PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842497

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842497

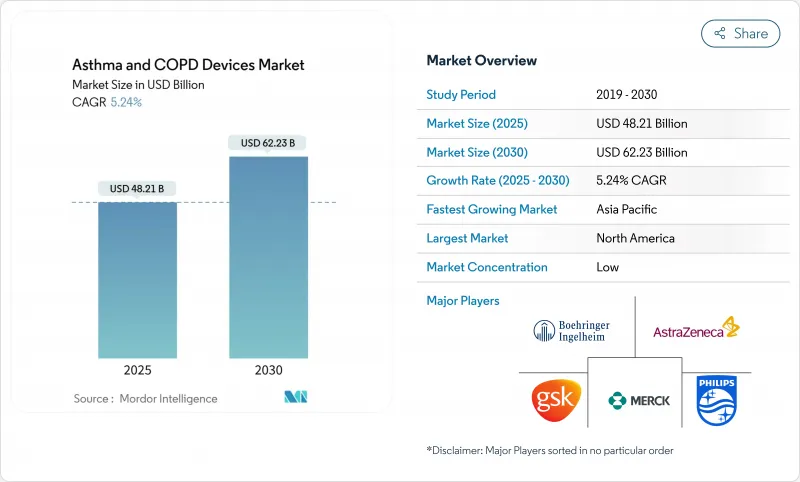

Asthma And COPD Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asthma and COPD devices market was valued at USD 48.21 billion in 2025 and is forecast to reach USD 62.23 billion by 2030, advancing at a 5.24% CAGR.

Demographic aging, rising asthma and COPD prevalence, and tighter environmental rules around inhaler propellants are widening demand for both conventional and connected delivery systems. Vendors are weaving artificial-intelligence modules into inhalers and nebulizers, shifting respiratory care from episodic symptom relief toward data-driven, predictive interventions that fit remote-care models. Propellant reformulations with sharply lower global-warming potential are turning regulatory compliance into a source of product differentiation. Meanwhile, reimbursement caps on out-of-pocket drug spending in the United States and value-based payment frameworks in Europe are rewarding devices that tangibly improve adherence and cut exacerbations.

Global Asthma And COPD Devices Market Trends and Insights

Rising prevalence of asthma & COPD

More than 545 million people now live with chronic respiratory diseases that could benefit from smart-inhaler technology. Urban migration, industrial emissions, and lifestyle changes are broadening patient pools far faster than clinic capacity. Asia-Pacific health systems feel the biggest strain, yet developed economies also face aging-related prevalence spikes. As a result, demand is swelling for affordable metered-dose inhalers, premium mesh nebulizers, and data-enabled adherence platforms that can be deployed at home or in virtual-care pathways. Connected-device alerts notifying clinicians of declining peak-flow scores exemplify how epidemiological pressure is catalyzing predictive care models .

Technological advancements in inhalation & nebulization

Mesh nebulizers achieve lung deposition rates more than triple those of jet units during non-invasive ventilation, making them the preferred platform for late-stage drug-device trials. Propellant reformulations such as HFA-152a cut carbon impact by over 90% while preserving therapeutic equivalence, allowing firms to satisfy both clinical-efficacy and sustainability mandates. Early adopters pairing environment-friendly propellants with Bluetooth-enabled dose trackers are commanding premium pricing in North America and Western Europe. The result is an innovation cycle in which device performance, eco-credentials, and digital connectivity reinforce one another.

Stringent regulatory approval timelines

The United States FDA now requires comprehensive human-factor studies and digital-component validation before clearing combination inhalers . Similar scrutiny from Europe's Medical Device Regulation has elongated review cycles, lifting R&D budgets and delaying commercial launches. Large incumbents can absorb these costs, but start-ups often struggle to fund extended pivotal trials, leading to fewer novel entrants and a gradual up-tick in market concentration.

Other drivers and restraints analyzed in the detailed report include:

- Growing geriatric population base

- Increasing indoor-outdoor air-pollution levels

- Inadequate reimbursement in developing regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nebulizers generated a 6.23% CAGR outlook through 2030, the fastest within the Asthma and COPD devices market, even though inhalers retained a commanding 63.43% share in 2024. Mesh platforms improve drug delivery efficiency, trim treatment times, and run quietly enough for use during virtual consultations. Vendors pairing mesh chambers with digital-dose counters report 3-point gains in Asthma Control Test scores versus standard devices. Meanwhile, low-global-warming-potential propellants are rebooting the metered-dose inhaler line-up, and soft-mist inhalers now serve as a middle ground, offering high lung deposition without cold-gas plume discomfort .

Second-generation nebulizers capitalize on these shifts by bundling smartphone dashboards that visualize nebulization adherence trends for clinicians. The interplay of sustainability mandates, patient-experience imperatives, and biologic-drug compatibility ensures that both inhalers and nebulizers will coexist, but revenue momentum tilts toward mesh-equipped designs. Pharmaceutical partners co-developing fixed-dose triple therapies are specifying mesh units in clinical protocols, anchoring the segment's growth runway.

Asthma represented 65.98% of 2024 revenue, yet COPD devices are projected to grow faster at 6.34% CAGR, lifting their slice of the Asthma and COPD devices market over the next five years. COPD's progressive pathology often necessitates dual-bronchodilator or steroid-combo inhalers, inflating per-patient spend. Late-stage trials of biologics such as IL-5 inhibitors show promise, and their delivery will require advanced inhaler platforms capable of precise microgram dosing and built-in error detection.

Asthma management is shifting toward phenotype-guided therapies and preventive monitoring, leveraging connected inhalers that record usage and transmit peak-flow trends. Both indications are converging on digitally tracked regimens, but COPD's higher hospitalization burden aligns squarely with payers' cost-offset goals, accelerating adoption of premium connected devices in that sub-segment.

The Asthma and COPD Devices Market is Segmented by Product (Inhalers [Metered-Dose Inhalers and More] and Nebulizers [Compressor Nebulizers and More]), Indication (Asthma and Chronic Obstructive Pulmonary Disease), Age Group (Paediatric, Adult, and Geriatric), Mode of Operation (Conventional Devices and More), and Geography (North America, Europe, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 39.43% of global revenue in 2024, aided by structured reimbursement and early uptake of connected inhalers. A USD 2,000 annual out-of-pocket drug cap effective in 2025 is expected to encourage therapy intensification and higher device-drug bundling, even as insurers press for real-world evidence of outcome gains. Leading manufacturers have introduced monthly price ceilings of USD 35 for core inhaler lines, illustrating competitive responses to affordability mandates.

Asia-Pacific is the growth pacesetter with a 6.39% CAGR outlook. China's medical-device expansion aligns with Made in China 2025 and Healthy China 2030 agendas that incentivize domestic production of advanced respiratory devices. India's New Drugs, Medical Devices and Cosmetics Bill 2023 similarly targets faster approvals and quality enforcement, spurring local and multinational investments in mesh-nebulizer lines. Urban air-pollution spikes in Beijing, Delhi, Jakarta, and Bangkok amplify patient demand for portable, environment-aware inhalers.

Europe shows consistent, albeit slower, expansion as sustainability regulations accelerate turnover of legacy CFC-propellant inhalers. The bloc's Medical Device Regulation emphasizes lifecycle carbon accounting, and connected-device rollouts must satisfy stringent GDPR data-privacy thresholds. These rules raise compliance costs but reward firms delivering verified eco-performance and secure data architectures. New reimbursement paths tied to population-health metrics reinforce demand for adherence-tracking inhalers in markets such as Germany, the Nordics, and the Netherlands.

- GlaxoSmithKline

- AstraZeneca

- Boehringer Ingelheim

- Teva Pharmaceutical Industries

- Koninklijke Philips

- Merck

- PARI Pharma GmbH

- OMRON

- Drive DeVilbiss Healthcare

- Invacare

- Recipharm

- Cipla

- Sunovion Pharmaceuticals

- Resmed

- Chiesi Farmaceutici

- Vectura Group plc

- Mundipharma International Ltd.

- Aerogen Ltd.

- Propeller Health

- Adherium Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of asthma & COPD

- 4.2.2 Technological advancements in inhalation & nebulization

- 4.2.3 Growing geriatric population base

- 4.2.4 Increasing indoor-outdoor air-pollution levels

- 4.2.5 Payer-driven adherence programs in developed markets

- 4.2.6 AI-enabled smart inhalers integrated into tele-pulmonology

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory approval timelines

- 4.3.2 Inadequate reimbursement in developing regions

- 4.3.3 Price sensitivity & generic competition

- 4.3.4 Data-privacy concerns around connected devices

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Inhalers

- 5.1.1.1 Metered-Dose Inhalers

- 5.1.1.2 Dry-Powder Inhalers

- 5.1.1.3 Soft-Mist Inhalers

- 5.1.2 Nebulizers

- 5.1.2.1 Compressor Nebulizers

- 5.1.2.2 Ultrasonic Nebulizers

- 5.1.2.3 Mesh Nebulizers

- 5.1.1 Inhalers

- 5.2 By Indication

- 5.2.1 Asthma

- 5.2.2 Chronic Obstructive Pulmonary Disease

- 5.3 By Age Group

- 5.3.1 Paediatric

- 5.3.2 Adult

- 5.3.3 Geriatric

- 5.4 By Mode of Operation

- 5.4.1 Digital / Connected Devices

- 5.4.2 Conventional Devices

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GlaxoSmithKline plc

- 6.3.2 AstraZeneca plc

- 6.3.3 Boehringer Ingelheim GmbH

- 6.3.4 Teva Pharmaceutical Industries Ltd.

- 6.3.5 Philips Healthcare

- 6.3.6 Merck & Co., Inc.

- 6.3.7 PARI Pharma GmbH

- 6.3.8 Omron Healthcare, Inc.

- 6.3.9 Drive DeVilbiss Healthcare

- 6.3.10 Invacare Corporation

- 6.3.11 Recipharm AB

- 6.3.12 Cipla Ltd.

- 6.3.13 Sunovion Pharmaceuticals Inc.

- 6.3.14 ResMed Inc.

- 6.3.15 Chiesi Farmaceutici S.p.A.

- 6.3.16 Vectura Group plc

- 6.3.17 Mundipharma International Ltd.

- 6.3.18 Aerogen Ltd.

- 6.3.19 Propeller Health

- 6.3.20 Adherium Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment