PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842506

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842506

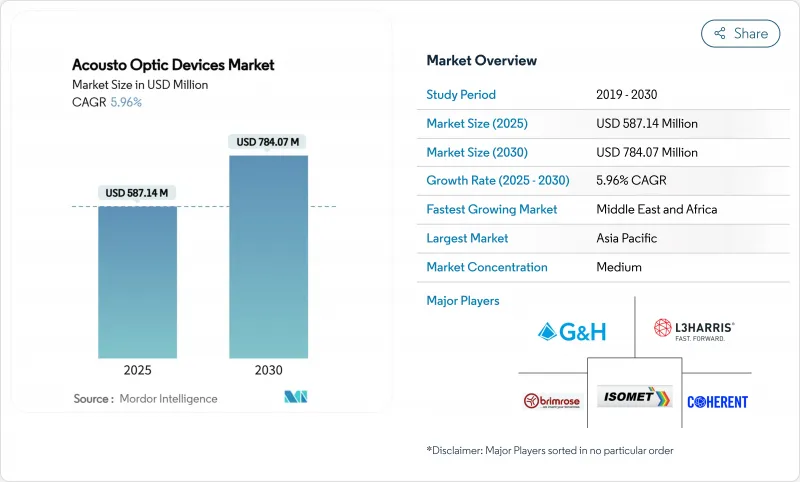

Acousto Optic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Acousto optic devices market is valued at USD 587.14 million in 2025 and is forecast to touch USD 784.07 million by 2030 on a steady 5.96% CAGR.

Growth stems from widening use of high-precision optical control inside 5G network nodes, semiconductor lithography lines, and next-generation laser systems. Manufacturers are leveraging vertical integration to guard against material shortages and shorten lead times, while sustained RandD in tunable filters is unlocking new revenue in hyperspectral imaging and quantum photonics. Sub-micron laser machining needs, rising adoption of TeO2-based Q-switches in medical devices, and demand for compact beam-steering solutions in aerospace are shaping competitive strategy. The acousto optic devices market is also benefiting from public-sector spending on defense-grade LiDAR and satellite-borne spectroscopy, creating fertile ground for specialized suppliers with radiation-hardened designs.

Global Acousto Optic Devices Market Trends and Insights

Expanding Ultrafast-Laser Micro-Machining Capacity in Asian Semiconductor Fabs

Surging adoption of ultrafast-laser workstations across leading Asian foundries is feeding demand for modulators and Q-switches that supply nanosecond-scale pulse gating. Chinese tool builders reported a 27% rise in TeO2 modulator shipments during 2024 as advanced packaging lines shifted to finer redistribution layers. Sub-micron beam control delivered by acousto-optic devices enables higher yield in through-silicon-via drilling and wafer dicing, positioning the acousto optic devices market for sustained pull-through across the region.

Rapid 5G/400G Optical Network Roll-outs Driving AO Modulator Demand

North American carriers are replacing legacy 100 G links with 400 G coherent optics, a migration that requires modulators capable of high extinctions at multi-gigahertz symbol rates. Acousto-optic phase modulators offer low chirp and reliable thermal performance, making them the component of choice for new metro and long-haul builds. Data-center interconnect providers also favor AO technology to maintain signal integrity as traffic density rises, supporting incremental growth for the acousto optic devices market through 2027.

Persistent Shortage of Optical-Grade Tellurium Dioxide Crystals

TeO2 is grown as a by-product of copper smelting, linking availability to mining cycles rather than photonics demand. Slow ramp-ups in purification capacity and yield losses during crystal pull keep lead times extended and prices volatile. Device makers hedge by pursuing lithium niobate or chalcogenide glass alternatives, but such shifts often require redesigns that dilute near-term margins within the acousto optic devices market.

Other drivers and restraints analyzed in the detailed report include:

- Defense-Grade LiDAR Adoption for Hypersonic Threat Detection

- Growth of Hyperspectral Imaging Cubesats Fueling Space-Qualified AOTF Sales

- Complex RF-Driver Integration in Above 10 kHz Beam-Steering Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acousto optic devices market recorded 34.6% revenue from modulators in 2024, reflecting their ubiquity in laser processing tools and optical switches. Recent designs reach 83% diffraction efficiency, boosting throughput in laser micromachining and fiber communication hubs. The second paragraph: AOTFs, advancing at 6.2% CAGR, benefit from the rise of hyperspectral payloads and in-vitro diagnostics where motionless wavelength selection minimizes maintenance. Deflectors, frequency shifters, and Q-switches contribute resilient demand, with Q-switches favored for medical pulses where fluence uniformity is mandatory.

TeO2 delivered 48.3% of 2024 sales thanks to its superior figure-of-merit and broad transmission window, yet constrained supply pushes integrators toward substitutes. The acousto optic devices market size for lithium niobate solutions is projected to expand swiftly as thin-film deposition methods produce low-loss waveguides suitable for on-chip AO modulators. Fused silica keeps a foothold in UV photolithography, and interest in Ge-Sb-Se chalcogenide glass is stirring after lab data showed a 270-fold gain over quartz in acousto-optic response.

The Acousto Optic Devices Market Report is Segmented by Device Type (Acousto-Optic Modulators, Deflectors, and More), Material (Tellurium Dioxide Lithium Niobate, and More), Wavelength Range (Ultraviolet, Visible, and More), Reconfiguration Speed (Low, Medium, High), Application (Material Processing, and More), Vertical (Aerospace and Defense, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific generated 36.2% of global revenue in 2024, reflecting dominant electronics production and expanded wafer-fab capacity. Policymakers channel subsidies toward domestic photonics supply chains, lifting consumption of AO components in cutting, drilling, and inspection tools. Near-term expansion of 5G backhaul links and research into quantum secure communication further cements regional leadership in the acousto optic devices market.

North America ranks second as telecom carriers densify fiber and cloud providers upgrade long-haul bandwidth. Defense contracts for directed-energy and LiDAR systems add dependable volume, while federal funding accelerates quantum photonics projects that depend on tunable AO elements. The acousto optic devices market size is reinforced by the presence of vertically integrated suppliers and university research clusters.

Europe commands a solid share built on high-precision manufacturing and medical technology adoption. Germany, the UK, and France spearhead R&D into high-speed AO deflectors for hypersonic surveillance. Regulatory support for space-based Earth-observation missions keeps demand flowing for radiation-hardened AOTFs, enriching the acousto optic devices market with specialized high-margin orders.

The Middle East and Africa hold a smaller base today yet post a leading 6.1% CAGR through 2030. National initiatives to diversify economies into photonics fabrication and 5G infrastructure create steady pipelines for AO modulators and Q-switches. Emerging research hubs in Israel and South Africa explore AO-driven spectroscopy for water and soil monitoring, adding scientific demand layers.

- Gooch and Housego PLC

- Brimrose Corporation of America

- Isomet Corporation

- Coherent Corp.

- L3Harris Technologies Inc.

- AA Opto Electronics Ltd.

- Lightcomm Technology Co., Ltd.

- IntraAction Corporation

- AMS Technologies AG

- APE Angewandte Physik and Elektronik GmbH

- CASTECH Inc.

- Sintec Optronics Pte Ltd.

- Hamamatsu Photonics K.K.

- Ushio Inc.

- Excelitas Technologies Corp.

- Holo/Or Ltd.

- PhotonTec Berlin GmbH

- Neos Technologies

- A*P*E China

- Glen Optics

- MPB Communications Inc.

- OptoSigma Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Ultrafast-Laser Micro-Machining capacity in Asian Semiconductor Fabs

- 4.2.2 Rapid 5G/ 400 G Optical Network Roll-outs Driving AO Modulator Demand in North America

- 4.2.3 Defense-Grade LiDAR Adoption for Hypersonic Threat Detection in Europe

- 4.2.4 Growth of Hyperspectral Imaging Cubesats Fueling Space-Qualified AOTF Sales

- 4.2.5 Demand Surge for TeO?-Based AO Q-Switches in High-Energy Medical Lasers

- 4.2.6 Increasing Adoption of AO-Enabled Tunable Light Sources for Quantum Photonics R&D

- 4.3 Market Restraints

- 4.3.1 Persistent Shortage of Optical-Grade Tellurium Dioxide Crystals

- 4.3.2 Complex RF-Driver Integration in Above 10 kHz Beam-Steering Systems

- 4.3.3 Limited Thermal-Management Window in High-Power Mid-IR AO Devices

- 4.3.4 Fragmented Export-Control Regimes for Dual-Use AO Components

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Acousto-Optic Modulators

- 5.1.2 Deflectors

- 5.1.3 Frequency Shifters

- 5.1.4 Q-Switches

- 5.1.5 Tunable Filters (AOTF)

- 5.1.6 Mode Lockers

- 5.1.7 Pulse Pickers/Cavity Dumpers

- 5.1.8 RF Drivers

- 5.1.9 Other Device Types

- 5.2 By Material

- 5.2.1 Tellurium Dioxide (TeO?)

- 5.2.2 Lithium Niobate (LiNbO?)

- 5.2.3 Fused Silica

- 5.2.4 Crystal Quartz

- 5.2.5 Calcium Molybdate and Others

- 5.3 By Wavelength Range

- 5.3.1 Ultraviolet (200-400 nm)

- 5.3.2 Visible (400-700 nm)

- 5.3.3 Near-Infrared (700-1500 nm)

- 5.3.4 Mid-Infrared (1500-3000 nm)

- 5.3.5 Far-Infrared (Above 3000 nm)

- 5.4 By Reconfiguration Speed

- 5.4.1 Low (Less than 1 kHz)

- 5.4.2 Medium (1-10 kHz)

- 5.4.3 High (Above 10 kHz)

- 5.5 By Application

- 5.5.1 Material Processing

- 5.5.1.1 Laser Macro-Processing

- 5.5.1.2 Laser Micro-Processing

- 5.5.2 Spectroscopy and Hyperspectral Imaging

- 5.5.3 Optical Signal Processing

- 5.5.4 Biomedical Imaging and Diagnostics

- 5.5.5 Other Emerging (LiDAR, Quantum Photonics)

- 5.5.1 Material Processing

- 5.6 By Vertical

- 5.6.1 Aerospace and Defense

- 5.6.2 Telecommunications

- 5.6.3 Semiconductor and Electronics Manufacturing

- 5.6.4 Industrial Manufacturing

- 5.6.5 Life Sciences and Scientific Research

- 5.6.6 Medical

- 5.6.7 Oil and Gas

- 5.6.8 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Southeast Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 Gulf Cooperation Council Countries

- 5.7.5.2 Turkey

- 5.7.5.3 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Gooch and Housego PLC

- 6.4.2 Brimrose Corporation of America

- 6.4.3 Isomet Corporation

- 6.4.4 Coherent Corp.

- 6.4.5 L3Harris Technologies Inc.

- 6.4.6 AA Opto Electronics Ltd.

- 6.4.7 Lightcomm Technology Co., Ltd.

- 6.4.8 IntraAction Corporation

- 6.4.9 AMS Technologies AG

- 6.4.10 APE Angewandte Physik and Elektronik GmbH

- 6.4.11 CASTECH Inc.

- 6.4.12 Sintec Optronics Pte Ltd.

- 6.4.13 Hamamatsu Photonics K.K.

- 6.4.14 Ushio Inc.

- 6.4.15 Excelitas Technologies Corp.

- 6.4.16 Holo/Or Ltd.

- 6.4.17 PhotonTec Berlin GmbH

- 6.4.18 Neos Technologies

- 6.4.19 A*P*E China

- 6.4.20 Glen Optics

- 6.4.21 MPB Communications Inc.

- 6.4.22 OptoSigma Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment