PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842516

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842516

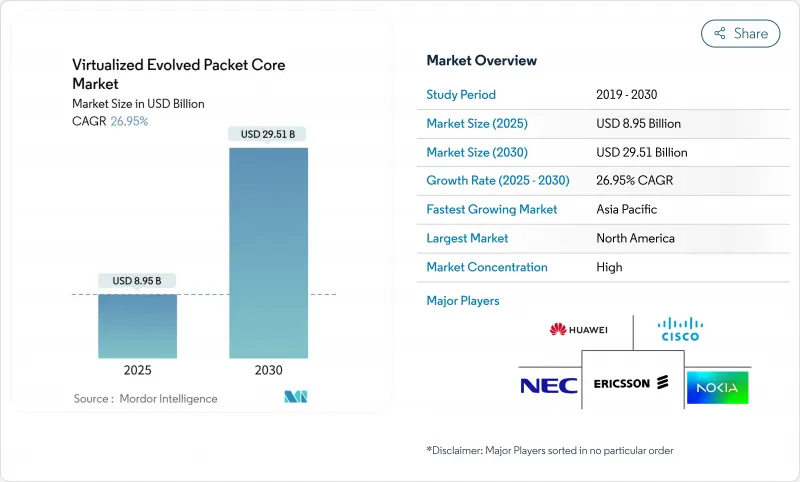

Virtualized Evolved Packet Core - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Virtualized Evolved Packet Core Market size is estimated at USD 8.95 billion in 2025, and is expected to reach USD 29.51 billion by 2030, at a CAGR of 26.95% during the forecast period (2025-2030).

Growth stems from 5G standalone rollouts, rising enterprise demand for private mobile networks, and operator sustainability mandates that favor energy-efficient virtualized cores. Telcos accelerate software-defined network functions to slash capital and operating outlays, while hyperscale public-cloud partnerships allow rapid service launches and global coverage. Asia Pacific drives adoption on the back of government-backed digital programs, whereas North America pushes differentiation through network slicing and edge-cloud synergies. Meanwhile, Europe emphasizes compliance and energy efficiency, a stance that shapes technical requirements and vendor selection.

Global Virtualized Evolved Packet Core Market Trends and Insights

Accelerated 5G Rollouts Demanding Cloud-Native Cores

Cloud-native service-based architectures are mandatory for true 5G standalone networks, making vEPC a non-negotiable investment for operators pursuing network slicing and premium-tier services. Ericsson secured more than 120 commercial 5G core contracts by late 2024, powering 37 live 5G SA networks worldwide, providing tangible proof of commercial readiness. Early movers such as T-Mobile leveraged nationwide 5G SA to introduce network-slice-enabled video calling, which positions them for differentiated pricing models. Competitive pressure compels lagging carriers to accelerate modernization or risk churn. Cloud-native cores also give smaller mobile virtual network operators fast-track entry into enterprise IoT niches. Consequently, the Virtualized Evolved Packet Core market experiences a compounding adoption cycle in the short term.

CapEx/OpEx Savings from Network-Function Virtualization

Operators record sizeable cost reductions as vEPC setups shift workloads to commodity hardware and shared cloud resources. Studies show 68% lower capital outlays and 67% savings on operating expense versus monolithic hardware cores. Digital Nasional Berhad achieved 99.8% network uptime and cut customer-complaint resolution time by 90% after moving to intent-based automated operations on a virtualized core. Energy savings add a further 22% efficiency, meeting both budget and sustainability goals. Faster service launches shorten time-to-revenue from over a year to less than six months. These economics shift vEPC from optional to essential in board-level investment plans. Vendors now embed AI-powered orchestration to shrink operational workloads even further.

Operator Inertia Toward Legacy Physical EPCs

Sunk investments and mission-critical risk aversion slow virtualization plans. Three UK replaced Nokia's end-of-life CloudBand only when forced to modernize, underscoring reluctance to disrupt stable traffic flows. Verizon's protracted 5G SA launch shows that even innovation leaders grapple with migration complexity. Mature markets face elevated regulatory oversight and stringent service-level expectations, making change management even more difficult. As a result, physical cores persist for longer than their economic utility justifies, dampening short-term momentum in the Virtualized Evolved Packet Core market.

Other drivers and restraints analyzed in the detailed report include:

- Private LTE/5G Networks for Industry 4.0 and Campus Connectivity

- Telco Sustainability Mandates for Energy-Efficient Core Networks

- Security and Compliance Concerns on Multi-Tenant Cloud

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud implementations represented 63% of the Virtualized Evolved Packet Core market share in 2024, reflecting carriers' preference for elastic scaling and rapid service iteration. The cloud cohort is forecast to grow at 32% CAGR, outpacing on-premises and hybrid alternatives as hyperscalers strengthen telecom feature sets. Samsung, TELUS, and AWS created North America's first virtual roaming gateway, which proves that cross-border service innovations flourish when control-plane elements run natively on the public cloud. These examples underpin a broad shift where infrastructure ownership yields to agility.

Operators that retain data on-site embrace transitional hybrid models to satisfy sovereignty rules without forfeiting cloud economics. Ericsson's Compact Packet Core reduces deployment complexity by 80% and cuts energy use by 30%, making cloud-ready bundles attractive to tier-2 carriers. As more contracts stipulate outcome-based pricing, the Virtualized Evolved Packet Core market embeds managed-service add-ons such as AI-assisted operations. Small regional telcos and MVNOs leverage SaaS delivery to launch new offers in weeks rather than quarters, broadening the customer base.

The Virtualized Evolved Packet Core Market Report is Segmented by Deployment Mode (Cloud, On-Premise, and Hybrid), Application (IoT and M2M, Mobile Private Networks (MPN) and MVNO, Broadband Wireless Access (BWA), LTE/VoLTE/VoWiFi, 5G Non-Standalone (NSA) Core, and More), End-User (Telecom Operators, Enterprises and Industrial Verticals, Government and Public Safety, Cloud Service Providers, and MVNE/MVNOs), and Geography.

Geography Analysis

Asia Pacific generated 38% of the 2024 Virtualized Evolved Packet Core market size, supported by China's 5,325 live private 5G networks that include more than 20,000 industrial use cases. Government incentives and spectrum policies accelerate manufacturing adoption, with Beijing investing USD 3 billion in 5G-Advanced coverage across 300 cities in 2025. India's 52% 5G SA coverage, well ahead of Europe's 2%, illustrates how emerging economies leapfrog legacy architectures via cloud-first rollouts. These programs supply scale that compels vendors to localize R&D and production, reinforcing Asia Pacific's leadership in the Virtualized Evolved Packet Core market.

North America emphasizes premium service tiers through network slicing and O-RAN integration. Verizon deployed more than 130,000 O-RAN-capable radios and launched slice-based video calling to capture high-value subscribers. Enterprise alliances produce headline case studies: BMW's Spartanburg plant realized uptime gains after adopting private 5G, and Samsung, TELUS, and AWS demonstrated roaming innovation via fully virtualized cores. Regulatory clarity around spectrum leasing further supports campus deployments, bolstering regional contribution to the Virtualized Evolved Packet Core market.

Europe shows mixed momentum. Three UK awarded Ericsson a 9 Tbps cloud-native core contract, and O2 Telefonica surpassed 1 million users on its AWS-hosted core within six months. Yet overall 5G SA availability stands at 2%, restrained by strict security rules such as the UK Telecoms Security Act and by a risk-averse culture that favors stability over aggressive modernization. Operators focus on energy efficiency and open-RAN experimentation, evidenced by Deutsche Telekom's O-RAN Town initiative. These priorities temper immediate spending but create long-term demand for highly interoperable, low-power vEPC solutions within the Virtualized Evolved Packet Core market.

- Ericsson

- Huawei Technologies

- Nokia

- Cisco Systems

- ZTE

- Samsung Electronics

- NEC Corporation

- Mavenir

- Microsoft (Affirmed Networks)

- Athonet (HPE)

- Telrad Networks

- Core Network Dynamics

- VMware

- Juniper Networks

- Red Hat (IBM)

- Intel

- Hewlett Packard Enterprise

- Casa Systems

- Parallel Wireless

- Druid Software

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth in LTE/4G subscriber base

- 4.2.2 Accelerated 5G roll-outs demanding cloud-native cores

- 4.2.3 CapEx / OpEx savings from network-function virtualization

- 4.2.4 Private LTE/5G networks for Industry 4.0 and campus connectivity

- 4.2.5 Edge-cloud synergies enabling distributed user-plane off-load

- 4.2.6 Telco sustainability mandates for energy-efficient core networks

- 4.3 Market Restraints

- 4.3.1 Operator inertia toward legacy physical EPCs

- 4.3.2 Security and compliance concerns on multi-tenant cloud

- 4.3.3 Inter-operability gaps across open, disaggregated cores

- 4.3.4 Unpredictable hyperscale cloud TCO for 5G SA workloads

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Investment Analysis (Baseline-specific)

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 Cloud-based

- 5.1.2 On-premise

- 5.1.3 Hybrid

- 5.2 By Application

- 5.2.1 IoT and M2M

- 5.2.2 Mobile Private Networks (MPN) and MVNO

- 5.2.3 Broadband Wireless Access (BWA)

- 5.2.4 LTE/VoLTE/VoWiFi

- 5.2.5 5G Non-Standalone (NSA) Core

- 5.2.6 5G Standalone (SA) Core

- 5.3 By End User

- 5.3.1 Telecom Operators

- 5.3.2 Enterprises and Industrial Verticals

- 5.3.3 Government and Public Safety

- 5.3.4 Cloud Service Providers

- 5.3.5 MVNE/MVNOs

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Italy

- 5.4.3.6 Spain

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia and New Zealand

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 GCC Countries

- 5.4.5.1.2 Turkey

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Egypt

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ericsson

- 6.4.2 Huawei Technologies

- 6.4.3 Nokia

- 6.4.4 Cisco Systems

- 6.4.5 ZTE

- 6.4.6 Samsung Electronics

- 6.4.7 NEC Corporation

- 6.4.8 Mavenir

- 6.4.9 Microsoft (Affirmed Networks)

- 6.4.10 Athonet (HPE)

- 6.4.11 Telrad Networks

- 6.4.12 Core Network Dynamics

- 6.4.13 VMware

- 6.4.14 Juniper Networks

- 6.4.15 Red Hat (IBM)

- 6.4.16 Intel

- 6.4.17 Hewlett Packard Enterprise

- 6.4.18 Casa Systems

- 6.4.19 Parallel Wireless

- 6.4.20 Druid Software

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment