PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842503

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842503

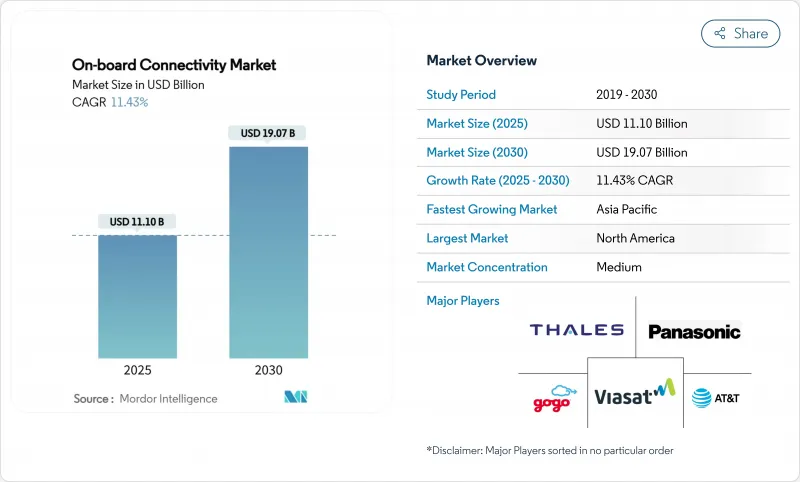

Onboard Connectivity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The onboard connectivity market size is estimated at USD 11.10 billion in 2025 and is forecast to reach USD 19.07 billion by 2030, representing an 11.43% CAGR.

Sustained growth reflects a decisive migration from sole reliance on geostationary satellites to hybrid architectures that merge LEO, MEO, and GEO capacity, delivering lower latency and stronger network resilience. Regulatory momentum-most notably the Federal Communications Commission's Supplemental Coverage-From-Space rules-now permits satellite-terrestrial convergence that unlocks direct-to-device business models. Airlines, rail operators, and shipping lines translate these rule changes into new revenue streams via advertising-supported Wi-Fi, integrated 5G backhaul, and predictive-maintenance analytics. Equipment vendors respond by embedding software-defined networking and multi-constellation terminals whose adaptive routing improves uptime and mitigates single-orbit failure risks.

Global Onboard Connectivity Market Trends and Insights

Surge in Demand for High-Speed Passenger Wi-Fi

Eighty-seven percent of passengers are willing to view adverts in exchange for free Wi-Fi, shifting revenue models toward advertising-supported access. Broadband-enabled services could generate USD 30 billion in ancillary airline revenue annually by 2035. Viasat now supports more than 60 airlines under advert-funded contracts, demonstrating scale. Passenger surveys indicate that 83% would rebook with carriers offering superior Wi-Fi, cementing connectivity as a differentiator. Maritime lines echo this trajectory; Carnival Corporation's fleet-wide Starlink rollout lifted guest satisfaction and crew welfare. Airlines also merge seatback displays with personal devices, delivering targeted content that boosts brand loyalty and advertising yield.

Rapid Deployment of LEO Constellations

Starlink's initial 12 Direct-to-Cell satellites began text services in 2024, aiming for voice/data capability in 2025, reducing reliance on cabin antennas for many use cases. Viasat integrates Telesat Lightspeed capacity, while Hughes' Fusion package blends LEO and GEO bandwidth for Delta Air Lines. Direct-to-device agreements between satellite and mobile operators eliminate specialized terminals for the rail and maritime sectors. Arctic-region coverage has improved following Eutelsat OneWeb and Intelsat demonstrations above the Arctic Circle. Falling satellite manufacturing costs from 3D printing and vertical integration support competitive pricing that undercuts traditional GEO economics. FCC spectrum allocations further streamline constellation rollouts, shortening time-to-service.

High Retrofit and Certification Costs

Connectivity retrofits can extend 12-18 months and cost millions per aircraft, driven by FAA Advisory Circular 20-168 test requirements. EASA's ETSO framework imposes parallel hurdles for cross-border fleets. Electronically steered antennas introduce new approval categories that lack historical benchmarks, prolonging reviews. Harsh maritime environments demand ruggedized hardware and prolonged sea trials, inflating unit economics. Fixed certification expenses weigh hardest on smaller carriers, reinforcing scale advantages for larger operators.

Other drivers and restraints analyzed in the detailed report include:

- Rising Global Passenger Volumes

- Multi-Orbit Network Reliability Gains

- Stringent Aviation and Maritime Regulation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware retained 45.98% of 2024 revenue, covering antennas, modems, and routers that anchor physical links within the onboard connectivity market. Services, however, are forecasted to grow at 12.60% CAGR, reflecting operator preference for outcome-based contracts that shift performance risk to vendors. The onboard connectivity market size attached to managed services is projected to widen as multi-orbit complexity outpaces in-house skill sets.

Service growth parallels rising demand for installation expertise, end-to-end monitoring, and guaranteed uptime. Providers bundle software maintenance, cybersecurity, and regulatory compliance, fostering predictable total cost of ownership. Airlines and rail operators increasingly sign multi-year service agreements that align fees with passenger usage, while maritime firms seek packages that merge crew welfare and operational data backhaul. Hardware vendors respond by embedding software functions that enable remote diagnostics, ensuring continual service revenue even after equipment sale.

Satellite solutions delivered 75.65% of 2024 revenue, underscoring the historical foundation of the onboard connectivity market. Yet, hybrid multi-orbit architectures are expanding at 16.54% CAGR, shifting the competitive center of gravity. The onboard connectivity market share commanded by single-orbit models is expected to narrow as operators prioritize resilience.

Hybrid adoption accelerates because LEO segments cut latency for real-time services, while GEO remains ideal for bulk streaming. Software-defined radios switch between constellations in milliseconds, supporting uninterrupted sessions. Rail corridors in dense geographies deploy ground-to-train 5G for cost-effective capacity, defaulting to satellite over remote stretches. Vendors differentiate via orchestration algorithms that allocate traffic to the lowest-cost path without user intervention.

The Onboard Connectivity Market is Segmented by Component (Hardware, Solution, and Services), Connectivity Technology (Satellite, Air-To-Ground, and Hybrid/Multi-Orbit), Transportation Platform (Aviation, Maritime, and Rail), Application (Entertainment, Communication, Safety and Operations, and Others), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 41.78% share in 2024 demonstrates the region's early embrace of LEO services, policy clarity, and significant airline upgrade budgets. Gogo's Galileo solution for business aviation highlights demand for globally roaming multi-orbit capability. Federal funding of USD 8.2 billion toward Amtrak's Northeast Corridor accelerates station-to-train Wi-Fi projects. Gulf of Mexico energy assets rely on Tampnet subsea fiber combined with AT&T 5G for offshore coverage.

Asia-Pacific is growing at 13.20% CAGR, powered by USD 43 trillion of infrastructure investment demands through 2035. ASEAN economic-integration plans position digital connectivity as foundational, fostering uniform passenger expectations. High-speed rail in China, Japan, and India embeds multi-gigabit links from design, avoiding retrofit delays. Shipping lines in Singapore retrofit fleets with hybrid terminals that auto-switch between LEO and GEO. The region's young demographic accelerates the adoption of connected entertainment and e-commerce during travel.

Europe maintains steady growth through Trans-European Rail Network expansions and North Sea renewable projects that require robust offshore links. The Starline blueprint for continent-wide rail coverage underlines the European Commission's commitment to seamless roaming. The UK has agreed a public-private deal to eradicate mobile dead zones on main rail routes. Cruise and cargo operators integrate Ka-band capacity with legacy L-band safety channels, balancing redundancy with cost. Stricter data-protection laws oblige suppliers to embed advanced encryption as a default.

- Panasonic Corporation

- Viasat, Inc.

- Intelsat

- Gogo Inc.

- Thales Group

- Honeywell International Inc.

- RTX Corporation

- ALE International

- Huawei Technologies Co., Ltd.

- AT&T Inc.

- Space Exploration Technologies Corp.

- Eutelsat OneWeb (Eutelsat Group)

- SES S.A.

- Cobham Limited

- Anuvu Operations LLC

- Iridium Communications Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in demand for high-speed passenger Wi-Fi

- 4.2.2 Rapid deployment of LEO constellations

- 4.2.3 Rising global passenger volumes

- 4.2.4 Advertising-supported connectivity models

- 4.2.5 Multi-orbit network reliability gains

- 4.2.6 Direct-to-device satellite services

- 4.3 Market Restraints

- 4.3.1 High retrofit and certification costs

- 4.3.2 Stringent aviation and maritime regulation

- 4.3.3 RF spectrum congestion (Ku/Ka)

- 4.3.4 Cyber-security vulnerabilities

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Antenna Systems

- 5.1.1.2 Modems and Routers

- 5.1.1.3 Wireless Access Points

- 5.1.2 Solution

- 5.1.2.1 Network-Management Platforms

- 5.1.2.2 Content Management Systems

- 5.1.3 Services

- 5.1.3.1 Installation and Integration

- 5.1.3.2 Managed Connectivity

- 5.1.3.3 Support and Maintenance

- 5.1.1 Hardware

- 5.2 By Connectivity Technology

- 5.2.1 Satellite

- 5.2.2 Air-to-Ground (ATG)

- 5.2.3 Hybrid/Multi-Orbit

- 5.3 By Transportation Platform

- 5.3.1 Aviation

- 5.3.1.1 Commercial Airlines

- 5.3.1.2 Business Jets

- 5.3.1.3 Unmanned Systems

- 5.3.2 Maritime

- 5.3.2.1 Commercial Shipping

- 5.3.2.2 Cruise and Ferry

- 5.3.2.3 Offshore Energy

- 5.3.3 Rail

- 5.3.3.1 High-Speed

- 5.3.3.2 Commuter and Metro

- 5.3.1 Aviation

- 5.4 By Application

- 5.4.1 Entertainment

- 5.4.2 Communication

- 5.4.3 Safety and Operations

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Panasonic Corporation

- 6.4.2 Viasat, Inc.

- 6.4.3 Intelsat

- 6.4.4 Gogo Inc.

- 6.4.5 Thales Group

- 6.4.6 Honeywell International Inc.

- 6.4.7 RTX Corporation

- 6.4.8 ALE International

- 6.4.9 Huawei Technologies Co., Ltd.

- 6.4.10 AT&T Inc.

- 6.4.11 Space Exploration Technologies Corp.

- 6.4.12 Eutelsat OneWeb (Eutelsat Group)

- 6.4.13 SES S.A.

- 6.4.14 Cobham Limited

- 6.4.15 Anuvu Operations LLC

- 6.4.16 Iridium Communications Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment