PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842519

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842519

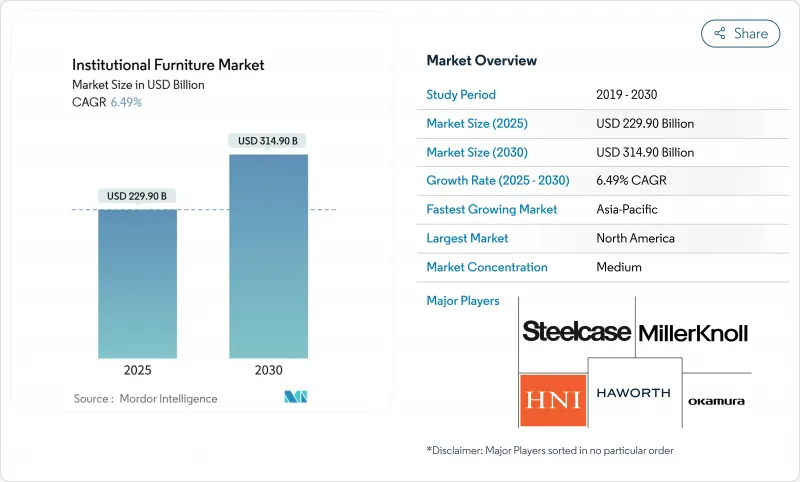

Institutional Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The institutional furniture market is valued at USD 229.9 billion in 2025 and is forecast to reach USD 314.9 billion by 2030, expanding at a 6.49% CAGR.

Demand is buoyed by record student enrollments, enlarged healthcare capital budgets, and a widespread turn to hybrid work-learning formats that require furnishings able to shift from individual to group use within minutes. Buyers now insist on third-party sustainability labels, making FSC, GREENGUARD, and BIFMA LEVEL certifications baseline entry requirements. Heightened digital procurement activity, led by public e-tendering platforms, shortens buying cycles for standard lines yet raises expectations for rapid configuration support. Meanwhile, sensor-enabled seating and other connected products are opening a new data-driven services layer for manufacturers that can interpret utilization insights for clients.

Global Institutional Furniture Market Trends and Insights

Rapid Expansion of Global Education Enrolments and Campus Construction

Student populations are rising sharply, spurring the construction of new schools and universities that specify learning spaces able to morph from lectures to group tasks within the same period. In 2000, approximately 445 million children were enrolled in secondary education. By 2023, that figure surged to roughly 641 million . As school enrollments surge, the construction of educational institutions ramps up, leading to a heightened demand for furniture solutions in schools and universities. Responding to the growing student population and the demand for contemporary, adaptable learning spaces, Shanghai Jiao Tong University broke ground on a new campus in Chenjiazhen Education Park, Chongming District, Shanghai, in October 2024. In September 2024, in a significant move to address the rising student population, Mayor Eric Adams unveiled 24 new public school buildings across New York City. This expansion, which added 11,010 K-12 seats in Brooklyn, the Bronx, Manhattan, and Queens, represents the most substantial increase in school seats since 2003 . Administrators now favor modular desks, mobile storage, and stackable seating that support open pedagogies, universal design, and technology-rich curricula. Demand for ergonomic adjustment features continues to climb as institutions address varied body sizes and accessibility mandates. Growth is strongest in Asia-Pacific and the Gulf Cooperation Council, where public budgets for K-12 and tertiary facilities remain intact despite wider fiscal pressures. As a result, the institutional furniture market sees larger bid sizes and longer call-off contracts tied to multi-phase campus projects.

Growing Worldwide Spend on Healthcare Infrastructure and Patient-Centric Waiting Areas

Hospitals and clinics are redirecting capital toward interiors that reduce stress and infection risks. Waiting zones increasingly mirror hospitality lounges, employing soft seating, calming palettes, and biophilic accents to raise patient satisfaction scores. For instance, the Asklepios Clinic in Schaufling, Germany, exemplified patient-centric design. The clinic collaborated with Appia Contract GmbH to redesign its reception area, focusing on enhancing patient comfort. The redesign featured spacious layouts, upgraded furniture, and modular seating. These improvements not only enhanced the clinic's aesthetics but also supported better hygiene practices. Furniture specifications now also include antimicrobial laminates, sealed foam cores, and fully welded frames such as those in Stance Healthcare's Spry Seating line. Health-system mergers in the United States and Europe standardize design templates across networks, compressing decision timelines, and extending contract volumes. These trends keep healthcare the fastest-expanding end user within the institutional furniture market and reward suppliers able to verify cleanability and durability through real-time usage data.

Volatility in Global Steel, Hardwood, and Petrochemical Prices Impacting Input Costs

Volatile costs for manufacturers are significantly restraining the growth of the market. In 2024 and early 2025, benchmark steel coil and hardwood indexes fluctuated by double-digit percentages quarter-to-quarter, eroding margin visibility for contract-linked projects. Because raw materials can account for three-quarters of furniture lifecycle impact, manufacturers hedge with forward-buy strategies and alternative material R&D. Yet, sudden cost spikes still force price renegotiations or scope reductions, tempering the institutional furniture market's overall growth pace.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Hybrid Work-Learning Models Driving Demand for Re-Configurable Multi-Use Furniture

- Rising Global Preference for Certified Sustainable Materials

- Intensifying Price Competition from Low-Cost Manufacturing Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The institutional furniture market share for chairs reached 36% of total revenue in 2024, underscoring their universal role across campuses, clinics, and offices. Growing ergonomic awareness keeps task-chair refresh cycles short, sustaining volume even in mature regions. Sofas and other soft seating, though smaller in absolute terms, are projected to advance at a 7.2% CAGR to 2030 as institutions remodel lobbies, libraries, and break-out zones into informal collaboration areas.

A parallel trend boosts demand for acoustic pods, booths, and partition-integrated couches that mitigate noise without erecting permanent walls. Within open-plan schools, rolling ottomans and loveseat modules help educators reconfigure lessons swiftly, supporting inclusive pedagogy. Healthcare suites specify bariatric-rated lounge pieces that meet both durability and infection-control protocols, signaling that comfort-oriented design is becoming a clinical standard rather than a luxury. These shifts collectively steer incremental growth in the institutional furniture market, favoring vendors with broad upholstery fabrics and modular geometries.

Wood held 34% of the institutional furniture market share in 2024, reflecting both aesthetic appeal and long-standing purchaser familiarity. Specifiers increasingly request chain-of-custody documentation, pushing mills toward FSC-certified timber and water-based finishing systems. Plastics and advanced polymers are the fastest-rising material class, expected to post a 7.0% CAGR through 2030. Their gains stem from recycled content innovation, reduced weight for shipping cost savings, and emerging bio-based resins that match structural requirements.

Metal frames remain critical for strength and reusability; aluminum and closed-loop steel benefit from indefinite recyclability and are championed in procurement guidance from several EU member states. Hybrid composites blending natural fibers with polypropylene now appear in student chair shells and hospital recliners, balancing impact resistance with lower embodied carbon. Such material experimentation widens choice yet obliges manufacturers to maintain multi-process capabilities, adding operational complexity across the institutional furniture industry.

The Institutional Furniture Market Report is Segmented by Product (Chairs, Tables, Sofas/Soft Seating, and More), Material (Metal, Wood, and More), Price Range (Economy, Mid-Range, Premium), End-User (Schools, Universities & Colleges, and More), Distribution Channel (Direct Sales, Dealer, Online, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 35% of the institutional furniture market revenue in 2024, supported by large-scale commitments to refresh K-12 classrooms and modernize hospital campuses. Adoption of sit-to-stand desks, active stools, and adjustable monitor arms continues as employers seek to reduce musculoskeletal claims and enhance retention. Canada mirrors these patterns, though capital outlays concentrate in higher education laboratories and public-sector workplaces.

Asia-Pacific is forecast to register a 7.4% CAGR through 2030, underpinned by urban migration, rapid school construction, and public-private investment in new hospitals. Chinese regulations now restrict precious hardwoods in state furnishing, nudging demand toward engineered timber, bamboo, and recyclable metals. India's Production-Linked Incentive scheme should spur local manufacture of plastic injection and metal fabricated furniture, trimming delivery lead times for domestic projects. Southeast Asian producers, meanwhile, expand export capacity, reinforcing the region's dual role as consumer and supplier within the institutional furniture market.

Europe maintains a deep design influence. Stringent Extended Producer Responsibility laws encourage take-back programs, prompting many brands to label components for easy recycling. Nordic governments already mandate public-sector furniture to include minimum recycled content percentages, setting precedents likely to spread across the bloc. The Middle East and Africa region pursues large university and hospital schemes financed by sovereign funds, while South America's growth is tied to Brazil's classroom digitization push and corporate headquarters openings in Sao Paulo and Santiago. Collectively, these dynamics sustain the institutional furniture market's global expansion, even as regional mix shifts toward emerging economies.

- MillerKnoll, Inc.

- Steelcase Inc.

- HNI Corporation

- Haworth Inc.

- Okamura Corporation

- Krueger International (KI)

- Smith System, Inc.

- Irwin Seating Company

- Fleetwood Group

- Global Furniture Group

- Teknion Corporation

- Godrej Interio

- Virco Mfg. Corp.

- Classroom Select

- Edsal Manufacturing Co.

- Seats Inc.

- VS America

- Jiangsu Hongye Furniture

- Sedus Stoll AG

- Vitra International AG

- USM Modular Furniture

- Kimball International

- Fursys Inc.

- Bene Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Expansion of Global Education Enrolments and Campus Construction

- 4.2.2 Growing Worldwide Spend on Healthcare Infrastructure and Patient-Centric Waiting Areas

- 4.2.3 Shift Toward Hybrid Work-Learning Models Driving Demand for Re-Configurable Multi-Use Furniture

- 4.2.4 Rising Global Preference for Certified Sustainable Materials (FSC, GREENGUARD, BIFMA LEVEL)

- 4.2.5 Digital Procurement & E-Tendering Platforms Boosting Cross-Border B2B Furniture Sourcing

- 4.3 Market Restraints

- 4.3.1 Volatility in Global Steel, Hardwood and Petrochemical Prices Impacting Input Costs

- 4.3.2 Intensifying Price Competition from Low-Cost Manufacturing Hubs (Vietnam, Malaysia, China)

- 4.3.3 Lengthy Public-Sector Procurement Cycles and Compliance Certifications

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Industry Standards for the Institutional Furniture Industry in Key Geographies

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Chairs

- 5.1.2 Tables

- 5.1.3 Storage Units

- 5.1.4 Sofas/Soft Seating

- 5.1.5 Waiting Benches

- 5.1.6 Other Products (stools, booths and partition, etc.)

- 5.2 By Material

- 5.2.1 Metal

- 5.2.2 Wood

- 5.2.3 Plastic and Polymer

- 5.2.4 Other Materials

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-range

- 5.3.3 Premium

- 5.4 By End User

- 5.4.1 Schools (K-12)

- 5.4.2 Universities & Colleges

- 5.4.3 Offices

- 5.4.4 Healthcare Facilities (Hospitals, Clinics)

- 5.4.5 Government & Public Administration

- 5.4.6 Religious Institutions

- 5.4.7 Others (Theaters & Auditoriums, etc.)

- 5.5 By Distribution Channel

- 5.5.1 Direct Sales (from manufacturers to end-users)

- 5.5.2 Dealer or Distributor Networks

- 5.5.3 Online

- 5.5.4 Other Distribution Channels (through government procurement portals, architectural firms or contractors, home centers, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 India

- 5.6.4.2 China

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East And Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 MillerKnoll, Inc.

- 6.4.2 Steelcase Inc.

- 6.4.3 HNI Corporation

- 6.4.4 Haworth Inc.

- 6.4.5 Okamura Corporation

- 6.4.6 Krueger International (KI)

- 6.4.7 Smith System, Inc.

- 6.4.8 Irwin Seating Company

- 6.4.9 Fleetwood Group

- 6.4.10 Global Furniture Group

- 6.4.11 Teknion Corporation

- 6.4.12 Godrej Interio

- 6.4.13 Virco Mfg. Corp.

- 6.4.14 Classroom Select

- 6.4.15 Edsal Manufacturing Co.

- 6.4.16 Seats Inc.

- 6.4.17 VS America

- 6.4.18 Jiangsu Hongye Furniture

- 6.4.19 Sedus Stoll AG

- 6.4.20 Vitra International AG

- 6.4.21 USM Modular Furniture

- 6.4.22 Kimball International

- 6.4.23 Fursys Inc.

- 6.4.24 Bene Group

7 Market Opportunities & Future Outlook

- 7.1 Integration of IoT & Sensor-Enabled "Smart Seating" for Utilization Analytics & Maintenance