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominates the global deodorant market with a 27.88% share in 2024, primarily attributed to high disposable incomes and strong consumer awareness of personal hygiene products. According to Statistics Canada data from 2024, the household disposable income of Canada was USD 1,709,311 . The region's market demonstrates a significant shift toward premium products, with consumers actively seeking natural ingredients and sophisticated fragrances. This trend is particularly evident in urban areas, where consumers show increased willingness to invest in high-quality personal care products. The market also benefits from robust retail infrastructure, extensive product availability, and effective marketing campaigns that emphasize product innovation and lifestyle benefits.

Asia-Pacific exhibits the highest growth potential with an 8.25% CAGR projected for 2025-2030, driven by increasing disposable incomes, rapid urbanization, and growing adoption of Western personal care routines. The region's market transformation is characterized by a notable shift toward premium and natural products, with domestic brands successfully capturing market share by addressing specific local preferences and cultural requirements. International companies are actively adapting their product portfolios and marketing strategies to meet evolving consumer demands in the region. E-commerce platforms, particularly JD.com, have become instrumental in market expansion, offering convenient access to a wide range of products and contributing significantly to online personal care sales growth. The digital marketplace has also enabled broader market penetration in tier-2 and tier-3 cities.

Europe maintains a substantial market presence, distinguished by strong environmental consciousness and stringent regulatory frameworks that promote natural and sustainable products. The region's consumers demonstrate increasing preference for eco-friendly packaging and organic ingredients. The consumption of personal care products is increasing in the country, due to which the demand for deodorants is increasing. According to the Office for National Statistics (UK) data from 2024, consumer spending on personal care in the United Kingdom was GBP 41.9 billion . The Middle East and Africa and South America represent emerging markets with significant growth potential, driven by increasing urbanization rates and rising awareness of personal hygiene practices. Brazil leads the South American market with distinct consumer preferences for fragrances and innovative product formulations, while Saudi Arabia spearheads growth in the Middle East, influenced by cultural preferences and increasing disposable incomes. The global reach of the deodorant market is exemplified by Unilever's performance, which achieved double-digit growth in its deodorants category in 2024, with Rexona and Axe brands showing strong performance across multiple regions, particularly in emerging markets.

- Chanel SA

- The Estee Lauder Companies Inc.

- LVMH Moet Hennessy Louis Vuitton

- Church & Dwight Co., Inc.

- L'Oreal SA

- Puig SL

- Shiseido Co. Ltd.

- Natura & Co. Holding SA

- Weleda AG

- Procter and Gamble Company

- Unilever Plc

- Beiersdorf Global AG

- Revlon Group Holdings LLC

- Edgewell Personal Care Company

- Amorepacific Corp.

- Kao Corporation

- Colgate Palmolive Co.

- Ajmal Perfumes LLC

- Arabian Oud Co

- Swiss Arabian Perfume Group

- Oriflame Cosmetics AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Natural and Clean-Label formulation shift stimulating innovation globally

- 4.2.2 Rising Awareness of Personal Hygiene

- 4.2.3 Influence of social media and celebrity endorsement

- 4.2.4 Product Differentiation in terms of fragrance

- 4.2.5 Effective Promotional and Marketing Strategies

- 4.2.6 Expansion in emerging markets

- 4.3 Market Restraints

- 4.3.1 Proliferation of counterfeit Products

- 4.3.2 Health concerns over chemical ingredients

- 4.3.3 Price Sensitivity among consumers

- 4.3.4 intense market competition

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Sprays

- 5.1.2 Creams

- 5.1.3 Roll-on

- 5.1.4 Other Product Types

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 Ingredient

- 5.3.1 Conventional/Synthetic

- 5.3.2 Natural/Organic

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarket

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Chanel SA

- 6.4.2 The Estee Lauder Companies Inc.

- 6.4.3 LVMH Moet Hennessy Louis Vuitton

- 6.4.4 Church & Dwight Co., Inc.

- 6.4.5 L'Oreal SA

- 6.4.6 Puig SL

- 6.4.7 Shiseido Co. Ltd.

- 6.4.8 Natura & Co. Holding SA

- 6.4.9 Weleda AG

- 6.4.10 Procter and Gamble Company

- 6.4.11 Unilever Plc

- 6.4.12 Beiersdorf Global AG

- 6.4.13 Revlon Group Holdings LLC

- 6.4.14 Edgewell Personal Care Company

- 6.4.15 Amorepacific Corp.

- 6.4.16 Kao Corporation

- 6.4.17 Colgate Palmolive Co.

- 6.4.18 Ajmal Perfumes LLC

- 6.4.19 Arabian Oud Co

- 6.4.20 Swiss Arabian Perfume Group

- 6.4.21 Oriflame Cosmetics AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK