PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842520

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842520

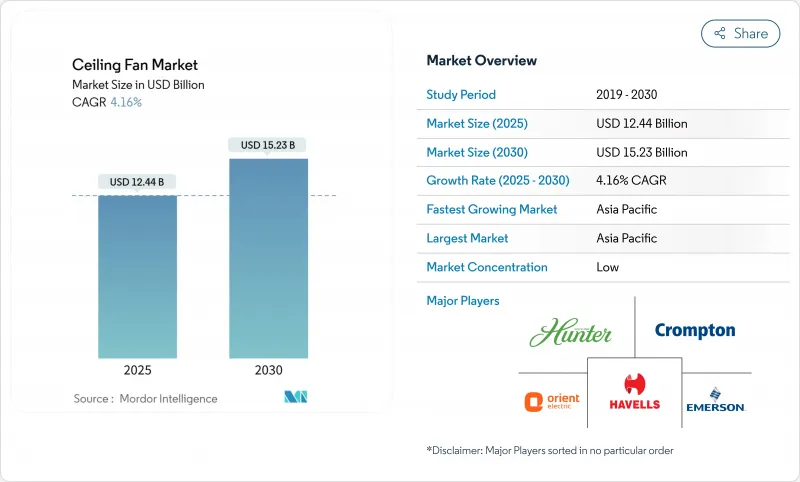

Ceiling Fan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ceiling fan market stands at USD 12.44 billion in 2025 and is forecast to reach USD 15.23 billion by 2030, advancing at a 4.16% CAGR.

This trajectory reflects a shift from price-led competition to performance-led differentiation as global energy-efficiency rules, smart-home adoption, and urban heat-mitigation strategies raise the bar for product design and functionality. The U.S. Department of Energy's Ceiling Fan Energy Index (CFEI) has already tightened compliance thresholds, while California's 2025 Energy Code and new European eco-design mandates align efficiency targets across major economies and accelerate BLDC motor penetration. Asia-Pacific remains the production nerve center thanks to low-cost component ecosystems, yet rare-earth export curbs from China in April 2025 have put upward pressure on magnet prices, underscoring the need for supply-chain hedging. On the demand side, smart-building standards such as ASHRAE 55 and 90.1 reinforce the business case for connected ceiling fans that integrate with BACnet, KNX, and other automation protocols. Meanwhile, cold-chain logistics growth has created a specialized pocket for HVLS solutions that deliver destratification gains and double-digit energy savings in warehouses .

Global Ceiling Fan Market Trends and Insights

Energy-efficiency regulations boosting BLDC fan adoption

CFEI has replaced the legacy cubic-feet-per-minute-per-watt test, making it tougher for low-efficiency AC designs to stay compliant in the ceiling fan market. California's new code raises baseline efficacy values for residential and commercial fans, while the EU's eco-design update targets 31 TWh in power savings by 2030. Canada extended similar thresholds through Amendment 18 in March 2025, forming a tri-national block that implicitly favours BLDC technology. Because BLDC architectures draw 50-70% less power than legacy AC rivals, OEMs that ramped up magnet sourcing and inverter design ahead of 2024 now slot products seamlessly into these new rulebooks. Early beneficiaries include Atom Berg in India, which markets a 28-W fan validated by STAR labelling, and Hunter Fan in the U.S., which migrated its premium lines to BLDC motors with Sure Speed aerodynamics. As a result, regulatory momentum remains the most potent catalyst for the ceiling fan market over the next four years.

Proliferation of IoT-enabled smart ceiling fans

The passage of ASHRAE 55 positioned ceiling fans as controllable comfort devices, and subsequent smart-home innovation layered Wi-Fi modules and voice-assistant compatibility onto premium SKUs. Hunter Fan's SIMPLEconnect platform links Alexa, HomeKit, and Google Home ecosystems, allowing automatic speed shifts based on thermostat data . Commercial buildings leverage the same connectivity via BACnet and KNX gateways, optimizing heat-removal loads in mixed-mode HVAC schemes. Demand is highest in the U.S. and European retrofits, where building owners seek quick-payback energy upgrades. Over the long term, falling costs of Bluetooth Low Energy chips coupled with matter-ready firmware are expected to embed networked capability even in mid-priced products, raising the average selling price and service revenue potential across the ceiling fan market.

Growing penetration of low-cost room air-conditioners

Record sales of 14 million AC units in India during 2024 revealed an affordability inflection that diverts spend from mass-market fans . PLI incentives have effectively reduced domestic assembly costs, allowing brands like Voltas and LG to achieve notable double-digit shipment growth. The rising prevalence of urban heat islands, coupled with climate change-driven temperature increases, is accelerating consumer demand for refrigeration-based cooling solutions. This shift in preference is exerting downward pressure on the ceiling fan market, particularly in densely populated Southeast Asian metropolitan areas. While future adjustments in carbon pricing and tariff structures could potentially rebalance market dynamics, the current trend indicates a growing substitution effect favoring air conditioning systems. As a result, air conditioning adoption is outpacing traditional cooling alternatives, reshaping the competitive landscape in these regions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of low-cost BLDC motor manufacturing in Asia

- HVLS demand in cold-chain warehouses for destratification

- Seasonal demand swings impacting inventory planning

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy-saving fans represent the fastest-growing slice, clocking a 6.94% CAGR, even though standard models held 38.34% of the ceiling fan market share in 2024. Consumers in regulation-centric regions now benchmark CFEI labels before purchase, nudging OEMs to redesign blade aerodynamics and adopt inverter drives. Decorative SKUs maintain relevance in premium residential interiors, while HVLS platforms serve warehouses and gymnasiums where one unit displaces many smaller fans. Solar-powered fans remain niche, limited by panel cost and mounting complexity, yet benefit from green-building incentive stacking in markets like California. Across all variants, integrated LED lighting and remote-control kits elevate basket size and retain customer loyalty.

The energy-efficient ceiling fan market is anticipated to witness substantial growth, supported by supply chain optimization in Asia, which is expected to drive down retail premiums to below. Meanwhile, performance-rich HVLS and IoT lines improve manufacturer margins because motor electronics, wireless modules, and cloud-service add-ons bundle into higher ASPs. Strategic SKU rationalization is underway, with heritage AC-motor catalogues shrinking in favour of fewer, upgrade-ready platforms.

BLDC motor shipments trail AC motors in absolute volume, yet their 8.56% CAGR underscores structural change. AC designs retain 56.56% share because replacement cycles in price-sensitive regions exceed seven years and because distributor inventories still skew toward legacy SKUs. Nevertheless, India's voluntary 5-Star labeling for BLDC fans and ENERGY STAR v4.1 thresholds in the U.S. grant visible differentiation cues at retail. DC motors carved out mid-tier adoption owing to simpler driver circuitry and reduced magnet dependence, but efficiency plateaus at IE2 levels.

The ceiling fan market, driven by BLDC systems, is anticipated to grow significantly as variable-frequency drivers become more cost-effective. Persistent constraints in the supply of rare-earth materials may prompt OEMs to expedite their shift toward SynRM technologies, which deliver comparable performance without relying on NdFeB. This transition could reshape the competitive landscape, emphasizing innovation in rotor geometry and control algorithms. The focus on proprietary designs and advanced control systems offers a strategic edge over traditional winding operations. As a result, manufacturers investing in these areas are likely to gain a competitive advantage in the evolving market.

The Global Ceiling Fan Market and the Market Segmented by Type (Standard, Decorative, Energy Saving Fan, and More), by Technology (AC Motor, DC Motor, and BLDC Motor), by End-User (Residential, Commercial, and Industrial), by Distribution Channel (Offline and Online), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region accounts for nearly half of the global revenue and is projected to register the highest CAGR through 2030. Urbanization in India since 2020 has significantly driven the demand for cost-effective and energy-efficient climate control solutions. Despite the growing adoption of air conditioners, ceiling fans remain essential in tier-2 and rural areas due to budget limitations and inconsistent grid reliability. China's restrictions on magnet exports create potential cost pressures; however, its well-established parts ecosystem and ODM clusters sustain the region's competitive edge. Additionally, Southeast Asia's infrastructure expansion, including shopping malls, logistics centers, and smart-city developments, continues to fuel commercial fan demand.

North America represents a regulation-driven landscape where CFEI compliance and smart-home adoption intertwine. California's 2025 code revision raises baseline performance, effectively phasing out low-efficiency SKUs. Canada followed with Amendment 18, forming a harmonized North American standard. Smart fans enjoy pull-through from robust retrofit incentives and the popularity of voice-controlled ecosystems, reinforcing average selling-price resilience.

Europe is oriented around carbon-reduction targets. The EU's eco-design update will slash 31 TWh from industrial-fan consumption by 2030, and member-state subsidy frameworks guide residential fan replacement. Passive and mixed-mode ventilation strategies gain traction in Mediterranean climates where energy prices spiked post-2022. In contrast, the Middle East and Africa prioritize entry-price ceiling fans for mass housing, though premium villas incorporate decorative and smart models tailored for high ceilings. South America shows steady incremental demand tied to construction sector rebounds in Brazil and Colombia.

- Hunter Fan Company

- Crompton Greaves Consumer Electricals Ltd.

- Orient Electric Ltd.

- Havells India Ltd.

- Emerson Electric Co.

- Panasonic Corporation

- Midea Group

- Minka Group

- Haier Group

- Usha International

- Superfan (Versa Drives)

- Atomberg Technologies

- Fanimation Inc.

- Westinghouse Lighting

- Vent-Axia (CEME Group)

- Casablanca Fan Company

- Delta Electronics

- LG Electronics

- Bajaj Electricals Ltd.

- Khind Holdings Berhad

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency regulations boosting BLDC fan adoption

- 4.2.2 Proliferation of IoT-enabled smart ceiling fans

- 4.2.3 Expansion of low-cost BLDC motor manufacturing in Asia

- 4.2.4 Green-building codes favoring passive cooling solutions

- 4.2.5 HVLS demand in cold-chain warehouses for destratification

- 4.3 Market Restraints

- 4.3.1 Growing penetration of low-cost room air-conditioners

- 4.3.2 Seasonal demand swings impacting inventory planning

- 4.3.3 Rare-earth magnet shortages inflating motor costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Suppliers

- 4.5.3 Bargaining Power Of Buyers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights Into The Latest Trends And Innovations In The Market

- 4.7 Insights On Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, Etc.) In The Market

- 4.8 Insights on Regulatory Framework and Energy-Efficiency Standards in Key Geographies

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Standard

- 5.1.2 Decorative

- 5.1.3 Energy-Saving

- 5.1.4 High-Speed

- 5.1.5 With Integrated Light

- 5.1.6 HVLS

- 5.1.7 Smart / IoT

- 5.1.8 Solar-Powered

- 5.2 By Technology

- 5.2.1 AC Motor

- 5.2.2 DC Motor

- 5.2.3 BLDC Motor

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail Channels

- 5.4.1.1 Multi-Brand Stores

- 5.4.1.2 Exclusive Brand Outlets

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Project Channels (direct from the manufacturers)

- 5.4.1 B2C/Retail Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Hunter Fan Company

- 6.4.2 Crompton Greaves Consumer Electricals Ltd.

- 6.4.3 Orient Electric Ltd.

- 6.4.4 Havells India Ltd.

- 6.4.5 Emerson Electric Co.

- 6.4.6 Panasonic Corporation

- 6.4.7 Midea Group

- 6.4.8 Minka Group

- 6.4.9 Haier Group

- 6.4.10 Usha International

- 6.4.11 Superfan (Versa Drives)

- 6.4.12 Atomberg Technologies

- 6.4.13 Fanimation Inc.

- 6.4.14 Westinghouse Lighting

- 6.4.15 Vent-Axia (CEME Group)

- 6.4.16 Casablanca Fan Company

- 6.4.17 Delta Electronics

- 6.4.18 LG Electronics

- 6.4.19 Bajaj Electricals Ltd.

- 6.4.20 Khind Holdings Berhad

7 Market Opportunities & Future Outlook

- 7.1 Growing demand for sustainable materials and less toxic coatings

- 7.2 Increasing penetration of e-commerce and omni-channel presence