PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842493

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842493

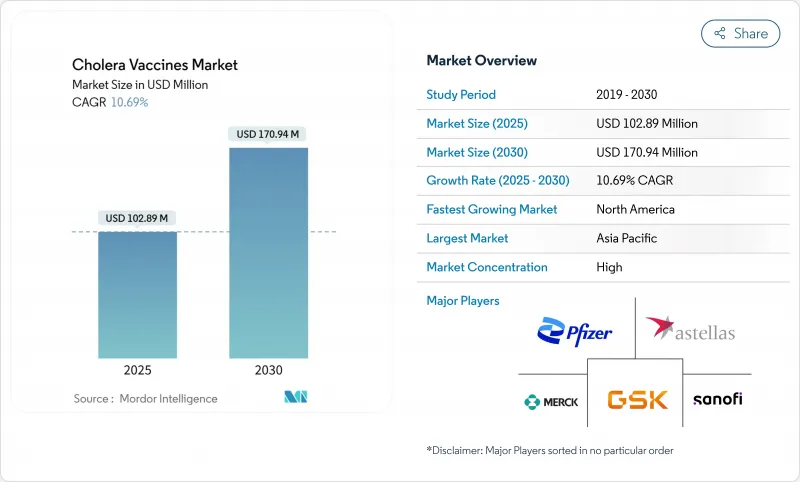

Cholera Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cholera vaccines market stood at USD 102.89 million in 2025 and is forecast to reach USD 170.94 million by 2030, advancing at a 10.69% CAGR.

This outlook reflects a hard pivot from reactive outbreak control toward systematic, preventive immunization programs as global transmission accelerates. Demand is intensifying in Asia-Pacific, where India, China, and several Southeast Asian nations are scaling seasonal campaigns in response to climate-related flooding and rising sea-surface temperatures. Supply-side momentum is equally strong: EuBiologics' simplified killed-vaccine formulation and Gavi's USD 1.2 billion African Vaccine Manufacturing Accelerator are expanding capacity while de-risking geographic concentration. At the same time, single-dose live vaccines and mRNA platforms promise faster protection and rapid strain adaptation, creating new commercial niches in travel medicine and emergency response. Together, these factors keep the cholera vaccines market on a steep growth trajectory despite periodic stockpile shortfalls.

Global Cholera Vaccines Market Trends and Insights

Escalating Multi-Continent Outbreaks

Thirty-three countries reported active cholera outbreaks in December 2024, more than double the historical norm, underscoring shifting epidemiology driven by extreme weather and population displacement . Rising case-fatality ratios in fragile health systems are propelling governments toward pre-emptive vaccination rather than purely reactive campaigns, thereby lifting baseline demand across the cholera vaccines market. Expanded geographic spread into previously cholera-free zones further stretches stockpile requirements, increasing order volumes and sustaining commercial growth. Health agencies are now forecasting vaccine needs on a multi-year basis, giving manufacturers stronger demand visibility that underpins capacity investments. Elevated outbreak frequency therefore exerts the single largest positive influence on the market outlook.

Expanded Gavi OCV Stockpile Funding

Gavi's pledge to supply 230 million doses to 31 countries-and its record 96 million-dose shipment over the past two years-marks the largest coordinated cholera vaccination effort to date. The African Vaccine Manufacturing Accelerator allocates USD 1.2 billion to regional production, with France contributing EUR 10 million, signaling long-term procurement security for producers . Preventive campaigns need three to four times more doses than reactive drives, directly scaling the cholera vaccines market. Guaranteed offtake contracts de-risk capital spending, accelerate line expansions, and encourage technology transfer to Africa and Asia, ultimately broadening supply resilience. Together these funding mechanisms inject consistent volume growth into the forecast period.

Two-Dose Compliance Gaps

Second-dose completion rates dip to 64-73% in mass campaigns, limiting population immunity and prompting calls for simpler schedules. Barriers include migration, competing livelihoods, and inadequate community messaging. Although alternative delivery models-such as self-administration or extended intervals-improve uptake, each adds logistical complexity. The constraint reduces effective coverage and tempers near-term growth projections, catalyzing investment in single-dose approaches that can close the compliance gap.

Other drivers and restraints analyzed in the detailed report include:

- Climate-Linked Coastal Flooding in Endemic Megacities

- Live Single-Dose Approvals in Travel Clinics

- OMV Component Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Killed Oral O1 and O139 vaccines generated 74.54% of the cholera vaccines market in 2024, a position secured by decades of field evidence and WHO prequalification. The segment accounted for the largest cholera vaccines market size portion at USD 77 million in 2025. Capacity gains from EuBiologics' Euvichol-S line alone will add 50 million doses annually, strengthening supply resilience. However, recombinant B-subunit enhancements are unlocking higher pediatric efficacy and, at 11.34% CAGR, are the fastest-advancing sub-segment through 2030.

Live-attenuated candidates, though still niche, match the industry's pivot toward single-dose ease. Vaxchora exemplifies the commercial potential: its 90.3% short-term efficacy and 79.5% at three months position it as the traveler's vaccine of choice. Development pipelines include edible rice-based formulations and mRNA prototypes that could bypass cold chains, underscoring an innovation race likely to re-shape competitive dynamics after 2027.

The Cholera Vaccines Market is Segmented by Vaccine Type (Whole Cell V. Cholerae O1 With Recombinant B-Subunit and Killed Oral O1, and O139), Product (Vaxchora, Dukoral, Euvichol-Plus, and Others), Distribution Channel (Public and Private), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 37.67% of 2024 revenue, propelled by Vaxchora's premium pricing and a mature travel-health infrastructure that guarantees consistent uptake even during global shortages. Corporate duty-of-care policies further institutionalize demand, ensuring that private-sector volumes remain insulated from humanitarian stockpile dynamics.

Asia-Pacific is the fastest-growing territory, advancing at an 11.89% CAGR through 2030 as India, Bangladesh, and Vietnam shift to routine pre-monsoon vaccination. National demonstration projects have validated cost-effectiveness, attracting multilateral financing that secures multiyear procurement. Emerging manufacturing hubs in India will shorten supply chains and curb freight costs, reinforcing regional self-sufficiency.

Europe maintains a dual role as both buyer and manufacturer. Robust regulatory frameworks, coupled with Sanofi's EUR 1 billion investment in flexible bioproduction, support future mRNA-based cholera candidates. Meanwhile, development assistance from France and the EU is channeling technology transfer to Africa, reflecting a policy stance that sees vaccine self-reliance as a pillar of global health security.

- EuBiologics Co., Ltd.

- Valneva

- Emergent BioSolutions Inc. (PaxVax)

- Sanofi (Shantha Biotechnics)

- Incepta Vaccine Ltd.

- GlaxoSmithKline

- Merck

- Takeda Pharmaceuticals

- Astellas Pharma

- Mitsubishi Tanabe Pharma

- Pfizer

- Hilleman Laboratories

- Bharat Biotech International Ltd.

- Johnson & Johnson (Janssen Vaccines)

- Serum Institute of India

- Medigen Vaccine Biologics

- Vabiotech

- Vaxient Inc.

- Vaxarto Inc.

- SK Bioscience Co., Ltd.

- Biological E. Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Multi-Continent Cholera Outbreaks

- 4.2.2 Expansion of Global OCV Stockpile Funding by Gavi 2.0

- 4.2.3 Climate-Change Driven Coastal Flooding in Endemic Megacities

- 4.2.4 Live-Attenuated Single-Dose Formulations Winning Travel-Clinic Approvals

- 4.2.5 mRNA-Enabled Rapid Antigen-Switch Vaccine Platforms

- 4.2.6 Integration of OCV in WHO Humanitarian Rapid-Response Kits

- 4.3 Market Restraints

- 4.3.1 Two-Dose Compliance Challenges in Mass Campaigns

- 4.3.2 Manufacturing Bottlenecks for OMV Components

- 4.3.3 Low Commercial Incentive in Non-Endemic High-Income Countries

- 4.3.4 Hybrid O139-O1 Strains Eroding Current Vaccine Efficacy

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vaccine Type

- 5.1.1 Whole cell V. cholerae O1 with Recombinant B-subunit

- 5.1.2 Killed Oral O1 and O139

- 5.2 By Product

- 5.2.1 Dukoral

- 5.2.2 Euvichol-Plus

- 5.2.3 Vaxchora

- 5.2.4 Others

- 5.3 By Distribution Channel

- 5.3.1 Public

- 5.3.2 Private

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 EuBiologics Co., Ltd.

- 6.3.2 Valneva SE

- 6.3.3 Emergent BioSolutions Inc. (PaxVax)

- 6.3.4 Sanofi (Shantha Biotechnics)

- 6.3.5 Incepta Vaccine Ltd.

- 6.3.6 GlaxoSmithKline plc

- 6.3.7 Merck & Co., Inc.

- 6.3.8 Takeda Pharmaceutical Co. Ltd.

- 6.3.9 Astellas Pharma Inc.

- 6.3.10 Mitsubishi Tanabe Pharma Corporation

- 6.3.11 Pfizer Inc.

- 6.3.12 Hilleman Laboratories

- 6.3.13 Bharat Biotech International Ltd.

- 6.3.14 Johnson & Johnson (Janssen Vaccines)

- 6.3.15 Serum Institute of India Pvt. Ltd.

- 6.3.16 Medigen Vaccine Biologics

- 6.3.17 Vabiotech

- 6.3.18 Vaxient Inc.

- 6.3.19 Vaxarto Inc.

- 6.3.20 SK Bioscience Co., Ltd.

- 6.3.21 Biological E. Limited

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment