PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842510

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842510

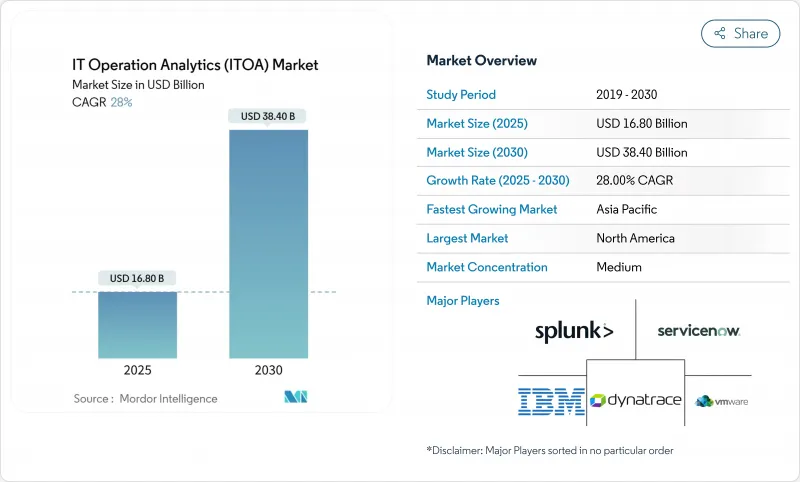

IT Operation Analytics (ITOA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The IT operations analytics market reached USD 16.8 billion in 2025 and is on course to hit USD 38.4 billion by 2030, reflecting a solid 17.9% CAGR.

Expansion is powered by enterprises re-tooling from reactive monitoring to AI-enabled operational intelligence that prevents costly outages in increasingly hybrid and multi-cloud estates. Cloud deployment is the default architecture because it eliminates hardware overhead and permits elastic scaling, while predictive analytics de-risks business-critical workloads by turning raw telemetry into early-warning signals. Intensifying regulatory scrutiny in financial services and heightened cyber-risk across critical infrastructure further amplify adoption. Market momentum is reinforced by strategic M&A, notably Cisco's USD 28 billion purchase of Splunk, which marries deep-packet visibility with advanced analytics to create end-to-end insight platforms.

Global IT Operation Analytics (ITOA) Market Trends and Insights

Cloud-Native Observability Adoption Accelerates Real-Time ITOA Demand

Cloud-first architectures fragment workloads across containers, serverless functions and edge nodes, making unified telemetry indispensable. Organizations that implement modern observability platforms record 45% faster mean-time-to-resolution than users of legacy tools. Integrated pipelines stream logs, metrics and traces into a single data plane, where machine-learning models flag anomalies and launch auto-remediation. Tight coupling with DevOps workflows lets engineers catch performance regressions before production cut-overs. Together these capabilities lift service reliability while shrinking incident noise, propelling the IT operations analytics market forward.

Rapid Shift from Siloed ITOM Tools to Unified AIOps Suites

Enterprises historically juggled 15-20 standalone monitoring products, breeding alert fatigue and blind spots. Consolidated AIOps suites collapse those silos and apply AI for event correlation, cutting manual operational effort by 90% and shrinking incident resolution time 21%.Centralized insight also trims vendor overhead and licensing complexity. As hybrid architectures multiply data sources, one-stop suites that fuse infrastructure, application and business metrics become essential, squeezing single-function vendors and reinforcing platform plays that dominate the IT operations analytics market.

High Initial Data-Engineering & Licensing Costs

Standing up full-scale analytics pipelines can top USD 10 million once data lakes, stream processors and AI tooling are counted. Fee structures that charge per node or per GB scale linearly with infrastructure growth, constraining budget predictability. Smaller enterprises see total cost of ownership absorb 15-20% of annual IT spend, delaying entry into the IT operations analytics market. Cloud SaaS models soften capex, but long-term subscription totals can still rival on-premise expense.

Other drivers and restraints analyzed in the detailed report include:

- Need for Predictive Outage Prevention in Hybrid-Cloud Estates

- FinOps Mandates Push Cost-Aware Analytics Adoption

- Shortage of Site-Reliability / DevSecOps Skillsets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deliveries secured 71.3% of the IT operations analytics market share in 2024 and are forecast to rise at 22.8% CAGR through 2030, underscoring buyer preference for managed services that eliminate hardware upkeep. This model slashes deployment lead-times by up to 60% and aligns capacity with volatile telemetry loads, directly enlarging the IT operations analytics market size by USD 15.1 billion over the forecast window. In contrast, on-premise options persist in heavily regulated verticals that must anchor data within jurisdictional borders.

Financial institutions and public agencies retain local stacks for sovereignty mandates, yet even these users increasingly adopt hybrid blends that shuttle non-sensitive workloads to SaaS AIOps platforms. Hyperscalers strengthen their advantage by embedding observability hooks directly into infrastructure-as-code templates, further consolidating buyer spend. At the edge, lightweight collectors push summaries to cloud cores, preserving low latency while retaining centralized analytics governance.

Security and network monitoring constituted 29.0% of the IT operations analytics market in 2024 as cyberattacks exploit operational weak points before signature-based tools trigger. Converged SecOps dashboards that correlate packet flows with application traces detect anomalies 50% faster than siloed models, reinforcing the IT operations analytics market size premium attached to risk mitigation.

AIOps-centric root-cause analytics is the fastest riser, clocking 24.6% CAGR, as AI-driven clustering collapses duplicate alerts and pinpoints origin faults. Infrastructure monitoring matures toward predictive capacity planning, while business service monitoring links SLO breaches to revenue impact, a feature prized by digital retailers during flash-sale peaks. Telecom operators harness 5G network data-analytics functions to lower total cost of ownership 45%, illuminating the breadth of use cases spanning the IT operations analytics market.

IT Operation Analytics (ITOA) Market is Segmented by Deployment (Cloud and On-Premise), Application (Application Monitoring, Business and IT Services Monitoring, and More), End-User Industry (BFSI, Healthcare, and More), Analytics Type (Predictive Analytics, Root-Cause Analytics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the IT operations analytics market with 37.4% revenue in 2024, buoyed by mature DevOps cultures, well-funded venture ecosystems and federal programs that subsidize cloud migration. Flagship vendors such as Splunk, IBM and ServiceNow enjoy dense enterprise install bases, so regional growth pivots from greenfield deployments toward value-added AI extensions and cross-domain integrations. Regulatory pushes for zero-trust architectures further elevate analytics budgets, though overall expansion moderates as first-wave projects reach optimization stage.

Asia-Pacific is the fastest-growing geography, projected at 19.8% CAGR to 2030. Governments position AI adoption as a lever for industrial competitiveness, prompting manufacturers to integrate shop-floor OT streams with IT telemetry for predictive maintenance rollouts. AI investment intentions exceed 20% budget growth among 43% of enterprises, feeding a sizeable pipeline of analytics demand. Edge-native architectures, abundant engineering talent and vibrant start-up ecosystems offset skills shortages in advanced SRE disciplines, cementing the region as a primary engine of the IT operations analytics market.

Europe balances innovation with strict data-sovereignty rules, requiring platforms to localize processing while enabling federated analysis across borders. Legislation such as the Digital Operational Resilience Act shapes procurement criteria toward auditability and governance, prompting vendors to add policy-aware data-routing features. Sustainability directives create incremental use cases as enterprises leverage analytics to track energy consumption and carbon footprints within data centers. Despite slower macro-economic growth, compliance-driven spending keeps the IT operations analytics market vibrant across the continent.

- Splunk Inc.

- IBM Corporation

- ServiceNow Inc.

- VMware Inc. (Broadcom)

- Dynatrace Inc.

- Oracle Corporation

- BMC Software Inc.

- Micro Focus Intl. plc

- Cisco Systems Inc.

- AppDynamics LLC

- Elastic N.V.

- SAS Institute Inc.

- New Relic Inc.

- PagerDuty Inc.

- Datadog Inc.

- SolarWinds Corp.

- ManageEngine (Zoho)

- OpsRamp Inc.

- Evolven Software

- XpoLog Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-native observability adoption accelerates real-time ITOA demand

- 4.2.2 Rapid shift from siloed ITOM tools to unified AIOps suites

- 4.2.3 Need for predictive outage prevention in hybrid-cloud estates

- 4.2.4 FinOps mandates push cost-aware analytics adoption

- 4.2.5 Sovereign-cloud regulations spur regional ITOA variants

- 4.3 Market Restraints

- 4.3.1 High initial data-engineering and licensing costs

- 4.3.2 Shortage of site-reliability / DevSecOps skillsets

- 4.3.3 Data-residency limits on log export hamper AI training

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Deployment

- 5.1.1 Cloud-based

- 5.1.2 On-premise

- 5.2 By Application

- 5.2.1 Application Monitoring

- 5.2.2 Business and IT-Service Monitoring

- 5.2.3 Infrastructure Monitoring

- 5.2.4 Network and Security Monitoring

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Telecommunication

- 5.3.4 Retail and E-commerce

- 5.3.5 Industrial / Manufacturing

- 5.3.6 Government and Public Sector

- 5.4 By Analytics Type

- 5.4.1 Predictive Analytics

- 5.4.2 Root-Cause Analytics

- 5.4.3 Visual / Dashboard Analytics

- 5.4.4 Behavior Analytics

- 5.5 By Geography (Cross-segmentation)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Splunk Inc.

- 6.4.2 IBM Corporation

- 6.4.3 ServiceNow Inc.

- 6.4.4 VMware Inc. (Broadcom)

- 6.4.5 Dynatrace Inc.

- 6.4.6 Oracle Corporation

- 6.4.7 BMC Software Inc.

- 6.4.8 Micro Focus Intl. plc

- 6.4.9 Cisco Systems Inc.

- 6.4.10 AppDynamics LLC

- 6.4.11 Elastic N.V.

- 6.4.12 SAS Institute Inc.

- 6.4.13 New Relic Inc.

- 6.4.14 PagerDuty Inc.

- 6.4.15 Datadog Inc.

- 6.4.16 SolarWinds Corp.

- 6.4.17 ManageEngine (Zoho)

- 6.4.18 OpsRamp Inc.

- 6.4.19 Evolven Software

- 6.4.20 XpoLog Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment