PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842524

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842524

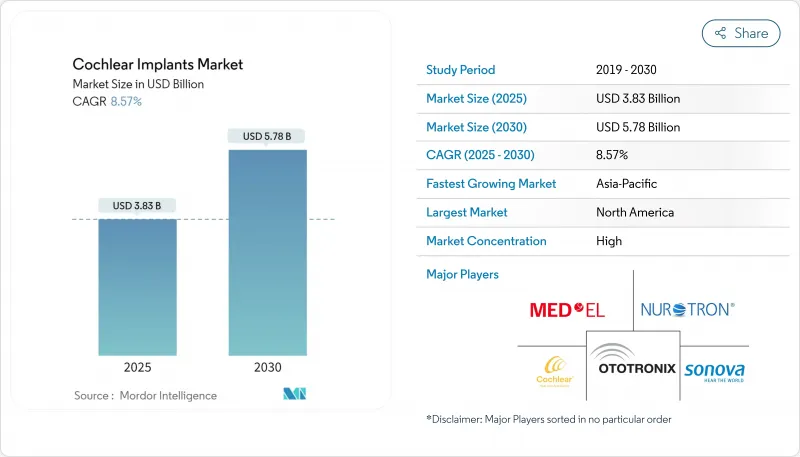

Cochlear Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cochlear implants market is currently valued at USD 3.83 billion in 2025 and is forecast to reach USD 5.78 billion by 2030, reflecting an 8.58% CAGR.

Sustained demand arises from an aging global population, expanding indications that now cover single-sided and asymmetric hearing loss, and continuous innovation in fully implanted devices that remove external hardware. Wider Medicare coverage in the United States and similar reimbursement reforms in Europe are accelerating adult and geriatric uptake. Meanwhile, pediatric volumes are climbing as regulators lower minimum age thresholds and clinicians document superior language development when implantation occurs early. On the competitive front, vertical integration and patent-driven differentiation remain decisive, with fully implantable systems poised to redraw share allocations once commercial launches begin.

Global Cochlear Implants Market Trends and Insights

Growing Geriatric Pool with Severe-To-Profound Hearing Loss

Older adults already represent most new cochlear implant recipients, and clinical data confirm that implantation substantially improves speech perception even after age 70 years. Expanded Medicare eligibility for asymmetric loss is removing historical reimbursement barriers and could unlock treatment for several million newly qualified seniors . Policy makers emphasize that each implanted senior yields significant societal savings through reduced healthcare utilization and improved independence, supporting the positive economic case advanced by device manufacturers .

Noise-Induced Hearing Loss in Younger Demographics

Industrial noise exposure and prolonged headphone use are driving earlier onset of severe sensorineural deficits, with epidemiological reviews charting sustained increases among adolescents between 1990 and 2021. Younger users show strong adoption of digital health tools and typically experience longer productive work lives, increasing the lifetime return on implantation . FDA expansions that authorize implantation in less disabled ears-such as MED-EL's extended indications-are accelerating uptake in this cohort.

High Device, Surgery & After-Care Costs

Full treatment-device, surgery, anesthesia, programming, and habilitation-typically exceeds USD 100,000 per patient, placing the therapy out of reach in low-income settings. Cost-effectiveness studies in South America and Asia show favorable lifetime economics, yet cash-flow constraints and limited insurance penetration defer adoption. Legislative proposals such as the Hearing Device Coverage Clarification Act aim to widen U.S. reimbursement but remain pending.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization & Longer Battery Life of CI Systems

- Expanded Candidacy for Single-Sided & Asymmetric Hearing Loss

- Supply-Chain Crunch for Medical-Grade Semiconductors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unilateral implantation held 78.43% of the cochlear implants market share in 2024. Although unilateral surgery remains dominant, mounting evidence shows that simultaneous bilateral implantation delivers superior speech understanding and spatial awareness in noisy environments. Sequential procedures remain common in adults due to funding limitations, whereas most pediatric centers now default to concurrent bilateral placement. The cochlear implants market size for bilateral systems is projected to expand at 9.23% CAGR, reflecting improving reimbursement in Europe and Japan. Manufacturers are focusing on synchronizing processor firmware to counter asymmetric outcomes, while surgeons refine atraumatic electrode insertion to preserve residual hearing.

Clinical societies increasingly recommend early bilateral intervention, citing neuroplastic advantages that drive language acquisition and social integration. In response, device makers are extending battery capacity to 48 hours of continuous use and simplifying magnet adjustments to reduce follow-up visits. These technical advances, coupled with outcome data, are nudging payers toward parity coverage, positioning bilateral implantation as the future mainstream standard within the cochlear implants market.

Moderate hearing loss is growing faster than the severe segment, with a CAGR of 9.41%. FDA guidance now permits implantation when aided speech scores fall below 60%, a threshold that captures patients who previously struggled with conventional amplification. Studies show that early implantation in moderate loss preserves auditory nerve integrity, leading to better long-term outcomes than delayed surgery.

Severe cases still represent the core of the cochlear implants market share, holding 69.67% market share in 2024. Yet growth has plateaued in saturated high-income regions. Profound loss users benefit from next-generation electrode arrays engineered for near-total cochlear coverage, improving music appreciation and tonal language recognition. Together, these shifts extend the cochlear implants market size and emphasize the need for modular product lines that match diverse residual-hearing profiles across all severity bands.

The Cochlear Implants Market is Segmented by Type (Unilateral Implantation and Bilateral Implantation), Hearing Loss Type (Moderate and Severe), Age Group (Adults, Geriatrics, and Pediatrics), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated USD 1.61 billion revenue in 2025, equal to 42.12% of the cochlear implants market, buoyed by broad private-insurance coverage and Medicare policy shifts. Bilateral implantation is increasingly reimbursed in Canada, further lifting procedure counts. Clinical networks rely heavily on tele-health mapping, which proved effective in rural Alaska and Appalachia, bridging access gaps.

Europe contributed significantly with stable single-digit growth. National health systems fund lifelong device support, yet cost containment pressures encourage tender-based procurement, favoring vendors with robust service footprints. German sickness funds now reimburse fully implanted trials, highlighting regulatory openness to disruptive technology.

Asia-Pacific delivered USD 0.73 billion in 2025 but charts the fastest expansion at 9.54% CAGR. China's provincial subsidy programs cover paediatric implantation, and local manufacturer Shanghai Listen is scaling low-cost internal components that comply with domestic content rules. India is piloting public-private cochlear banks to recycle external processors for low-income families, while Japanese hospitals report near-universal neonatal screening. Across the region, rising disposable incomes and urban hospital construction translate into an enlarging cochlear implants market.

Middle East & Africa and South America together represent a significant portion of the market. Uptake is hampered by limited surgeon numbers and high out-of-pocket costs, yet private Saudi hospitals and Brazilian social insurers are funding simultaneous bilateral surgeries for paediatric users. Regional ENT societies are partnering with manufacturers to train local surgical teams, demonstrating early but promising momentum for the cochlear implants market.

- Cochlear

- MED-EL

- Advanced Bionics (Sonova)

- Zhejiang Nurotron Biotech

- Demant A/S (Oticon Medical)

- iotaMotion

- Envoy Medical Corp.

- Neubio

- Ototronix

- Gaes Medica

- Microson S.A.

- Sivantos Pvt Ltd (Signia)

- Inspiration Hearing Inc.

- Oticon Medical India Pvt Ltd

- Neurelec (MXM)

- Alpha Hearing Tech

- Otodyne Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Geriatric Pool with Severe-To-Profound Hearing Loss

- 4.2.2 Noise-Induced Hearing Loss in Younger Demographics

- 4.2.3 Miniaturisation & Longer Battery Life of CI Systems

- 4.2.4 Expanded Candidacy for Single-Sided & Asymmetric Hearing Loss

- 4.2.5 Breakthrough Fully Implanted Cochlear Implants

- 4.2.6 Growing Awareness About the Advantages of Cochlear Implants

- 4.3 Market Restraints

- 4.3.1 High Device, Surgery & After-Care Costs

- 4.3.2 Surgical-Procedure and Anaesthesia-Related Risks

- 4.3.3 Low Awareness in Underdeveloped Regions

- 4.3.4 Supply-Chain Crunch for Medical-Grade Semiconductors

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Unilateral Implantation

- 5.1.2 Bilateral Implantation

- 5.2 By Hearing Loss Type

- 5.2.1 Moderate

- 5.2.2 Severe

- 5.3 By Age Group

- 5.3.1 Adults

- 5.3.2 Geriatrics

- 5.3.3 Pediatrics

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Specialty Clinics

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Cochlear Ltd

- 6.3.2 MED-EL Medical Electronics

- 6.3.3 Advanced Bionics (Sonova)

- 6.3.4 Zhejiang Nurotron Biotech

- 6.3.5 Demant A/S (Oticon Medical)

- 6.3.6 iotaMotion Inc.

- 6.3.7 Envoy Medical Corp.

- 6.3.8 Neubio

- 6.3.9 Ototronix

- 6.3.10 Gaes Medica

- 6.3.11 Microson S.A.

- 6.3.12 Sivantos Pvt Ltd (Signia)

- 6.3.13 Inspiration Hearing Inc.

- 6.3.14 Oticon Medical India Pvt Ltd

- 6.3.15 Neurelec (MXM)

- 6.3.16 Alpha Hearing Tech

- 6.3.17 Otodyne Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment