PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842522

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842522

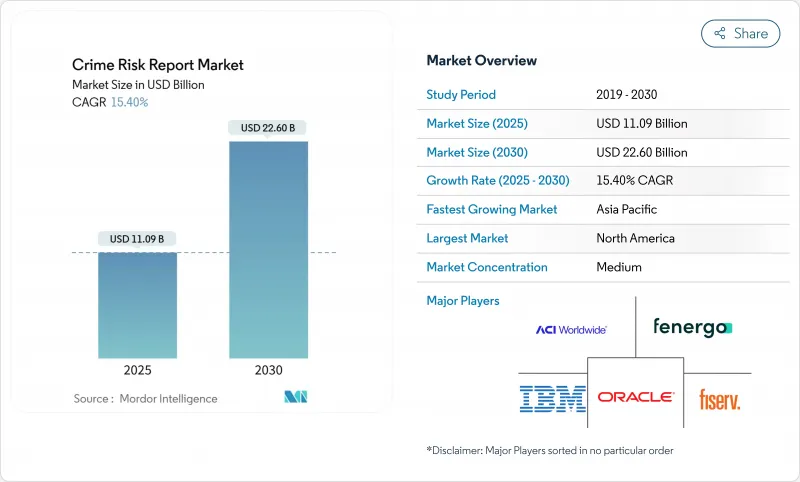

Crime Risk Report - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Crime Risk Report market size stood at USD 11.5 billion in 2025 and is on course to reach USD 28.9 billion by 2030, advancing at a 20.4% CAGR.

This expansion is rooted in the rapid digitalization of banking, financial services, insurance, and real estate workflows, where institutions now process high-velocity transaction streams and must detect fraud in milliseconds. New mandates-such as FinCEN's rule on reporting non-financial residential property transfers effective December 2025-add urgency by extending anti-money-laundering (AML) obligations to parties previously outside the regulatory perimeter. Spending momentum is reinforced by the USD 342 billion in AML fines levied on banks since 2019, a financial burden forcing institutions to adopt AI-native surveillance tools that minimize manual reviews. Cloud-native deployment has become the default approach because it accommodates real-time watch-list screening, advanced graph analytics, and dynamic risk scoring while reducing false positives by up to 65%. Regional leadership remains with North America, where public incentives such as the USD 39 billion CHIPS Act bolster domestic semiconductor capacity, indirectly enhancing the hardware backbone supporting crime analytics workloads. Meanwhile, the Asia-Pacific corridor is the fastest growing, spurred by Australia's plan to fold almost 80,000 additional businesses into its AML/CTF regime from July 2026.

Global Crime Risk Report Market Trends and Insights

Escalating Digitalization Across BFSI & Real-Estate

Financial institutions now rely on AI transaction-monitoring engines that screen trillions of dollars in payments each year, flagging business-email-compromise schemes that caused USD 2.9 billion in 2023 losses. Parallel progress in real-estate digital workflows, accelerated by FinCEN's looming disclosure rule, has compelled title agents and property platforms to map shell-company ownership structures at closing. Deep-fake identity fraud amplifies these threats, prompting demand for multimodal biometric systems able to authenticate video, voice, and document streams in real time. Regulatory agencies have warned that AI-generated personas are surfacing in new-account openings, intensifying the investment case for machine-learning models tuned to synthetic IDs. The net effect is sustained capital allocation to predictive analytics that surface crime patterns invisible to manual audits.

Rising Compliance Cost & Regulatory Scrutiny

An unprecedented USD 342 billion in AML penalties since 2019 illustrates the financial sting of non-compliance, encouraging banks to automate case investigation and sanctions screening. Global executives cite shifting rules as the top obstacle: 49% say keeping pace with sanctions updates is their primary challenge kroll. Beneficial-ownership transparency laws in Canada and the United States extend reporting granularity, particularly in real-estate transactions. Crypto-asset oversight has also widened; new FATF guidance compels blockchain-forensics integrations able to follow assets through mixers and multiple exchanges. Institutions that cannot produce real-time, audit-ready evidence of program effectiveness face heavier fines, driving adoption of intelligent surveillance suites.

Algorithmic Bias Concerns & Emerging Regulations

Proposed U.S. legislation seeking a 10-year moratorium on state-level AI laws underscores the political complexity of regulating automated decision-making. Cities like San Jose are already enforcing AI-transparency rules for predictive policing, obliging vendors to reveal model logic to public oversight bodies. The Consumer Financial Protection Bureau has clarified that existing fair-lending statutes apply equally to machine-learning credit models, forcing banks to adopt bias-testing pipelines to document algorithmic neutrality. Compliance costs escalate for smaller platform providers that now need governance frameworks, secure model-audit trails, and explainability toolkits, potentially slowing product launches and narrowing supplier diversity inside the Crime Risk Report market.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Cloud-Native Crime-Risk Analytics

- AI Geo-Spatial Micro-Forecasting for Property Valuation

- Fragmented Data Standards Across Jurisdictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software accounted for 70% revenue in 2024, confirming its centrality to end-user strategies that require flexible, code-centric crime-analysis stacks able to integrate new detection algorithms without heavy hardware refresh cycles. This component alone shapes the near-term Crime Risk Report market trajectory because platform vendors continuously ship API-based upgrades that address emerging typologies such as crypto-mixing and deep-fake onboarding. Services, while a smaller revenue pool, are rising at 18.2 CAGR as banks and insurers contract domain specialists to re-architect data pipelines, curate training sets, and certify models for regulatory audits.

Consulting demand intensifies whenever new reporting rules land, evidenced by the scramble to interpret FinCEN's real-estate mandate. Implementation partners configure ingestion layers that pull data from core banking systems, government registries, and unstructured feeds. Managed services appeal to community banks that lack in-house data-science teams but still face the same regulatory scrutiny as global peers. As these consumption models proliferate, the Crime Risk Report market repeatedly pivots around software extensibility and the outsourced talent that keeps it current.

Cloud delivery captured 64% of 2024 revenue, underscoring the structural swing away from on-premise mainframes toward elastic compute clusters optimized for parallel model scoring. The scale gained here translates directly into response speed: platforms like SAS's cloud AML suite slash false positives by two-thirds while serving decisions fast enough for digital-wallet authorizations. Hybrid designs emerge when institutions wish to retain customer PII on-premise yet stream anonymized feature vectors to cloud GPUs for scoring.

Multi-cloud adoption surged following cases such as GAMA-1's NOAA replication exercise, proving terabyte-scale mobility across providers. Spending on infrastructure-as-a-service hit USD 94 billion in Q1 2025, a 23% lift year-over-year, and much of that budget fuels crime-analytics container clusters. Conversely, institutions bound by data-sovereignty statutes still procure hardened local appliances, but their share within the Crime Risk Report market is eroding as service-level agreements and encryption frameworks mature.

Crime Risk Management Market is Segmented by Deployment (On-Premise, Cloud), Deployment (On-Premise, Cloud-Based), Solution Type (Fraud Detection & AML, Crime Mapping & Predictive Analytics and More), Application (Banking, Insurance, Real Estate), and Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America maintained 39% revenue in 2024 on the back of robust regulatory enforcement, ample venture capital for reg-tech start-ups, and public investments such as the CHIPS Act that modernize domestic compute capacity supporting advanced analytics. FinCEN's focus on real-estate transparency tightens reporting loops around shell-company-funded purchases, opening new workloads for AI graph-analysis engines. Canada's money-laundering risk assessment flagged real estate as a high-risk sector, pushing lenders and brokers to integrate crime-risk scores into due-diligence checklists.

Europe's trajectory is anchored in GDPR alignment and forthcoming AI governance rules that prioritize explainability. Germany's AI strategy stresses human-centric risk models, stimulating demand for transparent algorithms that can withstand regulatory audits. Europol's 2024-2026 programming document itemizes investments in data-fusion platforms to enhance cross-border intelligence, indirectly expanding the addressable Crime Risk Report market within government contracts. With stringent data-protection regimes, European institutions often adopt edge-compute or sovereign-cloud patterns, a nuance vendors must address to secure local certifications.

Asia-Pacific posted the fastest CAGR at 18%, reflecting widespread digital-payment adoption and aggressive scam activity that cost Southeast Asian economies USD 18-37 billion in 2023 alone. Australia will fold roughly 80,000 additional entities into AML oversight from July 2026, compelling an upgrade cycle for compliance software. Japan's draft Basic Act on Responsible AI is shaping procurement criteria that favor bias-audited models. Emerging financial hubs like Singapore are also issuing granular advisories on crypto-asset tracing, further boosting regional demand.

Latin America and the Middle East & Africa remain smaller but strategically relevant. Rising real-time payment adoption in Brazil and Saudi Arabia increases exposure to authorized push-payment fraud, prompting domestic banks to pilot AI-enabled behavioral analytics. Capacity-building grants from multilateral bodies help local regulators establish beneficial-ownership registries and e-filing portals, laying the groundwork for gradual Crime Risk Report market penetration.

- ACI Worldwide Inc.

- Capco (Wipro Ltd.)

- CoreLogic Inc.

- Fenergo Ltd.

- Fiserv Inc.

- IBM Corporation

- Mphasis Ltd.

- NICE Ltd. / NICE Actimize

- Oracle Corporation

- Refinitiv (LSEG)

- RiskScreen (KYC Global Tech)

- LexisNexis Risk Solutions

- SAS Institute Inc.

- Palantir Technologies

- Moody's Analytics

- Thomson Reuters

- BAE Systems Applied Intelligence

- ServiceNow (Risk and ESG)

- Experian PLC

- Fair Isaac Corporation (FICO)

- Accenture PLC

- SandP Global Market Intelligence

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating digitalization across BFSI and real-estate

- 4.2.2 Rising compliance cost and regulatory scrutiny

- 4.2.3 Shift to cloud-native crime-risk analytics

- 4.2.4 AI geo-spatial micro-forecasting for property valuation

- 4.2.5 Crime-risk scoring for dynamic IoT-asset insurance

- 4.3 Market Restraints

- 4.3.1 Algorithmic bias concerns and emerging regulations

- 4.3.2 Fragmented data standards across jurisdictions

- 4.3.3 Privacy-preserving synthetic data reducing external feed demand

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud-based

- 5.3 By End-user Industry

- 5.3.1 Banking

- 5.3.2 Insurance

- 5.3.3 Real Estate

- 5.3.4 Law-Enforcement and Public Safety Agencies

- 5.3.5 Other Industries (utilities, retail, telecom)

- 5.4 By Solution Type

- 5.4.1 Fraud Detection and AML

- 5.4.2 Crime Mapping and Predictive Analytics

- 5.4.3 Compliance and KYC Reporting

- 5.4.4 Property Crime-Risk Scoring

- 5.4.5 Intelligence and Investigation Platforms

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ACI Worldwide Inc.

- 6.4.2 Capco (Wipro Ltd.)

- 6.4.3 CoreLogic Inc.

- 6.4.4 Fenergo Ltd.

- 6.4.5 Fiserv Inc.

- 6.4.6 IBM Corporation

- 6.4.7 Mphasis Ltd.

- 6.4.8 NICE Ltd. / NICE Actimize

- 6.4.9 Oracle Corporation

- 6.4.10 Refinitiv (LSEG)

- 6.4.11 RiskScreen (KYC Global Tech)

- 6.4.12 LexisNexis Risk Solutions

- 6.4.13 SAS Institute Inc.

- 6.4.14 Palantir Technologies

- 6.4.15 Moody's Analytics

- 6.4.16 Thomson Reuters

- 6.4.17 BAE Systems Applied Intelligence

- 6.4.18 ServiceNow (Risk and ESG)

- 6.4.19 Experian PLC

- 6.4.20 Fair Isaac Corporation (FICO)

- 6.4.21 Accenture PLC

- 6.4.22 SandP Global Market Intelligence

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment