PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842498

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842498

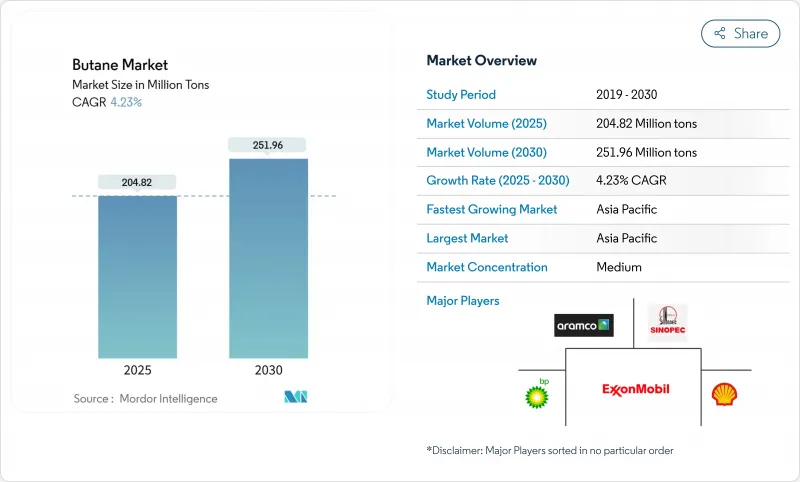

Butane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Butane Market size is estimated at 204.82 Million tons in 2025, and is expected to reach 251.96 Million tons by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).Hydrocarbons serve as key components for residential LPG and petrochemical feedstocks, particularly in ethylene and propylene chains, with Asia-Pacific operators adding world-scale crackers.

Normal butane supports winter gasoline blending, while isobutane enhances high-octane alkylate streams. North American shale output boosts natural gas liquids recovery, curbing price spikes and addressing regional tightness, as noted by the Dallas Fed. Digital twins at storage terminals reduce handling losses and optimize ship-loading windows. These factors mitigate crude-linked pricing volatility and drive investments in production, logistics, and downstream conversion assets.

Global Butane Market Trends and Insights

Growing Demand from the Petrochemical Industry

Expanding cracker capacity spurs structural butane uptake, with China's LPG feedstock pull rising 2.1 million b/d between 2019 and 2024 and more additions scheduled to 2030. The International Energy Agency projects that over half of the 2025 liquids-demand increase will come from NGL feedstocks such as butane. Downstream margins tighten as new plants dilute spreads, pushing operators toward long-term offtake contracts and efficiency measures.

Increasing Demand from the Metalworking and Construction Industry

Industrial users favour butane-fired torches for consistent flame temperatures and lower soot formation, enhancing weld quality and cutting precision. Portable heaters using LPG cylinders support site work in cold climates where the electric supply is unreliable. While electrification gains traction in high-income economies, emerging-market contractors still prefer cost-effective LPG solutions. Growth, therefore, tracks new-build activity in Asia and infrastructure upgrades in Africa. Adoption also hinges on cylinder distribution networks that shorten last-mile logistics, signalling opportunity for midstream players.

Volatility in Raw Material Prices

Butane's close linkage to crude and natural gas indices exposes users to rapid swings that complicate procurement budgets. Lower crude leads to softer NGL pricing, but sudden ethane weakness heightens co-movement with butane, increasing hedge complexity. The US producer-price index dropped from 210.934 in January 2025 to 144.296 in April 2025, a 32% slide that unsettled inventory planning. Price risk discourages greenfield capacity in capital-scarce zones and channels investment into flexible logistics that arbitrage regional spreads.

Other drivers and restraints analyzed in the detailed report include:

- Growing Usage of Butane in Autogas, a Cleaner Alternative to Gasoline and Diesel

- Digital Twin Optimisation of LPG Storage Logistics

- Availability of Fuel Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

n-Butane held 56.19% of the butane market size in 2024 and posts the fastest 4.94% CAGR to 2030. Winter-grade gasoline necessitates higher normal-butane blend ratios to meet Reid-vapor-pressure limits, securing consistent off-take from refiners. Petrochemical players integrate normal butane into steam crackers oriented toward C4 extraction streams that switch flexibly between butadiene and raffinate production.

The Butane Market Report Segments the Industry by Product Type (n-Butane and Iso-Butane), End-User Industry (Residential/Commercial, Industrial (Including Chemical Feed Stock), Engine Fuel, Refinery, and Other End-User Industries), by Source (Natural Gas and Refining), and by Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Ton).

Geography Analysis

Asia-Pacific commanded 54.18% butane market share in 2024 and sustained the fastest 5.28% CAGR. China's steam-cracker wave continues to pull US NGL cargoes, accounting for 56% of Chinese LPG imports in 2024.

North America remains the supply powerhouse, with ample shale-derived output feeding rising export volumes. The US shipped roughly 500 thousand b/d of butane in 2024, routing 41% to Asia and 36% to Africa. Europe presents a balanced picture: forward-looking climate policy checks demand growth, but legacy petrochemical assets keep baseline offtake steady.

The Middle East leverages advantaged feedstock to sustain petrochemical expansions, while Africa and South America see incremental cylinder penetration supported by subsidy frameworks in Colombia and Nigeria.

- Bharat Petroleum Corporation Limited

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- ConocoPhillips

- Dow

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom

- Linde PLC

- Petroliam Nasional Berhad (PETRONAS)

- Petron Corporation

- Reliance Industries Limited

- Saudi Arabian Oil Co.

- Shell

- TotalEnergies

- Valero Energy Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from the Petrochemcial Industry

- 4.2.2 Increasing Demand from the Metalworking and Construction Industry

- 4.2.3 Growing Usage of Butane in Autogas, a Cleaner Alternative to Gasoline and Diesel

- 4.2.4 Increasing global consumption of liquefied petroleum gas (LPG) for cooking and heating

- 4.2.5 Digital twin optimisation of LPG storage logistics

- 4.3 Market Restraints

- 4.3.1 Volatility in Raw Material Prices

- 4.3.2 Availability of Fuel Alternatives

- 4.3.3 Limited Infrastructure in Emerging Markets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 n-Butane

- 5.1.2 Iso-butane

- 5.2 By Source

- 5.2.1 Natural Gas

- 5.2.2 Refining

- 5.3 By End-user Industry

- 5.3.1 Residential/Commercial

- 5.3.2 Industrial (Including Chemical Feedstock)

- 5.3.3 Engine Fuel

- 5.3.4 Refinery

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments}

- 6.4.1 Bharat Petroleum Corporation Limited

- 6.4.2 BP plc

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation

- 6.4.5 ConocoPhillips

- 6.4.6 Dow

- 6.4.7 Equinor ASA

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 Gazprom

- 6.4.10 Linde PLC

- 6.4.11 Petroliam Nasional Berhad (PETRONAS)

- 6.4.12 Petron Corporation

- 6.4.13 Reliance Industries Limited

- 6.4.14 Saudi Arabian Oil Co.

- 6.4.15 Shell

- 6.4.16 TotalEnergies

- 6.4.17 Valero Energy Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment