PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842518

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842518

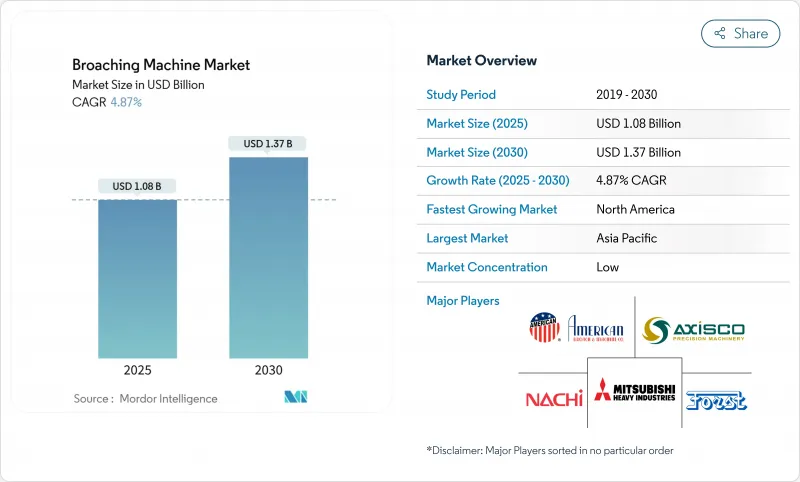

Broaching Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Broaching Machines Market was valued at USD 1.08 billion in 2025 and is expected to reach USD 1.37 billion by 2030, registering a 4.87% CAGR.

Rising demand for sub-micron tolerances in electric-vehicle gearboxes, the rebound of commercial aviation production schedules, and defense localization mandates lift capital spending on advanced broach lines. Orders for horizontal and surface machines expand as factories pair legacy CNC cells with high-speed broaching units to compress takt times. Equipment-as-a-service subscriptions, remote diagnostics, and predictive-maintenance modules widen access for small and mid-sized suppliers that lack upfront capital. Labor scarcity and tungsten-carbide price swings weigh on profit margins, yet regional incentives for smart-factory retrofits maintain a supportive investment climate. Collectively, these elements sustain a steady, mid-single-digit growth path for the broaching machines market through 2030.

Global Broaching Machine Market Trends and Insights

Surge in Precision-Machined EV Power-train Components (Asia)

Electric-vehicle gearboxes now require tooth accuracy of +-0.0005 inches, a tolerance level impractical for milling at scale. Chinese manufacturers leverage policy loans and tax credits to install horizontal broach cells with fully enclosed servo drives that hold dimensional drift below 2 microns for 20-hour runs. Integrated e-axle designs fold multiple gears, splines, and keyways into a single housing, pushing demand toward flexible broaching lines able to complete internal and surface cuts sequentially. Export contracts for Asia-manufactured e-power-trains into North American assembly plants reinforce capacity additions, amplifying the broaching machines market across both regions. As product life cycles compress, suppliers favor modular broach heads with quick-change guides that cut setup times by 40%, further entrenching technology adoption.

Aggressive Automation Retrofits in Chinese Tier-2 Job Shops

Beijing's equipment-upgrade initiative seeks 25% real growth in machine-tool investment by 2027 and targets 75% numerical-control penetration across key processes. Provincial grant programs reimburse up to 30% of CNC broach-line spend for small and mid-sized firms. Automation retrofits integrate robot loaders, vision-based datum checking, and closed-loop tool-wear sensors, enabling lights-out operation in high-mix environments. Pilot plants report 18% unit-cost savings and 32% scrap reduction, reinforcing repeat orders. Technology diffusion to ASEAN vendors follows, as Chinese tier-ones transfer production packages to regional partners, expanding the broaching machines market footprint across Southeast Asia.

Shortage of Broach-Skilled Toolmakers in EU & U.S.

The manufacturing sector forecasts 2.1 million unfilled roles by 2030 as senior machinists retire. Broach-tool design demands expertise in rake-angle sequencing and shear-zone heat management, skills rarely covered in standard CNC curricula. Finland's Tampere region reports machinist graduation rates at half replacement demand, mirroring shortages across Germany and the United States. Factories hesitate to install new broaching lines until apprenticeship pipelines improve. Vendors respond with mixed-reality simulators and cloud-based application support, yet the talent gap persists as a structural cap on throughput, limiting upside for the broaching machines market.

Other drivers and restraints analyzed in the detailed report include:

- Revival of Commercial Aerospace Build-Rates (North America & Europe)

- Defence Offset Mandates Fueling Local Gear-Hob & Broach Demand (Middle East)

- Volatile Tungsten-Carbide Pricing Disrupting Broach Tool Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Horizontal models generated 45.1% of 2024 revenue, reflecting their dominance in drive-shaft and heavy-equipment lines where components exceed 1 m length. Built on cast-iron bases, modern units integrate dual-servo hydraulic drives that boost push forces to 300 kN without chatter. Surface broach systems, though smaller in unit shipments, post the fastest 6.8% CAGR as aerospace and orthopedic applications require fir-tree and bone-plate contours unachievable with grinding. The broaching machines market size for surface platforms is projected to climb from USD 210 million in 2025 to USD 292 million by 2030.

Rotary-table attachments expand reach into high-mix gearbox shops. Mounted on standard CNC centers, they cut 10 times faster than milling while holding +-0.0005 inches. Quick-change guide packs enable programed switch-over in under 3 minutes, attractive for batch sizes below 200 pieces. The broaching machines industry continues to evolve toward hybrid vertical-horizontal frames that swap out heads for shaping or slotting, delivering a flexible cell capable of three distinct cutting processes without repositioning, thereby deepening equipment utilization.

The Broaching Machine Market is Segmented by Product Type (Vertical Broaching Machines, Horizontal Broaching Machines, Surface Broaching Machines, and Others), by Operation Mode (Manual, Semi-Automatic, and Fully Automatic), by End-User Industry (Automotive, and Others), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 55.86% global share in 2024, buoyed by China's 25% equipment-investment growth target through 2027. Chinese OEMs integrate broach lines into intelligent-manufacturing cells under the "Made in China 2025" strategy, while Japan upgrades long-stroke machines for precision machinery exports. South Korea and ASEAN nations invest in semiconductor and automotive supply chains, spurring incremental demand. India contributes fresh orders via defense-offset gear-train plants, though import tariffs on Japanese CNC systems raise cost hurdles.

North America is projected to post the fastest 7.3% CAGR to 2030 as US air-frame build-rates rebound and defense programs expand. Reshoring policies funnel grants toward small machine shops that add broaching to shorten component lead times. Canada benefits from Pratt & Whitney turbofan offsets and mining-truck component demand, while Mexico's Bajio corridor hosts new propulsion and aerospace machining centers. The broaching machines market size for North America is estimated to climb from USD 173 million in 2025 to USD 247 million in 2030.

Europe maintains stable growth as Germany's automotive supply chain refreshes horizontal broach capacity, and the United Kingdom accelerates aerospace tooling upgrades. France and Italy renew equipment under energy-efficiency tax credits, and Nordic plants leverage automation to offset labor scarcity. Skilled-worker shortages remain a limiting factor, with 367 occupations flagged as in deficit across the EU in 2024. Nonetheless, vendor managed-services and virtual training mitigate bottlenecks, sustaining a modest yet predictable expansion of the broaching machines market.

- Mitsubishi Heavy Industries Ltd.

- American Broach & Machine Co.

- Apex Broaching Systems

- Nachi-Fujikoshi Corp.

- Arthur Klink GmbH

- Axisco Precision Machinery Co. Ltd.

- Colonial Tool Group Inc.

- Forst Technologie GmbH & Co. KG

- Pioneer Broach Co.

- Steelmans Broaches Pvt Ltd.

- The Ohio Broach & Machine Co.

- Hoffmann Raumtechnik GmbH

- Accu-Cut Diamond Tool Co.

- General Broach Company

- Hexagon Manufacturing Intelligence

- Phoenix Broach Co.

- V W Broaching Service Inc.

- Fuji Seiko Ltd.

- Suzhou HXM Broaching Machine Ltd.

- Shanghai Machine Tool Works Co. Ltd.*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Precision-Machined EV Power-train Components (Asia)

- 4.2.2 Revival of Commercial Aerospace Build-Rates (North America & Europe)

- 4.2.3 Defence Offset Mandates Fueling Local Gear-Hob & Broach Demand (Middle East)

- 4.2.4 Aggressive Automation Retrofits in Chinese Tier-2 Job-Shops

- 4.2.5 OEM Shift from Hobbing to Rotary-Table Broaching for High-Mix Gearboxes

- 4.2.6 Rapid Tooling-as-a-Service Models for Short-Run Prototyping

- 4.3 Market Restraints

- 4.3.1 Shortage of Broach-Skilled Toolmakers in EU & U.S.

- 4.3.2 Volatile Tungsten-Carbide Pricing Disrupting Broach Tool Supply

- 4.3.3 Cap-Ex Freeze at Oil-field Service Firms (2024-25)

- 4.3.4 Import Tariffs on Japanese CNC Systems in India

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Global Manufacturing Sector Snapshot

- 4.9 Metal-working Industry Snapshot

- 4.10 Spotlight on Broach Tools

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Product Type

- 5.1.1 Vertical Broaching Machines

- 5.1.2 Horizontal Broaching Machines

- 5.1.3 Surface Broaching Machines

- 5.1.4 Others (Rotary, CNC Broaching, Hydraulic Broaching Machines)

- 5.2 By Operation Mode

- 5.2.1 Manual

- 5.2.2 Semi-Automatic

- 5.2.3 Fully Automatic

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Fabrication & Industrial Machinery

- 5.3.3 Aerospace & Defense

- 5.3.4 Oil & Gas / Energy

- 5.3.5 Construction Equipment

- 5.3.6 Electronics & Precision Components

- 5.3.7 Medical Devices

- 5.3.8 Others (Agricultural Equipment, Firearms & Defense, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Peru

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Kuwait

- 5.4.5.5 Turkey

- 5.4.5.6 Egypt

- 5.4.5.7 South Africa

- 5.4.5.8 Nigeria

- 5.4.5.9 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Tech-Licensing)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Mitsubishi Heavy Industries Ltd.

- 6.4.2 American Broach & Machine Co.

- 6.4.3 Apex Broaching Systems

- 6.4.4 Nachi-Fujikoshi Corp.

- 6.4.5 Arthur Klink GmbH

- 6.4.6 Axisco Precision Machinery Co. Ltd.

- 6.4.7 Colonial Tool Group Inc.

- 6.4.8 Forst Technologie GmbH & Co. KG

- 6.4.9 Pioneer Broach Co.

- 6.4.10 Steelmans Broaches Pvt Ltd.

- 6.4.11 The Ohio Broach & Machine Co.

- 6.4.12 Hoffmann Raumtechnik GmbH

- 6.4.13 Accu-Cut Diamond Tool Co.

- 6.4.14 General Broach Company

- 6.4.15 Hexagon Manufacturing Intelligence

- 6.4.16 Phoenix Broach Co.

- 6.4.17 V W Broaching Service Inc.

- 6.4.18 Fuji Seiko Ltd.

- 6.4.19 Suzhou HXM Broaching Machine Ltd.

- 6.4.20 Shanghai Machine Tool Works Co. Ltd.*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet Need Assessment