PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842502

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842502

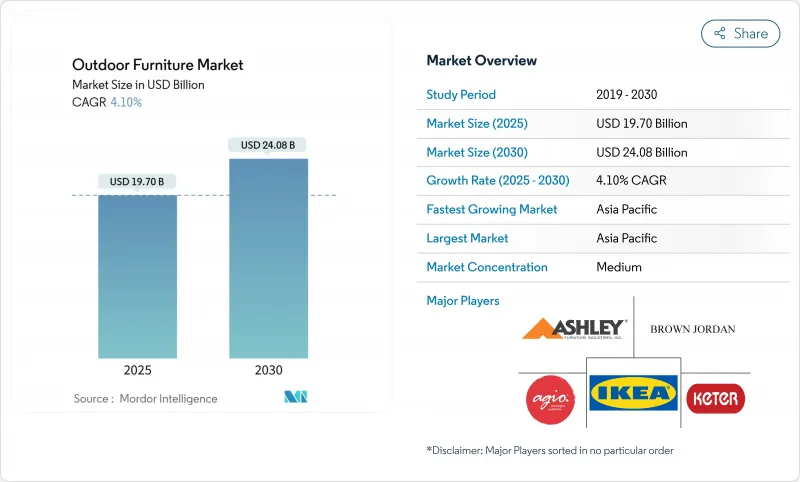

Outdoor Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The outdoor furniture market stands at USD 19.70 billion in 2025 and is forecast to reach USD 24.08 billion by 2030, advancing at a 4.10% CAGR.

Despite volatile raw-material costs and seasonal demand swings, the sector is set to maintain steady growth as manufacturers pivot to eco-friendly materials, modular designs, and omnichannel distribution. Strong investment in resort construction, rooftop amenities, and outdoor-living renovations keeps commercial demand high while the residential segment accelerates on the back of work-from-home lifestyle shifts. Premium collections outpace the overall market as buyers weigh total cost of ownership and curb-appeal value more heavily than the upfront price. Material innovation, especially recycled composites and hybrid designs, remains a crucial differentiator, while smart features such as built-in charging ports help brands stand out in a crowded field.

Global Outdoor Furniture Market Trends and Insights

Surging Resort and Boutique-Hotel Construction Boosting Premium Poolside Furniture Demand

Developers in 2025 allocated Furniture, Fixtures, and Equipment (FF&E) budgets to outdoor zones, turning pool decks and beach clubs into headline amenities that drive guest bookings and social-media exposure. Marriott's network expansion to 8,800 properties across 139 countries and its 2025 leisure-travel revenue surge testify to the scale of future demand. Properties increasingly specify modular seating that can be reconfigured for events, pushing suppliers to design re-stackable frames and quick-swap cushions. Contract buyers also demand performance fabrics that resist sunscreen stains, salt spray, and UV fading across multiyear duty cycles. As hospitality pipelines diversify into glamping, bungalow, and wellness-retreat formats, product lines that blend resort durability with boutique aesthetics enjoy an enlarged addressable market.

Outdoor-Living Room Renovation Trend among Millennials and Gen-X Homeowners

Homeowners now treat patios, balconies, and yards as true extensions of the floor plan, with deep-seating sectionals, plush daybeds, and coordinated decor mirroring indoor comfort. Millennials already account for a rising share of category spending and frequently dedicate up to one-quarter of home-improvement budgets to open-air spaces. Manufacturers respond with mix-and-match modules that let buyers add pieces over successive seasons, mitigating budget constraints while driving brand loyalty. Built-in USB ports, solar-powered lighting, and weather-responsive textiles boost functional value and create cross-sell opportunities for smart-home suppliers. Architectural Digest reports that 82% of U.S. homeowners became more inclined to upgrade outdoor areas post-pandemic, a signal that the behavior has structural rather than temporary roots.

Volatile Raw-Material Prices Pressuring Manufacturer Margins

Aluminum, teak, and petroleum-based inputs have swung sharply since 2024, leaving mid-market producers vulnerable. Material efficiency in wood processing can range from 70-85%; any spike in timber prices flows straight to cost of goods sold and erodes profitability. Larger groups combat volatility through multi-source contracts and scrap-recycling programs, yet smaller firms must either hedge, absorb the hit, or pass costs to distributors. Capital-intensive vertical-integration moves promise future savings but worsen near-term cash-flow strain.

Other drivers and restraints analyzed in the detailed report include:

- Direct-to-Consumer E-commerce Platforms Lowering Barriers for Bulk Outdoor Furniture Purchases Globally

- Environmental Regulations and Green Procurement

- Seasonality and Weather Variability Increasing Inventory Risk for Retailers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Loungers and daybeds are the fastest-growing category, advancing at a 5.8% CAGR as buyers invest in premium relaxation pieces suitable for pool decks and shaded reading nooks. The chairs segment, while mature, retained 40% of 2024 revenue and continues to anchor bundled patio sets in both hospitality and residential channels. Advancements in quick-dry foams, UV-stable dyes, and ergonomic forms elevate perceived value and extend upgrade cycles. Integrated side tables, shade articulations, and electronic charging modules further differentiate high-end loungers amid rising competition.

Manufacturers target multifunctional formats that adapt from sun-bathing to social-gathering layouts, an approach favored in urban settings where balconies double as dining and lounging zones. The outdoor furniture market size for loungers is expected to outstrip overall growth as wellness-focused consumers allocate discretionary income toward yoga daybeds and zero-gravity recliners. Meanwhile, dining tables and benches gain traction in commercial patios where year-round outdoor service extends guest capacity. Designers cite texture layering-rope, woven accents, and teak inserts-as a key tactic to lift aesthetic appeal without hiking frame weight.

Wood preserved its 40% share in 2024 on the strength of teak's weather resistance and warm appeal, yet supply constraints and price sensitivity push experimentation with eucalyptus, bamboo, and thermally modified pine. Plastics and polymers hold the highest growth runway at 5.1% CAGR as suppliers commercialize recycled composites such as ScanCom's DuraPlast, which meets circular-economy goals while outperforming virgin HDPE under UV exposure. Hybrid builds combine aluminum skeletons with synthetic-rope or TechTeak slats, creating lighter yet robust profiles that speed container loading and reduce freight emissions.

Commercial buyers increasingly request environmental declarations alongside warranty documents, embedding sustainability into the procurement scorecard. The outdoor furniture market size for recycled plastic collections is set to climb steadily, supported by park agencies and hospitality chains seeking maintenance-free solutions. Metal frames remain the mainstay in high-traffic venues where resistance to impact and vandalism supersedes weight considerations. Powder-coat advancements and marine-grade stainless steel bolsters corrosion defenses in coastal installations.

The Outdoor Furniture Market Report is Segmented by Product (Chairs, Tables, Seating Sets, Loungers, Daybeds, and More), Material (Wood, Metal, and More), End User (Residential, and Commercial), Price Range (Economy, Mid-Range, and More), Distribution Channel (Retail/B2C Channels, and B2B Channel/Contractors), Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads with a 46% share and should maintain a 6.4% CAGR to 2030 as rising urban middle-class households adopt Western-style outdoor-living concepts. China dominates production and internal demand, while India's fast-growing residential construction and hotel pipelines underpin long-run volume gains. Japan and South Korea focus on compact, modular lines that suit high-density living, whereas Australia spends heavily on all-season alfresco culture. Singapore and Malaysia benefit from tourism and luxury condos that demand high-end communal decks furnished with contract-grade sets.

North America ranks second in revenue. The United States remains the bellwether; its deep-seated patio culture drives replacement cycles every four to six years. Covered porches and three-season rooms mitigate strict winter off-season periods, smoothing sales curves. Canada mirrors the U.S. in design tastes but emphasizes harsher climate resistance. Mexican demand rises as resort development and a growing middle class converge. Reshoring is also gaining traction as U.S. case-goods manufacturers convert tariff headwinds into competitive advantage by relocating portions of production to domestic facilities. These moves shorten lead times, buffer supply-chain shocks, and let brands highlight "Made in USA" provenance in premium positioning. This intensifies competition for skilled labor and raises interest in automation technologies to offset higher labor cost.

Europe exhibits sophisticated taste and strict sustainability. Germany spearheads eco-compliance, forcing suppliers to refine coatings and secure FSC timber certificates. France and Italy leverage heritage manufacturing and design cachet in the premium tier, while the Nordics favor weather-adaptive textiles that cope with short summers and long winters. Mediterranean nations sustain a robust cafe culture that privileges dining sets, umbrellas, and stackable seating. Eastern Europe expands its manufacturing footprint, luring OEM contracts and accelerating domestic availability of mid-range collections.

- IKEA

- Ashley Furniture Industries Inc.

- Brown Jordan Inc.

- Agio International Company Ltd.

- Century Furniture LLC

- Keter Group

- Lloyd Flanders Industries

- Homecrest Outdoor Living LLC

- POLYWOOD LLC

- Treasure Garden Inc.

- Dedon GmbH

- Kettal Group

- TUUCI LLC

- Fermob SA

- Gloster Furniture GmbH

- Roda Srl

- Royal Botania NV

- ScanCom International A/S

- B&B Italia (Outdoor Collection)

- RH (Restoration Hardware)

- La-Z-Boy Outdoor (Sunset West)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Resort & Boutique-Hotel Construction Boosting Premium Poolside Furniture Demand

- 4.2.2 Outdoor-Living Room Renovation Trend among Millennials & Gen-X Homeowners

- 4.2.3 Direct-to-Consumer E-commerce Platforms Lowering Barriers for Bulk Outdoor Furniture Purchases Globally

- 4.2.4 Urban Rooftop & Co-working Terrace Projects Requiring Modular, Contract-Grade Sets

- 4.2.5 Environmental Regulations & Green Procurement

- 4.3 Market Restraints

- 4.3.1 Volatile Raw Material Prices Pressuring Manufacturer Margins

- 4.3.2 Seasonality & Weather Variability Increasing Inventory Risk for Retailers

- 4.3.3 Stringent Anti-Deforestation & Chemical-Preservative Regulations Limiting Wood Supply

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (new product launches, investment, capacity expansion, partnerships, acquisitions, etc.) in the Industry

- 4.8 Insights on Regulatory Framework and Industry Standards for the Global Outdoor Furniture Industry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Chairs

- 5.1.2 Tables

- 5.1.3 Seating Sets

- 5.1.4 Loungers and Daybeds

- 5.1.5 Dining Sets

- 5.1.6 Other Products

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Price Range

- 5.4.1 Economy

- 5.4.2 Mid-Range

- 5.4.3 Premium

- 5.5 By Distribution Channel

- 5.5.1 Retail/B2C Channels

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Stores

- 5.5.1.3 Online

- 5.5.1.4 Other Distribution Channels

- 5.5.2 B2B Channel/Contractors

- 5.5.1 Retail/B2C Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 India

- 5.6.4.2 China

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East And Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 IKEA

- 6.4.2 Ashley Furniture Industries Inc.

- 6.4.3 Brown Jordan Inc.

- 6.4.4 Agio International Company Ltd.

- 6.4.5 Century Furniture LLC

- 6.4.6 Keter Group

- 6.4.7 Lloyd Flanders Industries

- 6.4.8 Homecrest Outdoor Living LLC

- 6.4.9 POLYWOOD LLC

- 6.4.10 Treasure Garden Inc.

- 6.4.11 Dedon GmbH

- 6.4.12 Kettal Group

- 6.4.13 TUUCI LLC

- 6.4.14 Fermob SA

- 6.4.15 Gloster Furniture GmbH

- 6.4.16 Roda Srl

- 6.4.17 Royal Botania NV

- 6.4.18 ScanCom International A/S

- 6.4.19 B&B Italia (Outdoor Collection)

- 6.4.20 RH (Restoration Hardware)

- 6.4.21 La-Z-Boy Outdoor (Sunset West)

7 Market Opportunities & Future Outlook

- 7.1 Integration with Smart Outdoor Tech

- 7.1.1 Sustainability-Driven Materials and Circular Design

- 7.1.2 Modular & Flexible Designs